Retirement account fantasy and middle class erosion – 1 out of 3 Americans has zero dollars in a retirement account. From 1950 to 1989 top 1 percent earned roughly 7 to 8 percent of nationwide income. Today it is inching closer to 20 percent resembling pre-Great Depression levels.

- 5 Comment

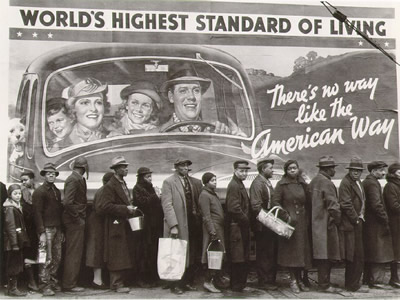

Many Americans live precariously close to the edge of financial insolvency flirting with economic disaster daily. If you casually browse mainstream articles and watch any amount of television you would think that the US still had a vibrant and strong middle class. When we pull back the covers on the current financial situation we realize that many Americans are merely getting by and many would like to live in some 1984 Orwellian fantasy world where suddenly things are back to financial equilibrium. 43 million Americans are depending on government food assistance to get by. But many more millions are merely living paycheck to paycheck hidden in the cellar of the headlines. 1 out of 3 Americans has zero in any retirement account (not one slowly eroding dollar). Half of Americans have $2,000 or less which puts them one month away from needing government assistance. With the volatile job market and turbulent Wall Street middle class Americans are feeling the once prided stability being slowly washed away. Let us examine how retirement is now becoming more of a fantasy for many Americans.

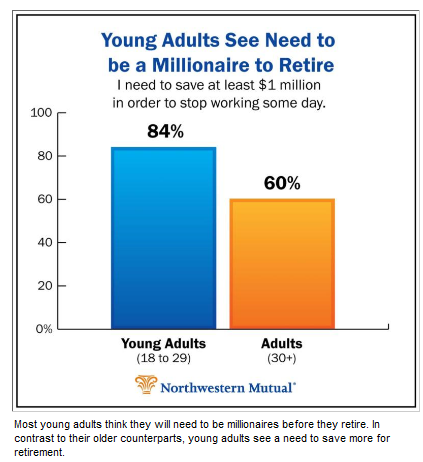

Many Americans especially young adults realize that saving large amounts of money is a key to a sustainable retirement:

Over 84 percent of 18 to 29 year olds surveyed feel they need at least $1 million saved up in order to stop working some day. 60 percent of those 30 and older feel that they will also need $1 million saved up. Yet the actual figures are somewhat disturbing in contrast to the perceptions of many:

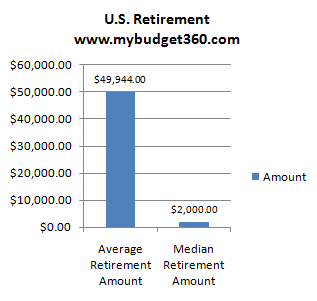

Source:Â Census

The median retirement account for US households is $2,000. This is why the vast majority of retirees depend on Social Security as their primary source of funds in old age even though Social Security was never designed to be a long term pension system. You’ll notice that the average retirement account is closer to $50,000 a year but this is heavily skewed by the top 1 percent that keep most of their funds in stock wealth.

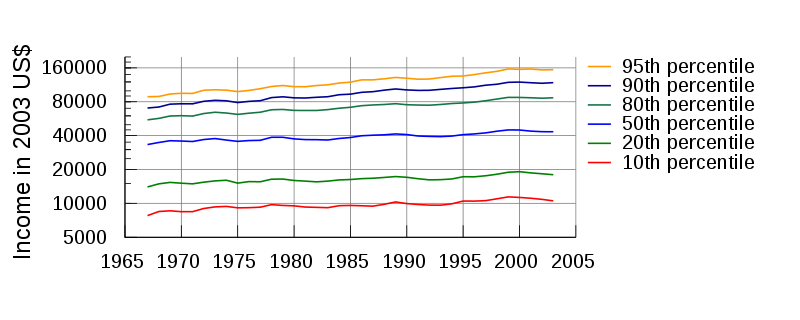

The reason retirement is slipping through the fingers of many like sand is the disjointed income equality in the country that has grown in the last decade. If we look at income growth it has been heavily tilted at the top:

Source: Census, Chart: Wikipedia

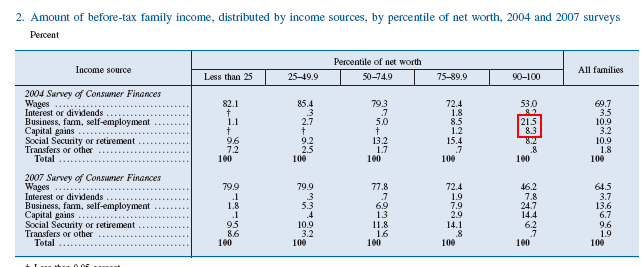

There has been virtually no real income growth for most Americans. The real significant wage growth over the last 50 years has occurred at the very top 10 percent of income earners in the country with this inequality accelerating in the last bubble decade. What is more important is that 75 percent of Americans largely depend on a job as a primary source of income which seems rather obvious:

Source:Â Federal Reserve

If you examine the chart closely, it is only the top 10 percent that really benefit from a buoyant and thriving stock market. As we have mentioned earlier 1 out of 3 Americans has zero, nada, or zilch in their retirement account. The movement of the stock market is like watching the score of a football game where the outcome means nothing to the individual. Yet the problem is that Wall Street has taken the one item that was stable like a rock for Americans, housing and turned it into another commodity to be gambled and speculated against.

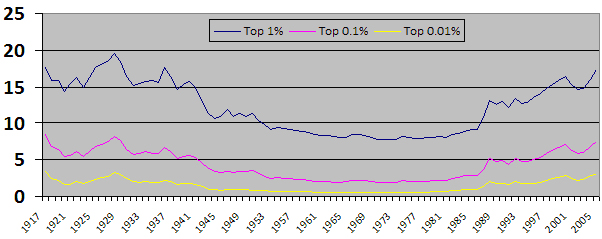

The share of income flowing to a smaller and smaller group of Americans is draining the life blood out of the middle class:

“From 1950 to 1989, nearly 40 years of data the top 1 percent earned roughly 7 to 8 percent of all the nationwide income. Today it is inching closer to 20 percent, a figure resembling the massive income inequality seen during the Great Depression.â€

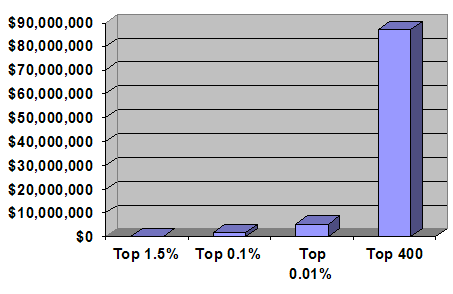

Even within the top 1 percent the difference in incomes is striking:

This kind of income inequality is coming at the cost of the middle class. Banks and the financial press would like you to believe that this isn’t the case but just look at how far your dollar is now going. If you are fortunate to have a retirement account it is likely you don’t have the gambling devices of options, hedges, and other items that are largely new casino devices for Wall Street. Most Americans are comfortable with income discrepancies but not at these levels and not when much of the gains are based on bets that hurt the overall economy.

The problem as many are now seeing is the financial sector is largely rent seeking by pilfering the future of many middle class Americans. The banking system extracts wealth by devaluing the US dollar, by charging interest or fees on retail banking, and ultimately suckering many Americans to dump money into a stock market that is operated like a casino. Washington Mutual, a once popular bank used to offer free checking for life. JP Morgan Chase took over Washington Mutual in a government shotgun wedding. Now, Chase is looking to extract $10 to $12 per month merely for having a checking account. Of course they’ll waive this if you have $5,000 saved in a handful of their accounts. Look above again. 1 out of 3 Americans have no savings so how will this be accomplished?

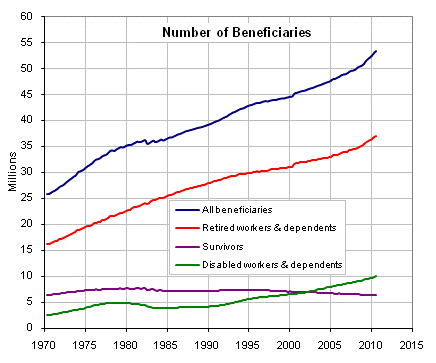

As we mentioned Social Security is largely becoming the retirement account default of many Americans. Yet the growing number of beneficiaries is now putting strain on the system:

The above chart will only continue to show expansion. Where will all this money come from? We have a smaller workforce with the young that are already having a tough time saving any money in this economy. Many of the good paying jobs of today require a college education and college has largely entered its own student loan bubble. Many of the future middle class are merely trying to service their own massive debt even before they begin their careers. To save that $1 million will become a daunting task moving forward. Also, if the Federal Reserve has its way $1 million 30 or 40 years from now may not be much.

With 17 percent of Americans unemployed or underemployed many are simply looking for that next paycheck let alone planning for a retirement where they can sip margaritas in some picturesque beach location. Wall Street has pilfered the pockets of the middle class through bailouts for their reckless gambling and incredible excess. Many Americans now understand this yet the current political class is merely interested in protecting the established plutocracy by pillaging the American village. Most Americans are becoming exhausted by both political parties and their pandering to Wall Street that provides a revolving door of money, jobs, and connections.

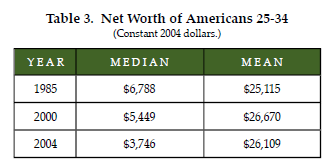

The younger generation is seeing their ability to grow their net worth diminishing:

This figure has only dropped even further in the last few years. Retirement was once thought of as a place where one would reach a comfortable existence after many years of hard work. Not an extravagant lifestyle but one in where a home was paid off and enough money came in for food and daily necessities. But now with Wall Street turning housing into a giant commodity and stripping bear the employment base of the country; many are wondering if retirement is even an option especially when the stock market is at the same level as it was one decade ago.

Ultimately what needs to happen is to get money out of politics and to split up commercial and investment banking. The answer is obvious but the plutocracy is relentless in keeping this game going as long as possible. As this continues, retirement will continue to look more and more as a fantasy to millions of Americans.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!5 Comments on this post

Trackbacks

-

peter troncale said:

The downfall started in 1913 the the passing of the Fed. Res. Act the approval of lobbyist And the Progressive Taxation.

How can you allow lobbyist?? They make the elected officials crooks. You constantly discuss the war on the middle class but what you do not discuss who is causing or better yet who is stealing their wealth.

Lets begin:

1-The Fed. Res.

2-Govt.

3-Multi-Nationals

We Need Legislatures that think of american for americans.

God Help us No one else is.December 28th, 2010 at 6:58 am -

SB123 said:

Although Wall Street is undeniably greedy and contributed *at least* 50 percent of the blame for the current economic crisis, as a renter I would say that the real estate industry had no problem convincing the average homeowner that “real estate always goes up.”

Sorry to say, but the average homeowner went for using their primary home as leverage to buy more “income” properties so they could raise rents on folks like me and make “a killing” on resale.

They lied about the house being their primary residence in order to get favorable home loans and tax treatment. They did this in the Las Vegas market, the Arizona market, the Utah and New Mexico markets to name a few.

A whole lot of Americans, not just Wall Streeters, are to blame for the housing run-up. There were huge billboards next to the 55 freeway in Orange County CA advertising for ” Competitive, Low Interest Home Loans” so people could buy multiple properties.

Americans used their house as a savings account rather than save money in other vehicles such as precious metals or thoughtfully investing in equities and TIPS. Nope, instead housing became a big free-for-all so much so that illegal aliens were in on it too.

One of the several catalysts for this circumstance was the book Auto Millionaire (title condensed intentionally) as well as books and seminars featuring an Asian-American with the first name of Robert (who will sue anyone for suggesting he helped cause the collapse).

Further, folks who voted for politicians who promised the moon of houseownership for all Americans are to blame.

Wall Street would love it if you blamed everything on them since YOU and others who are culpable will just go on making the same mistakes which works in their favor.

Instead, be humble and admit that everyday Americans took willing part in this run-up and collapse.

Try not to read so many “Investing for Dummies” and “The Lazy Way to Millions” and “The Lawnchair Guide for Reaping Millions by 40” and “Your House is Your Big Asset – Use It to Make Millions!” and other nonsense designed to separate you from your money.

December 28th, 2010 at 12:11 pm -

Charles Klaer said:

I am most grateful for research and packages of information you consistently produce.

I am of the understanding that of all the dollars that are in play, fewer and fewer are available for the socially productive economy. That is, I think that a larger portion of the dollars in play are being drawn from the socially productive economy into to an unproductive sphere.

I think I’m observing a phenomenon where by the public… neighbors are turning on neighbors, trying to squeeze more and more blood/money from the proverbial stone… a stone with less and less blood/money available for squeezing.

If you have addressed this phenomenon can you direct me to an archived issue. If not hopefully you will be addressing the issue, if I’m correct, in the future.

Thanks again for you helpful budgetary insights

Chuck Klaer

December 28th, 2010 at 12:15 pm -

M. Scholl said:

Charles Klaer:

Not sure where you are referring to (neighbor vs neighbor) however in California, (I just drove up and down the State over the Thanksgiving and Xmas holidays and live on the coast) I have not seen anything such as you describe.

On the contrary, people are being very polite and are going out of their way to “get into it” with anyone.

January 6th, 2011 at 2:35 pm -

M. Scholl said:

Sorry no edit function, however I posted above:

“On the contrary, people are being very polite and are going out of their way to “get into it†with anyone.”

Should be:

On the contrary, people are being very polite and are going out of their way to NOT “get into it” with anyone.

January 6th, 2011 at 2:37 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!