The relentless punishment of the American saver. Fed policy has encouraged spendthrift attitude and yield seeking behavior from Americans.

- 3 Comment

The Federal Reserve has actively pursued a policy that punishes American savers. The drive to push interest rates lower has inflated both the stock market and housing market once again. Yet little of this gain has trickled down into household income for Americans. The primary reason for this is that most Americans do not derive a significant portion of their wealth from stocks. In fact, a large portion of Americans are living paycheck to paycheck so if the Fed was really interested in boosting wages, they would have looked at income first instead of making it easier for banks to borrow money. Since 2008 savings rates at banks have been below one percent. In many banks, they have hovered slightly above 0 percent. Unfortunately the slow eroding power of inflation has eaten away at the purchasing power of Americans. For many, the choice has been to simply spend income as it comes in or try to chase yields in other markets. Ultimately the prudent saver has been punished.

The punishing rate of being a saver

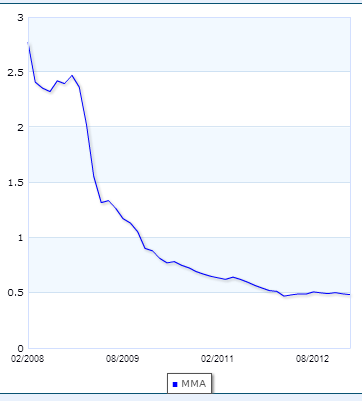

There was a time when a more conservative saver would put money into CDs or money market accounts and yield a moderate rate. Some will argue that this drop in yield is a reflection of added risk but this is false. The Fed has essentially stepped in and soaked up all risk when it comes to yield. When the Fed states that they will buy whatever mortgage backed securities necessary to keep rates low via Quantitative Easing they are essentially picking winners and losers. It is clear who has lost:

These rates do not come close to keeping up with headline inflation. Stick your money in a bank account and you are guaranteed to lose money over time. While the inflation rate did dip during the recession it is now picking up steam:

Even a moderate amount of inflation when wages are stagnant is debilitating. Purchasing power is paramount in an economy. What is currently unfolding is a financial system that is trying to force spending by Americans that actually have the means to do so. 47.5 million Americans are on food stamps so they are rather limited. The median household income of $50,000 only has so much disposable income after needed expenses. So many households that do want to save are limited by their investing options.

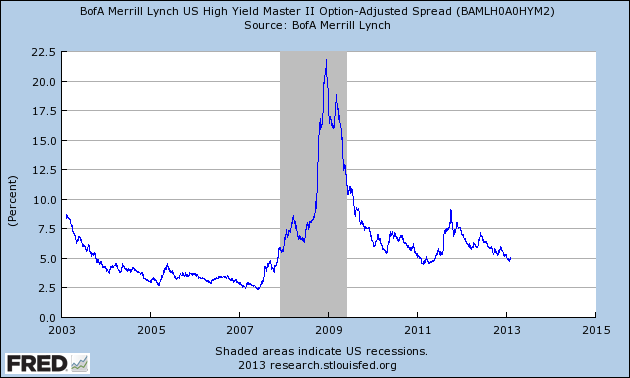

Even the rates on “high yield†bonds, otherwise known as junk bonds, are reflecting a market that is chasing yield in high risk places:

Nothing has fundamentally changed in the years since the recession hit to warrant this rate on high yield bonds. These are incredibly risky bets for what would amount to be a five percent return. A five percent return is what a safe CD would have given you in the early 2000s.

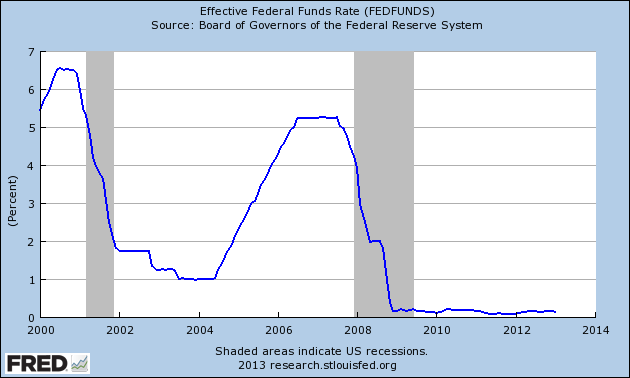

But why punish savers outright? The US is a consumption based economy. Given the massive contraction, purchasing power has fallen for most families. A high rate will encourage people to save and monetary policy is about lowering rates. Well the Fed did this starting in the early 2000s pushing interest rates low and causing the housing bubble. When the bubble burst, the Fed went to this policy again but ended up lowering rates to zero. The Fed since that point has effectively monetized debt and has digitally printed money for years:

The Fed ran out of ideas in 2008 at least on the monetary front. It was time to monetize. Keep in mind where we are. The market is acting as if the Fed is allowing rates to go back to normal. To the contrary, the market is still in fighting mode. The exuberance that is now occurring is reminiscent to what happened after Greenspan injected massive amounts of money into the economy after the tech bust. Isn’t it ironic that the Fed that openly states they are for open markets and stable systems is the one that engineers the biggest booms and busts? Savers continue to be punished and this is likely to continue.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Paul Verchinski said:

If rates were at average levels for savers, it would put about $400 billion in their pockets. Instead, the $400 billion is being picked out of retirees pockets who can ill afford to play in the Wall Street casino.

February 8th, 2013 at 6:11 am -

M said:

In order to pay interest the money changers need borrowers.

In order to pay interest the borrowers need discretionary income.

In order to have discretionary income , one needs a good job.

A good job is allegedly 40 thousand with benefits.

Only one out of four jobs pay that well in today’s economy for the bottom 90 % of the workforce .The bottom line is prices of everything from investments to real estate are still in free fall .

Hope you all got a parachute ).February 8th, 2013 at 7:00 am -

Dennis Roubal said:

The gov’t knows that we can no longer compete with an emerging China since Americans make so much more than emerging market workers. There will have to be some equilibration of wages for all developed countries with China and other emerging economies. Otherwise jobs will continue to move out of our economies and into theirs. It is difficult to lower worker wages directly; it is easier to dissolve them through inflation. All this money printing will eventually cause inflation, a lot of inflation. That is when life will become difficult for most people. Stocks, real estate, land, natural resources, all those things will adjust to inflation. The people that don’t own any of them will be the ones to suffer most. See: The 5 Largest Landowners in America. The rich are already adjusting.

Thanks for your work,

DennisFebruary 8th, 2013 at 12:02 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!