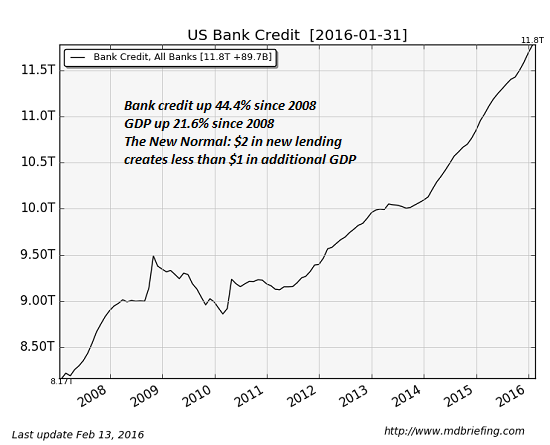

New banking normal where lending $2 increases GDP by $1: US bank credit up 44 percent since 2008 while GDP up 21 percent.

- 0 Comments

Remember a time when people used to be cautious when it came to taking on debt? Probably vaguely since the entire U.S. economic system is built on “gold†and “platinum†credit cards being shelled out to people that can’t afford an ounce of either. In the mail I’m receiving overwhelming offers for credit cards and personal loans. The last time credit was flowing this easily was in 2005 and 2006. I’m not sure if people realize that the Great Recession was caused by excessive debt. Too much leverage. So it should be sobering to hear that since 2008 bank credit is up 44 percent while GDP is up 21 percent. What is basically happening is that for every $2 in lending GDP is moving up by $1. In other words, we are building a house of cards once again.

Making $2 out of $1

You have to realize how much power is in the hands of banks through the lending mechanism. Banks are able to create money out of thin air. Take credit cards for example. A consumer is basically spending future earnings with interest for consumption today. What you are doing is pulling in future GDP for immediate gratification. This works if there is a careful balance but that balance is not to be found today.

Take a look at this chart:

This is not healthy. We’ve already noted that over the last few years lenders have gotten aggressive in many areas including subprime auto debt. With the market low on good credit borrowers, many lenders are now venturing to riskier clients just to squeak out more profits. This can only last for so long. A minor hiccup in the economy and defaults are going to soar.

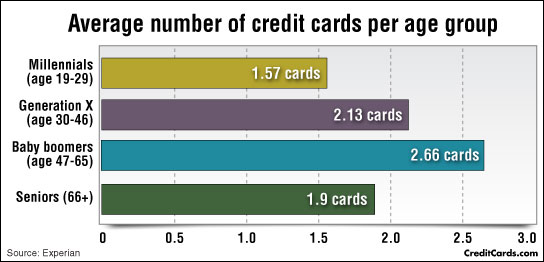

Practically every American has at least one credit card:

Baby boomers, a generation that grew up during a major stock market and housing bull run are finding retirement a distant dream. On average, many boomers have nearly 3 credit cards to finance activities of today with future earnings (even though these earnings are largely in the rear view mirror). The debt addiction cycle is resulting in less real economic activity.

The first chart in this article is incredibly telling since you realize debt is losing its real world impact. Taking on $2 of debt is creating a real change in GDP of $1. In other words, the market is mispricing debt for what it can actually achieve. Usually when you take on too much debt relative to GDP you end up with bankruptcies and foreclosures.

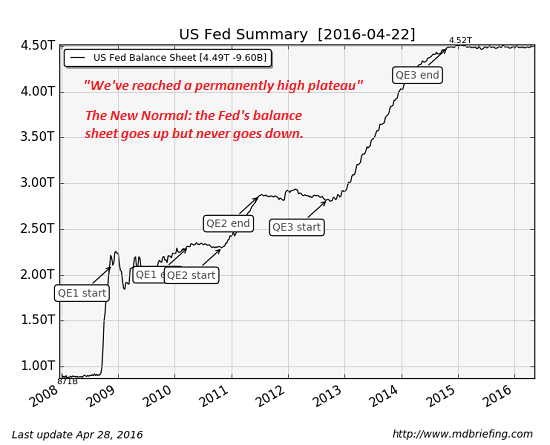

It is odd to see things playing out again in a similar fashion and the Fed’s balance sheet is bloated:

The Fed’s balance sheet is maxed out. Of course they point to signs of weak inflation but in reality, the cost of living is soaring for most Americans. You don’t need to be a rocket scientist to understand that borrowing $2 to receive $1 is not a good business practice. It looks like the Fed is maxing out its balance sheet just like that of millions of Americans.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â