Shipping the housing market overseas. Long-term housing prospects hinge on an economic recovery for working Americans first – No housing bottom until middle class recovers a foothold in the U.S.

- 3 Comment

The housing market can have no sustainable recovery without the employment market improving. It is incredible that over three years into this crisis that there has been little focus on coupling employment with housing. Banks argue that many are simply not paying their mortgage yet they want the Federal government to ease lending restrictions. Who are they going to lend to? Over 95 percent of all mortgages now being originated are government backed. It is disturbing that all bank bailouts including the Fed forcing the interest rate lower merely focus on one aspect of the financial equation. The reality is, without a burgeoning middle class housing will never recover. Even the rising default rates in government backed loans, many “plain vanilla†loans are defaulting in record numbers because people are not able to service their debt.

We need a backdrop to the current foreclosure problems. The financial industry simply dominates too much of our economy and now has deep connections in our political system. Let us first look at mortgages currently in foreclosure:

Historically you will always have roughly 1 to 1.5 percent of mortgages in foreclosure. This is just the background noise to the housing market even when we are running at full employment (i.e., under 5 percent unemployment). Roughly 50 million homes have mortgages so the maintenance rate should be hovering around 500,000 foreclosures in the pipeline at any given time (or 5 percent of total mortgages). Today we have over 2 million active foreclosures. But the bigger issue is the number of homes that have borrowers not making payments:

Roughly 10 percent of mortgages not in foreclosure are now past due. That means another 5 million mortgages are not in the foreclosure process but have borrowers who have completely stopped making payments. Total the two categories and you have 7 million loans in foreclosure or with borrowers not making payments. Banks are unable to deal with this self created mess and the massive amount of volume has created foreclosure mills where documents were fabricated just to get people out of their home. So now we have finance trumping the laws of our nation. Due process and diligence is necessary here. This is actually what got us into this mess in the first place with banks itching for a quick profit and Wall Street creating a toxic market for mortgage backed securities to satiate their gambling ways.

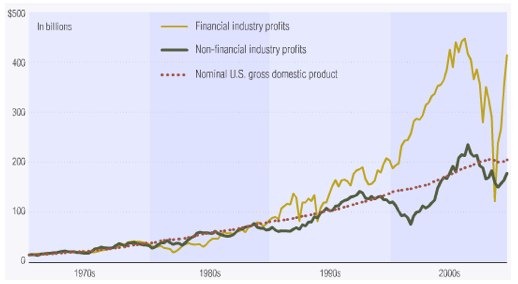

Corporate profits from the finance industry are bursting at the seams:

The problem of course is that the real economy is not thriving like profits in the financial industry. It is now the case that many of the too big to fail banks merely survive because of their explicit government guarantee that failure is not an option and the taxpayer will step in no matter what happens. Yet the vast majority of the public doesn’t want this and countless polls show a justified anger and frustration with the banks. But the poor and working class don’t fund current politicians, corporate and banking interest do. Many of the S&P 500 corporations now draw large portions of their revenues from abroad. They have international work forces, the majority who don’t live and buy homes in the U.S.

The current housing mess has to be connected to the health of the real economy. It doesn’t matter that Wal-Mart offers cheap prices by using cheap international labor if American workers are seeing their jobs disappear. I was talking with a colleague and he mentioned that we are now undergoing the biggest experiment of our time by slowly exporting the American middle class to the world and forcing many American workers to conform to the low wages of globalization. Wall Street presents this as a given and that nothing can be done and is all part of the free market while they just experienced the biggest government handout in the history of humankind. Is this the kind of world we want to live in?

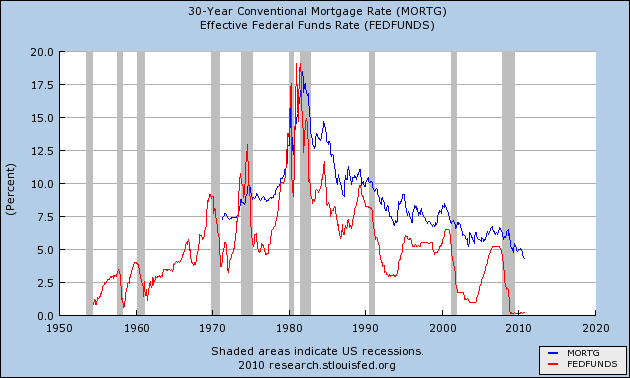

Clearly the housing market is tied at the hip to this trend. That is why even with historically low interest rates the market is still in the trough and potentially heading lower:

Until the economy recovers there is little that can be done to help the housing market. Banks can stomp their feet but the reality is, you need a sizeable working and middle class that can actually afford the mortgage payment to occupy housing units. If wages are being pushed lower you can rest assured that home prices are heading that way as well. There are only so many homes a CEO can buy.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

bob said:

Yet again an excellent article, you have encapsulated most of the issues in an easy to understand form. Thank you.

October 27th, 2010 at 4:12 pm -

Mr. Glett said:

Yes, takes a basic thought and imprints it well in the mind: no housing recovery until a middle class can re-emerge. Can that happen when capital formation in THIS country is being largely prevented by terribly artificial low interest rates and debt monetization ? No.

The media seldom connects employment with housing because the invidious ramifications become too obvious. The media much prefers to involve itself with happy talk. It’s on to important things: Is Bristol Palin still in contention on Dancing With the Stars ?

October 28th, 2010 at 11:02 am -

JeremiadJones said:

Agree completely with your conclusion. Welcome to the Banana Republic del Norte!

October 29th, 2010 at 5:29 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!