Student loan shark industry – total revolving debt contracts during recession while student loan debt increases by a stunning 80 percent on an annual basis. A college degree for working at McDonald’s?

- 9 Comment

College sticker shock is probably stunning many parents as college aged students now sign their intent to register at thousands of schools across the country. You can almost feel the panic when Johnny or Suzie tells mommy and daddy she is going to University of Break the Bank while they watch their home equity plummet. What should be a proud time is now becoming a scary prospect for many parents looking at backbreaking student loan debt. If not the parent, many teenagers are looking at going into debt similar to taking on a mortgage without even owning a brick and mortar house. Many private schools now charge $50,000 or more per year in tuition and fees. Given that the average annual income for an American worker is $25,000 this one year cost is daunting. In the past if you picked the wrong major or school you ended up with a nice looking piece of paper and a likely opportunity to work in the blue collar world as a backup earning a relatively decent income. Today, pick the wrong career and school and not only do you have that same piece of paper but you also have limited prospects in finding even a basic job to service your college debt, forget about paying the rent or filling up your car with $4 a gallon gas. To expect teenagers to pick the right college and have their lives figured out early on is a bit much to ask. Students in the past did not have this same albatross hanging over their head. The big problem now is the massive cost of college.

Student loan debt outpacing all other forms of debt

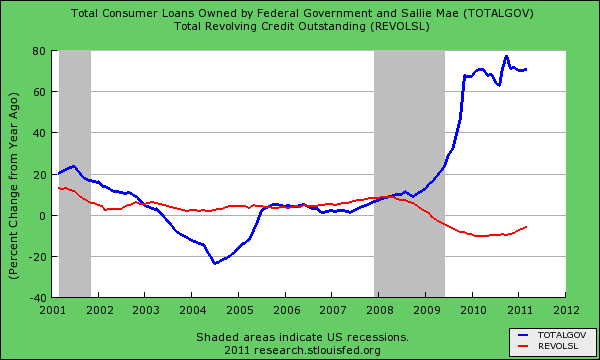

Probably the most disturbing development in the last few years is with households deleveraging on mortgage and credit card debt there is a doubling down in student loan debt:

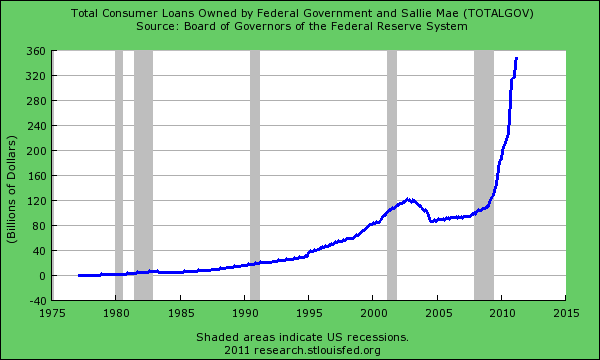

The above chart looks at the Sallie Mae portion of student loans on the government balance sheet. While total revolving credit has gone negative year-over-year since 2008 student loan debt has increased by 20, 40, and even 80 percent year over year. Some will argue that this is usually the case in recessions. Well look at the recession of 2001. Student loan debt quickly decelerated at this time. Why? Many simply jumped into the real estate industry as mortgage brokers, agents, construction, or other industries that were fine with simply a high school diploma. These positions paid very well. But it was all a bubble.   Today the few sectors with employment growth and solid pay do require a college degree and even that isn’t sufficient to secure a job. If we look at the raw amount of student loan debt we can see this problem more clearly:

Student loan debt has far surpassed the total amount of credit card debt outstanding in the United States. Currently there is over $900 billion in student loan debt and is quickly approaching the $1 trillion mark. Yet simply looking at the above charts you would concluded that colleges are doing a great job luring people into their expensive libraries and selling people on their deep pocket sports teams. Yet how is this translating in the work world?

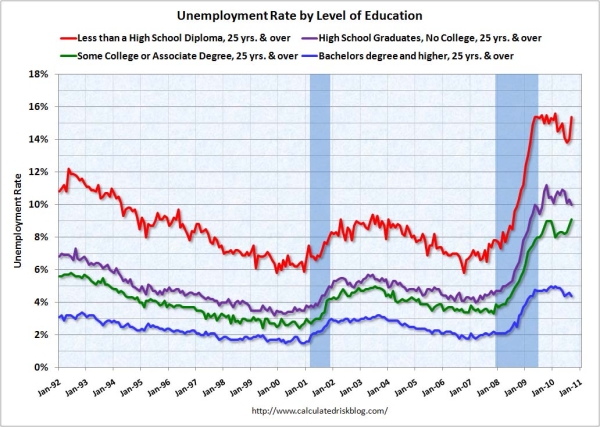

Source:Â Calculated Risk

Those with a college degree are now seeing higher rates of unemployment as well. The cost keeps going up because these loans are secured tightly to students where debt can be collected similar to tax liens. There is no walking away from student loan debt (at least not as easy as it is with say credit card debt or a mortgage).

The profit machine of colleges

The cost of going to college has surpassed every category in the magnitude of price hikes:

College tuition and fees have gone up faster than housing, income, and medical care costs which are already stripping bare the balance sheet of American households. This is a similar question I had during the housing boom. How is it possible for home prices to go up while incomes are stagnant? In the case of housing it was massive and easy to get credit. Why are college costs soaring when middle class income is shrinking? Again it is access to this debt as seen above.

While other sectors decline colleges can rest assured their money is secured by the Federal government. The largest source of funding for education is the government:

Nearly half of college funding comes from the government. There have been studies showing that for each jump in loan access tuition subsequently rises. No shocker here. Colleges are trying to get as much profit as possible even if results are not showing up in the overall economy. Of course it depends on what university you go to as well.

Attend a top private school and you are likely to make solid connections that will yield a solid return on your investment. Yet I would argue that this goes for the top 50 colleges in the country. We have over 4,800 institutions of higher education. If not a top 50 private then a public college. Public colleges however are now getting more expensive as well because of poor state budget issues. The fact of the matter is most people attend okay to mediocre to bad schools. When the economy tightens up like it has career choice and quality start to matter much more. Many of the for-profit institutions are one step above paper mills.

McDonald’s hiring lures thousands of people

Many lob jokes at “McJobs†and burger flipping yet McDonald’s recent hiring campaign of 50,000 workers is yielding thousands of applicants:

“(Yahoo) Managers at a McDonald’s in Cincinnati said a dozen or so applicants had lined up by 7 a.m., an hour before the restaurant planned to start interviews. By 10 a.m., the store had interviewed 100 people and had 25 more waiting.

Tiwian Irby, 28, was hoping for a full-time job and wasn’t particular about what it would entail. He said he’d had trouble finding regular work since getting laid off from his construction job two years ago.

“A job is a job to me,” said Irby, a father of three. “I’ll take whatever is available.”

McDonald’s and other fast-food chains, once an entry point into the work force for teenagers, appear to be turning into an employer of more adults, a legacy of the recession, industry watchers said. The average age of a fast-food worker is 29.5, up from 22 in 2000, according to the U.S. Census Bureau.â€

This little summary virtually sums up the current situation. You have someone that lost a good paying job in construction and is now looking for work at McDonald’s. What is also the key here is that the average age of a fast-food worker went from 22 in 2000 to 29.5 currently. Welcome to the new world of low wage capitalism. The choice then becomes accept this low paying work or go into massive debt to enter college?

It is no surprise then in these desperate times that people will fork over tens of thousands of dollar for a college education. But for every one solid college institution you have fifty seeking to take student financial aid and provide an experience similar to a rollercoaster ride; fun for a brief moment but what are the longer term results? So far with student loan defaults rising and the results in industry, the numbers are not positive.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!9 Comments on this post

Trackbacks

-

Jocelyn Vance said:

What talented message 🙂

April 23rd, 2011 at 5:34 pm -

Rick said:

A simple way to avoid college debt- Send your kids to a community college for 2 years, while they “find themselves”, and take required freshman classes. Bank the difference of what you would have paid for 2 years at a fancy school. Student should work part time, and bank all the salary.

Year 3 – transfer to a 4 year, in state school. Continue working part time. The savings from year 1 and 2, along with the part time job will just about pay for year 3 and 4. Parents can kick in the rest, and student graduates debt free.

This worked very well for my 5 children.April 24th, 2011 at 8:50 am -

CLARENCE SWINNEY said:

AS USUAL CHARTS ARE SUPERB THANKS

April 24th, 2011 at 9:32 am -

peter troncale said:

WHEREVER OR WHENEVER GOVT. GET INVOLVED IN ANYTHING THEY JUST SCREW IT UP. IF YOU HAD FAIR COMPETITION YOU WOULD BE PAYING WHAT I PAID TO GO TO NYU 12.50 CENT PER POINT. WHATEVER HAPPENED TO THE GOOD OLD DAYS? OH I FORGOT IN 1913 A CROOKED GOVT. AND A CROOKED PRESIDENT ELECTED THE FEDERAL RESERVE TO MONITOR THE ISSUANCE OF OUR MONEY. SINCE THEN INFLATION HAS GONE FROM WHAT A HUNDRED DOLLARS PURCHASED IN 1913 TO NEEDING 2410.00 TO BUY THE SAME AMOUNT OF GOODS. OH YES FROM 1800 WHAT COST 100.00 IN THE YEAR 1913 IT ONLY TOOK 57.00 TO BUY THE SAME AMOUNT OF GOODS. YES THE FEDERAL RESERVE IS THE ONLY CORP. IN AM. THAT MAKES OVER A TRILLION DOLLARS A YEAR AND HELLO PAYS NO TAXES. THE QUESTION ALL SHOULD ASK WHY IS THIS GOVT. STILL EMPLOYING THEM?? OH ITS PROBABLY BECAUSE THEY ARE ALL CROOKED. TO BAD WHAT A NICE PLACE THIS WOULD BE WITHOUT THE ELETE.

April 24th, 2011 at 10:18 am -

Jason said:

A college education can be a financial death-trap if one is unwary, or unlucky. The housing-bubble trashed the finances of many middle-aged, this student loan/”education”-bubble is a trap for the youth. The Banksters strike yet again.

Oh, you should add the fact that student loans get reported to credit rating agencies, and that potential employers use credit scores to weed out potential candidates.

April 24th, 2011 at 5:55 pm -

Jason said:

cut-and-paste this link to bridge off my riff:

http://articles.moneycentral.msn.com/Banking/YourCreditRating/how-bad-credit-can-cost-you-a-job.aspx?page=1April 24th, 2011 at 6:18 pm -

Steve said:

There should be an investigation of government profits here. For instance, gonernment profits whenever a student loan defaults. They recover 122% of the amount owed thatks to the removal of all consumer protections from student loans. These loans can’t be discharged in bankruptcy and “loan shark” methods are allowed to be used in collecting them. The collection agency is even allowed to garnish Social Security and disability checks.

April 26th, 2011 at 1:31 pm -

JP Merzetti said:

Subprime McEducation?

I don’t know how long it will take for people to finally believe for themselves that there isn’t enough to go around.

So many tackling higher education don’t belong there.

But the choices otherwise available appear more grim than this educational Vegas crapshoot.

It took some time for educational debt to overtake credit card debt……………….a valuable option for all those investors who shy away from real estate.

In this way we commodify our youth, cannibalize them, and commit them to indentured slavery.May 8th, 2011 at 12:44 am -

Matt said:

Enterprise Rent-a-Car in Southampton, NY (in the upscale Hamptons) has want-ads for workers to wash and prep cars, and to move them around between their agencies. For this demanding position it is only proper that they require a Bachelor’s degree. They pay $ 9.00 per hour.

May 12th, 2011 at 7:46 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!