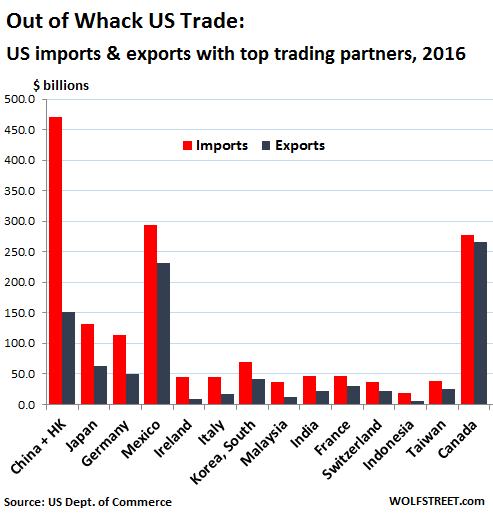

The most depressing chart showing US imports and exports in 2016 with top trading partners.

- 1 Comment

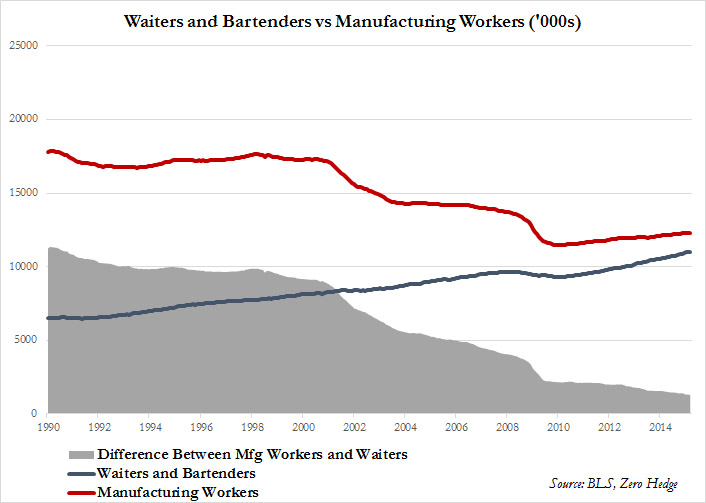

The manufacturing base has completely eroded in this country and one chart dramatically highlights this (shown later in the article). It is deeply disturbing that we now have as many people working in restaurants as waiters and bartenders as we do in manufacturing. This of course is for good reason given that you can’t export (yet) the ability to order a meal and have a stiff drink served to you to drown away your economic sorrows. As a nation we have enjoyed spending on a lax credit card for an entire generation. And now that money is coming back rushing in buying up real estate, studios, hotels, franchises, and everything else you can imagine. For every debt there is a collector. That is basic accounting (assets and liabilities). In a simplified equation you want to have more assets and fewer liabilities. However when you look at our export and import data, a troubling picture emerges.

Spending more than we earn

If you want to see the current situation we are in take a look at our trade balance with our top trading partners in 2016. What this highlights is our spending beyond our means:

It should come as no surprise that our trade deficit with China is off the literal charts. But that is simply one country. We are running trade deficits on pretty much all fronts. In other words we are buying more from these countries than they are buying from us. That is the ultimate generational game of low wage capitalism. However, when that game gets near an end, you see money repatriating back since many of these countries have big surpluses and there are very wealthy people around the world that fed into this global hunger of low wages and insatiable consumption.

On a personal level, imagine the person that diligently saves for retirement driving a modest car and investing wisely. His neighbor is the spendthrift with a new car every three years, eats out every week, and basically spends more than he earns. One appears to live better in the short-term. Fast forward 30 years and one has nothing to show for it and the other has a rather large nest egg to deploy. That global nest egg is being deployed in a ravenous fashion.

We even see this in our manufacturing base. Here is a chart showing manufacturing workers contrasted with restaurant workers:

So it shouldn’t come as a surprise that the middle class is now a minority in this country. We’ve essentially traded good paying manufacturing jobs for flipping burgers or wrapping up burritos at Chipotle. You can support a family working on an assembly line for cars but not for serving up frozen yogurt.

Some people seem to think that this situation is fine but that is the smaller elite class in this country. They can leverage global workers and use arbitrage to increase their wealth. But the average American doesn’t have that luxury and their standard of living has eroded. Wages in fact in places like China have increased. We’ve reached a very low wage internationally and might have hit a bottom. We talk about buying American products but most workers in the US are cash strapped. What would happen if the cost of most items goes up 30 to 50 percent? Inflation is never talked about in the mainstream press but this slow erosion of purchasing power is just that.

That chart showing exports and imports just reflects a continuation of spending beyond our means. It doesn’t seem like that will turn around anytime soon. Just keep imaging that person with the shiny new car. Who are we in this picture?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Nonya said:

You can thank 8 years of worthless obama administration and another 20+ years by moron administrations before him.

February 15th, 2017 at 4:55 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â