Pillaging the Average American: Wall Street Paying Back Bailouts with Bailouts. Total Bailout Package Ceiling of $14 Trillion Yet Focus Only on TARP Repayments in the tens of Billions.

- 2 Comment

In the last few weeks the corporatocracy has gone on a massive Madison Avenue public relations tour touting the great job banks are doing and how they are paying back the taxpayer for the generous gift of life. Instead of working with small business or lowering credit card rates banks have taken it upon their shoulders to issue record breaking bonuses. It is true that banks are paying back TARP handouts yet few are focusing on how the banks have made profits in the last 9 months since those dismal days of March. There is also this convenient avoidance of fact that some $14 trillion in bailouts have been made to banks and Wall Street. The TARP repayments amount to a few hundred billion, no small amount, but a fraction of the real cost to the American taxpayer. The average American has benefitted very little from the corporatocracy handout to their banking colleagues.

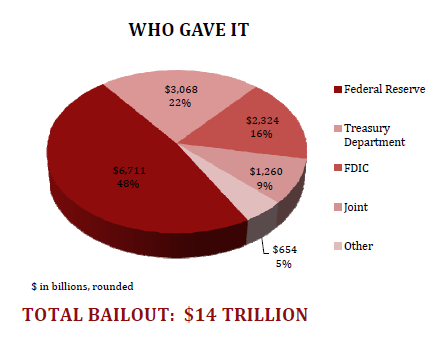

As the Federal Reserve comes under attack, they are attempting to play it calm and collected while telling the American public that there is nothing to see behind their mythical curtain. That is the furthest thing from the truth since the Federal Reserve has been the biggest player in the $14 trillion bailout:

Source:Â It Takes a Pillage

Do you ever wonder how in the world the American banking system can continue to make 30 year fixed mortgages at historically low interest rates even though the FDIC and other banking arms are virtually insolvent? Well first, banks don’t hold onto the mortgages anymore since the entire game is now backed by government loans. Fannie Mae, Freddie Mac, and FHA insured loans are all the rage now. And the market has no appetite for these loans. The Federal Reserve through one of the mechanisms above, has bought $1.25 trillion in mortgage backed securities to keep mortgage rates artificially low. In other words, banks are merely passing through government paper to consumers which begs the question, why do we even need the bank in the first place? Why not borrow directly from the government and cut out the middleman?

Of course, that is merely one play on the bailout PR lie machine. Next, you have credit card rates spiking through the roof while banks, the same players in the mortgage game borrow near zero percent from the Fed and U.S. Treasury and then turn around gouging customers on rates and even going as far as entering the realm of the absurd with 79.9 percent rates. You want to know how banks made their money since March? They went to the Fed and U.S. Treasury and borrowed money for free and basically charged high premiums on customers (aka, taxpayers who saved them from implosion) and also used this interest free money to gamble on Wall Street. Since we are now operating in a mode of “nothing will fail” especially if you are a bank, these institutions took it upon themselves to gamble it up on Wall Street. If things went down, they had the taxpayer to eat the bet. If things went up as they did they pay off their TARP handcuffs and it is back to record bonuses for the corporatocracy.

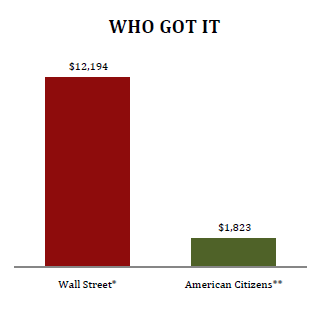

How much did the average American get in direct help from the bailouts?

This is how lopsided the game has become. The gap between the extremely rich and the poor has never been this big except for the Roaring 20s. We all know what followed. The notion that these banks are earning profits in some sort of free market capitalism is the biggest joke going around. This isn’t capitalism. This is a market that is run by the best money can buy. And for the past 30 years Wall Street and D.C. have built a bond that now ignores for the most part the plight of the average American. Wall Street is so disconnected from Main Street that they don’t even realize foreclosures are still near their peak! They seem to ignore the fact that unemployment and underemployment is up over 17 percent. These are simply erasable facts.

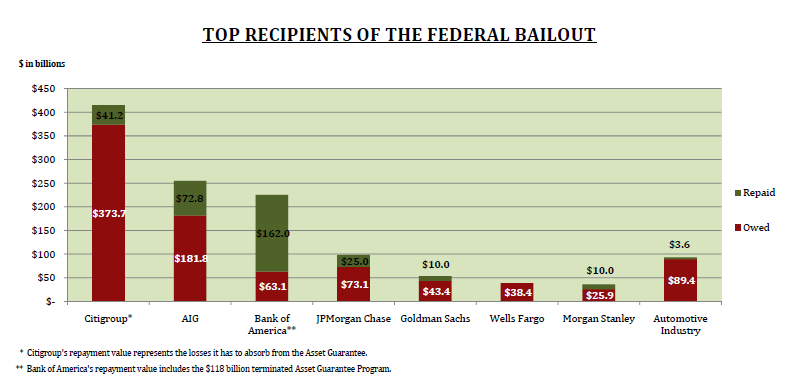

What they want you to focus on is the bailout paybacks:

Source:Â It Takes a Pillage

Keep focusing on these diversions. It is also the case that many of these banks are trying to payback TARP as quickly as possible so they can go back into their black boxes and gamble as much as they can without any kind of oversight. This is the kind of deregulation that led us into this mess and we have yet to see any sensible market restraints come into the arena. What is it going to take to have some serious legislation? Are we going to need to go Mad Max style before something changes? The politicians certainly don’t reflect the views of the public. The majority want to audit the Fed but Congress on both sides of the aisle is bought and only listens to their contributors. Is it any wonder why so much money is being used to circumvent any kind of audit? If there is nothing to hide then why even worry about it?

The financial engineers, those paper pushers who caused this mess, want you to believe that somehow they have the solution to the crisis. To them this recent economic collapse is simply a road bump in their path to perpetual greed that sucks the life out of the productive economy. Banking needs to go back to being a utility like water or electric. Boring, stale, and there to provide a service to the real economy. Deregulation has failed miserably because people ignore the inherent behavior of mankind. It really is no surprise that Wall Street is fleecing the American people for all they got, even the lint in their pocket lining. As they borrow for near zero, they then go out and lend it for 5.5 percent on mortgages if they are even to hold the note or give out credit cards with 28.9 percent variable rates. With that kind of margin is it any wonder they are making money? Last time I checked my mortgage wasn’t at zero percent. I’m starring at a credit card bill right now and I can tell you that the rate is not even close to zero. But of course banks need to charge this margin because of the risk in the lending process even though they can’t fail because of the nanny banking state. Then why not just have the government lend to the American people directly? Because then, we reveal that the wizard behind the curtain is nothing more than a money vortex for the middle class.

Americans are feeling furious. These TARP paybacks are absurd. We even hear the Treasury Secretary talk about the “profit” we made. This is such nonsense for the above reasons. This isn’t like banks went out and created new products and sold them on the market for a benefit to society. What they did is they went back to the casino and made gigantic bets that paid off. The problem of course is those bets were financed by the American taxpayer. Trillions in bailouts still remain outstanding. A few trillion sit on the books of the Fed. What have they taken for collateral? They don’t want to open up their books because what we will find will horrify the public. Toxic mortgages, questionable loans, and other securitized junk that was exchanged for U.S. Treasuries.

Is it any wonder why the dollar is being pummeled? We are slowly being robbed by Wall Street and the Federal Reserve. Who needs conspiracy theories or back room talks when they are doing it right in front of our eyes?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

richard said:

When will Americans wake up and realize that the money hasn’t vanished it simply has gone to the Zionist criminal hands.

The Federal Reserve is a privatley own bank why people still believe it is run by the government is amazing.

December 15th, 2009 at 6:36 pm -

heidi silva said:

An outstanding article.

Thank you, thank you!

~HeidiDecember 16th, 2009 at 9:45 am