The big economies cannot avoid a soft default as they face their debt reckoning: U.S. and other central banks battle it out for artificially low interest rates on unsupportable levels of debt.

- 1 Comment

Would you lend money to someone that you knew would never pay you back? The answer is, probably not unless you are okay with burning through hard earned cash. The global central banks unfortunately have entered into terminal velocity when it comes to debt support. The U.S. carries a stunning $17.51 trillion in total public debt. This is bigger than the annual GDP of the largest economy in the world but this pattern is not only in the domain of the U.S. Other central banks like the Bank of Japan and European Central Bank have also entered a mode where digital money printing is the only way out. Everyone does realize that this $17.51 trillion is never going to be paid back right? The Fed needs to push rates low in whatever method it can because the interest payments on the total outstanding debt would crush our economy alone. The Fed is mainly looking out for this when it comes to facing the debt reckoning and why we are witnessing inflation in debt based items like housing and higher education. It should be clear that many large economies are simply in a soft default already. In other words, they can only pay their debt by financial chicanery.

The soft default in the face of a global debt reckoning

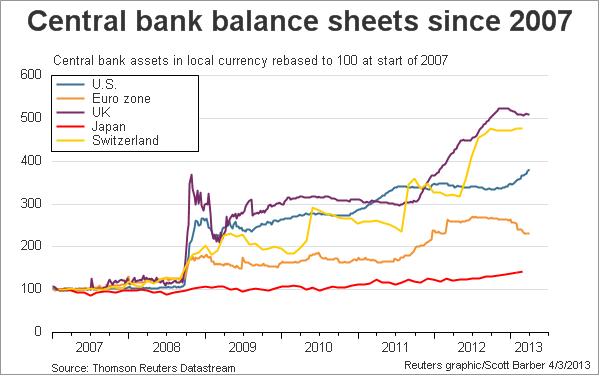

The Fed has artificially pushed interest rates lower by expanding their balance sheet above $4 trillion. Remember how no one is going to get paid in full at the end of this Ponzi scheme? For this reason the Fed needs to push interest rates lower to keep the interest payments on the total outstanding debt from crushing the economy. It is simply buying time. This is a critical point to understand. It matters because some tend to think the Fed is looking out for housing or other key industries but in reality, they are merely looking out on keeping debt payments low on this runaway train and allowing the finance sector to siphon off every penny before the well runs dry.

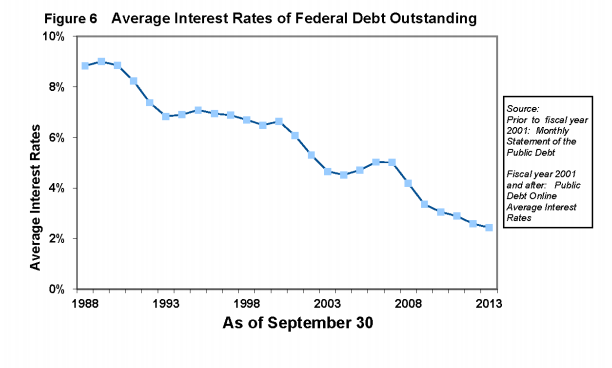

For example, the average interest rate on Federal Debt in 1998 was close to 8 percent. Today it is closer to 2 percent. The difference?

Source:Â U.S. Treasury

@ 8 percent annual interest payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1.4 trillion

@2 percent annual interest payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $350 billion

Last year the Fed actually paid out $415 billion in interest payments alone. The first figure above is the most important and should give you pause when it comes to central banking policy. If rates merely went back to where they were in 1998 the U.S. would be paying over $1.4 trillion in interest payments alone each year. This is why central banks are doing all they can to artificially keep rates low:

Practically every major central bank since the recession hit in 2008 has expanded their balance sheets dramatically. This is fully unsustainable and it will only take another Black Swan event to tip the scales over. It also helps to explain why debt fueled items like housing have had a stunning run in 2013 while household incomes remain stagnant.

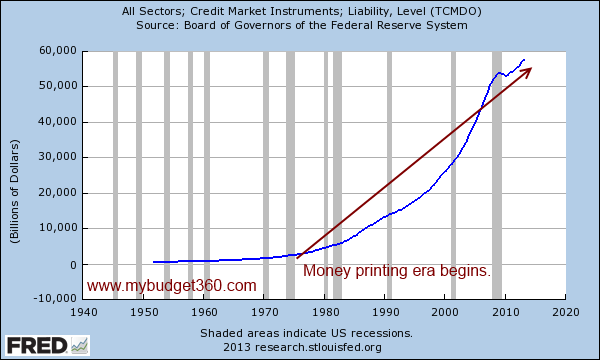

In 2013 household debt went up largely because of a continuing expansion of student debt and auto debt. These are not categories you want to see increasing at a time when household incomes stay stagnant. Total debt appears to be an addiction of the entire system:

Low rates need to exist simply to keep the underlying price of items inflated. This applies to housing, cars, education, and practically everything else that is financed. What happens when people come to terms that this debt will not be paid back? This already happened and that is why the Fed’s QE buying is basically an incestuous way of the Fed buying up mortgage backed securities that no one else wants (at least at current rates). In other words, they are the seller and buyer and the Fed balance sheet growing over $4 trillion is a direct symptom of this reality.

The soft default is here. Inflation is real and is eroding the quality of life of many families. Think that $17.51 trillion is ever going to be paid back?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

zorba the greek said:

“Think that debt will ever be paid back”

Yes, it will probably will be paid back, but in Zimbabwe dollars,

if the Fed has its way.March 19th, 2014 at 7:54 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!