The coming failure of Operation Twist – The Federal Reserve resurrects a program from the 1960s named after the Twist Dance. Appropriate timing for a Dancing with the Stars nation.

- 4 Comment

The Federal Reserve has literally run out of ideas. Operation Twist, a throwback to the 1961 action taken by the Fed named after the Twist Dance fad at the time, is now back in 2011. This time the Fed plans to purchase $400 billion of bonds with 6 to 30 year maturities while selling bonds with shorter term maturities. The Federal Reserve continues to deal with a debt crisis with more debt. The market has quickly spoken shaving off 700 points in two days and many global markets are now solidly back in bear market territory. The problem with this program is that it assumes that the only problem with the economy is that not enough people are borrowing and spending. The Fed goes after interest rates like a lion after a zebra. Interest rates are not a problem. Rates are at historical lows. The problem of course is that household income has gone south for well over a decade. The only true winners with these low rates are the banks who can access cheap money to wildly speculate in the stock market casino.

Operation Twist largely benefits the too big to fail banks

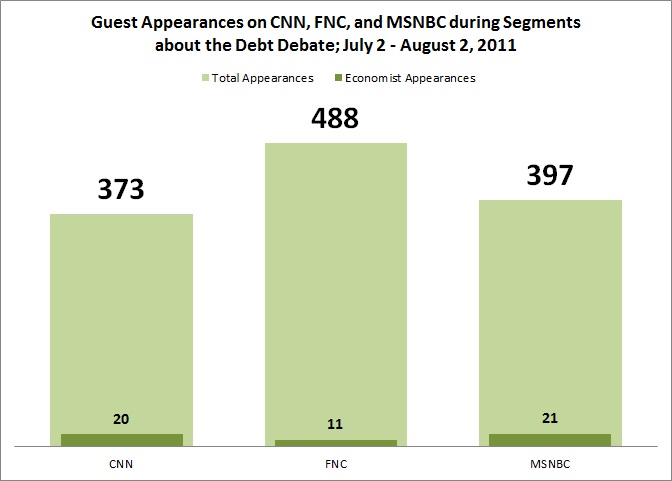

The recent Federal Reserve move only makes it cheaper for banks to borrow and speculate. As the above chart highlights, banks already have an abundant amount of money in their excess reserves. Banks before Operation Twist had $1.6 trillion in reserves that are readily available to lend to the public. The problem is twofold:

-1. Banks are keeping this money because of their horrific balance sheets.

-2. Banks are now back to using due diligence and with the average per capita income at $25,000 not many credible borrowers are coming to the table.

In other words, these excessively low rates continue to bailout the too big to fail banking syndicate. This comes at the expense of savers and those that are prudent. The average savings account in the U.S. is paying roughly 0 percent while banks can charge 15 percent or higher on credit cards. Banks can simply keep that $1.6 trillion and actually earn interest on it. Wouldn’t you like to get free money and earn easy interest on it? The mission of the Fed is to protect the banking system and this is like rule number one of the banking Ten Commandments. The success of the overall economy is only a factor if it aligns with banking profits.

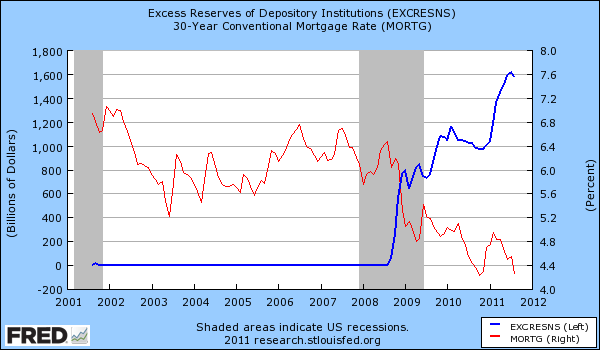

Operation Twist is also a failure because households in America are in the process of deleveraging after reaching a peak crisis in debt. Households are maxed out. The lost decade in household income was covered up with a nice tidy ribbon of debt. It gave the impression that things were better but like the Pied Piper, at some point you need to pay up. That point was reached in 2007. Households have been pulling back ever since:

This is a monumental trend shift. This isn’t your typical recession. All of us need to go back deep in the history books to find a similar time. The last economic crisis of this magnitude was the Great Depression. The above chart highlights this dramatic reversal that is occurring for the first time in 60 years.

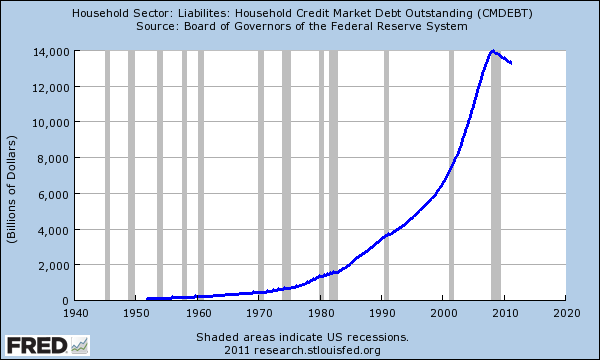

Do you think people are going to be motivated to purchase a home just because mortgage rates went from 4 to 3.75 percent? Of course not. In fact the bulk of activity in the mortgage market is coming from people simply refinancing. So you are helping those who really do not need the help. Plus, you punish savers who are simply looking to park their cash in the bank. Instead, many are forced to guess what the Fed is going to do next to save their banking comrades.

New home sales tell the story

Mortgages rates are at historically low levels. This isn’t something that is new and should tell you that the Fed has ran out of ideas and will continue to play the same tune of helping their banking allies. This is a small dance for banks and you aren’t invited. The 30 year rate on a fixed mortgage is at historical lows. This is artificial of course but has done absolutely nothing for the housing market. Why? Because people need jobs from the real economy! Our economy for the last decade was largely based on financial gambling, trading houses with one another, and going massively into debt. How is this even sustainable? It isn’t and this is obviously the end result of a grand super cycle of debt and allowing investment banks to co-opt our politicians and gamble in the hidden shadows of hedge funds.

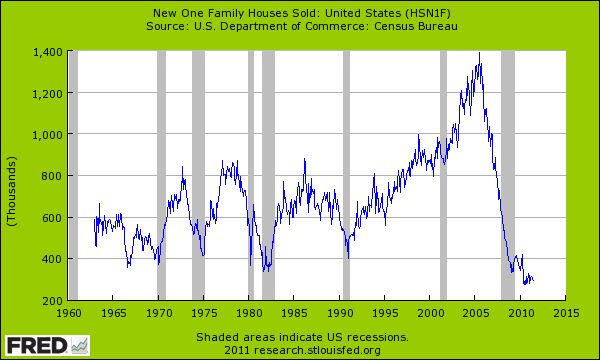

Then we have our media which is largely one giant circus. An interesting snapshot of a few big “news†networks was done last month:

Source:Â Balloon Juice

Think about how absurd this is! This is like having a debate about anatomy and healthy lifestyles then inviting daily McDonald’s customers to be your experts instead of those with some expertise in the field. It is one giant spectacle and the only thing missing is the Coliseum. Operation Twist was named after the popular Twist Dance. How appropriate for a country now obsessed with Dancing with the Stars. While banks continue to raid the wallets of the public at least some nice dance moves will be televised, because it certainly won’t be anything about the real status of the economy.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

peter said:

YOU HIT IT RIGHT ON THE HEAD OPERATION TWIST WAS TO FURTHER IMPROVE THE BANKS BALANCE SHEET AT THE COST OF THE PEOPLE.

THE FEDERAL RESERVE IS A CRIMINAL ORGANIZATION THAT HAS TAKEN OVER OUR GOVT. TOGETHER WITH THE PEOPLE OF THIS COUNTRY. THE PEOPLE OF THIS COUNTRY IN THE EYES OF THESE ELITE ARE PARASITES TO EXTRACT WEALTH AND POWER FROM.September 23rd, 2011 at 5:34 am -

juserbogus said:

It’s my belief that all of this would have been avoided if Gramm–Leach–Bliley wasn’t signed and the separation between investment banking and commercial banking still existed.

September 23rd, 2011 at 6:58 am -

Dumbfounded said:

This is what it looks like when an empire is collapsing. Don’t believe me, just wait. Tomorrow will always look worse than today. It’s too late. We have hit the iceberg. Guess who is running tomthe life boats first. You guessed it, the bankers and politicians. And they just stepped on your baby.

September 25th, 2011 at 12:59 pm -

The Cash Flow Is King said:

Great article Mybudget360. I think you covered all of the important areas here; household income, peak debt, and liabilities and household credit. It is a total joke and targeting interest rates at this point would cause any shift in the housing or employment situation.

Will 1% point saving on a mortgage payment spur you off the sidelines and into the housing market at this time?

– Housing has shown no appreciation in many states for the last decade.

– Income has been stagnant for the last decade.

– Inflation has eaten up savings and causes commodity prices to surge.And that 1% point should stimulate you to jump into the housing market? I don’t this so…

September 26th, 2011 at 10:11 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!