State and Local Budget Crisis Black Swan – California paying out $100 Million per Day in Unemployment Insurance. Detroit’s Shrinking Population Crushes Revenues. The Employment Situation at a Micro Level.

- 6 Comment

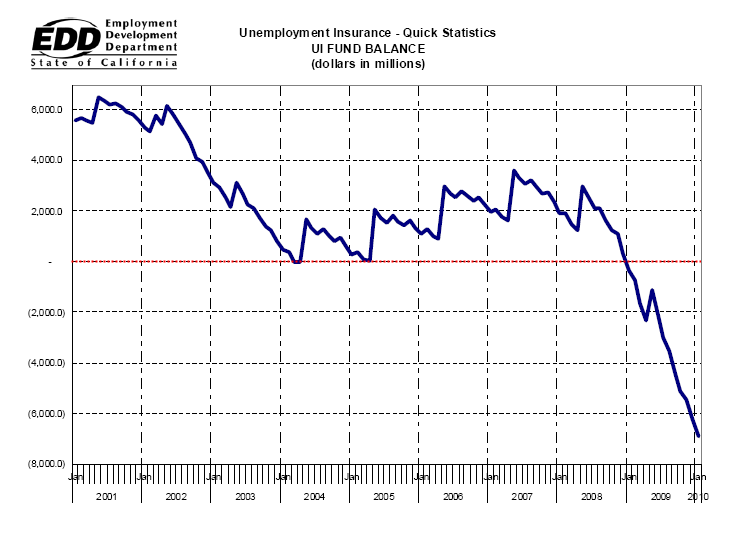

One stunning statistic that hit this week regards California’s unemployment insurance claims being paid out. California is paying out some $100 million per day in unemployment benefits. I’m not sure if I would call it a “benefit†but more as a buffer to get by. In reality if we really want to get a pulse on what Americans are facing in terms of the recession unemployment claims and benefits are a good place to start. The unemployment rate as we all know can be fudged in many ways. If you work 10 hours at Wal-Mart but want full-time work then you are counted as employed in terms of the headline rate. This isn’t a big deal when a small part of the country is working part-time for economic reasons but this group is enormous (9 million to be exact). The headline rate is 9.7 percent but add in this group and we are up to 16.9 percent. And people seeking unemployment rarely fudge numbers because they need the money and they have to report their status every two weeks to continue receiving claims.

If we look at California for example, the numbers show anything but a recovery:

Source:Â California EDD

Even with 99 weeks of unemployment insurance between federal and state, extensions, and other emergency support programs we have a sizeable number of people reaching the end of their rope. This shows how pervasive and deep this economic crisis has hit average Americans. I tend to look at unemployment insurance payouts as a good measure to see how quickly the economy actually recovers. After all, if after two weeks you find a job, you would expect that less would be coming out of the fund when it comes to renewing your benefits. So it is very sensitive to market changes in the employment market. We have so many market indicators from consumer confidence to home sales but in terms of employment, I’d be following the unemployment insurance payouts very closely to see when things actually take a turn.

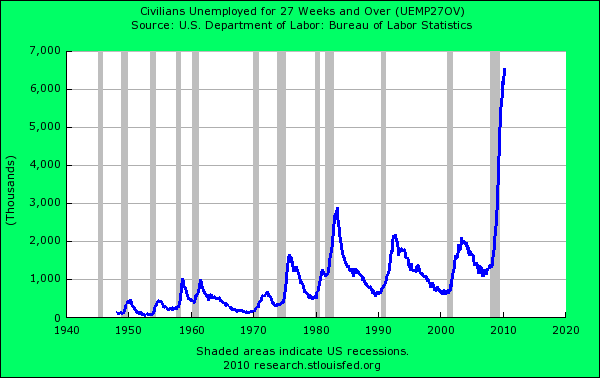

And one unique aspect (there are many) about this recession is the length of time people have been out of work:

Of the 15 million officially unemployed people, nearly 7 million have been unemployed for 27 weeks or more. The problem when people remain without work this long is that they typically will be shifting into other industries. Think of a mortgage broker that now needs to retool for another industry that is hiring (i.e., health care). Congress is currently debating whether to extend unemployment benefits but the fact that we are even having this debate with 99 weeks of unemployment insurance in some states is troubling in itself.

In many places like Los Angeles and Detroit, you are seeing massive deficits in their budget but for different reasons. California relied heavily on the housing bubble. States that really built an entire tax collecting expectation around real estate are being harmed deeply:

The Real Estate Foursome

California

Nevada

Arizona

Florida

The private sector responded quicker. Massive layoffs and crashing home values. Yet state and local governments are still expecting revenues at higher levels. Even if they don’t expect it, they haven’t done anything to the level necessary of balancing their budgets. Many middle class Americans will probably be shocked to see their local tax rates blossom even as they see their wages cut.

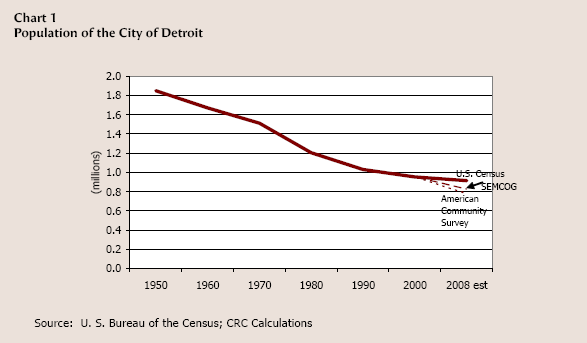

The other side of the budget issue has ex-manufacturing states like Michigan and Ohio that are struggling from the economic downturn but for other reasons. People forget that Detroit for example has had a crashing housing market for over 15 years. This has to do with the dismantling of our manufacturing base but also people leaving the city:

Once the fifth largest city in the U.S. Detroit has lost half its population in 60 years. This has caused deep ramifications in budgets but also in how the city deals with problems. For example, there is an effort to bulldoze parts of the city to reflect the actual services available and the new population dynamics. Drastic measures indeed but this is what is happening.

So dwindling revenues are another important aspect of the budget crisis. Looking at local governments because many depend on tax collections for revenues, things are still in bad shape. So if revenues are not up to par, then it is merely a reflection of the weak economy. These are indicators that prove to be better at giving the “feel†of the recession because simply looking at Wall Street, you would think that we would all be partying with a 70+ percent stock market rally. But Wall Street does not reflect Main Street and they only care about the worker on the street when it comes to taking their money for bailouts of their horrible business decisions of the past decade.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!6 Comments on this post

Trackbacks

-

cas127 said:

Another helpful statistic that makes up for the intentionally misleading unemployment rate (which ignores graduates who can’t get jobs and the long-term unemployed) is the “employed-to-population” figures from the BLS.

Of course, the E2P shows a historic crash…even more interestingly, it illustrates the essential non-recovery we’ve had going all the way back to 2002…

April 9th, 2010 at 5:32 am -

Ross Wolf said:

If Congress keeps printing and borrowing money to extend and pay unemployment benefits to persons not producing, the dollar could become worthless.

It is expected Obama might try to offset U.S. Government’s huge deficit spending and borrowing by inducing inflation, effectively stealing Americans savings. Seniors and others on fixed incomes would be thrown under the bus. Inflation added to the current huge interest cost paid on U.S. accumulating debt would strangle Citizens and the U.S. economy with unfathomable higher taxes; unprecedented unemployment would follow, as Citizens’ discretionary income evaporated to purchase goods and services that create jobs.

While the press has not discussed it, Obama’s health care bill will force unaffordable health insurance costs on Americans that will increasingly disqualify home buyers getting home mortgages. Many homeowners will not be able to pay both health insurance premiums and their mortgage. Obama claims he wants to stop the huge number of home foreclosures, but costs of forced health insurance will destroy most Americans’ largest single asset, their home equity as values drop because individual health insurance costs will disqualify millions of new home buyers getting loans. That could prove disaster because qualified mortgage borrowers are needed to stabilize homes values that now secure $Trillions in bank held mortgages. Consequently county governments will increasingly see lower property values causing less collected property taxes and will have to increasingly layoff government employees to stay within declining budgets.

April 9th, 2010 at 11:04 am -

Tim Gaser said:

Detroit instituted a CITY income tax around 1968, which drove businesses out of the city. That is the major reason Detroit is a basket case.

April 10th, 2010 at 10:17 am -

Kurt said:

The real issue is the states. I saw a graphic in NewsWeek that showed my state alone has borrowed over $2.4 Billion from the feds to supplement unemployment.

32 other states are in the same boat. How much longer can we continue to do this?

April 12th, 2010 at 5:50 am -

Scott E said:

The first figure, 100 million a day on unemployment – seems implausible. Where did you get that number? If true that is $36.5 BILLION per year. For example, all California state spending FY 2007-2008 is listed at $144.8 billion, according to sunshinereview.org.

And as we all know, spending has been cut since then… If true, it is shocking, but a source would lend credibility.

May 24th, 2010 at 10:05 am -

PVTidy said:

Black Swans are inside traders, front runners, market manipulators. The Mad Max of Wall Street Anthony Elgindy was a Black Swan (con); and his partner, a crooked FBI agent (insider). Do any of you think that this Black Swan insurance might possibly be an undercover federal investigation? A sting?

July 28th, 2010 at 6:33 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!