Student debt crisis enters a tipping point – Delinquent student debt now reaching record levels as defaults spike. Paying more and earning less.

- 11 Comment

The great deleveraging event continues to unwind while one sector of debt continues to grow by leaps and bounds. While other forms of debt have fallen by $1.6 trillion since the peak of the debt bubble mania, student loan debt has increased by a stunning $303 billion since the third quarter of 2008. What is more disturbing is the rising delinquencies seen in the student debt market that has now breached the $1 trillion barrier. While education overall is correlated with higher wages, there isn’t a clear distinction between university quality or even various degrees. Most of the studies examine the aggregate college pool when many went to college when prices were much cheaper.  Many students are sucked into the for-profit vortex only to come out with a worthless piece of paper and mounds of debt. There is absolutely a bubble in higher education and how things unfold will carry a deep impact on the economy.

Rising problems with student debt

The cost of attending college has outstripped almost every other spending category. Even the housing bubble cannot contend with the rising costs of college tuition. Yet problems are now soaring with student debt:

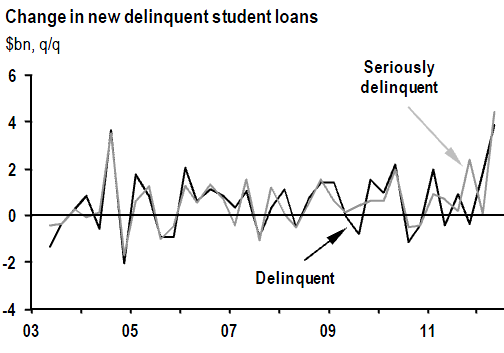

Source:Â JP Morgan

Keep in mind the above is occurring at the same time of a supposed economic recovery. What this tells us is that many with student debt are no longer able to service their existing debts. This is extremely problematic. Of course the issue stems from the way college attendance rises during economic downturns. This wouldn’t be such an issue if the cost of going to college wasn’t so sky high. So you have the perfect storm:

-1. Economic sluggishness pushing many to go to college

-2. Federal backing of student debt creates a situation where schools care very little of a student’s financial well being

-3. A prevalence of subpar academic institutions with an appetite and marketing budget to drag in many students

-4. Students graduate with degrees that largely do not meet the demands of the current employment market but also have back breaking debt

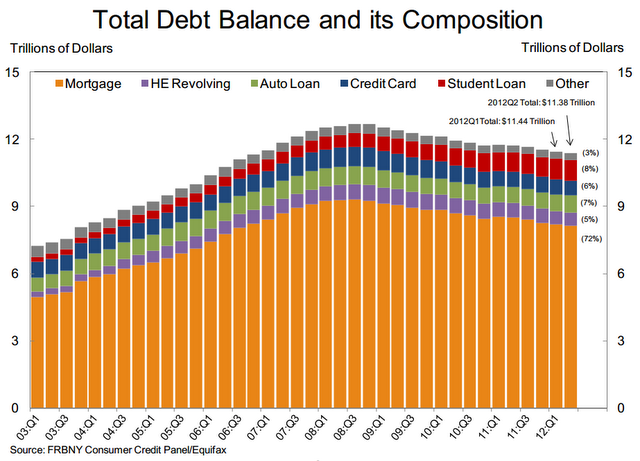

The above scenario is the ecosystem that has created a student debt market that now soars above $1 trillion far surpassing the credit card debt market. Student debt now makes up over 8 percent of the total US household debt market:

In our car obsessed culture student debt has also surpassed this category. Yet the more you spend on college does not mean you will earn more:

A big disconnect has occurred and that is why we are seeing massive amounts of student debt going bad. Even more troublesome is the reality that many of the loans have insane clauses where the initial principal soars because of late fees and other charges. Since this debt is not dischargeable through bankruptcy many find themselves with loans that compound many times over. Take a look at this example:

“Cutting to the chase, I borrowed about $6,500 and finally repaid over $20,000.

After college I got a job as a reporter for a small daily newspaper here in California. After a couple of years of trying to survive and pay my debts with an hourly wage of $6 (first year) and $7 (second year) — this was around 1990 — I declared bankruptcy and defaulted on my student loans. Unfortunately, as we all know, student loans are forever, with interest eternally compounding.

It took two years to get enough financial footing to start repaying, and six more years to finally pay the last dime. A huge weight lifted off me once I paid it off, but I soon learned that the hammer could still come back down. Shortly after making my last payment I read about someone who had paid off his loan, only to have them come after him 20 years later to say that he had not repaid and was in fact deeply in debt. The moral: Once you finally pay off your loan, keep your documentation safe — forever.

The plight of student loans might seem new to recent grads, but the usury has been going strong since way back.â€

So a $6,500 loan ended up costing over $20,000. This is on the low-end of course but you begin to realize how the FIRE segment of the economy is prospering in this sluggish low wage system. Expect the student debt bubble to cause problems for years to come.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!11 Comments on this post

Trackbacks

-

david said:

The only reason other debt has dropped is because they were written off via bankruptcy and foreclosure, not so with student debt. Otherwise “other” forms of debt would still be increasing.

September 4th, 2012 at 5:27 pm -

Frank said:

Time to take back this country!

Warrior’s Call

Feel the fire they’ve entered the ring

The mindet only knows how to win

This Bank fighter will break you in two

You will feel the powerFeel the power of a warrior

Fight, fight, fight, fight.

Let’s get ready to rumble

A gladiator’s left hand hook

Feel the pain tomorrowBehold here comes the people

Believe it, they were born to be the chosen one

The call is for a warrior

The name will echo on the sea and cloudsSeptember 4th, 2012 at 9:17 pm -

Melvin Tagggart said:

The US should never have gone into Iraq el al. They robbed SS Medicare, Civil Service pensions, now Military pensions are getting a good drooling, The have robbed the federal taxes on tires, tubes, gas and diesel also. They have Fanie & Fredie bankrupt. A large number of banks are not liquid enough to make loans on 2/3rds of the cost a a new home. LOL

September 4th, 2012 at 11:46 pm -

RUSS SMITH said:

Hi!, Patrons Of My Budget 360 Et Al:

Reasons explained here are what has become the incentives for many younger people to self educate themselves taking lessons @ home, until they qualify for an online resumae from a qualified institutional educator without the emense expenses extracted from them from what is often thought to be a more sophisticated albeit more expense option to their education with an on campus experience. Too bad we’ve tried to invite the idea that making more money is a sound economic response in life; when we have a profligate, overspending government that is proof positive that that road to riches life we are inspired to aspire to more often than not ends up placing US on poverty rowe. The pay as you go guys often are the ones who become the millionairse that hire others to do their work for them.

RUSS SMITH, CALIFORNIA (One Of The Broke States)

resmith@wcisp.comSeptember 5th, 2012 at 6:26 am -

ARIZONA said:

ALL the kids who owe money to the BANKERS had better watch their ass,they have been sold to the chinese,THE WHOLE SYSTEM is about to CRASH,and everyone is worried about their money,WHEN the RUSSIANS and CHINESE show up at your DOOR,it ain’t going to matter how much money you have ,their going to take what ever they want,and that will include your teenage girls or your wife,AMERICA HAD BETTER WAKE UP,right now you got way BIGGER problems then your money…………….

September 5th, 2012 at 8:05 am -

wisefool said:

You’d think if the government was actually for the people (by now every idiot should know it’s not) they would give out interest free loans on money that wasn’t really even theirs to begin with, but instead they treat it as a revenue building business. Sorry folks. No Star Trek utopias in our future. Death and destruction, yes, and plenty of it.

September 5th, 2012 at 10:32 am -

William @ Drop Dead Money said:

Here’s another chart constructed from that same report and database:

From that you can clearly see how student loans went from the smallest to the largest category of non-mortgage debt in the country.

Scary…

September 5th, 2012 at 11:25 am -

btruth said:

This bubble & the derivatives bubble, need to POP! People need to be made aware that all the debt & current circumstances are an illusion, built upon epic fraud. I recognized our broken system when I was 12 & I knew within my lifetime, it would all come tumbling down. May God have mercy on Babylon (ussa)

September 5th, 2012 at 11:59 am -

Bill Porter said:

It’s very important to bear in mind one central fact about statistical analysis, so well illustrated by this piece- its use by those informed by a pre-ordained agenda [resulting in an ulterior motive] tends to render stats useless, dangerous and/or irrelevant. Don’t think the use of the anecdotal burp at the end here was casually chosen: it was ment to underline, reinforce and drive home the subliminal message developed earlier and delivered through the narrative and charts [ostensibly carefully decocted from the supposedly mathematically- inarguable nature of stats]: “student as victim”.

So in the spirit of anecdote as coup de grace, here’s mine: my wife and I co-signed student loans for a child who proceeded to run up a total at the end nearly matching our mortgage. As has been said elsewhere, “You can live in or sell the mortgaged house; you can’t live in or sell a student loan”. To boot, this student left school after four years WITHOUT a degree and now has a reasonably well-paid position with a nationwide company, owns a car and a motorcycle, has an apartment and, so far this year alone, has been to Vegas, Atlantic City, Georgia, Tennesee and Texas on pleasure, not work trips. Did I mention he refuses to pay one penny on his loans? Of course you would automatically assume his rapidly aging parents are now being threatened and harrassed to the tune of 100++ calls and letters per month, and you would be right. Two lawyers have told us the same thing: “You’re f****d!”

So understand this, there is a large contingent out there sharing our misery- parents, grandparents, relatives and others who, out of a desire to see their young people succeed, have been betrayed and screwed, not by the government, the schools, the credit card companies or any of the other straw dogs and pinatas this peice hangs up for public bashing and ridicule; no, no, no- WE are the victims, and not of your supposed miscreants, but of the very ones we meant to help.September 6th, 2012 at 10:32 am -

clarence swinney said:

Always Great Thanks

why do not D leaders tell the people

not a”mess”‘ a disasterGOP SENATE KILLED –good letter to editor material

————–THE AMERICAN JOBS ACT———

WHICH:

Provides tax credits for hiring service personnel returning from war.

Keep 280,000 teacherS, cops, firemen, on their job.

Modernizing at least 35,000 public schools in bad need of repair.

A bipartisan National Infrastructure Bank modernizing our roads. rails, airports and waterways

putting hundreds of thousands to work.

“Project Rebuild‖leveraging private capital to put people to work rehabilitating homes, businesses and communities.

“High Speed Wireless Project‖freeing up the nations’ spectrum

Cuts payroll taxes for businesses, double the size of the payroll tax cut for individuals, and give aid to states to prevent public sector layoffsALL JUST TO DEFEAT A DEMOCRATIC PRESIDENT

TO XXXX WITH THE PEOPLE!

WHY VOTE THESE BACK INTO OFFICE???? KICK EM OUT.September 7th, 2012 at 8:52 am -

clarence swinney said:

call this a CLINTON TO BUSH TO OBAMA

Who Dug the Deep Hole? Who Fumbled the ball?

Numbers roundedClinton left Bush an 1800B Budget

Bush Left Obama a 3500 BudgetClinton left Bush a 240B Surplus as far as the eye can see

Bush left Obama a 1400B Deficit as far as the eye can seeClinton left Bush 5,700B of Debt

Bush left Obama 11,800B of DebtClinton left Bush a 237,000 net new jobs created per month

Bush left Obama a 31,000 lowest number since Hoover.Clinton left Bush 17 Million Manufacturing Jobs

Bush left Obama 11 Million Manufacturing JobsClinton left Bush a 10,800 Dow

Bush left Obama an 8028 DowClinton left Bush Peace on Earth Good Will From Most Men

Bush left Obama Hell on Earth Two disastrous wars. Enmity of 1500 Million MuslimsClinton left Bush a President most highly rated of any peacetime President in Asia, Africa, Europe.

Bush left Obama the most hated President in history

Bush left Obama an Housing Tsunami and Financial Volcano

Bush left Obama, in 2008, an 8500B Bail out commitment Yes! 8500 not just 700

Bush left Obama his Takeover of Fannie/Freddie, AIG, and first bailout of Chrysler

Bush increased maximum loan by Fannie/Freddie from $153,000 in 2000 to $300,000 then to $729,000

That is how F&F got stuck with so many toxic mortgages. Bush gift to Big Bank pals.

Bush increased FDIC maximum deposit coverage from $100,000 to $250,000. Help the rich.

“mess” I call it hell in America.September 7th, 2012 at 8:53 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!