The retirement myth – 1 out of 3 Americans has no savings or retirement account. Half of Americans have $2,000 or less in their retirement account. 401k new name for Wall Street grease.

- 9 Comment

Middle class Americans are witnessing the conversion of their retirement accounts into gambling pots used by Wall Street. The metamorphosis of Wall Street into one giant fraud ridden center moved by investment banking funds has slowly occurred over the last four decades. Average Americans have sat back over these years since they were given enough hope that they too, by investing in Wall Street managed funds can also become a multi-millionaire if they just try hard enough. Yet this was all one giant ruse and direct challenge to the middle class to basically allow a bunch of financial predators to siphon off any productive value from the economy. The 401k for example was a small unheard of investment item two decades ago. It has now become a larger part of the retirement pie for Americans.

The idea of not working and having a long retirement is actually rather new to this era:

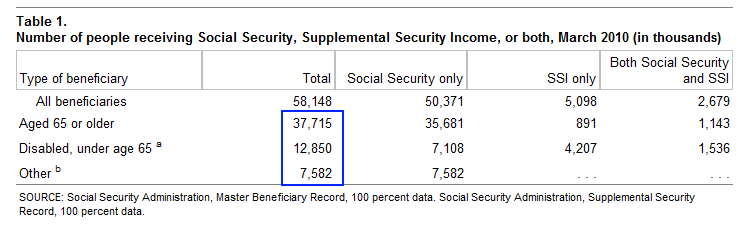

When Social Security came about in the 1930s, it was largely a program to keep families from starving and from going absolutely broke. It was never intended as a long-term benefits program. Yet life expectancy has increased over time and now today, many Americans depend on Social Security as their primary source of retirement:

58 million Americans receive either Social Security or SSI. 37 million Americans receive Social Security benefits from reaching retirement age (this will grow with baby boomers retiring). And don’t think that middle class Americans are living it up with Social Security. The average monthly benefit from 53 million beneficiaries is $1,066 yet a large number of Americans depend on this as their primary source of retirement. Some recent surveys say that as many as 1 out of 4 Americans will depend completely on Social Security as their primary retirement source.

As fragile as Social Security might appear, the 401k has become the bigger scam for Americans. Many companies only offer a handful of investments to Americans to choose from and many are managed by the same Wall Street crooks that have caused massive volatility in the markets. The 401k has allowed many employers to push off the retirement question or even caring about their workers as they once did by:

-Using Social Security as the last stop-gap measure

-Claiming they don’t need to have any sort of pension plan

Many companies have no loyalty to any worker. Over the decades Wall Street has brainwashed the public into believing that companies can do whatever they want to employees because Wall Street is just a “free market†where goods can travel where they want. But as we are now realizing, Wall Street is simply one selective syndicate that decides to transfer wealth to the top 1 percent of our country with really no work involved. It is manipulation and stealing of the productivity of the working economy.

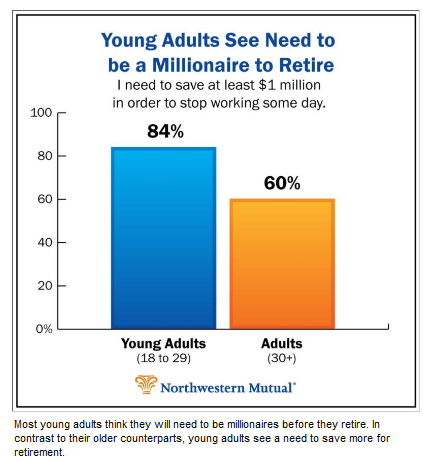

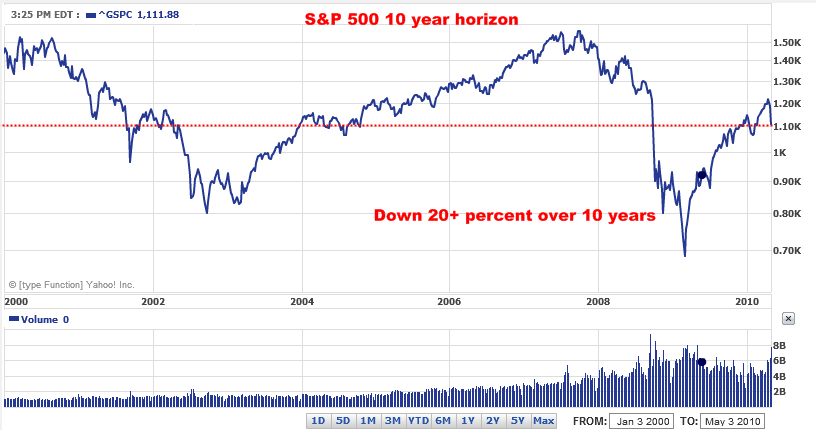

The 401k was used with sophisticated charts put together by large investment firms showing Americans that if they only put away 5, 10, or even 15 percent of their income into the stock market through the magic of compounding, they too can retire rich just like their Wall Street idols. Of course, this has all been a sham and many middle class Americans are waking up. Over the last decade the stock market has done nothing but move sideways while miraculously, the banking sector has gotten bigger and bigger:

After 10 years, the S&P 500 is down over 20% even after the record breaking stock market rally. No compounding going on here. And when the market can fall 700 points in a matter of minutes, we start to realize that many retirement accounts are merely greasing the wheels of the Wall Street roulette game.

So this absurd notion of easy street has been pushed and sold by Wall Street to take away the responsibility banks and companies have for their workers. They like to claim all is a free market but have no problem taking trillions in taxpayer bailouts. Let us not forget that many Wall Street banks would be gone today without government assistance.

Let us dig deeper into the details of the 401k:

“(Bloomberg) The average 401(k) fund balance dropped 31 percent to $47,500 at the end of March 2009 from $69,200 at the end of 2007, according to a Fidelity Investments review of 11 million accounts it manages. The average balance of the Fidelity accounts recovered, to $60,700, as last Sept. 30 as the stock market rebounded.â€

“Seven in 10 U.S. households object to the idea of the government requiring retirees to convert part of their savings into annuities guaranteeing lifetime payments, according to an institute-funded report today. The Washington-based institute represents the mutual-fund industry.â€

I actually find this part interesting. The average retirement account balance is small relative to what is needed in retirement. How long will $60,000 last you without a paycheck? Think you can cover your rent/house payment, medical bills, food, college for kids, and other items for 1, 2, or even 3 decades? But many Americans, even after two decades of pure gambling on Wall Street still want to believe in that Horatio Alger myth:

“People value the tool of the 401(k),†Paul Schott Stevens, chief executive officer of the institute, said at a news conference in Washington. “They do not want government to take it away from them. They think the structure works very effectively.â€

U.S. direct-contribution plans, which include 401(k) and other employer-sponsored retirement programs, held about $3.6 trillion as of mid-2009, according to the report. They account for 25 percent of total U.S. retirement assets. Annuities, with $1.4 trillion, represent about 10 percent of U.S. retirement funds.â€

The structure does not work effectively. The stock market has not gained over the last decade. You would have done better by buying CDs or sticking your money into the mattress over the past decade. This isn’t because we have no good companies in the U.S. On the contrary, we do and we still have the strongest economy around the globe. But Wall Street uses that as a way of leveraging to the max and putting solid companies at risk for raids and stock manipulation.

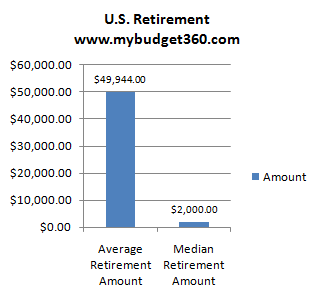

Yet Wall Street and the financial industry like to parade the “average†retirement account including the millions of the top 1 percent; the actual details are different:

Source:Â U.S. Census

While it is true that the average retirement accounts for many Americans is near $50,000 half of Americans have $2,000 or less in their account. Many middle class Americans are simply not prepared for retirement. Even with Social Security, this will only be a small amount. So with a large number of baby boomer depending on a smaller income in years to come, what does this do to our consumption based economy? Also, you have to sell your stocks to get the funds out of them so what is going to happen with millions of baby boomer selling stocks into a market where younger Americans have very little to save, not to mention save for retirement?

I found an article back in 2002 talking about the 401k and the same issues were present even then. But these articles are quickly forgotten after the stock market and housing bubble took off:

“While the fall in savings due to the stock market losses are causing a huge financial strain, many workers have no savings at all. According to a USA Today/Gallop Poll, more than one-third of adults say they have no money saved in any kind of retirement account and half of all households did not save a penny last year. “The average American household has virtually no chance to reach an adequate retirement savings in the next 50 years,†commented Christian Weller of the Economic Policy Institute (EPI).â€

Ironically things are worse today. As we have shown in the above chart, the stock market is basically back to 2000 price levels. A large part of Americans have no savings and no retirement accounts so they are completely at the mercy at whatever is available. Keep in mind we now have 40 million Americans receiving food assistance. 401k accounts also had the phony allure of having “company†matching funds but this only went up to a certain point of income:

“Even when companies offered matching contributions to 401(k) plans, on average they only contributed 2 percent of pay, compared to the 6 to 7 percent of pay they typically contributed to traditional pension funds. Enron, like many companies, strongly encouraged employees to invest in the company’s stock. Thousands of Enron’s current, laid-off and retired workers lost most of their life savings when the company prevented workers from selling its stock held in 401(k) accounts, just as the stock price was plummeting.â€

Much of that is gone today. Many companies are now using the recession as an excuse to even take away the company match. So now you are left putting money into the stock market while half of trades are basically computer generated trades in the big giant casino. Average Americans are basically putting their money into the one arm bandit of Wall Street. Yet someone as usual is taking the profits:

“Reports on account balances in 401(k) plans often give a more optimistic picture of retirement savings, because the assets of higher income workers skew the results. At the end of 2000, while the average account balance was $49,024, 44 percent of participants had balances of less than $10,000.

In contrast to the plight of working people, however, the top executives of companies engulfed in financial scandals have no retirement worries, even in those instances where their companies have collapsed. In the case of Enron, Jeffrey Skilling made $78 million. Laid-off Enron workers received a mere $4,500 severance payment, no matter how many years they had worked for the company.â€

This is a battle for the survival of the middle class. Many baby boomers who once believed Wall Street would be there to protect them will find they are out to sea with no paddle. Maybe this will wake many people up to take action but given the strong belief in the get rich myth, you wonder if many would rather be paupers as long as they can believe in the phony notion of big money with little work and effort. After all, Wall Street has mastered that game plan.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!9 Comments on this post

Trackbacks

-

Forty2 said:

In general the 401k is a scam feeding huge fees and commissions to the bankers. That’s by design.

I have however maxed mine out, and invested it all into the safest, lowest-expense bond funds I can find from the rather paltry selection. Unfortunately too many people passively sit and watch their savings vanish then bitch and cry rather than think ahead about what the economy might do. In my IRA and other accounts I went to cash/treasuries/GNMAs in 2007 and have not invested in stocks since then, despite the massive sucker rally that’s basically GS/JPM/BAC/C/et al trading between themselves. The average retail investor will never trust the casino again as well they shouldn’t.

May 9th, 2010 at 4:01 pm -

Deborah McQueen said:

Vice President Biden has only $27,000 in assets as stated on Politico. That won’t provide a first class retirement, but he could afford a senior pod.

May 10th, 2010 at 9:27 pm -

slavelabor said:

They want you to save for retirement so they won’t have to support you with government funds. Don’t be stupid, enjoy your money while you are young? WTF are you gonna do with $1M when you are 70? You may be too sick, too tired, too senile, to want to to anything. Doctors, lawyers and the cemetary system will drain all your cash. If you are old and broke they will not let you die, you will survive. No luxuries, but what do you need luxuries for when you are 70?

Most people will die broke no matter how much they save. The rest will be inherited by dumb kids and grandkids who will blow the money on electronic gadgets, hookers, and useless luxuries.

Bottom line. Don’t save for retirement, you may not make it that far. Enjoy it while you have it. All investments are SCAMS and PYRAMID schemes, with front loaded fees that make you a loser as soon as you put in the money. Net effect is Wall Street makes a killing and you go broke. Stop feeding the scam system and enjoy what you have. If you have too much donate to some poor kids in 3rd world countries.

If you are lucky, maybe you live to see retirement, but most likely you will work until you die.

May 18th, 2010 at 10:05 pm -

Richard said:

I’ve been an attorney working in private bank trust departments for almost 20 years. I’ve seen how people with money acquired it and how they retained it. They are smart enough to know that you can never acquire money by spending it. They would sooner die than go into debt to buy consumer goods. They’ll go into debt but only to purchase property likely to appreciate.

These are the people who, instead of buying iphone after iphone and ipad after ipad, bought the stock of Apple when it was selling for about $7 early in 2003. Today, July 1, 2010, it sells around $260.

People with money don’t care about consumer goods, cars, big-screen TV’s or anything else that the masses “must have”. They know all this stuff is junk and that to buy it simply wastes money better deployed otherwise. In short, people with money got and kept it not by buying things but by buying the stocks of companies that sell things to other people…you for example.

I’ll leave you with this unsettling thought. Suppose you’d had $15,000 in October 1980 and that you’d been of a mind to “invest it”. You might have been lured to purchase jewelry, say a diamond ring, on the utterly untrue but long spread lie that diamonds are rare. Any jewelry store would have been happy to lure you in with a lot of special lighting over plush counters served by shills who are trained in how to try to induce you to put reason on hold and think romantically about how happy you would be if only you had a $15,000 diamond ring. They’d tell you it would be “AN INVESTMENT”. God help you if you fell for the scam. The ring you’d have bought on Friday, October 10th, 1980 for $15,000 would have been worth about $3,000 on Saturday, October 11th if you’d tried to sell it. It might not be worth even that today.

On Friday, October 10th, 1980, stock of Johnson & Johnson traded around $83 per share; you could have bought 180 shares for $15,000. That investment, a REAL INVSTMENT, would today, July 1, 2010, be worth over $500,000. After 48:1 stock splits, you would have over 8,600 shares of Johnson & Johnson paying annual cash dividends of almost $19,000.

You can be young in this country and be without money but this is no country in which to be old and without money. If you have no money you have no power. If you want to end up parking cars for a high school kid who owns a parking lot, keep doing what you’ve been doing. Keep buying “diamond rings”. If you want to have some say about where and how you live and on what terms, leave the consumer good on the shelves and buy the stocks of companies that sell things to other people. Just make sure you’re not the “other person”..

Good luck.

July 1st, 2010 at 8:35 am -

Rob S. said:

You’re premise about Social Security is wrong. It was always promoted as a life-long benefit. I’m actually surprised more people aren’t completely reliant on Social Security.

http://www.ssa.gov/history/ssn/ssb36.html

“From the time you are 65 years old, or more, and stop working, you will get a Government check every month of your life, if you have worked some time (one day or more) in each of any 5 years after 1936, and have earned during that time a total of $2,000 or more.”

October 12th, 2010 at 5:22 am -

Mark said:

“Slavelabor” is correct.

Americans are duped into the retirement mentality.

Just live your life and die. Take advantage of programs that will benefit your lifestyle. You only get one life.

December 15th, 2010 at 12:30 pm -

Nan said:

Yeah, Richard, the poor SAP who wants to buy the phone for himself, that’s the ENTIRE reason he can’t afford his retirement.

Let alone, the poor sucker won’t ever own his home because the banks have their claws into it (for at least 30 years, WOW the interest payments)….

and to boot, he spends his days wearing cheap, shunken cotton t-shirts from China and rubber shoes.

Yeah, all the phone though.

April 12th, 2011 at 4:24 pm -

Darcy said:

You can mock Richard with know-it all condescension, but whether you like it or not, he’s right and he didn’t create the system (which has unquestionably gone way off course).

The sad truth is that if we want to take care of ourselves later in life, most of us will need to invest partially in the market (even just moderately) now.

It’s irritating that so many people leaving comments here are only thinking of themselves (“you get one life, spend your money now!”). Take some responsibility for the fact that when you’re old and you’ve spent your money, your kids and the younger generation of Americans will have to pay to keep you from starving.

For me, saving isn’t just so I”ll be able to live it up at 70; it’s to hold up my end of the bargain.

(In addition to saving for your own retirement, vote against any idiot politician who doesn’t support raising taxes on the uber-rich…WORKING Americans shouldn’t be paying double taxes while Americans living off of interest, most of which was earned on the backs of their ancestors, get ridiculous tax breaks. That isn’t the American dream.)

September 2nd, 2012 at 8:52 am -

Neo said:

I have yet to see an article factor in a problem which many of us face: being let go at around age 50 and be unable to find a job which pays anything for any decent length of time. The excuse is always “You’re over qualified” or “you don’t meet the physical requirements of the job” no matter what the facts. This is IF you even get an interview.

Thus for too many, retirement is a lie.

July 11th, 2019 at 2:48 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Follow us on Twitter!

Follow us on Twitter!