Meet the new financial boss, same as the old financial boss – Commercial real estate bailout implicates Federal Reserve as Fed balance sheet balloons to $2.7 trillion. CRE values down $3 trillion from their 2008 peak.

- 1 Comment

Commercial real estate (CRE) is still benefitting from a large shadow bailout by the Federal Reserve. This isn’t some secretive move since the Fed actually publishes data on this and is available to anyone in the public with a desire to shuffle through the mounds of information. There has been virtually no media coverage on the CRE industry even though CRE values have lost close to $3 trillion from their peak. You would think a $3 trillion loss would garner some attention but the media would rather focus on squabbles over a few billion dollars. Residential real estate is very tangible and most can understand what a bailout in housing means; at least in theory they grasp it since the bailouts really at their core were about saving big banks and making sure they were not penalized by their past transgressions. The irony of CRE problems is also the interesting support Donald Trump is getting even though CRE and residential real estate speculation are at the core of the financial mess. We can argue about taxes and public policies but the real money and the grease that ground the system to a halt was banking and their speculation on the real estate markets. This is why the CRE coverage has been completely missing from the morning shows. Let us look at this closer once again.

CRE delinquency hit new peak

Source:Â HousingWire

In 2011 delinquent loans reached a peak so the notion that this industry is healthy is a large misnomer but since it isn’t reported on mainstream news, I’d be surprised if 1 out of 100 people was even aware of this being an issue:

“(HousingWire) The rate of delinquencies within commercial mortgage-backed securities topped 9% for the first time in January although the number of delinquent loans fell for the third month in a row, according to Moody’s Investors Service.

Analysts said the agency’s delinquency tracker rose 22 basis points last month to 9.01% from 8.79% in December. There are now 4,052 delinquent loans in CMBS worth $55.7 billion, according to Moody’s. For the last month of 2010, there were 4,104 delinquent loans worth about $54.9 billion.â€

Of course the primary reason for CRE problems is either inflated valuations gained during the bubble or simply building places with no demand.

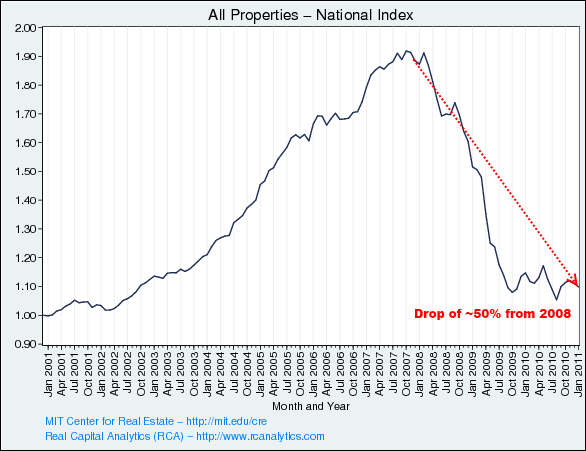

Unlike residential real estate, many CRE loans are repaid over short time frames. These time frames can span from 5, 7, or 10 years. Banks however have chosen to keep these loans on their balance sheet at inflated levels thanks to the suspension of mark-to-market. What this also meant was a property valued at $10 million during the peak with no demand today can still be an “asset†on the bank balance sheet of $10 million even if no payments are coming in. The banks are simply rolling over these loans like pushing a giant ball of debt down the highway. That is where the first chart comes in. We are talking about an industry valued at $3 trillion here. Take a look at the dramatic fall with the latest data from MIT:

Source:Â MIT

CRE values are no better off than they were at the start of the 2000s. A lost decade in nominal terms. Of course much of this was built merely to speculate on. The value of it is always paid on the back end but the banking sector churned trillions of dollars of wealth while the bubble was going strong. Images of empty parking lots and shopping malls reminds me of the China real estate bubble where they have 64 million apartment units sitting empty yet their bottom line GDP shows growth. Not all GDP is created equal as we all know. Growing for the sake of growing isn’t exactly the best policy and the Chinese are likely to pay dearly once the bubble bursts as it did in the U.S. except their bubble is much bigger in relative terms. Again it will be their working class that pays for the graft of the few.

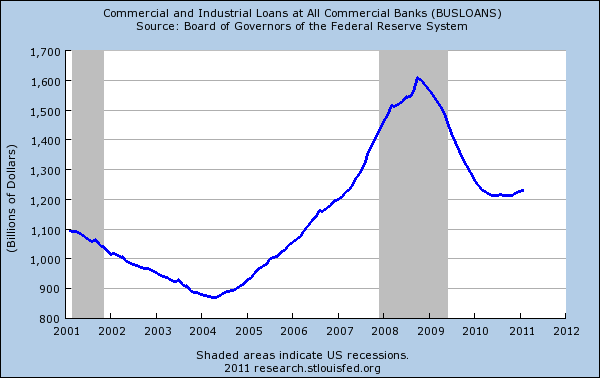

While banks continue to put on a public face that the CRE market is great the amount of loans being issued has hardly moved:

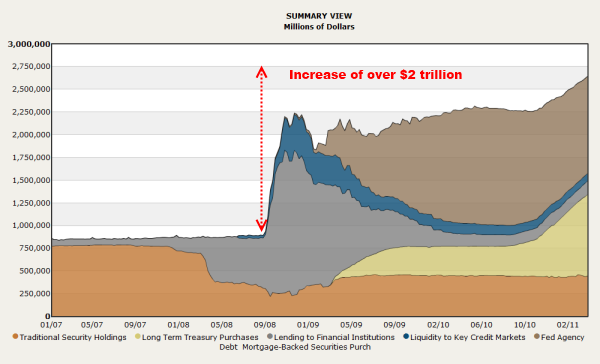

If the recession has been over for nearly two years, then why has demand for commercial loans not grown? You would expect expanding businesses to demand more loans to finance deals in the real world. Clearly the market is saturated with properties and the reality is most working and middle class Americans now have less money to spend. Are we going to build shopping malls just to say we built something? China is doing that to inflate their overall GDP but in the U.S. we have banks holding onto defunct CRE loans just to keep their balance sheets inflated. Many of the bigger banks have dumped these loans into the Federal Reserve:

This is accurate to the actual day and just look at the chart. The Federal Reserve balance sheet is at a peak of over $2.75 trillion. It is full of MBS bought from banks since no one else wants to purchase them at such low rates. You have MBS but also CMBS.

Take a look at one portfolio held by the Fed:

It is also filled with empty shopping malls, some Hilton properties, a shopping mall in Oklahoma, a Chick-fil-A, and other random items. The Fed is basically keeping the CRE bailout under wraps but the public doesn’t seem to care about these bigger banking issues because they are too busy with the Kabuki theatre of government. Democrat or Republican, our current structure is built to serve the financial interest. Meet the new boss, same as the old boss.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

1 Comments on this post

Trackbacks

-

John Anders said:

Nice site – Good job. I’ve been watching China for a while now, and Beijing residences took a 26.7% hit in March. It appears the Chinese bubble is popping as Chanos has long warned. Furthermore, the Chinese CRE sector may be even more overbuilt than residences.

China has big reserves, but building accounts for a huge portion of its GDP.

What do you think will be the real net effects?.

Regards,

John

April 15th, 2011 at 5:44 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!