The sinister nature of inflation – historic droughts push food costs up impacting 46 million Americans on food stamps. What happens when everything gets more expensive and incomes fall?

- 2 Comment

Inflation is an odd sort of economic beast. People take it for granted that inflation will always be a part of our life sort of like a quite humming background noise. The Federal Reserve is doing all it can to increase inflation so banks can essentially inflate their debts away. Yet the impact for most Americans is negative. The debt based system built on access to easy debt has seen a perpetual system of bubbles. We had the housing bubble now followed by the higher education bubble. While prices in the two most expensive pursuits for Americans went into bubbles, the average American has seen their net worth and incomes go negative. Inflation erodes the purchasing power of every dollar you have in your pocket. At the moment, the process of deleveraging is so large that inflation is muted in some categories. Yet items like college that are decoupled from income are soaring to stratospheric levels.

The process of inflation

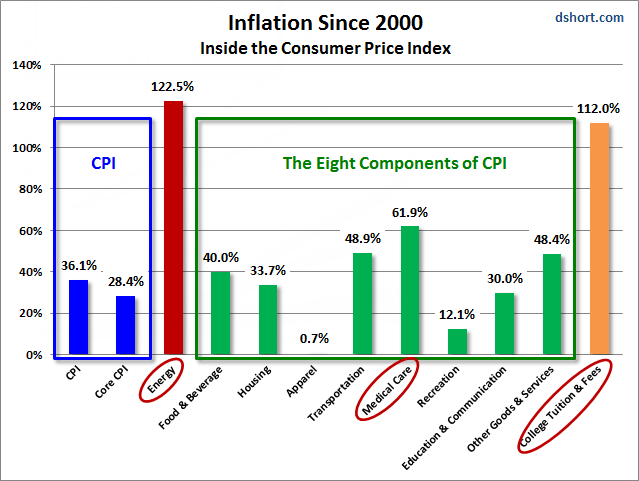

The CPI index is up 36 percent since 2000. Yet this index is a mixed bag of goods and a 36 percent rise with no household income increases is extremely painful. If you break the components down even further you realize where bubbles are hitting:

Tuition, energy, and medical care costs have soared since 2000 far outpacing every other category. The CPI measure actually missed the housing bubble because it tracked the owner’s equivalent of rent. Yet for the moment, there are few alternatives to oil and college costs are definitely in a bubble. The only reason costs remain where they are is the fact that $1 trillion in student debt is out floating in the market.

But back to the above chart you realize that Americans are seeing their quality of life decline. To be more specific, it is becoming more expensive to stay in the middle class with stagnant incomes when many items are going up in price. Home prices are cheaper because of the housing bubble bursting but also the Federal Reserve has pushed mortgage rates to historically low levels. Yet Americans are really not able to support current underlying prices without subsidizing the daylights out of the mortgage market. You also have global demand entering the market because of the crisis unfolding in Europe. Low rates are here not because of good times, but because of global fear in the massively over leverage debt based system.

Food

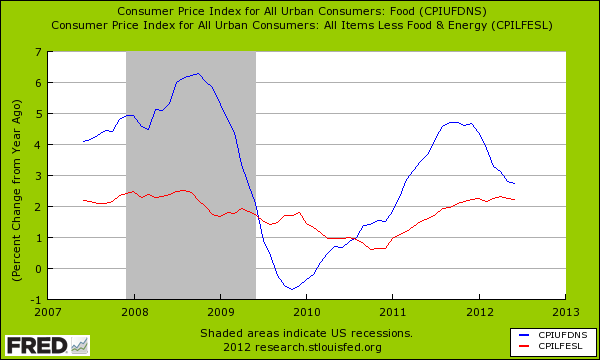

We have over 46,000,000 Americans on food stamps. Current drought conditions are pushing the cost of food items up:

For those on food stamps, food represents a larger portion of their monthly outflows. So a modest increase in food prices is really going to hit the 46,000,000 Americans directly in their pocketbooks. It is a troubling state of affairs but higher costs without higher incomes are simply a slow way of making the country poorer. Because of historic drought conditions corn futures are soaring:

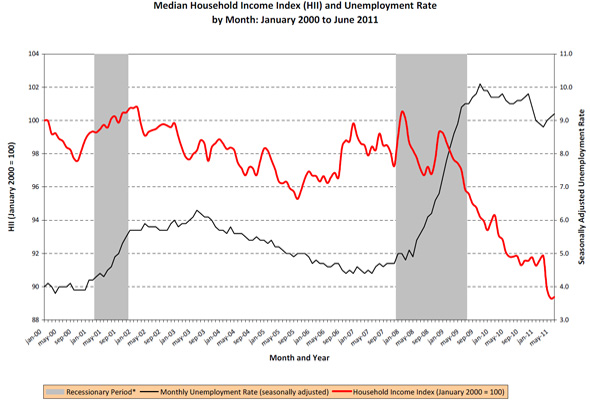

So with items getting more expensive the hit to household income becomes more prominent:

During the housing bubble, Americans to keep the aspirations of the dream alive simply went into massive debt. Many dove into massive auto loan debt as well. As that bubble burst, a process of deleveraging hit. Now, Americans are jumping into massive college debt simply believing that any college degree is worth massive levels of debt. This assumption is now being seriously questioned and with default rates soaring, we are simply looking at another crisis gearing up to unfold.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Corn Price said:

While corn has increased due to current severe drought (the kind we get about every 20-30 years). You can still lock in $6.30 corn Dec 13 contract. Current cash price near $8 should be compared with past prices. $14 (inflation adjusted) back in 1950, and $7.5 in 1960 for corn. We are just in a normal range. Even with this severe drought we will produce probably north of 10 billion bushels…so celebrate American Efficient Productive Agriculture. The number of calories we can buy as a percentage of our disposable income is still very low compared to our ancestors of only 100 years ago.

July 21st, 2012 at 5:09 am -

andy faris said:

food stamps are a cancer to this country. people sell their stamps 50 cets on the dollar. thats why the prices have stayed so high at the stores. i do not receive food stamps . farm subsidies paying farmers not to plant crops is another cancer to this country.

October 22nd, 2012 at 8:48 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!