Rationalizing and pushing the debt limit: The academic battle to open the gates on unlimited digital debt monetization.

- 0 Comments

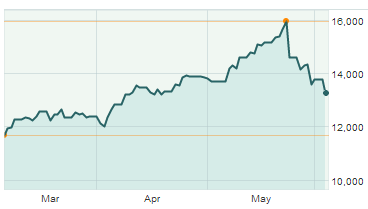

One of the recent cases for the never ending expansion of debt purchases via central banks is the case of the Bank of Japan. The BoJ has essentially gone into hyper-drive with their version of quantitative easing by going straight into the Nikkei. The case seemed simple: the European Union mired in austerity measures has failed whereas the US and now Japan in full QE mode were the models for ever expanding bank balances sheets. While the case for the working and middle class is still to be made in these nations, it is the case that GDP has expanded but how much of this has come because of financial speculation and additional risky behavior caused by easy debt. Well Japan is experiencing a quick correction in a few short weeks. The Nikkei is now down over 16 percent from the peak reached in May. This quick reversal is suddenly getting rationalized as some sort of market adjustment. Yet if you saw an individual that was in financial trouble because of debt the last thing you would offer them is more debt. That seems to be the recipe for success according to central banks.

There was a tipping point for household debt in the US

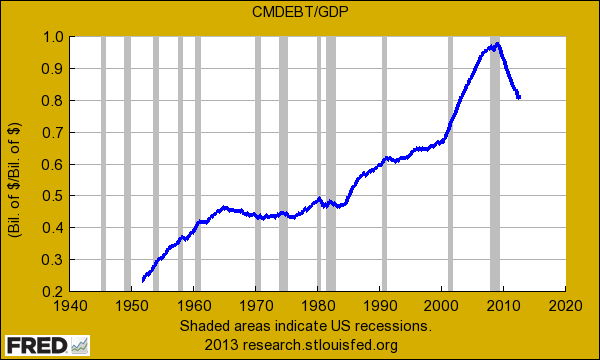

While the overall market for debt is expanding dramatically, household debt reached a tipping point when it hit 100 percent of GDP:

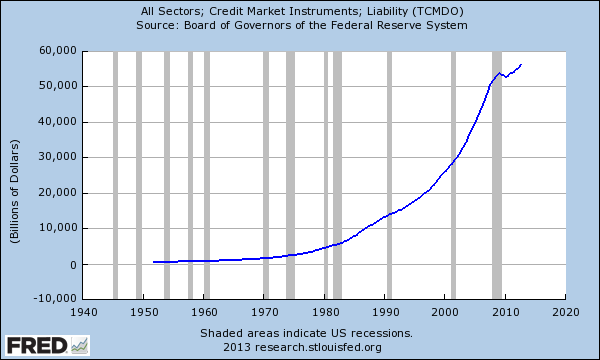

Clearly something happened at this point in the US. We all know the story of households taking on too much debt. Yet this memo was never passed on to the too big to fail financial sector because the overall debt markets are growing at a never ending pace:

The total debt markets are now approaching $60 trillion during a time that household debt has contracted (outside of student debt). For a couple of years the living discipline of economics seemed to favor the financial remedy of going into deeper debt to fuel expansion. Japan seemed to have found the perfect elixir to this by allowing the BoJ to dive deep into their national stock market. All seemed to be going well until this happened:

At first, the few plunges were rationalized as a normal healthy correction. After all, the market has gone up on a rocket ship upwards. Forget about the debt to GDP ratio of more than 200 percent. Yet there is no such thing as a perpetual money machine otherwise we should just set the Federal Reserve into the market to purchase the largest of US companies to get things going further up. Instead, the Fed has decided to lower interest rates to such a level that banks are now deciding to use this money themselves instead of actually lending it out to the public (see household debt chart above).

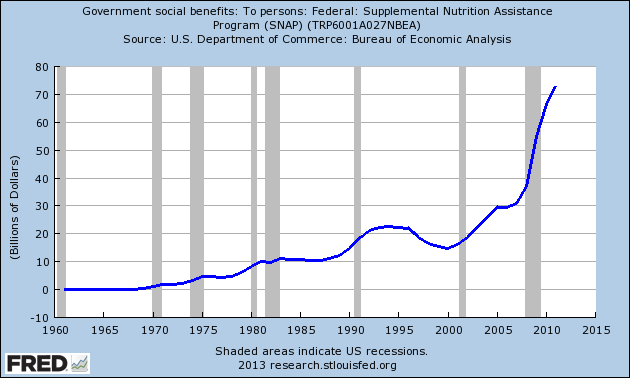

This big boom has resulted in over 47 million Americans now receiving food stamps and the payments are going out in droves:

To qualify for food stamps you need to demonstrate that you are barely scraping by. There really is no fudging the above numbers. This shows that a large part of America is only getting by with government help. Is this really a sign of a recovery? Those 47 million are unlikely to partake in the wonderful world of zero percent interest rates.

There seems to be this rationalization that central banks should simply print money into infinity since in the short-term, it seems to work. A major paper that discussed tipping points in debt to GDP ratios has come under major fire and now opponents seem to be dancing around advocating for the perpetual growth of debt as if the US and Japan are perfect case examples. There is no exact science here. Japan is showing us right now that there remedy isn’t perfect (and they have had multiple lost decades courtesy of quantitative easing). The working and middle class in the US are still in a recession. There seems to be a serious rationalization of debt from some as if the solution to a financial crisis caused by unchecked levels of debt will be solved by simply adding more debt to the mix. Some of these advocates were the same people that failed to see the biggest financial crisis since the Great Depression that we are still working through. Rationalization is a powerful tool especially when you stand to gain from taking a side.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!