As more Americans save the typical too big to fail banking savings account is paying close to 0 percent in interest. At the same time the average credit card interest rate is over 14 percent.

- 10 Comment

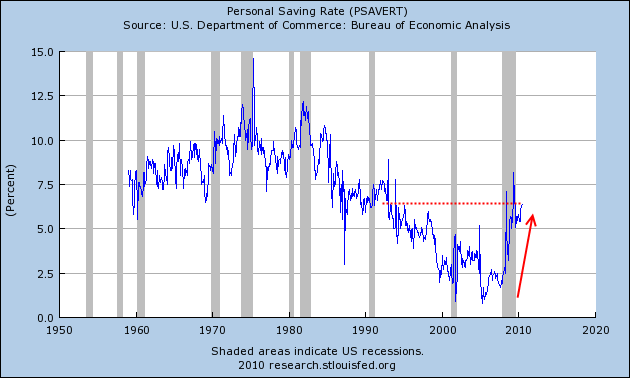

The one silver lining of this crisis if there is one to be had is that many more Americans are actually saving more money. However the problem that many now face is historically low interest rates through bank savings accounts. Average Americans have few places to go receive a decent return (5% or lower) without funneling their money into the highly speculative world of the stock market. The personal savings rate is at a level not seen for two decades and is occurring during the worst crisis since the Great Depression. Yet the interest on savings accounts is incredibly low while the too big to fail banks also provide credit cards for rates that are still near record levels. It is understandable that safer investments now offer lower rates. Yet the margin is based on taxpayer dollars. In other words, big banks are using the leverage of bailout funds to give Americans virtually nothing for stashing money away while ramping up the costs on credit cards and other fees like overdraft charges.

Let us first look at the savings rate on a historical perspective:

This is actually a beneficial turn of events. The Federal Reserve however is fighting with everything that it has to keep Americans spending. If you even think about basic nest egg building or investing, you don’t build a comfortable savings account by spending all the money you generate. So why is this trend the current national policy? You have to go against the grain to save money and unfortunately banks now offer virtually nothing more than a location to stuff your money with no return. Given how much we use electronic bill pay and payment systems, is there even the need of the too big to fail? In the past, it was understandable that a bank had to be big and mighty to give customers the sense of security and safety. But even in the early 1900s we had over 20,000 different banks competing with one another. That number has dwindled to less than 8,000 today with roughly 10 banks controlling the vast majority of resources. Today with online banking you can put your money directly with the U.S. Treasury and get a better return.

So let us look at three too big to fail banks and see what their current savings rates are:

Now this is really where many Americans will lose out on the system. The current interest rate at Bank of America on their savings account is 0.10%. So let us assume you have $2,500 stashed away for a year here. How much will you earn? Two dollars and fifty cents. And what is troubling is that if you withdraw more than three times in one month, you’ll get a $3 per withdrawal charge! There goes that one year of interest.

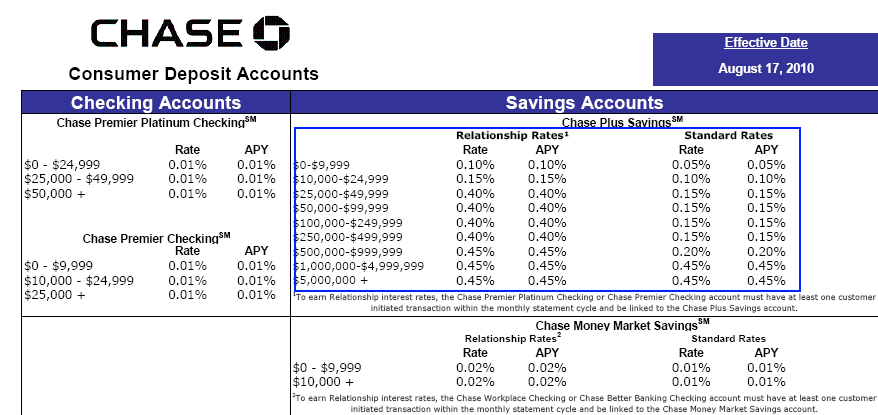

What about JP Morgan Chase?

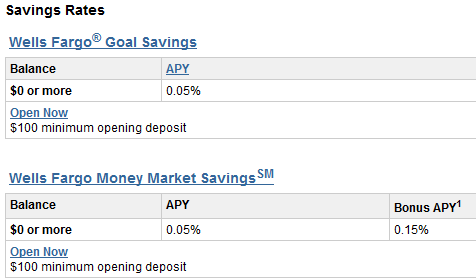

Chase offers the same interest rate as Bank of America does. You’ll need $500,000 before you can get the prime rate of 0.40 percent. Maybe Wells Fargo offers a better rate:

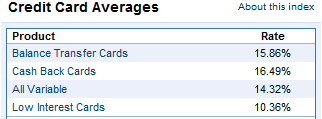

Wells Fargo actually has an even lower rate! We’re talking about 0.10% and 0.05%. I think at this level, it is more of a mind game and propaganda. Clearly banks can’t offer a 0 percent interest rate because the public would flip out. What do you mean a bank “savings†account is offering zero percent? But at this level, they can just say they offer a very low interest rate. But in reality, this is basically nothing. As we have documented before the too big to fail banks also provide most of the credit cards in the U.S. What is interesting is that after all the bailouts, the interest rate on savings accounts has evaporated but little has been done with credit cards:

The average interest rate is 14.32 percent. So while a bank will give you 0.10 percent on your hard earned savings, they are more than willing to let you spend money you don’t have at a rate of 14 percent. Since the taxpayer bails the too big to fail no matter what, this incredible margin is like growing money on trees for these banks. I think most Americans can understand if it were banks lending their own capital and taking on 100 percent of the risk. Then let them charge whatever they like on credit cards. But they are not operating in a free market. First, they can borrow from the Federal Reserve at zero percent. Next, they have the FDIC seal of approval that insures each account up to $250,000. Of course, the FDIC deposit insurance fund is now in the red but this will be taken care of by the American taxpayer (at least that is the implication).

Solutions?

Banks are at the core of the problem here. What needs to be done is to break up banks into two distinct components; one commercial banking that is run like a utility and another investment banking side that can run like a hedge fund if it wants but with no government support. Even after this crisis, this has not changed. Most Americans walk into a bank and think that all they do is provide checking, mortgages, credit cards, and a bank account. Not true. In fact, the last few quarters most of these too big to fail banks have made the bulk of their money speculating on Wall Street. Borrow low and invest in wild speculative items like derivatives or simply cashing in on the margin. Nothing wrong when you are using your own capital but there is definitely something wrong when it is taxpayer money.

At this point, commercial banking is the most important factor to keeping the American banking system going:

-Savings accounts

-Checking accounts

-Mortgages

-Credit cards

This should be a highly regulated and enforced industry just like it was after the Great Depression. Every other piece of a bank that isn’t part of the above will be broken out and spun off. This is the only way we will regain a hold of our economy without this boom and bust cycle that seems to get worse with each passing one. A zero percent interest rate is really all you need to know about our current banking structure. You would think that banks would at least offer Americans a decent interest rate for keeping them alive.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!10 Comments on this post

Trackbacks

-

Martin Noyes said:

I’m no macro-economist but it seems to me that the FED keeping the discount window at near zero percent for over a year is merely a transfer of wealth to the banksters. There borrow at near zero percent and then deposit the money with the FED and earn maybe 2% on the taxpayer’s dime. It hasn’t promoted lending by the banks.

If the FED promptly raised the discount rate to about 2 – 2.5% it may promote the banks to begin lending and also force up the interest rate that savers earn on their deposited funds in banks. This would stimulate the economy. Am I wrong?

August 18th, 2010 at 9:49 am -

JahLove63 said:

Wow! My little ‘ol community credit union is giving me way more interest on my savings than those “too big to fail” banks …a whooping 0.50%. I think I’ll stay with my local credit union, thank you very much!

August 18th, 2010 at 10:15 am -

Scott said:

Makes me want to shift more of my savings over to Prosper.com and lend it out for higher returns.

August 18th, 2010 at 11:52 am -

lilos said:

so they raise costs so savers spend savings…. no employment but rising expenses??????????????/

August 18th, 2010 at 12:23 pm -

lilos said:

but tho also..if the banks are doing so well..why are their shaRE PRICES SITTING AT LEVELS NOT SEEN IN SOME CASES FOR DECADES AND PAYING MINI DIVIDENDS, IF THAT and if its because, assets were sold off to pay bonuses and gigantic salarys all with approvals of the boards of directors and “officers” who got those salarys and counted the votes giving those paydays….that problem is in all the stock companys???/

August 18th, 2010 at 12:29 pm -

jay said:

If interest rates equal the value of money, then what the banks are telling us is that the value of the dollar is “0”.

August 18th, 2010 at 1:58 pm -

Pete said:

I think the best way to fight back is to pay off credit cards (as i have), don’t buy a new house or car, or use credit even though you can afford it. We need to stick it to these slimy corporate bastards. If you have the fortitude, close your too big to fail account and use a online bank like ING direct.

August 19th, 2010 at 12:11 am -

CH said:

Yup, it’s a system of the bankers, by the bankers, and for bankers. What we really need, debt payoff and an increase in savings, is not what the Fed wants, which is more spending and borrowing, thus rates are super low and savers get screwed. If we don’t incentivize saving and the elimination of debt, we won’t accumulate as quickly the capital we’ll need to get the next economic boom underway. In my mind, Fed policy seems counter to what this country really needs. A correction isn’t fun, but the sooner we get the imbalances fixed and the excesses cleared, the sooner we can get the economy rolling again.

August 20th, 2010 at 7:17 am -

RealisticOptimist said:

Like you said – this is actually positive news. It shows that despite the Fed and banks doing everything in it’s power to get people to return to spending beyond their means, it’s not working. The recessions of the past weren’t deep enough to change the way people view their money. We are now close to entering year 3 of the wake up call, and many people are starting to get it.

Maybe after time, the fed will begin to realize that monetary policy is a just SUPPLEMENT to a solution.

August 21st, 2010 at 7:31 am -

FleeceMe said:

But they do have ways of making us spend. They scare us into spending. Bed Bugs, whooping cough, H1N1, Bad Eggs,.etc. Bed Bugs…gotta get Terminex, and a new mattress, whooping cough, gotta buy a vaccine, and some antibiotics, Bad Eggs…dump them..and buy some “good eggs”…and on and on.

August 26th, 2010 at 12:58 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!