Student loan tsunami on the horizon:Â Of $847 billion in Direct Loan program, only $535 billion is actually being paid back at the moment.Â

- 1 Comment

The amount of student debt continues to grow like a skyscraper reaching for the clouds. There seems to be an unlimited amount of student debt that college students are willing to take. As of today, there is $1.44 trillion in student debt outstanding. But how much of this is being actively serviced? After all, if you take out a mortgage or auto loan you start paying on it right off the bat. You will be surprised at the small amount of student debt that is actually being paid back at the moment. Young Americans that are already cash strapped are going to get even more budget tightening once they graduate and need to pay back the large amounts of loans they have taken on.

The student loan tidal wave

The amount of student debt outstanding is daunting. We are already seeing very high levels of delinquencies on student debt. Student debt has the highest delinquency rate of all debt sectors in our economy. Like we mentioned before, with a mortgage or auto loan you start servicing the debt immediately. With student debt it can be 4, 6, or even 10 years later when you make your first payment (assuming you go to med school or a Ph.D.). Now some might say “well of course you pay after you study!â€Â And I would agree with that at some level but it also hides the repercussions of taking on too much debt and simply not earning enough to pay it back. You hear countless stories of students taking on tens of thousands of dollars in debt and are working in low wage jobs.

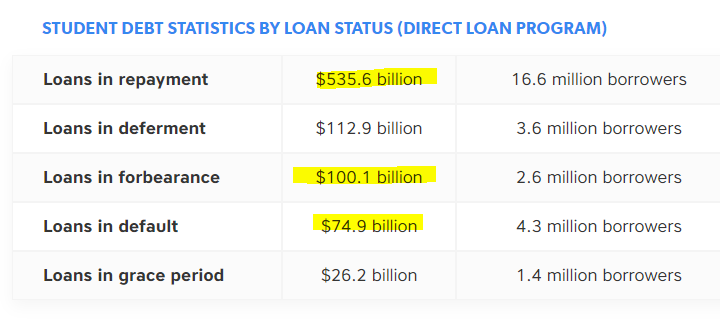

Out of the $847 billion in Direct Loan program, only $535 billion of it is actually being paid back at the moment:

This is really the bigger story. Let us go line by line here:

Loans in repayment:Â These are loans that are being actively serviced and being paid back.

Loan in deferment:Â These are loans that are not being paid back for a valid reason (i.e., going back to school, etc).

Loans in forbearance:Â Allows you to temporarily stop making payments or to temporarily reduce your monthly payment amount for a specified period.

Loans in default:Â These are loans where people simply are unable to pay the amount back.

Loans in grace period:Â You typically have six months after graduation before you start paying your college debt back.

This is very telling. We have good data on the Direct Loan program and you can see that large portion of the debt is just not being paid back.

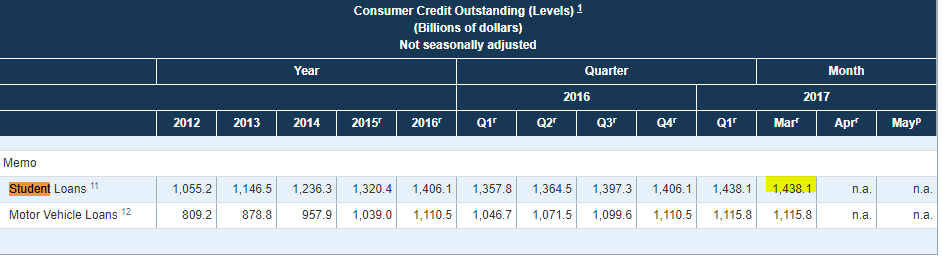

The growth in student debt is also startling:

Source:Â Federal Reserve

In 2012, there was $1 trillion in student debt outstanding. Today it is $1.44 trillion. So in five years alone we increased the balance by $440 billion (a 44 percent increase). Did income go up 44 percent in the last five years?

There is a big tsunami of loans that will go into repayment shortly and you already see how much people are struggling to pay this debt back.

![]() If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!    Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!    Â

1 Comments on this post

Trackbacks

-

SnowieGeorgie said:

It’s funny, things are AT LEAST as bad as stated in this article.

QUOTE :

“In 2012, there was $1 trillion in student debt outstanding. Today it is $1.44 trillion. So in five years alone we increased the balance by $440 billion (a 44 percent increase). Did income go up 44 percent in the last five years?“There is a big tsunami of loans that will go into repayment shortly and you already see how much people are struggling to pay this debt back.”

Either people will default on a massive volume of the outstanding loans — OR — ( however unlikely ) they will manage to pay some large part of the loans on schedule, thus draining them of “discretionary” left over income necessary to support our ridiculous “consumption-based” economy.

Either they don’t pay and things are bad; or, THEY DO PAY, and things are worse.

Damned if you do and damned it you don’t — is that a Hobson’s choice ? Not really sure .

SnowieGeorgie

July 23rd, 2017 at 10:54 am