We are absolutely in a stock market bubble: corporate equity valuations now higher than peak reached in 2007. Crestmont P/E of 26.3 is 90 percent above its average of 13.9.

- 0 Comments

Once again the stock market is in full bubble mode. The internet chat forums are full of people pumping up stocks and you also have penny stocks surging in light of people looking for the next free lunch. The stock market is a poor indicator of the overall economy but it does show how those with disposable income to invest are thinking. Even on more conservative investing boards, those that advocate dollar cost averaging into broad based mutual funds or stocks, you have people throwing caution to the wind and trying to time the market or go all in on stocks fully ignoring bonds as a part of a balanced portfolio. The market was already overvalued earlier this year and the froth continues to build. The Crestmont P/E of 26.3 is now 90 percent above its average of 13.9. Valuations are off the chart and euphoria is setting in. You even have penny stocks going up in rocket rides up which was very common during the tech boom of the 1990s. At the same time, you have inflation eroding the purchasing power of regular Americans not participating in this casino. All the signs are there: massive speculation, unexplainable valuations, and blind optimism. All signs of a bubble top when the fundamentals don’t make any sense.

Corporate equity valuations

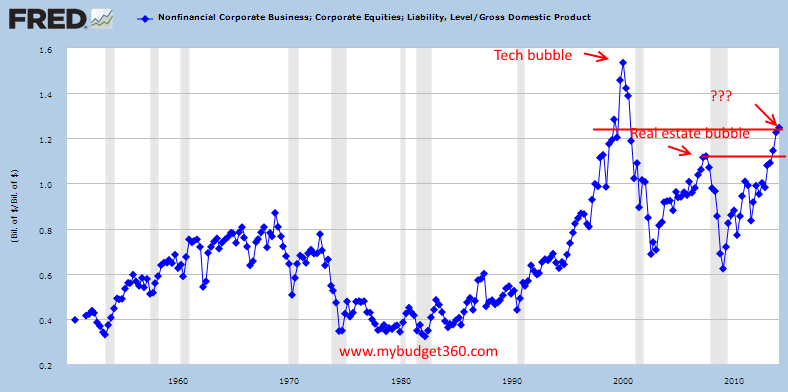

A good way to look at values is to take the value of corporate equities and measure them against GDP (the supposed true indicator of output from our economy). Stocks should be a reflection of what is being produced in the real economy. The market of course is merely a proxy for what is happening in the real world and when it loses this position, problems begin to arise.

Take a look at current valuations:

The current stock market is more speculative than it was in 2007 and we all know what came after that. You see the incredible euphoria by reading comments on investor forums. The S&P 500 is up 192 percent since 2009 so of course people are going to get wide eyed when they see things like this. Why balance your portfolio when you can go after big gains? Of course, this is when the public gets burned and a big part of this run has come from easy money policies that have already eroded purchasing power for many Americans.

Euphoria

There is a company called CYNK Technology that is up nearly 25,000% in 16 trading days:

Source:Â Google Finance

This company reported no revenue for any years on record and it shows an operating loss of $1.5 million for 2013. The valuation of this current company? $4.05 billion. This is for a company with no revenues and is based in Belize and registered in Nevada. The SEC has since halted trading of this company but this is symptomatic of what goes on in blind bull markets nearing a peak. People want to be the next millionaire even though there is no logic (or profits) from the companies they are investing in. People are looking to get rich without any actual work.

Valuations out of sync

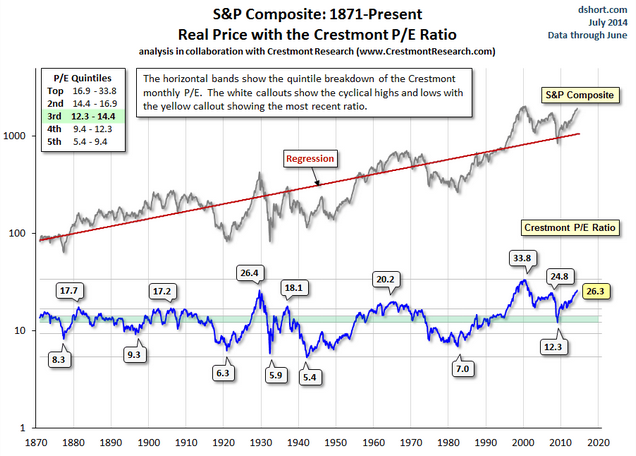

Now CYNK Technology is an extreme case. But overall, the market is looking extremely over valued:

The Crestmont P/E is at 26.3 which is 90 percent higher than the average going back to 1870. This is an important metric because it takes a look at current price and measures it against actual earnings. According to this measure, people are heavily overpaying for stocks today. As we had mentioned before, half of Americans do not own any stocks so this is very much a sideshow to them. Inflation has eroded much of their purchasing power over the last generation. Access to debt was confused with actual wealth when in reality, wealth continues to aggregate in fewer and fewer hands and the mass public with investable disposable income is trying to get rich quick. As usual similar to the tech boom and real estate boom, the public is the last to the party right when the bubble is inching closer to a bust.

These are all fairly clear signs that the market is overvalued and a correction is imminent. When you have a company with no measurable assets and no income being valued at $4 billion you know something else is going on. When the Crestmont P/E is valued at 90 percent above its historical average you know something is going to give. Then again, irrational exuberance can last a lot longer than you think.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!        Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!        Â