Oil Peaks at $100, Gold up $25, and Stocks Down. Where to Invest to Preserve Your Wealth?

- 0 Comments

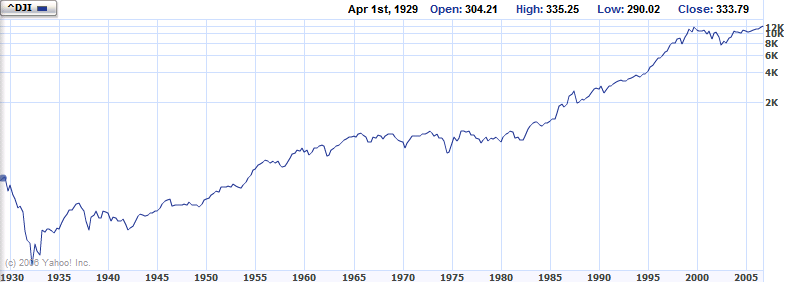

Welcome to myBudget360! The purpose of this site is to give you investing ideas during a bear market that we are entering into. Most of the conventional wisdom regarding conservative investing usually skips over the Great Depression. Keep in mind that during this time stocks lost over 90 percent of their value. It would have taken 25 years to reach the peak that was reached in 1929. During the roaring 20s, we had was termed the “Coolidge Prosperity” and much like today, discretionary spending was through the roof. The 1920s also saw a real estate bubble in Florida. Yet toward the end of the decade a massive excess in consumption was taking over and the air was full with the sense of a massive correction. Take a look at the chart below:

Clearly we are in very turbulent times and debt ratios are now reaching levels not seen since the Great Depression. In fact, housing for the first time in over half a century has had a negative year over year median price on a nationwide scale. Savings rates from banking institutions do not keep up with inflation. So what is a conservative investor to do? The purpose of this site is conservative investing ideas ranging from 401(K) asset allocations to investing in commodities to simple things you can do with credit cards. This is a holistic approach to managing your wealth. Through the process of preserving my own wealth, I will share ideas and hopefully open up a discussion with readers about ideas on keeping up with market trends.

January Conundrum

Investing Strategies

If you are planning on placing your money into CDs or government bonds you may expect a sad return that doesn’t keep up with inflation. For the above reasons, it is very likely that the Fed will keep cutting rates at the behest of the dollar to preserve an all out route of the credit markets. The similarities to

With that said, we can expect further pressure on gold and oil to appreciate for 2008. This of course is assuming the Fed doesn’t take a different course of action which doesn’t seem realistic. More aggressive plays are shorting weak financials and targeted builders. Inventory of unsold homes is at record highs and with the credit crunch, it is a two hit combo. First, it will take a very long time for inventory to wash out of the market at current sales rates. Second, those looking to buy homes are no longer finding any zero down or risky mortgages available. This in the face of a negative savings rate does not bode well for the housing and attached financial sectors.

The credit unwinding will continue into 2008 and election years always offer some sort of market stability but these issues remain bigger than any election. You may want to consider diversifying your portfolio into foreign currencies as well (a discussion for a future post).

What are your investing ideas for 2008? I look forward to reading your responses.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!