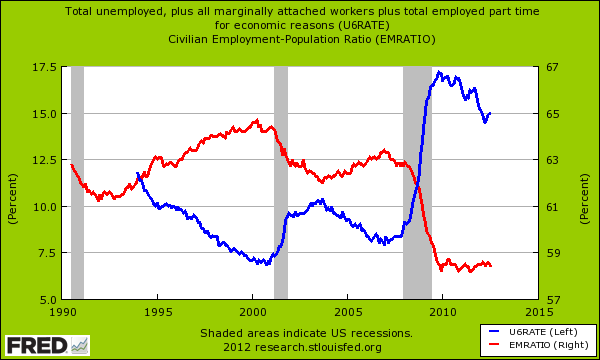

The other side of persistently high unemployment – Underemployment rate shoots up to 15 percent but is actually more problematic because of the civilian employment-population ratio.

- 2 Comment

Spending time examining the employment report shows continuing trends that appear beyond the headline figures. The number of Americans unemployed or marginally attached to the work-force increased to 15 percent and appears to be a new staple of our current workforce. A key data point is the civilian employment-population ratio that shows a continuing drop. The US is on a multi-decade trend where we have fewer working adults as a share of our overall population. This is not a positive trend where we have an aging population with less affluent younger workers. The headline rate is only a brief snapshot in time but the bigger trend of a shrinking middle class is all too prominent.

Looking at the underemployment rate

The underemployment rate increased to 15 percent last month:

The stock market of course took this as extremely positive news because of only examining the headline job figures (although we added 163,000 jobs the unemployment rate went up). It does make sense from a low wage capitalism view point. For example, having an excess of labor in the market allows for wages to be pushed lower. It also provides an eco-system where workers’ wages, benefits, and security can be slowly stripped away in the name of competition. Of course this logic does not apply to the financial system and large banks. Their idea of risk is sitting comfortably in an air conditioned office in Manhattan and pushing a few keystrokes. The real risk is the person launching a new technology product to market. The real risk is the person that decides to open up a restaurant. These are the true entrepreneurs and not the too big to fail banks that continually reap bailouts and subsidies.

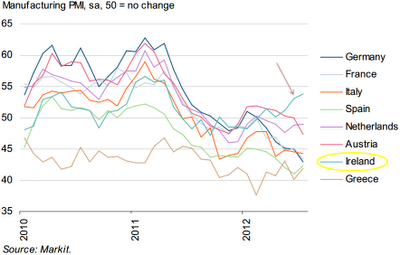

Yet what we are seeing is this new wave of low wage capitalism. Take for example what is happening in Ireland. Ireland was one of the first countries to go overboard and collapse financially due to the economic crisis. Ireland was a booming economy and was dubbed the Celtic Tiger for all the investment flowing into the country. Yet this bubble burst with the crisis and the economy came to a screeching halt. However I’ve seen a few places where this is now heralded as the path of success. When we look at manufacturing activity it does seem to be picking up:

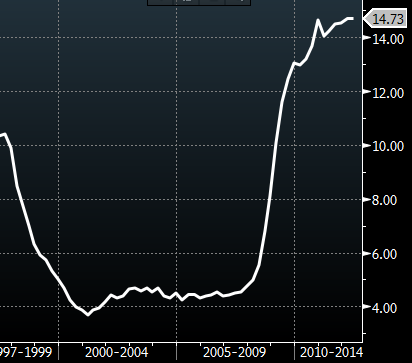

Ireland is the only economy above that is actually growing at the moment in the above list. However, the other side of the coin is the working class:

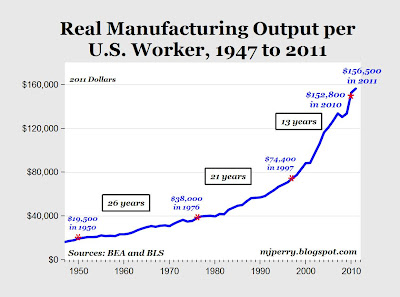

The Irish unemployment rate is near a peak. Profits can be increased when you can slam worker wages and capture more profits. In fact, a good portion of short-term profits have come from using the persistently high unemployment rate as cover to pay workers less. The idea that workers are less productive is simply not true. Take for example the productivity of the American worker:

American workers are much more productive today as shown by the chart above. A high unemployment rate is not good for the working and middle class. It is good for profits but this is only good if in turn it produces good paying jobs. What use is it if it gets captured and not released back into the economic system?

The current path is not one that is positive for the middle class. A high underemployment rate is showing that structurally, something is significantly changing in our economy. A low-wage system of work is developing and stripping many Americans of the opportunity to a middle class lifestyle.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

John said:

We are adapting to the deflationary effects of Asia’s labor force. We should not have allowed India and China access to the worlds economy. In addition, these two country’s practice a form of Fascism, where there respective government ensure there state run corporations are successful 100% of the time. Pitted against our free market companies.

Prepare for a rocky time while the bone heads in Washington D.C. have this reality beat through there collective skulls!August 5th, 2012 at 11:22 am -

William @ Drop Dead Money said:

This may sound simplistic, but I believe that a lower dollar will repatriate a lot of jobs that went overseas. Costs in China and India are rising, as measured in their local currencies.

The only thing that keeps them in the game is the exchange rate. If the dollar drops, it becomes a lot more enticing for corporations to move jobs back to the States….

August 6th, 2012 at 4:05 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!