Why is the cost of college education so ridiculously high? Is the current cost of pursuing higher education justified or are we witnessing another bubble?

- 1 Comment

Last week I had the chance to visit a large and prestigious public university. While walking through the massive football field, one of the tour guides mentioned that they were planning on building another one close by. “What is wrong with this one?†I asked and the tour guide responded that they were looking to modernize the stadium. Beyond this a new gym included an Olympic sized pool and all the amenities you could want. Brand new stores, buildings, and the feel of a new city being built. This is the situation of the modern college. In essence, many institutions are operating as premiere cities luring in top students with goodies you would expect from a selective gated community. These things are not cheap and the cost of tuition is rising to support this growth. Then you have on the other side of the spectrum for-profit “colleges†that exploit the poor and rely on government loans to basically provide subprime education to anyone they can lure in. Why is the cost of education so high in the US and is the cost truly justified?

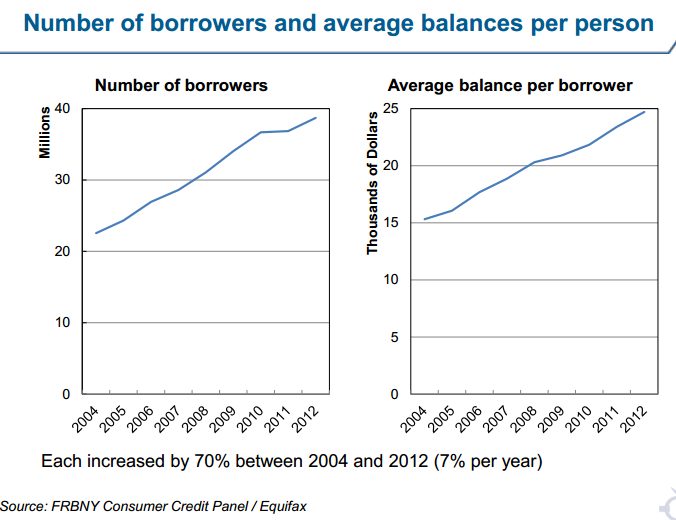

Number of student loan borrowers

It might be useful to first see how many people are borrowing to attend college:

Nearly 40 million Americans borrowed money to attend college. This is a large number. The average balance is close to $25,000. This number may not be so useful since you have people with tiny loans that went to school during more affordable times while younger graduates are routinely coming out with $50,000, $75,000, and even $100,000 in college debt. That is a hefty price tag for a college education. Some would argue that the price of something is whatever the market will support. Yet debt has a devious way of hiding bubbles. Sure, someone making $25,000 a year was able to take out a $500,000 subprime mortgage but could they truly afford it? No. The rising delinquencies with student debt highlight a similar story.

Many students are coming out with what amounts to a mortgage even before buying a home. So of course, this trend is impacting home buying.

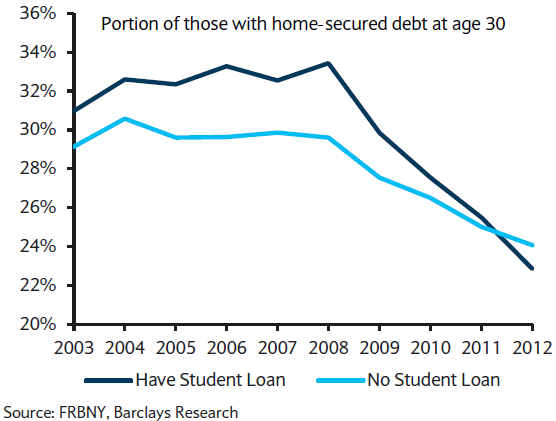

Impact of loans on home buying

Many students are leaving school with mountains of debt. As they exit and enter the workforce many are carrying debt that resembles that of a mortgage. This is impacting homeownership in this group dramatically:

Housing debt is being replaced with student debt for this age cohort. This group is valuing education over homeownership whether they consciously admit it or not. Younger Americans are deep in debt and wages for this group are lagging behind previous generations. This is the most educated group of people in terms of obtaining college degrees yet the most indebted as well. What is becoming painfully obvious is that many are unable to support paying off their student debt.

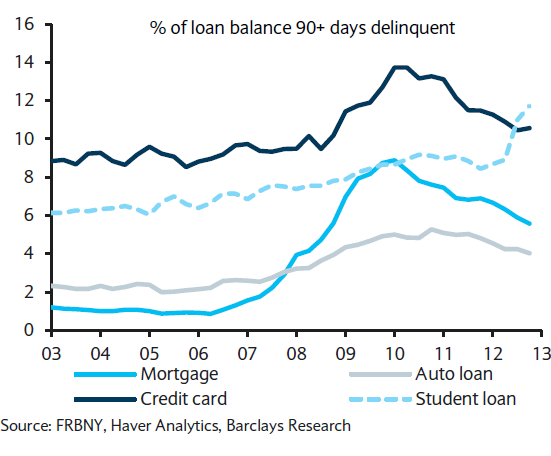

Student loan delinquencies

10 years ago credit card debt carried the stigma as the most delinquent debt class in the United States. Today that unfortunate award goes to student debt:

What is troubling about this trend is that it is only growing and is in its early stages. Student debt was the only sector of debt that grew during the Great Recession. And did it grow! This is why, if you go to many top colleges you will see grand new buildings and amenities being elevated from the ground. These young students are only supporting this either by loans or by parents paying for their college education.

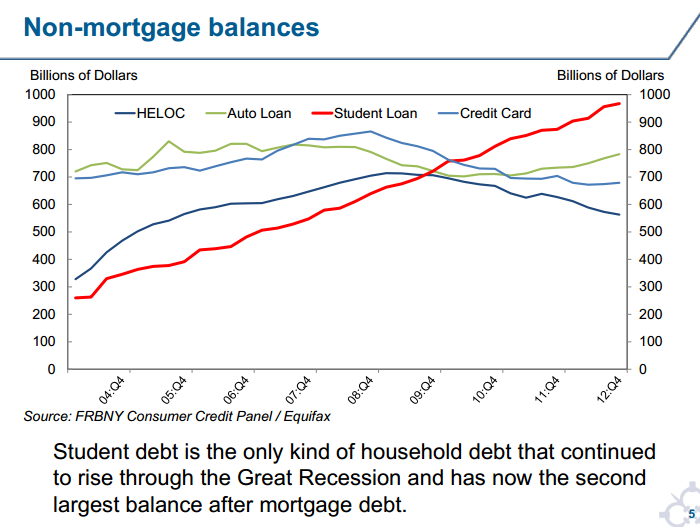

Non-mortgage debt growth

So why is college so expensive? Well another key reason, debt has allowed this segment of the market to balloon:

10 years ago student debt was the smallest of non-housing related debt. Today it is the largest outspending HELOC, auto loans, and credit card debt. How is this possible during a time of economic crisis and where incomes are actually falling? Student debt interestingly enough does not depend on income. It is a bet on the future. HELOC, credit cards, and auto loans at least look at your ability to pay these back. Student debt is the opposite. In fact, many state schools will give you larger grants the poorer you are. These are good since you don’t pay them back. Yet college is so expensive, many need to supplement their financial aid package with government backed loans and even private loans.

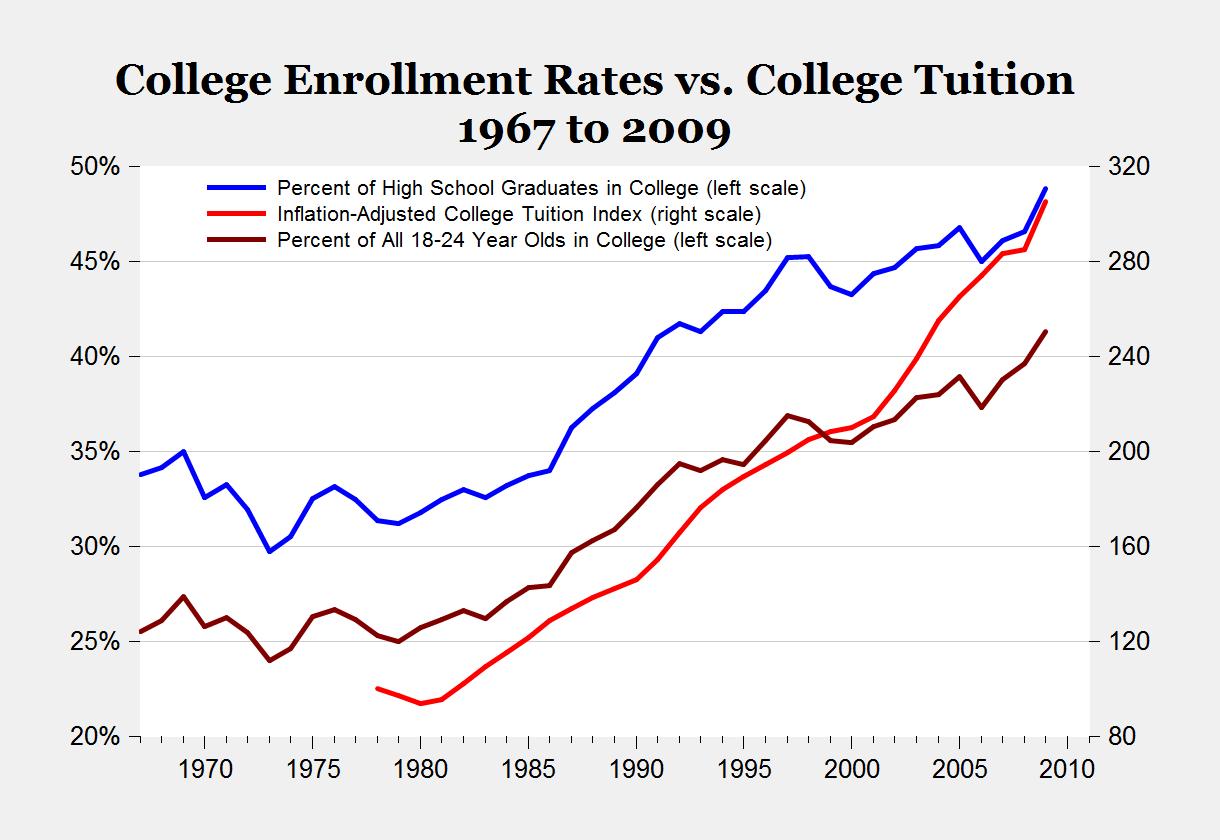

College enrollment versus college tuition

In no time in history have we had so many people going to college. This is good if you are truly gaining some value out of your education:

Source:Â mjperry

Close to 50 percent of high school graduates attend college (compared to 35 percent in 1970). That is a dramatic increase. At the same time, adjusting for inflation college tuition has gone up 300 percent since the 1980s. How much of this cost is because of “non-educational†items like stadiums and massive gyms versus actually improving the quality of education? You ask a 17 or 18 year old if they want a state of the art gym and of course they will say yes. Ask them if they want to have a competitive college team and many will say yes. Some students go to college because of these reasons. From a business perspective, colleges are simply responding to their clientele. The students by the time they are done have a solid experience but at a heavy cost. The magnitude of $50,000 in student debt may not hit until the first loan payment comes through. The industry is heavily subsidized and the fact that $1.1 trillion in student debt is outstanding is astonishing. Delinquencies are a canary in the coal mine telling us too much debt is being taken on. The fact that many are unable to pay their debt is telling. As we know, nearly 50 percent of recent college graduates are unemployed or working in jobs that don’t require a degree. For many, this is not a solid investment. We also hear that it is worth it in terms of ROI but we are looking at millions of college graduates that left school when it was cheaper and the economy was much better. If we look at the last decade of data, something dramatically has changed. Current costs seem unjustified in many respects but this will only continue to grow until delinquencies get fully out of hand.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Dewey said:

Universities do waste money (who doesn’t?) but their high cost is not totally self-inflicted. Here are some reasons for the high cost of higher ed no one likes to acknowledge:

1. Legal and governmental requirements require many more administrators for compliance. HIPA, ADA, EEOC, Title IX, everybody wants a say in how colleges do business.

2. The costs to provide education are simply higher now. IT depts. hardly existed 30 years ago and now they are among the largest and most expensive on campus.

3. Costly amenities to attract students must be pursued to counteract the massive government-loan-financed marketing by for profit colleges.October 24th, 2013 at 2:02 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!