Poor Americans carry a record level of debt leverage: Subprime economics and leveraging the poor into a treadmill of continual poverty.

- 1 Comment

Poor Americans carry deeper debt levels than they did during the depths of the Great Recession. To boost auto sales, many dealers have decided to offer subprime loans to prospective clients that have very little financial means. Many for-profit colleges have a business model that virtually solicits and lures in poor Americans into their debt saddling paper mills. So it is probably no surprise that poor Americans are now carrying the heaviest debt loads in history. The argument is interesting from some of these financial institutions and similar to what was being delivered during the subprime housing days. These “generous†lenders are making loans where no one else is. Of course the caveat is they are gambling with other people’s money. In the case of student debt, the American people will foot the bill for any implosion that happens and in the mean time salaries for executives at these institutions are extremely high. The model of financing based on too big to fail is all too familiar. The financial system has mastered the art of being a viper and extracting all wealth possible before things go bust. Poor Americans are in worse shape today than during the Great Recession.

The poor are massively in debt

Our system has replaced access to debt with wealth. The days of prudently saving and paying for college or actually buying a car outright seem like a distant memory. When many universities charge $40,000 or $50,000 per year in tuition how is the typical US household making $50,000 per year going to pay for their kids to go to school? They can’t. And that is why we have a massive student loan bubble with $1.2 trillion in outstanding debt and the CBO is projecting another $1+ trillion over the next decade.

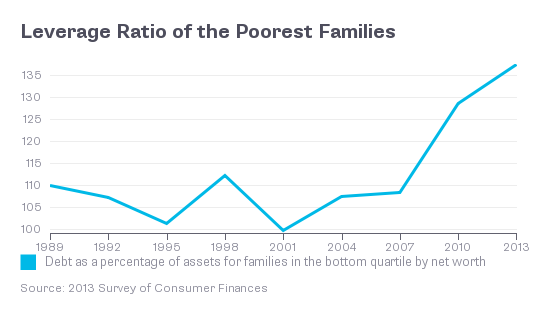

While American households overall have deleveraged since the Great Recession hit, poorer households have not:

Poor Americans have carried heavy levels of debt for a period of time. However, today the poorest Americans have a debt-to-net worth level of 135 percent. This is incredibly high considering that many poor Americans have very little assets to their name. 90 percent of all stock wealth is owned by the top 10 percent in the country.

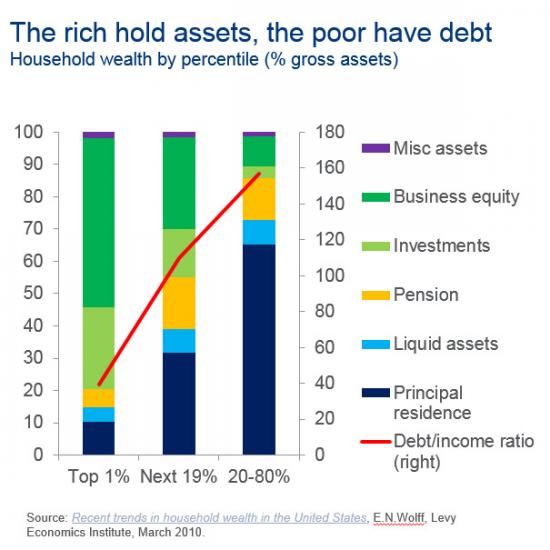

Wealth distribution in this country is heavily tilted. Take a look at this chart:

This chart is important to understand because it shows how much the bottom 80 percent of Americans rely on their home as their primary source of wealth (an area that has been crowded out by big money investors in the last few years). Yet a home does not provide an income. A home will actually cost you money. You will have to sell your primary home to unlock any money within it. Many poor Americans don’t even own a home. In fact, many only have a vehicle as their asset and now these are being financed with subprime debt.

The poor get caught up in vicious cycles of financial trouble. For example, pay day loans are notoriously poor ways about getting money. They charge incredibly high levels of interest and typically target the most vulnerable in the population. Instead of a one off deal, many pay day loan borrowers become repeat customers:

Adjusting for annual rates, some pay day loans end up costing people 500% a year or higher! Even a loan shark has better rates than that. Yet this is the terrain many poor people are confronting. They need a car to find work, so they take on a subprime loan. They need funds to pay for food and end up taking on a pay day loan. Hearing that education is the way out, many get lured into for-profit colleges and end up paying high tuition for a very poor education. Since easy debt is there, the cost of items essentially moves up to meet the price of maximum debt.

The fact that the poor carry such a high level of debt today shows that the financial system is still eager to lend money so long as they know they are not on the hook when things turn sour as they always do. The poor have no lobby that can voice their concerns to the crony apparatus. In the end, we have a financial system that cares not about the poor or even the middle class and we should not be surprised that our economy is looking the way it does today.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Ame said:

It occurred to me that the people who jumped from windows in the crash of 1929 were those who were in debt (margin) and suddenly became poor overnight. So what about those who are poor and in debt for X-Y-Z and become squeezed by ever-increasing inflation? Most windows are sealed shut these days, so do they jump from bridges? Bankruptcy is not an “out” for them.

September 17th, 2014 at 3:47 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â