34 percent of Americans financially carry the country: Those not in the labor force hits another record at 93,194,000.

- 6 Comment

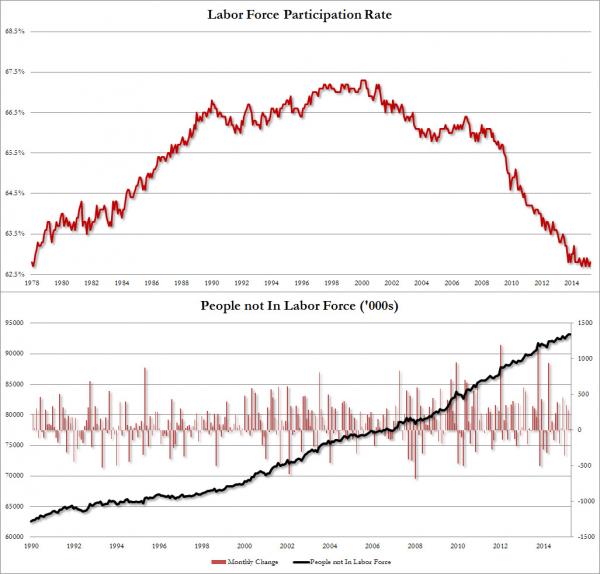

The unemployment rate is calculated by those in what is deemed the labor force. With the unemployment rate dropping you would think that somehow, we’d be back in a glorious economy where everyone was financially moving up. That is definitely not the case. Every single day we have 11,000 Americans hitting 65 years of age and many are approaching retirement with the “work until I die†mentality because they are financially ill prepared. We also have a gargantuan number of Americans not in the labor force. These are people able to work but are simply not doing so for a variety of reasons. Many of the reasons are legitimate like old age, college, or a disability but millions are on here that should be counted in the unemployment rate. While the market was cheering the unemployment rate dropping to a level that takes us back to pre-recession levels, we now somehow have a record number of Americans not in the labor force. The number is downright shocking.

Those not in the labor force

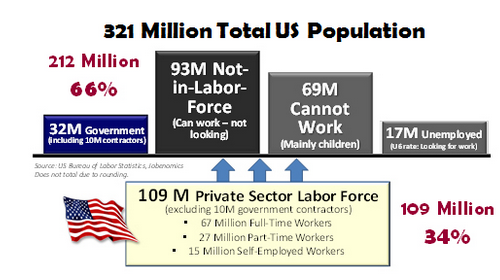

The number of Americans not in the labor force has hit another new record. The latest figures show that 93,194,000 Americans are not in the labor force. How big is this figure? How about the populations of our three most populated states in California, Texas, and Florida combined and you would still need to find millions more. To be exact, add all three up and you would still need another 8 million people to add up to this figure. This is about a third of the entire United States that is not in the labor force, and this is excluding the 69 million that can’t work (i.e., mostly children).

The trend itself doesn’t seem to be letting up. Plus you have a large number of added jobs coming from low wage employment. The trend for those not in the labor force is unmistakable:

Another problematic aspect of this transition is that you have 34 percent of the country supporting the rest financially. Does that come as a shock to you? I’m sure the media doesn’t bother going into this because they are too caught up in the narrative that money is flowing into all corners of the United States. That is simply not true. Sure, the stock market is near a peak. But very few Americans actually own stocks out right.

Take a look at the raw numbers of the entire United States:

Let us go through the categories one by one:

Government workers: Government workers are paid via tax revenues collected from the private sector. While many of these are legitimate jobs, the revenue for paying for these come from tax dollars collected from the private sector. That is simply a fact.

Not in the labor force: This is the black box of it all. These are able-bodied people that can work but choose not to do so. Some are old and some are in college, but this figure has to be examined closely. With more Americans going to college and more diving deep into debt, how many in this group should be working but are not? The growth here is not explained by old age trends or disability growth with the population. Something else is going on here.

Cannot work:Â This group is mainly made up of children so probably needs no further investigation.

Unemployed: This is the headline calculating group. These are Americans looking for work but are unable to do so. We keep hearing how great things are but we have 17 million Americans ready and wanting to work but not being able to do so.

Private sector: In terms of tax revenues, this is really the group that is supporting the rest of the country. Their tax revenues fuel and fund the government. But even their tax revenues are not enough as we go deeper into debt as a country.

Now maybe all of the above doesn’t fit in conveniently in a one minute television segment. But don’t you think this is important to think about when one-third of the country is supporting the rest financially? And isn’t it troubling that many new private sector jobs are also in the low wage segment of the economy?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!6 Comments on this post

Trackbacks

-

ebt.welfare.gov said:

big gov sends u a check 1st of every month,pay for your food,rent,cell,hbo,meds,etc keepin folks fat and happy and completely dumded down ,politicians and banksters throwin crumbs to the sheep in hopes they sit down and sthu,and it’s working better than could ever be imagined

May 10th, 2015 at 5:41 pm -

Jerry said:

Another fact about government workers is that they constitute nearly half of the total Federal Withholding Taxes paid.

What happens when government workers are the only taxpayers?May 11th, 2015 at 4:23 am -

Martin said:

Don’t forget that official definition of employed person is:

Anyone who had at least ONE hour of paid or UNPAID work in previous TWO weeks.May 11th, 2015 at 5:52 pm -

Sam from The Nude Investor said:

Participation rates have been in decline for nearly 13 years now. We are at the end of an era IMO. There are so many factors contributing to it all though – I don’t think we can solely blame the government for everything. EM’s are playing a big role in driving unskilled labour from developed countries. China in particular doesn’t play fair when it comes to FX either.

It’s a complex problem without a simple solution. We’ve gotta do something, but I have a feeling things are going to get much worse before they get better.

May 15th, 2015 at 1:49 am -

Neil said:

Also, don’t forget that many of the 109 million in the private sector labor force are also partially subsidized by the government via the SNAP and WIC programs. I personally know someone who works full-time at around $12.50 an hour, but they have a spouse who stays home and three small kids, so they get a hefty SNAP allowance every month. So it’s not hard to see how even those who are gainfully employed may actually still be net tax-consumers, rather than tax payers when it’s all said and done.

May 17th, 2015 at 4:49 pm -

Sam Son said:

“Not in the labor force” misses non-market investments of time that are HUGE, namely: (a) parenting — primary caregivers to children are investing huge amounts of time and energy in the well-being and success of their offspring and (b) higher education — to the extent a bachelor’s degree lifts one’s lifetime earnings by about $1 Million per year above HS diploma alone, it’s also a valid investment in one’s own future as well as the health of our skilled workforce tomorrow. To place all those caring for (8.6 million) pre-school aged relatives alone in (a) and all those 9.3 Million in (b) into a nebulous group of slackers and freeloaders does not paint a sufficiently clear picture of the investments and indirect or non-market contributions many of them are making. In fact, it would seem to explain the primary occupation of 10 (full time, unemployed students) to 20% (those students + caregivers for pre-school aged kids) of your able bodied folks. Add in primary caregivers for younger and older children, plus disabled relatives, and you may find your numbers making quite a bit more sense — especially in this era when market-based caregiving can cost more after tax $ than many earners otherwise would make.

June 21st, 2015 at 3:42 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â