The new retirement model revolves around dying broke and realizing that the 401k model of investing is a sham for most Americans.

- 4 Comment

The new retirement model means working until you die. Most Americans are broke and living paycheck to paycheck. Yet the stock market is near a modern day peak. What is going on? Wasn’t the 401k experiment that launched in the early 1980s to replace pensions supposed to be a panacea in terms of building out nest eggs for the masses in their golden years? That was the idea but unfortunately inflation has eaten away at the standard of living and many Americans simply did not have enough to save when it came to retirement. We know the drill – sock away X percent a month and after 30 or 40 years you will have seven figures. Well here we are, nearly 40 years from that experiment and most Americans have little to nothing in their retirement accounts and the pension (a forced 401k in a way) is virtually extinct. So is dying broke the new retirement model?

Americans have very little saved

This might come as a surprise but most Americans have very little saved when it comes to retirement (assuming they even have retirement savings). The numbers don’t even look that great after a massive bull market.

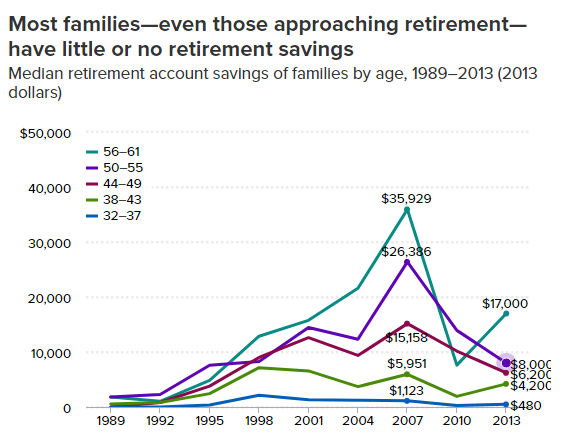

Take a look at the figures:

These are incredibly low numbers across the board. Essentially the median amount saved for retirement of those 55 and younger is $8,000 at the high-end and down to $480 for those 32 to 37 years of age. Even at the upper-end of age range the median is $17,000. That is basically one minor surgery from being bankrupt.

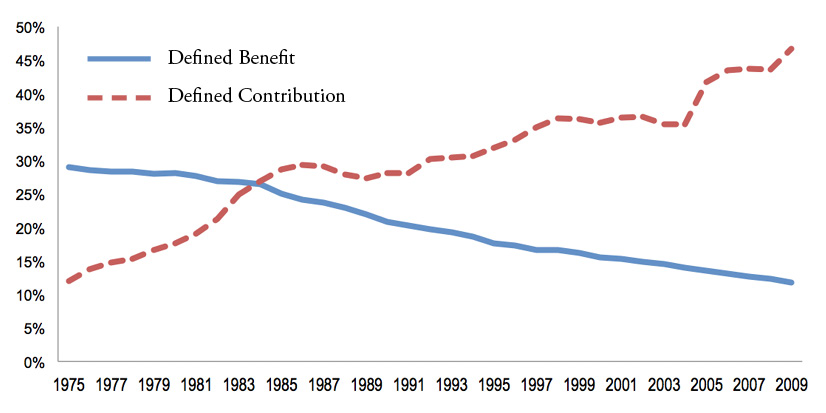

Why are so many Americans broke? Well the standard of living has simply deteriorated over time and the safety net of pensions for Americans has flat out disappeared:

That number is now down to about 13 percent of private sector workers that have access to a pension. So if Americans are not putting money away into stocks that 401k solution is not going to work. And here we are nearly a full 40 years from that move and most Americans just don’t have money saved. So the voluntary nature of the 401k just doesn’t seem to work. If we made Social Security voluntary we’d have homeless shelters the size of major metro cities across every state. So the benefits of compounding evaporate into thin air if you don’t consistently save.

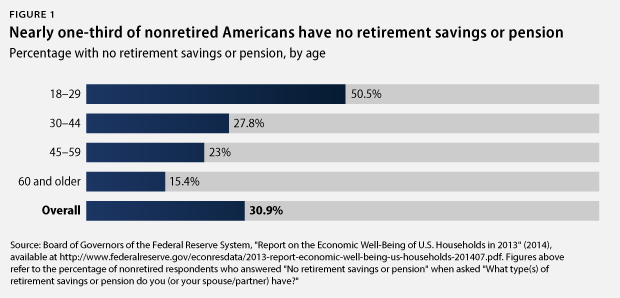

In fact nearly one-third of Americans have no retirement savings:

That is a big problem because that means that Social Security is going to be the default income source for most older Americans. And data shows that nearly half of the elderly would be out in the streets Great Depression style if it were not for Social Security. And we now have a record number of Americans living into old age.

The notion of a strong middle class was an anomaly in human history. For most of modern history, people worked until they died. And work can mean taking care of a farm or a “job†as we think of it. Retiring at 60 and living off of stocks or bonds for the average person is a rare concept in our modern human history. If we really valued financial literacy we would teach it in school early on or even in general education courses in college. Yet somehow, we leave this out. And here we are with millions missing out in another massive bull market.

Get used to this because many people don’t have 30 years to build that nest egg.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

Vlad the Skewerer said:

I have been sayin this for 30 years, the American economy is a house of cards, built on a foundation of debt and speculation and fueled by consumption levels that cannot be sustained. Used to lay that one on the brokers and traders when I was working on their server room AC units. I warned them at the time the money is coming in faster than you can legitimately find a place to put it so now you are making stuff up, the whole financial services industry.

July 1st, 2017 at 3:33 am -

Dennis said:

The Deep State does not want financially literate citizens. It wants people who spend everything they make. Spending accounts for most of GDP.

The 401k concept is not really a failure. The failure is that people don’t take advantage of tax advantaged investing accounts. You are correct, they lack financial literacy.

Beyond that, behavior is driven by media. Cars, clothes, and trips are paraded on TV and consumers are told they should have them.

When I grew up in the 50s and 60s, people lived in mostly 600 to 800 sq ft houses, and they only had one. They only had one car, one TV, one phone. They did not eat, all week long at fast food places, or go out to dinner every weekend, buying $10 cocktails. They did not go on cruises, or fly to Europe, Hawaii, or other destination spots.

Now, due a lot to media, lots of people expect to live like that and never think about saving or investing.

The last depression was too long ago to scare people into safer behavior. The next one will create more careful spenders, for another 80 years.

Thanks for your articles, I enjoy them regularly.Dennis

July 1st, 2017 at 5:41 am -

carefix said:

It looks pretty dismal in the US. In the illusioned UK I think things are better and there are some good company pension schemes still around. For example my wife was in one (of many) pension scheme for just eight months on an average salary. She retired early at 57 and as a defined benefit scheme it pays out a 50% joint pension with 5.0% annual increments (for life) of $20 per week. That is about 50 cents per week for every week she worked.

On the other hand a friend worked for decades and built up two pension funds, one private and one company. Recently I asked him what he might get on retirement and he told me “nothing”. “But I thought you had two pension funds?” I asked. ” I did” he replied. “One with Robert Maxwell and another with Equitable Life”.

Both funds went bust effectively stealing both pensions entirely.

July 5th, 2017 at 4:48 am -

Nicole said:

Im technically not a millennial, but on the cusp of this group. My view of retirement is quite different than my grandparents. The best bet for enjoying life now and in the future is to do the opposite of every one else. Checkout of the mainstream and live “slow” at home. It’s less stressful and overall a healthier way to live. Invest largely in physical assets and hold them. Buy a small house in farmville, pay it off, and invest in things that will make life more efficient like a appliances, good roof, windows, solar, water collection and a big garden.

I also invest in 401k and a Roth, but electronic money is no guarantee and imagining life 30 years into the future is scary. I know social security will barely pay for anything if I even get it. I would rather be at home doing my hobbies than traveling to other countries where freedom, privacy and sanitation is non-existent.

Maybe this makes me quite monkish but I personally get more enjoyment from being outside in nature, growing things, and reading books which cost very little.

I think life is better than what I have read about in the 30’s and 40’s. Technology has improved our lives and will continue to do so, but we cannot forget how fragile those systems are.

I will not take responsibility for those who fail to plan, educate themselves, or take care of their health.

Sadly most of them will die of drug overdose or cancer.

July 7th, 2017 at 2:57 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â