Millennials will be crushed under debt: Non-housing debt now reaches $4+ trillion in the United States.

- 9 Comment

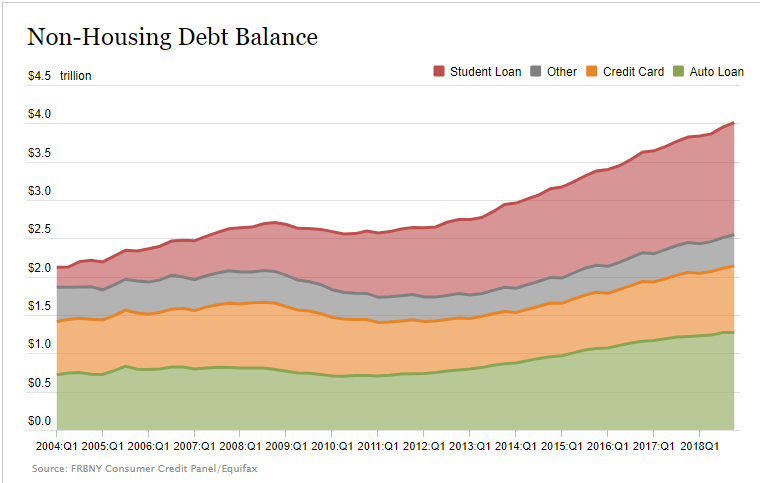

Millennials continue to face the struggles of living in a world where they are deep in debt and the idea of buying a home is becoming more of a farfetched pipe dream. As recently as 2009 non-housing debt stood at $2.5 trillion. Today it is over $4 trillion, a 60 percent increase in 10 years. Of course, it is no surprise that 2009 is the official end of the Great Recession and much of the recovery has come at the expense of going into massive debt. Millennials continue to face struggles in purchasing homes because they are saddled with $1.46 trillion in student debt. Non-housing debt is already creating deep pressures on the balance books of Millennial households.

Toxic debt

There is a big problem with the amount of non-housing debt floating in the economy. Much of this is tied to non-wealth building areas:

-Student Loans

-Credit Cards

-Auto Loans

-Other (e.g., personal loans, etc.)

There has been an explosive growth in this segment of debt in our economy:

What is interesting is that from 2004 to 2012 this figure stayed relatively stable despite the housing bubble expanding then popping. However, during this economic recovery it would appear that people have been borrowing from their future to go to college, purchase (on loans) cars, and finance purchases on plastic. We are already seeing major problems with auto loans going bad.

The chart above continues to highlight a story of where the middle class continues to be squeezed. Why did non-housing debt go up by $1.5 trillion from 2009 to 2019 but remained stagnant from 2004 to 2009? The reality is, younger households are having to go into large amounts of debt to finance college degrees, buy cars, and spend on daily living. Buying a home just doesn’t fit into this equation for many.

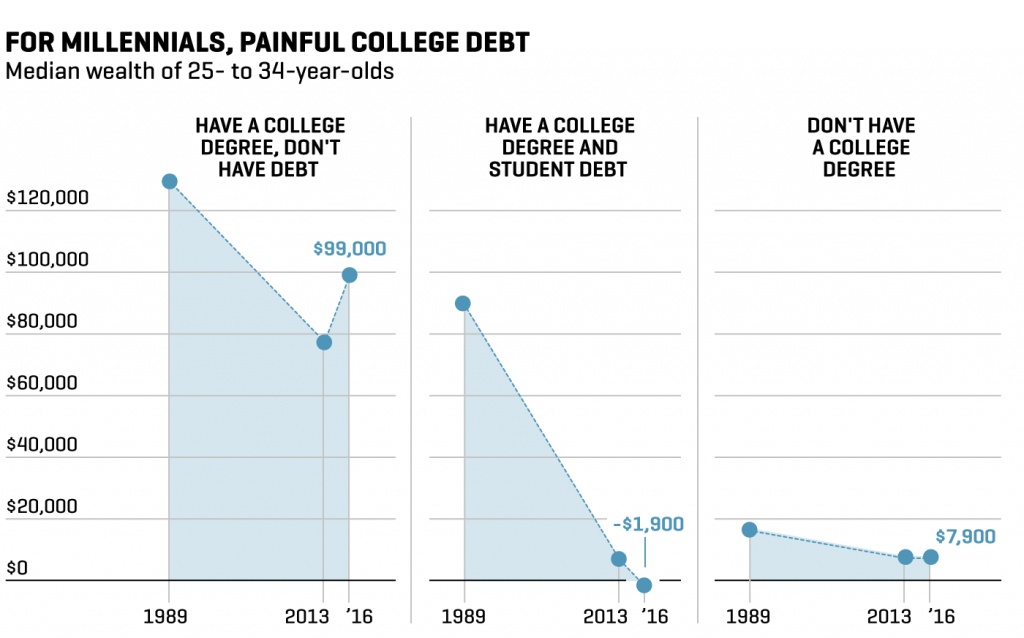

You can see how this debt hurts Millennials when it comes to wealth building:

[From the chart above, most Millennials that do have student debt have a negative net worth (and most college educated Millennials do have student loans). From looking at the above the biggest hit Millennials take when building out their net worth is with having student debt. And this makes sense since once you start earning income, a sizable portion of your money is going to service debt that would otherwise be used on buying goods in our economy or stashing away for a down payment on a home.

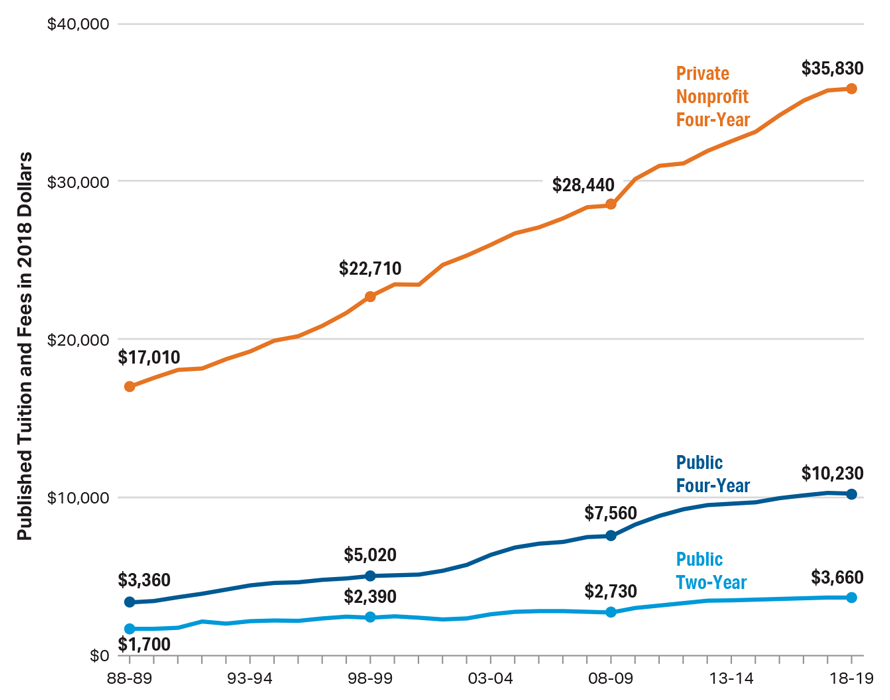

While we hear the baby boomer stories of “I worked delivering papers to pay for college†it is hard to deliver enough papers when the cost of tuition has gone haywire. This might have been doable a generation ago but with many colleges costing $40,000 to $50,000 a year in tuition, good luck with that. Take a look at this chart:

[tuition]

So yes, maybe a generation ago it was a feasible to pay your way through college with a part-time entry level job, those days are now non-existent. Hence we now have $1.46 trillion in student debt outstanding.

Now we hear about proposals to wipe student debt out and to make public higher education free. We also have $22 trillion in U.S. National Debt but who is counting. We are going to have some tough choices moving forward but creating a system entirely addicted to debt is going to cause some major withdrawal symptoms when the inevitable day of reckoning hits.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!9 Comments on this post

Trackbacks

-

Bob DD said:

That’s easy, recover the $20 Trillion missing from the DOD?

April 22nd, 2019 at 1:19 pm -

George said:

It’s all by design and working flawlessly. There are only two ways in which to conquer a nation. One is by the sword, and the other is by DEBT!!

April 22nd, 2019 at 1:26 pm -

Dave churbuck said:

They will become extinct because they belived in the false promise

of governments and commercial religion.

Share with all.https://www.youtube.com/watch?v=8bOJiTskr6wApril 22nd, 2019 at 5:58 pm -

unknown said:

After talking about this for over 10 years, sadly, no one gives a damn. Apathy in this country is an all time high among all ages. Capitalism has it’s flaws and it’s starting to show but instead of pointing them out. The wrong generation is being blamed and bashed as communists or socialists; mccarthyism 2.0, implemented by the man who was mentored by the very man who came up with it in the first place. The free market utopia is a pipe dream, it never existed, it never will. There is only one Savior, and sadly, most people who read this probably don’t even know what that means. Get ready for the fruits of your labor.

April 22nd, 2019 at 7:04 pm -

hello said:

Dear MyBudget360 – Happy New Year, Happy Easter, Happy Spring! Have not heard from you for a while (last post November) Good information to follow US macroeconomics, investments, and help plan and prepare for my children.

April 23rd, 2019 at 9:07 am -

Jason said:

When I graduated from high school the second most prestigious engineering school in the state cost $1600 per year in tuition. My first real job after college paid $9600. I paid off my student loans in two years.

April 25th, 2019 at 5:48 am -

TheManfromScovile said:

What exactly is “other”, because it’s more than auto, and more than cc? Could it be that mils are borrowing for their discretionary “experience” expenses? Trips to exotic places, sky diving tunnels, and various fun rides that seem to be the zeitgeist of this generation. Every generation has its folly, and crying that I can’t pay the rent, after a month in Tahiti rings a bit hollow.

April 25th, 2019 at 8:14 am -

Stephan Larose said:

The debt is entirely virtual. Banks create the credit out of nothing. It is quite literally legal counterfeit. Most inflation is due to the Fed and private banks leveraging themselves 30-40 times and loaning out money that doesn’t exist hand over fist.

The solution to the debt problem is to reform the banking system, not just the commercial banking system, but the Federal Reserve. Instead of using a debt-based monetary system, we switch away from the Fed and go to a constitutional debt-free monetary system. Money is issued and printed debt free and spent into the economy. When large projects such as dams and railways are completed, the moneys printed to build them are retired, keeping the money supply in balance.

A debt-free monetary system would mean the end of income tax–which was created specifically to pay off debts the Federal Reserve created. Taxpayers would be saved enormous sums of debt, interest and tax. That being the case, far less money would need to be printed to keep liquidity in the economy and inflation could be controlled simply by limiting issuance and retiring funds spent into the economy that have fulfilled their purpose. See “Moneymasters”

April 27th, 2019 at 10:02 am -

Mary @ The Dollar Blogger said:

The difference between the college experience for baby boomers and millenials is huge. As you have pointed out, Millenials can’t just easily pay their way through college as the baby boomers did. It is a completely different world now.

March 13th, 2020 at 1:16 pm