The frightening lack of accounting transparency in the student loan market: New York Fed has student loan debt at $1.027 trillion while Fed Board of Governors in Washington has it at $1.214 trillion.

- 0 Comments

You see what you want to see. This is the current state of the financial markets. When a handful of observers were warning the Fed and multiple government agencies about the subprime crisis floating in the market, hardly anyone wanted to listen. This is the same kind of accounting trickery that is now pervasive in the student loan market. Ironically, the vast majority of student debt is backed by the government and issued out by friendly member banks yet somehow, it is hard to get an accurate number of the actual amount of student debt floating in the market. This does seem to be changing as the Fed Board of Governors in Washington is now adopting a much larger scope of data. How big is this difference? Try $187 billion or an increase of 18 percent of the data that is commonly reported. This is important because student debt is the fastest and most problematic debt class in America today.

The lack of accounting consistency in student debt data

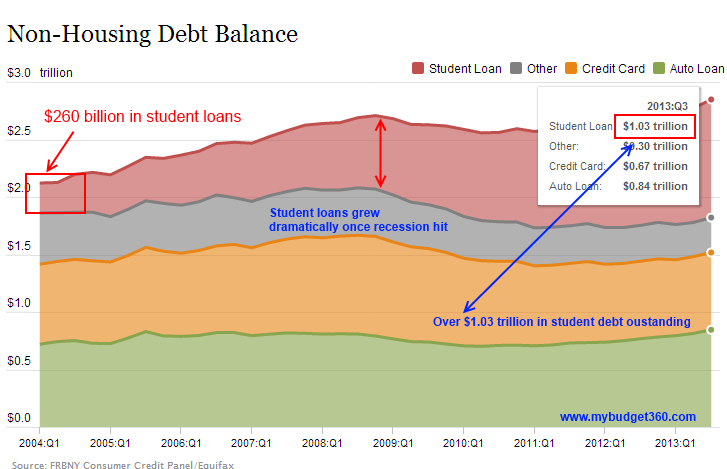

For the past few years, most of the data reported on the amount of outstanding student debt data has come from the New York Fed. The New York Fed looks at credit report data from sampling credit reports and the new Consumer Finance Protection Bureau (CFPB) has questioned the accuracy of this information. Here is the data:

Source:Â NY Fed

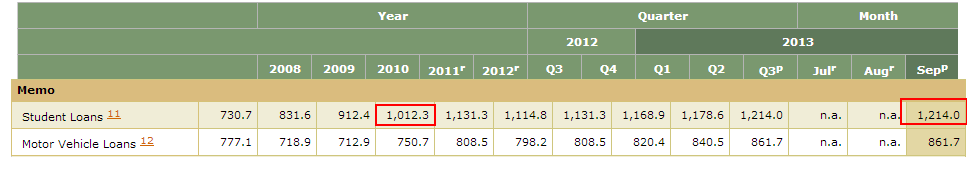

In spite of the accounting accuracy and understating the amount of student loans, student debt has grown dramatically over the last 10 years. In 2004 some $260 billion in student loans were outstanding across the country. Today, it is up over $1 trillion. And the figure is much higher than what the NY Fed is reporting. The Fed Board of Governors in Washington has now adopted the wider measure of student debt outstanding. This new modified figure shows that student debt outstanding is $1.214 trillion. This is a massive $187 billion difference:

Source:Â Federal Reserve

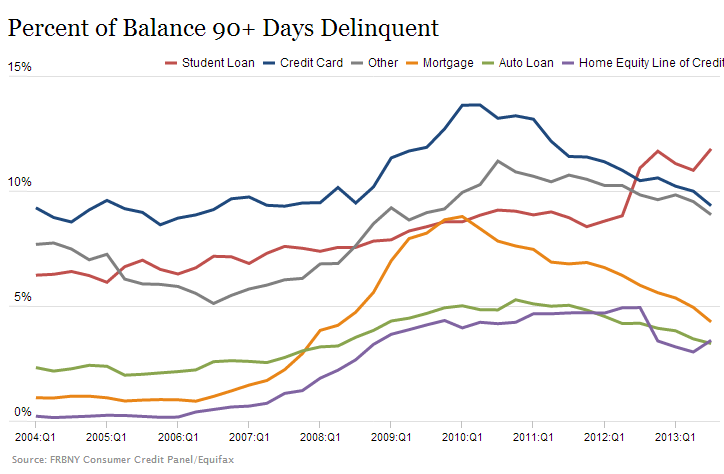

Now why is having an accurate count of student loans important? The major reason is that this is now becoming the most delinquent loan class in our country. Young Americans are largely burdened with this massive problem. Student debt used to be a safe bet. That is definitely no longer the case:

This is dramatically high. This is the only debt class with double-digit delinquency rates. What makes it more problematic is that it is being saddled on a large young population that in many cases, is unable to pay their debts because of a weak economy (hence the rising delinquency figures). Keep in mind that many government loans have the option of income based repayment plans so this really tells you how bad things are. Some simply have no income to pay it back.

With 40 million Americans owing an average of $30,000 (compare this to the per worker income of $27,000 across the nation) many are simply treading water. It is crucial to have an understanding of this market.

There are some eerie parallels with the subprime mortgage crisis. In March of 2007, shortly before the financial crisis ravaged the nation total subprime mortgages outstanding were estimated at $1.3 trillion. Total student debt is now at $1.214 trillion. By October of 2007, 16 percent of subprime ARMs were 90-days delinquent. Just look at the current delinquency rate of student loans and this rate is actually increasing.

This is a concerted effort to ignore a major issue because too many banks and people connected to this are making big money including for-profit paper mills. Don’t you think that agencies and banks that essentially function because they have data to the penny should have a better way of measuring this, especially if they are backing it up?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!