Taxes coming for $1 trillion in commercial real estate. 1.2 million partnerships own over $1 trillion in CRE. Too big to fail dumping CRE debt.

- 4 Comment

The problems for commercial real estate are deep and significant and have the potential of stifling any sort of recovery. Rather than looking at commercial real estate (CRE) as a reason for more stimulus or bailouts the question should examine why so many CRE locations are defaulting. Can this be a sign that demand for goods, strip malls, condos, and other large projects are simply not in demand from a middle class that is confronting a new austerity? The problems in commercial real estate have the potential of causing the same amount of market volatility as residential loans for a handful of reasons. Unlike residential loans, there is little sympathy for CRE owners. It is expected that those who buy into million and billion dollar projects understand what they are doing (even if this assumption is wrong as we are finding out). So the potential for massive support here is limited from the public but we have seen the U.S. Treasury and Federal Reserve bail out virtually anything with a connection to the banking industry.

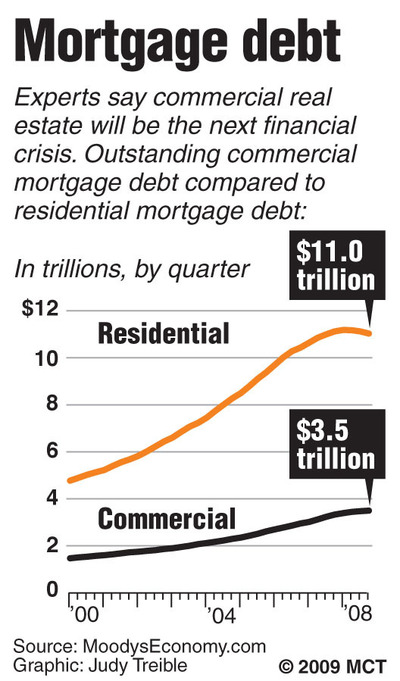

The CRE market is enormous:

Source:Â McClatchy

$3.5 trillion in commercial real estate loans are out in the market. The problems will be magnified for smaller regional banks that went into this market hand over fist. There are little mechanisms to bailout this industry. Yet why should there be a bailout function for real estate developers and investors that purchased land at overvalued prices and now expect to be made whole by the American public? The middle and working class are largely opening their eyes to the massive wealth transfer that is taking place. On the one hand you hear representatives telling the public to tighten their belts and be cautious with their money while trillions of dollars are transferred to the banking industry with no strings attached. After 29 months of crisis, it looks like there is movement against the real estate industry as we heard last week that the Feds charged 1,200 people with mortgage fraud. This is a step in the right direction.

Yet there is a growing examination of how commercial real estate loans are structured and who is making money from this. As we all know, our government is spending large amounts of money it does not have. Put aside the problems this will cause for the U.S. dollar down the line. In order to come back into balance, two things can happen. Either spending is cut to run on a leaner machine. This is very unlikely given that last month without the government there would be no job growth. The other option is to find other additional revenues meaning raising taxes. Commercial real estate has caught the attention of many as a potential source of new found income:

“(Zanesville) Despite this, Congress might pass the American Jobs and Closing Tax Loopholes Act. This bill raises taxes on investment partnerships in real estate and other ventures by more than 150 percent and will stifle economic activity. Rep. Zack Space joined his Democrat colleagues in voting “yes,” and the U.S. Senate might vote on the legislation soon.

This bill increases taxes on carried interest, taxing it higher than the current capital gains rate. It will stifle profits on commercial real estate transactions and will harm the real estate industry, whose health is vital to economic recovery. The still-fragile real estate industry cannot handle this tax increase, too.

More than 1.2 million partnerships own more than $1 trillion in commercial real estate nationwide and rely on the current system to build and revitalize our neighborhoods. Business partnerships are the primary model for development of commercial investments. The Ohio Senate passed a resolution I sponsored urging Congress to maintain the current carried interest tax rates.â€

Aside from the reporting trying to protect the CRE market, for too many years CRE owners have used tax loopholes that were designed to protect a grandparent from being booted out of their home because of taxes to their advantage. There is little reason to offer special protection to this industry and as the U.S. government is hungry for money, it is highly likely that at some point the way CRE is valued and taxed will come under additional scrutiny.

The CRE market is merely one way governments from top to bottom are going after more sources of money. After all, they’ve already picked the pockets clean of the middle class to bolster and support the banking industry. Now that the too big to fail are protected at all costs, why not put the act of toughness on and go after smaller banks with too much CRE debt? Once they fall over the too big to fail banks can have some CRE locations for a massive discount. After all, who else is in the market to purchase CRE in today’s market? Think this isn’t the case?

“(Housing Wire) JP Morgan sold $716.3m of commercial mortgage-backed securities (CMBS) bonds this week, marking the second deal this year.

The JPM deal marks the second CMBS issued in 2010 and one of the first since the freeze of the securitization market. The Royal Bank of Scotland issued the first in April 2010.â€

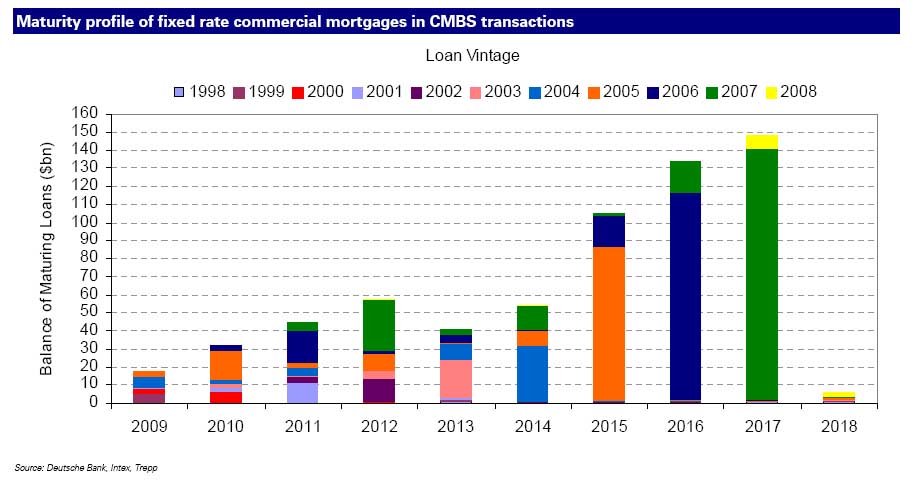

The commercial real estate structure aside from being massive with $3.5 trillion in loans, also has an adjustment structure that doesn’t bode well for longer term stability:

Source:Â Zero Hedge

If you look at the above charts, from 2009 to 2010 the amount of maturing CMBS has doubled. It will double again from 2010 to 2011. Then there is a significant spike from 2011 to 2012. Even with the amount we are dealing with right now we are seeing major problems in large CRE projects including large Las Vegas condo projects. There has been little to combat the above trend and what really can be done? The banking industry was hoping to buy time to have some miraculous price recovery so they would be able to off load the properties to some other unsuspecting investor. Unlike the stock market or banking profits, commercial real estate values are still near their trough:

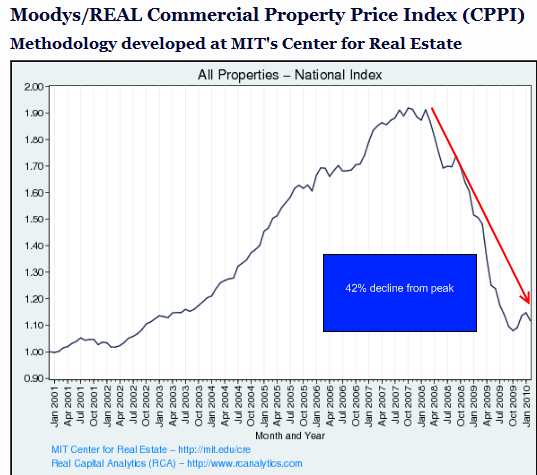

Source:Â MIT

Market prices remain depressed as you would expect given current economic conditions. And that is why the amount of CRE loans going into default is large and growing. If we look at the CMBS portfolio chart we realize that billions of loans in this market are largely toxic and inching closer to insolvency. We are reminded every Friday of one or two banks being closed by the FDIC that had their hands too deep in the real estate market including CRE loans.

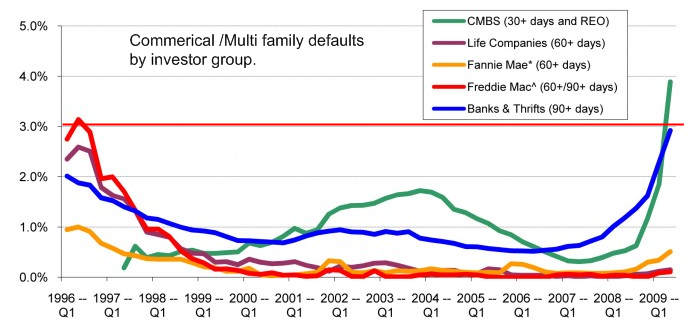

The fact that the government is exploring taxing CRE is interesting because it shows the tone of where we are heading. There is this odd balance of banking power. As long as you are part of the giant banks and Wall Street power brokers, you can fail on a continuous basis and you will be protected. Fall out of that realm, and you are in a “free market†with no support. Not a hybrid system that is conducive to a healthy economy. And we can see that the amount of defaults with CRE loans are booming:

Source:Â MBA

Not exactly a chart that bodes well for a growing commercial real estate market.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

StarDust said:

Gold/silver are too high to invest now. I might suggest everyone start buying canned food (expiration date 2012-13). You’ll pay today’s prices & not 2012-13 inflated prices (no capital gains taxes to pay).

From the article just read, I can see massive unemployment &, from the NYTimes, we are entering into the 3 depression in American history. Stock up!

June 28th, 2010 at 5:16 am -

Rev Reggie Jackson said:

The Great American Empire is doomed because of these murderous and genocidal International Bankers/Bilderbergers/Illuminati Freemasons who will plunge the whole world into greater wars and steal what little wealth the world has left. And they will demand that we take their coming zombie making mark of the beast chip very soon!! And that chip will turn you into their brainless zombie slave. And the 3rd depression is near!! And it is to enslave the whole world and bring it to their lord Satan and his antichrist beast leader son!! And if you take that mark (chip) you will forever be doomed and cursed by God because you have taken Satan as your god along with his antichrist beast leader son!! Read Revelation 14:9-11 which says that you will be forever in the great lake of fire and brimstone if you take their beast chip!!

June 28th, 2010 at 9:39 am -

J. Scrimmage said:

If you own a gadgety cell phone, chances are you already have the chip – the sim card in your phone is a chip.

June 28th, 2010 at 12:27 pm -

Jack Tax said:

America is going to destroy itself if this kind of activity is allowed to continue. More power should be given to the small and medium sized businesses.

June 29th, 2010 at 2:32 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Follow us on Twitter!

Follow us on Twitter!