Quantitative Easing has been the fuel for rising inequality and welfare for the modern Gilded Age: President Fisher from the Federal Reserve Bank of Dallas mentions QE’s gift to the rich.

- 4 Comment

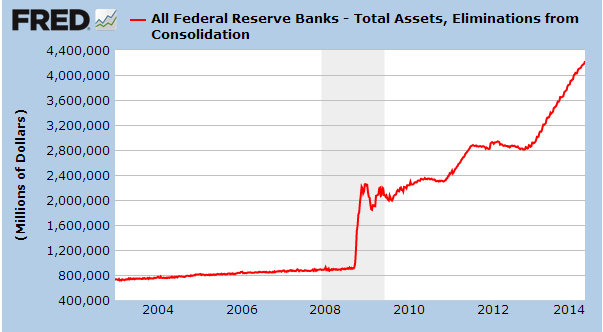

As the Fed begins to slightly ease up on Quantitative Easing the reality of the winners and losers is becoming more apparent. QE was welfare for the wealthy and even President Fisher of the Dallas Federal Reserve Bank hints at QE being a massive gift to boost wealth. Well if we merely look at wealth across America, the only group that saw wealth increase after the recession ended was the top 10 percent. QE was ushered in under the guise of helping the nation overall but what we have seen is massive low-wage work taking over good paying jobs while banking profits hit new record highs. The Fed’s balance sheet has ballooned to well over $4 trillion and even though tapering is slowly beginning, there is no sign that the balance sheet is shrinking. The average American may not care about the Fed or even realize what is going on with rising wealth inequality but this is absolutely important. QE was the picture perfect example of welfare for the wealthy.

Income inequality at new record levels

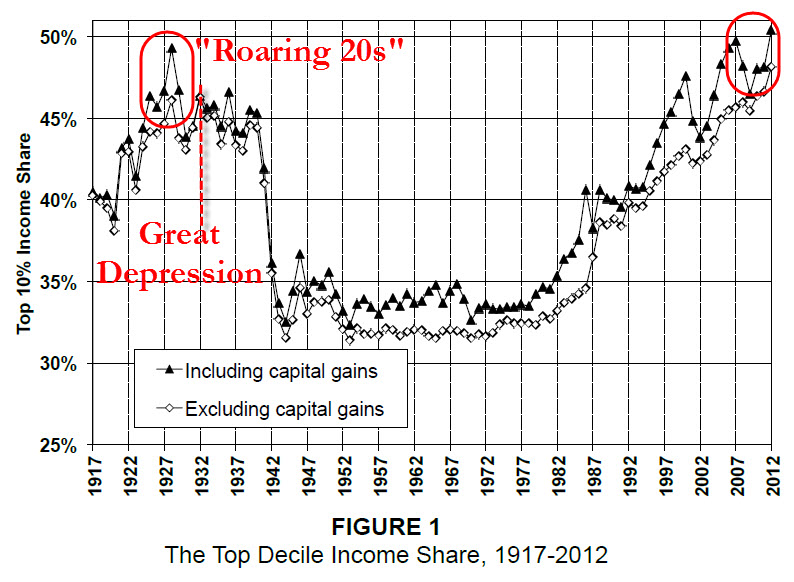

Historians and economists point to the rising income inequality that was reached during the 1920s as a precursor of the Great Depression. It was also the case that at the time, they had a banking sector gone wild. In an economy that depends on consumers, people need actual money to spend. Well more money is being consumed by the cost of daily living thanks to inflation hitting products that rely on massive debt financing. These things include housing, college education, and automotive purchases. It is no surprise that these segments of the economy are expanding at a pace faster than the wage growth of the average American.

Income inequality today is higher than it was in the 1920s:

This is a troubling trend and we are seeing the nation create a giant pool of labor that is transient, low paid, and lacking many of the benefits that were once common even in the 1980s. Slowly over the last generation each piece of worker protection has been stripped away yet here we are with QE, a massive gift to the wealthiest in our country. It is no surprise that wealth inequality has risen because of these actions.

Take for example what is happening in housing. Since 2008 close to one out of every three home purchases is going to investors. Why? Large banks and hedge funds are leveraging low rates and are simply buying up properties to rent out. This has caused housing prices to rise in spite of stagnant incomes. The end result is that more money is simply spent on housing and more money funnels into the hands of a select few.

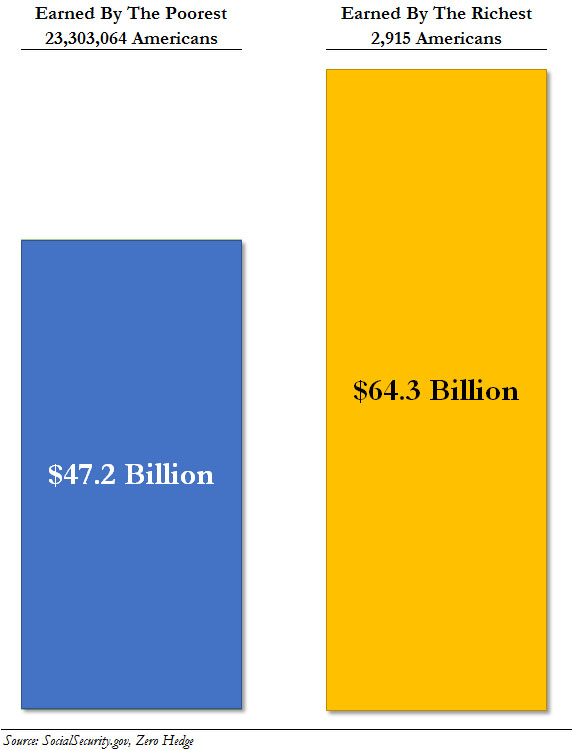

Take a look at the income disparity that is now hitting:

The top 2,915 richest Americans earn more than the poorest 23,303,064 Americans combined. There will always be income and wealth inequality in a capitalist system. Yet the magnitude of what we have today is unprecedented. It also doesn’t help when policies taken at the higher level merely serve as welfare for the rich and actually resemble more of a command-control economy.

While the stock market reaches record levels so does the Fed’s balance sheet in the face of talk of tapering:

The market is being manipulated in the favor of the few. If things happen to improve for the rest of Americans, then that is merely a secondary result but the primary goal was to protect the wealth of a few and these policies have helped immensely. I mean we have 51.4 million Americans stuck in low-wage jobs. We have another 47 million Americans on food stamps. Yet the stock market reaches another record high. This does not seem like a real recovery but I’m sure for a small group of people, this is the best recovery money and policy actions can buy.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

Ken Brodeur said:

We live in an extortionary not capitalist system. Government that borrows is owned by the rich. The very purpose of government is protection of people and due to size, need only print money interest free. This would eliminate the wealth of the richest people and be the engine of innovation along with a prosperous middle class. Look at the greenbacks of Lincoln, the inventions that developed in the latter 19th Century and the growth of the US into a world power.

March 22nd, 2014 at 11:31 am -

Larry Crawford said:

Ken, succinctly and well said?

Question is, how are greedy deep state sociopaths that conceive of no limits to extractive wealth accumulation, ultimately to their own demise, cured?

March 23rd, 2014 at 9:30 am -

Larry Crawford said:

oops, exclamation point intended after “well said”…

March 23rd, 2014 at 9:34 am -

northwind said:

at some point it’s going to blow. the lower 50% are not going to just go along. I was around for the city riots of the ’60s. the National Guard was called out then. this will be a lot worse. there’s a lot more spoiled dissatisfied people with a lot more anger simmering just below the surface.

March 23rd, 2014 at 3:56 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â