Saving Money is Bad for the Economy: Personal Savings Rate Higher, Consumption Slightly Up, Banks get new American Express, and Markets Begging for Money.

- 3 Comment

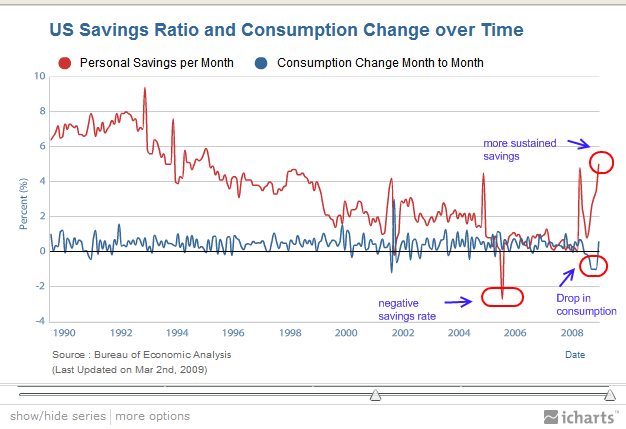

Last month the savings rate hit the 5 percent mark. That makes two months over 4 percent and for the first time in a decade that Americans have actually saved more than 4 percent for two consecutive months. Saved 4 percent of what? Of their personal income. You would think that most people would be saving a little bit of money but that has not been the case. The average American household does not make as much as the media once portrayed. This fact is hard to reconcile when our eyes see brand new cars and clothes on virtually every person we come into contact. Yet the fact of the matter is the large majority of these people have those new shiny artifacts because of debt. Let us take a look at the savings rate and consumption over the past two decades:

There are three key factors in the chart above. First in this decade, we saw an incredible occurrence where the savings rate actually dipped strongly into negative territory. That is, Americans were spending more than they actually brought in. Next, what you’ll be seeing is a sustained growth in the savings rate. You may be wondering how is it that Americans are now saving while the economy is now in a deep recession? First, credit is still tight for the average consumer and much of the last decade spending came from easy money. The stock market has slammed the bottom line of many Americans. So many are concerned and rushing to actual basic savings. Finally, you’ll notice that we have seen the first sustained drop in consumption occur in nearly 2 decades. We had a slight jump last month but this can be attributed to lower rates and all the bailouts now probably having a slight impact.

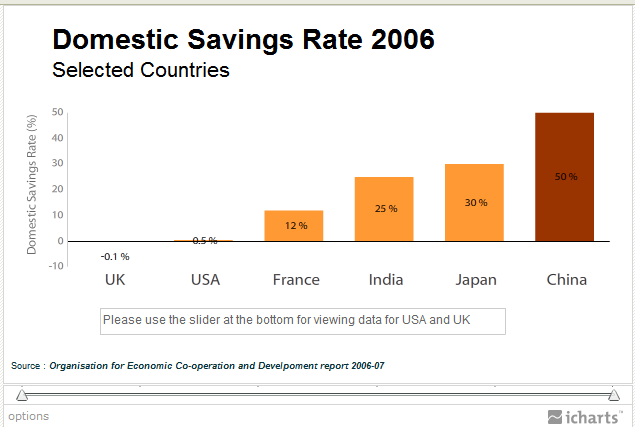

And to give you a sense of our savings rate versus other countries, let us take a look at this chart:

Keep in mind that we are now seeing a 4 to 5 percent savings rate that I would suspect will go higher (probably not passing 10 percent however). Yet look at the savings rate for other countries. Having a negative savings rate is not good for a country yet ironically, that is the last thing our economy can sustain. That is why the U.S. Treasury and Federal Reserve combined is doing a two-pronged battle. First, they want to decimate the dollar to make us spend more money and discourage us from saving a more and more worthless currency. Second, they are creating elaborate “credit” (aka debt) facilities to keep Americans spending. What do you think the TALF is about? It is about purchasing securitized consumer debt to give more debt to tapped out Americans. This is troubling that we have reached a point where even a modest savings rate (i.e., 10 percent) is enough to keep us in a deep and prolonged recession. What this does signify is that we need to keep spending like good little hamsters to keep the wheels turning.

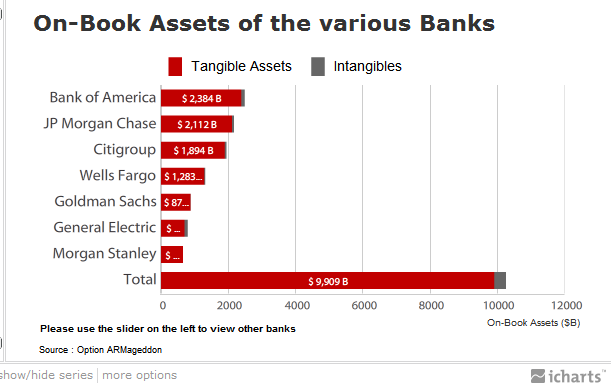

And if you think banks are okay just look at the stuff on their books:

You know about that new “private-public” partnership with a price tag of $1 trillion? It is targeted to buy the junk off these banks. While the average consumer needs to save to clean up their balance sheet and is seeing credit being shutoff from their access, these large institutions with toxic debt have the biggest credit card available to them to dump whatever assets they see fit. And this credit card is funded by the U.S. taxpayer, the same group of people that are seeing their access to funds being limited. A double standard is partly why many Americans are gravitating toward populist rage.

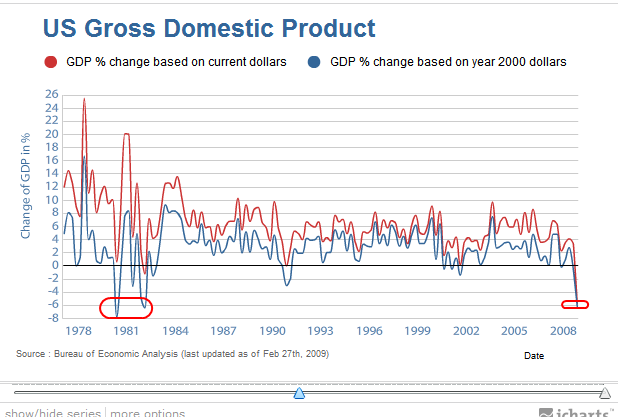

And of course, this spending stop has caused GDP to fall the most in nearly 3 decades:

When 70 percent of your economy runs on consumption and consumption is contracting, it is only logical that you will see GDP fall off. Yet it is fascinating that no one in public life or Wall Street is encouraging Americans to be prudent or careful with their finances. This is the right thing to do. Instead, we hear “go out and buy a car” or some other mantra. Why? Americans have over spent! Wall Street has over spent! The government has over spent! Debt is the problem. I understand the need for unemployment insurance and things of that nature but extending credit lines for more credit card debt? Really? Where do we draw the line on what we bailout?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Dan Holsopple said:

FIRST: Save! Save! Save!… like a REAL Patriot. Get your own financial house in order. It will be health to our nation in the long run. “The borrower is servant to the lender.” Ask stores for a lay-away option. Save up for things you need. Then they will be special, not just another item in a yard sale. Avoid using credit cards unless you can pay the balance off each month. GET OFF THE TREADMILL. Start saving NOW for the next car you will need.

SECOND: VOTE OUT THESE BUMS who are complicit in this huge theft of taxpayer money to bail out their cronies in the Banks and Investment firms. We don’t need these companies, or these politicians, and we are promoting moral hazard and future ripoffs.

The media is complicit in this scheme, towing the party line that we really need to be ripped off, go into more debt…bla …bla …blaMarch 29th, 2009 at 3:05 pm -

Jewellery said:

In the long run, of course, the only sustainable model is growth that is equal to the increase in productivity – the more a society can produce, the more it can consume.

April 10th, 2009 at 5:27 am -

Rockin B Ranch said:

Correct Jewellery. The only problem we have is that we now produce nothing but worthless paper with ink. This ink could be on the paper in your wallet or the paper from your monthly savings & investment statements. In the long run you cannot eat either of these items. The only true sustainable economic model based on the real free market is the one that has lasted thousands of years and will last for another thousand. A self-sufficient family oriented lifestyle based on producing most of the things your family eat’s, selling or trading the excess to buy the things you cannot produce, and producing those things that others want to buy. A $20 gold piece would buy a cow in 1890, and it will still buy a cow in 2009. What will that $20 dollar bill buy you today? This country has slowly abandoned the family structure in the meaningless pursuit of an unobtainable utopia always just out of reach until that next gadget is bought with debt, then we’ll be complete. I see a mass of wasted lives, time, labor, and for what? A big house with a yard too small to raise even a chicken that would give your family an egg everyday. The government promotes this lifestyle so that alone should wake people up that it will not work. Good luck out there and if you come accross a $20 gold piece I’ll trade you a nice 1200 pound Black Angus cow for it.

May 23rd, 2009 at 3:05 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!