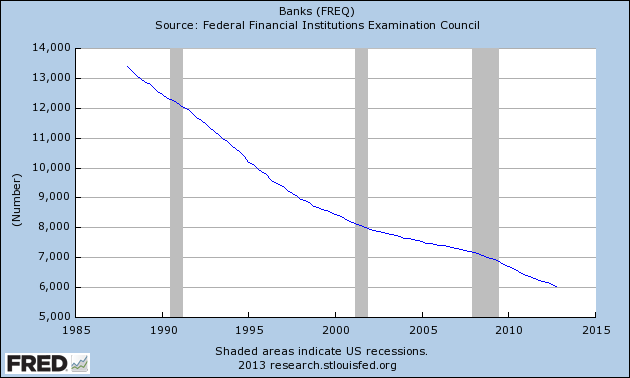

Too big to fail or ignore: How the US went from over 13,000 banks in 1987 to 6,000 today. $7.4 trillion in deposits backed by $32 billion dollars.

- 4 Comment

Remember when too big to fail brought our economy to a grinding halt? Of course you do because this is a recent financial event with dramatic ramifications. In the time since the buffet of bailouts was rolled out you might be surprised that the too big to fail banks have only grown even larger and if they were too big to fail before, what happens when they become even bigger? Some walk around in a financially comfortable delusion about our current system even though we all realize that we will never payback our $16 trillion in national debt. You also have a banking system backing $7.4 trillion in insured deposits with $32 billion (that is, 0.43 percent). Yet in our current system the Fed is digitally inflating away our currency and limiting available banking options. Are we simply ignoring the too big to fail?

Shrinking the number of banks while becoming even bigger

The US banking industry has been consolidating for many years. In fact, we have gone from over 13,000 banks in the US in 1987 to roughly 6,000 today:

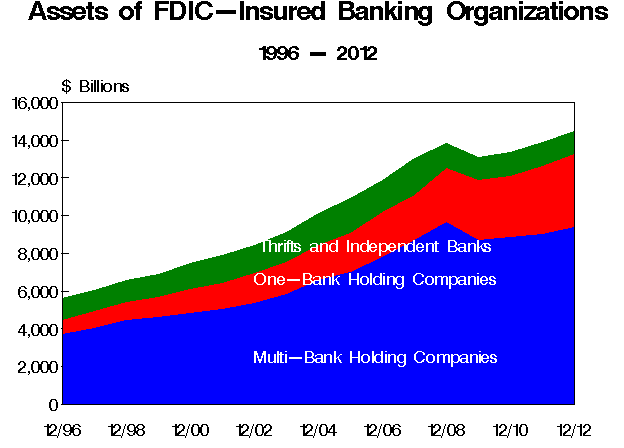

At the same time, you can track the trend that banks have gotten much larger in this same period of time in terms of the assets they carry:

You need to remember what banks consider “assets†because it will be a different definition from what you would consider an asset. For a bank, a mortgage is an asset. This is money that you owe the bank while the mortgage is a liability on your balance sheet. The home is an asset but certainly not the mortgage. Think you own your home? Stop paying on that mortgage and find out who really owns it. Yet banks can increase their asset column by the simple act of writing more mortgages. This is good when housing prices only go up but when they go down, suddenly those assets can go underwater. Deposits are not an asset to a bank since these are liabilities that must be paid back to customers. That is why the fact that $7.4 trillion in deposits is backed up by only $32 billion is somewhat astonishing. I think few people realize this but in reality, the Fed and U.S. Treasury would simply turn on the printing press and inflate away our currency if they had to (and they are).

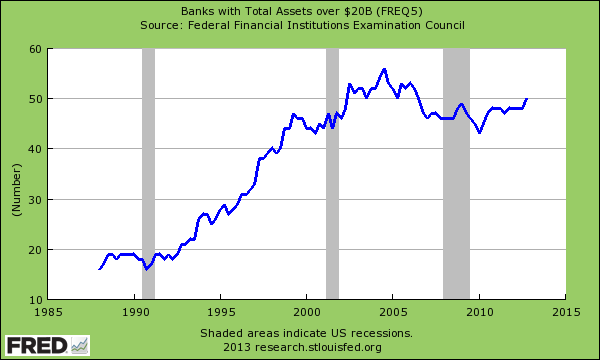

We have more than 50 banks with $20 billion in assets or more. Take JP Morgan Chase for example. Chase had $2.031 trillion in assets under management in 2009. Today? That number is $2.359 trillion (an increase of $328 billion at a time when we fully realized that too big to fail was the central culprit of our economic collapse). Yet here we are simply allowing the banking sector to get even larger with the full unbridled support of the Federal Reserve.

What occurred in Cyprus is somewhat telling even though this was a tiny island in Europe. To preserve the central currency the Euro exacted some tough measures on Cyprus and their banks. Cyprus is a tiny part of the EU but it is part of the union. This is very telling in terms of how central banks will act when push comes to shove. In a way, we see similar actions of how the government and banking system is essentially forcing states where cost of living is more modest to subsidize the spending of expensive states (i.e., New York and California). One clear example of this is the mortgage deduction. Most people get very little benefit from this because the typical home in the US is roughly $170,000. So the deduction only helps out a little. But what about people that take on $500,000, $750,000, or even million dollar mortgages? These people can claim a ridiculously high deduction and this comes at a cost to the rest of the nation. Banks benefit of course because they can carry more “assets†on their books and appear larger.

The financial system encourages heavy leverage. It is a big reason why student debt is now well over $1 trillion as well. There is little reason why the banking system would want to put any sensible brakes on this until of course, we have another financial crisis that will hit because the same risks are being taken just in slightly different forms. Yet people are getting more in tune to this and the standard of living for most Americans has gone stagnant. Sure the press is focused on the Dow reaching a record peak but a very tiny portion of Americans even own stock and a good part of gains came from slashing labor and reducing wages. Too big to fail has become too big to ignore but ignoring is exactly what we are doing. Let us all rest assured and feel comfortable that $7.4 trillion is backed by $32 billion.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

CMASS said:

Banks need to be constrained. Recent news of their criminal activities in money laundering, mortgage fraud and investor fraud as well as GAMBLING ( London whale episode) all the while BACKED by taxpayer funding/bailout is unaccepatable! Here’s hoping new SEC chair Mary Jo White will step UP and Prosecute these renegade institutions and force compliance with the LAW. Paying fines as they do now is only viewed as the cost of doing business….Having Sr. Executives in jail cells is the only way to change behavior.

March 27th, 2013 at 6:06 am -

RUSS SMITH said:

Hi!, Patrons Of My Budget 360 Et Al:

Let the FED print a hundred million billion trillion $ bill for everyone and then nobody will ever need to work again huh? All the FED has to do, after issuing such bills is to get everyone receiving them to believe that they have value plus put on price controls whereby a loaf of bread is only a $. Is this any different than the slow motion path to the same thing we are now on people?

RUSS SMITH, CA. (One Of Our Broke Fiat Money States)

resmith@wcisp.comMarch 28th, 2013 at 8:28 am -

Rich Uncle EL said:

These numbers are a bit scary when you put it that way. I have heard in the media that banks are required to hold only 3-10% of reserves requirements in cash. So 48% is better than what I expected. This cannot be sustained long if the gap widens.

March 28th, 2013 at 11:52 am -

Dr. Goldstein said:

These mega-banks and “bank-holding” companies are criminal enterprises, operating with the full support of our sold-out governments.

Had they made billions or trillions on their “derivatives” and other reckless gambling creations, we the people would have never received one penny of it. Nothing.

But we the people get stuck with the tab for these risky and corrupted schemes gone bad? Why? Because we are all victims of criminal tyrants posing as legitimate businesspeople, and criminal tyrants posing as representatives of the people.

The system is broken and collapsing, just like all empires in their final days.

March 30th, 2013 at 5:41 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!