Retirement means having to work in current economy – new survey shows 34 percent of workers in their 60s do not plan on retiring. The hunger for higher yields in a weak stock market.

- 4 Comment

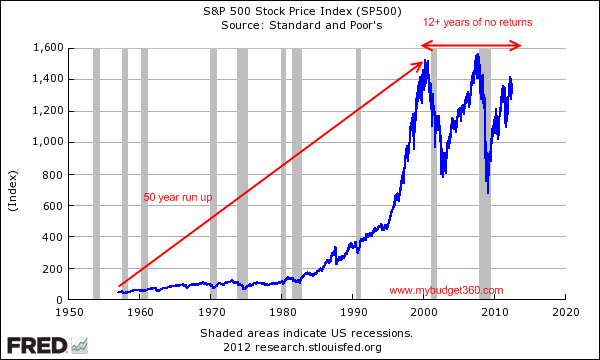

The chase for yield is causing money to flow into unlikely places in the market. The low performance market has taken a toll on retirement planning models for millions of Americans nearing retirement age. Many of the models were built on the assumption that stock market gains would return 7 to 10 percent annual gains year-over-year. So of course many of the models had extremely generous projections. This of course applies to those that actually were able to save some money. Many Americans are unable to save any money. One out of three Americans has not one dollar set aside for retirement. Those that have invested in the stock market have seen one of the worst periods ever. For example, even with the recent rally the S&P 500 is back to a point last seen in 1999. Over this 13 year window boring CDs outperformed the stock market. Yet this raises an important question about retirement. How will millions of Americans retire when they have so little money to their name?

The 13 year winter

Driving forward looking back is never a good strategy. Yet this is what many investment models were built on. For example, after World War II, the stock market went on a massive bull rally:

But after the late 1990s, we went into a boom and bust model:

-Technology bubble

-Real estate bubble

-Financial bailout bubble

The higher education bubble and financial bailout bubble are ongoing. Even with that said, the S&P 500 is back to levels last seen in 1999. Not only is this not 7 to 10 percent annual growth but is actually throwing many retirement models into question. Many pension models were built on the assumption of 7 percent gains. Consequently, as many now reach retirement age, the timing could not be worse and many of these pensions are massively underfunded.

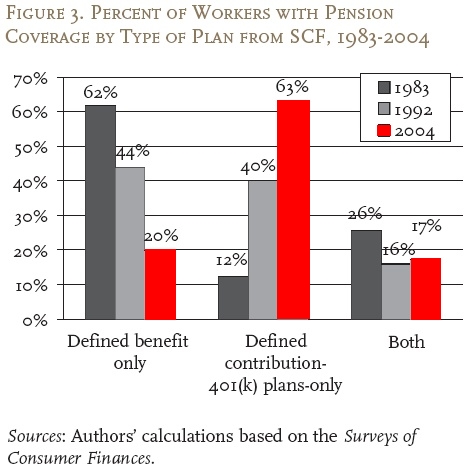

The pension system model is largely going away:

“This is a rather dramatic shift in events over the last 30 years. In 1983 62 percent of working Americans had some sort of defined benefit plan. In 2004 it was down to 20 percent and today it is lower. Americans have been forced to play the stock market game through their 401ks. This has actually turned out worse for average Americans as they try to compete with high frequency swindlers and investment banking crooks. Clearly someone is making profits as investment bankers pull down million dollar bonuses all the while the stock market has gone into reverse over a decade.â€

Today less than 20 percent of Americans have some sort of defined benefit plan when in the early 1980s it was above 60 percent. Many are left with figuring out how to compete with high frequency traders and hedge funds and a world where yield is being pushed much lower for higher risk. Because of this, many near retirement are shifting their perspectives:

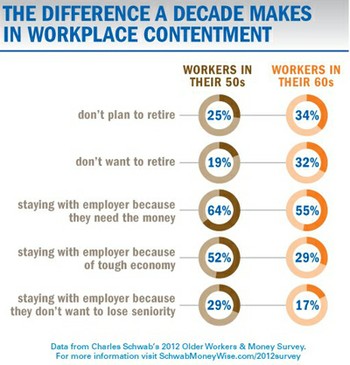

It is interesting that 25 percent of workers in their 50s don’t plan to retire and 34 percent of those 60 and older don’t plan on retiring. In other words, the new retirement model is no retirement. This puts a strain on younger workers that are currently funding Social Security with weaker job prospects and are set to support the largest population of old Americans ever.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

RUSS SMITH said:

Hi!, Patrons My Budget 60 Et Al:

Let’s not forget the 48 million Americans on Food Stamps plus there are now statistical projections out showing Americns will soon be experiencing 50% unemployment which pays them to not work 99 weeks or nearly two years. Can we call this the BIGGEST jobless & Food Stamp economic recovery ever recorded in human history? Mitt Romney as a Mormon seems to have the answer to our National dilema: store food!?

RUSS SMITH, CALIFORNIA

resmith@wcisp.comJuly 28th, 2012 at 6:45 am -

Ulysses said:

Re: Americans have been forced to play the stock market game through their 401ks. This has actually turned out worse for average Americans as they try to compete with high frequency swindlers and investment banking crooks.

The basic fact is that in order to make money one has to buy low and sell high. Now, in any free market the price goes up with buying pressure and approaches the top when most are buying. Conversely, the price drops with selling pressure and approaches the bottom when most are selling. Therefore the majority will always buy high and sell low, i.e., lose money and their losses will be the gains of the other side, i.e. the minority.

This is a mathematical fact and has nothing to do with swindlers and crooks.

July 28th, 2012 at 7:51 am -

D Gough said:

No one seems to understand that one of the driving forces for dismantaling pension system, particularly CalPERPS and calSTRS, is to get them out of the SEC watchdog business. These pension systems have been at the heart of all the stock market scandal law suits while the SEC was, at best, asleep at the heml, or likely part and parcel to these scams.

No amount of talk by politcian on either side is going to improve the US employment situation until they stop the outsourcing of Amercan job. Allowing companies to essentially use what amounts to slave labor is the real cause of the erosion of the US standard of living. If the politcian had the courage to change the tax code to reward Amercain hiring and eliminating tax deductions for foreign work and services it would help to valetocopherol cost US workers vs. outsourced worker.

July 29th, 2012 at 1:22 pm -

laura m. said:

Husband retired at 62 with a 401k over eight years ago. If people have a safe investment portfolio (mostly bonds and a percentage in S&P 500) then save in a money market savings at a credit union, and don’t breed any offspring, they will be able to retire at 65 or under and be ok.

August 6th, 2012 at 7:43 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!