The American Dream deferred for young Americans: Living in rentals, inflated college tuition, and low wages await millions of young Americans.

- 6 Comment

The Americans Dream was largely built on a few simple ideals. One was the ability to purchase your own home without needing artificially low rates and dangerously low down payments. Another key aspect of the dream was allowing young Americans to receive a college education to pursue their future. While more Americans are going to college, many are taking on dangerously high levels of debt to embark on this journey. Another key component of the American Dream was having the ability to have a job that paid well enough to have a good standard of living. That standard of living is eroding as inflation is eating away purchasing power. It is hard to come to terms but the upcoming generation may not have it as good as that of the baby boomers. There is no fast and hard rule saying that each generation should be better. That is why the middle class rising in the US was a historical anomaly. Something worth aspiring and investing in. Yet if we look at history, you largely have one of a small wealthy elite and the rest. The fact that we are looking more like the Gilded Age is not a positive sign. For many, dreams are being deferred.

Building for cash strapped young

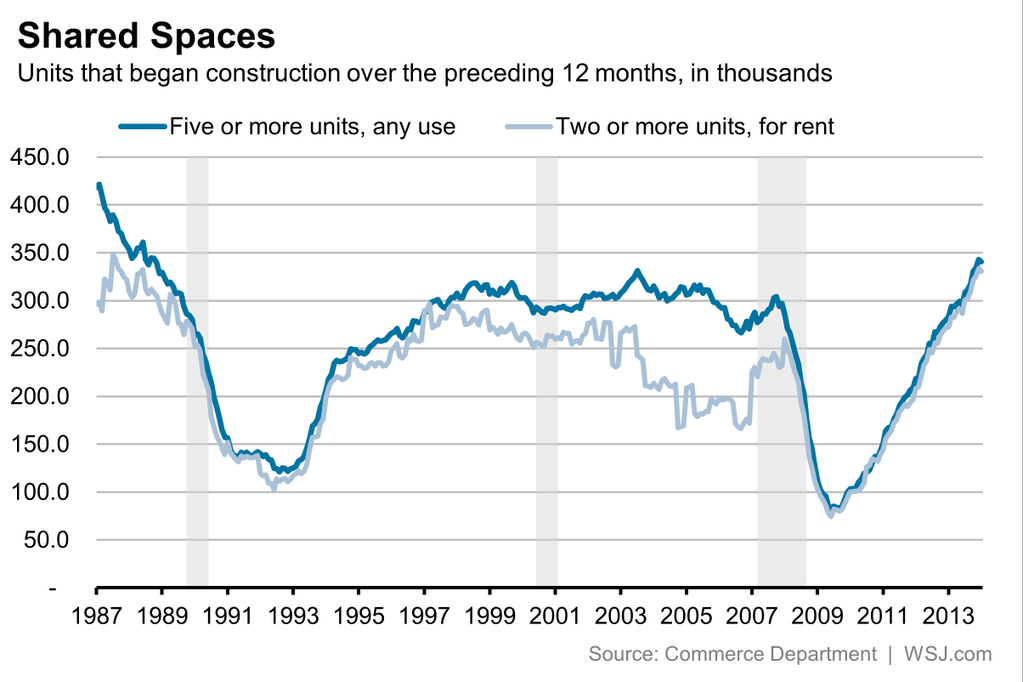

Since the Great Recession hit, many builders are realizing that the future for many Americans will be of renters. The flood of money and bailouts allowed big banks to shift properties from regular homeowners that over leveraged into the hands of investors and hedge funds. This has been going on for well over half a decade. At this point, the growth in rental demand is zooming up.

Builders are well aware of this and are focusing their energies on building multi-unit housing:

Rentals and condos. And condos can be easily converted back to rentals should the economy slow down. But this speaks to the fact that many young Americans are having a tougher time pursuing the big box home dream of the suburbs. Why? It is too expensive relative to their wages.

The education dilemma

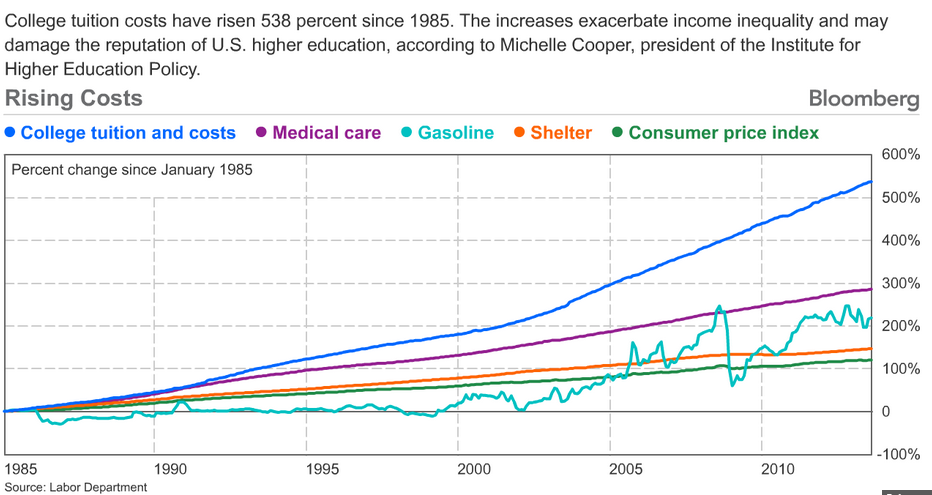

There is mega inflation going on in college tuition. Since 1985 college tuition costs have soared 538 percent. This rate has far surpassed all other large buy areas:

And for middle class jobs like those in engineering, computer science, accounting, and healthcare there is no choice but to go to college. Blue collar work doesn’t pay as well and there are fewer jobs here as well. The bulk of jobs added since the Great Recession have come in the form of lower paying jobs. Yet college tuition continues to go up. The market is still demanding technical skills but many for-profits target lower income households with paper mill like degrees and actually cause more harm than good. Many of these students would be better off pursuing a technical degree or certification at a low cost community college. Yet local community colleges are cash strapped and have pathetic marketing budgets while for-profits spend upwards of one-third of their revenue on aggressive marketing.

But even those going to reputable schools, there is no assurance of a good career or a good paying job once they graduate. The latest jobs report shows a mismatch between jobs being offered and skills in the market. Yet we continue to pump out expensive college graduates and debt continues to pile on.

Low wages

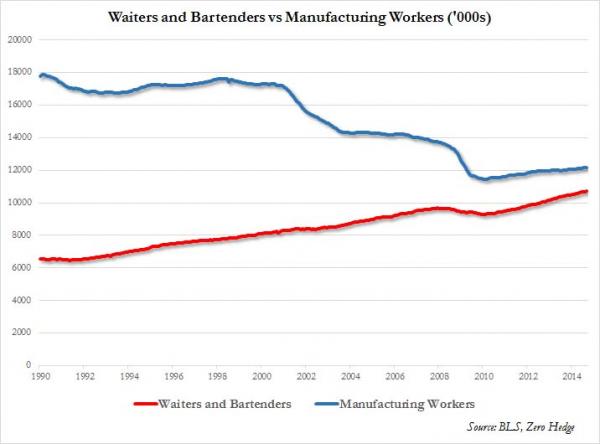

Low wage jobs continue to dominate the open job market. Benefits are being slashed and more of the burden on side benefits like healthcare or retirement planning are being pushed onto workers. For example, we are likely to have more waiters and bartenders than actual manufacturing workers in a short timeframe:

“This is not a good trend for most Americans given how many people occupy each of these fields. Back in 1990 which wasn’t exactly a booming time, we had 3 manufacturing workers for each 1 waiter or bartender. Today, we now have nearly a 1-to-1 ratio.â€

And this also highlights why so many Americans are basically winging it for retirement. Many young Americans are actually in a negative net worth column given big college debt.

The future of course is never completely bleak. There is a need for highly skilled workers. If you plan accordingly, you can leverage this to your advantage but it does appear that the massive labor intensive jobs are simply not there. The labor intensive jobs in the service industry pay very little to pursue the American Dream as we once knew it. Renting or living at home is the only option for millions. College will be a very expensive proposition. In the end, this is the new dream.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!6 Comments on this post

Trackbacks

-

Ame said:

I have to wonder if today’s college grads will start to exit the U.S. in search of a brighter tomorrow; just as students in Spain, etc.

It is a sad day when our children are educated here, yet take that talent to another country (possibly an adversarial country) in order to actually “have a life.”

We as a country have to ask ourselves whether we are interested in keeping a human resource at home that will have a huge impact upon the future. If so, it’s time to demand change. If banks can be “bailed out”, why can’t students with crushing debt?

December 10th, 2014 at 4:53 pm -

Seasoned_Citizen said:

Great article, PLUS, its title is very subtle.

Those poets of us immediately recognize Langston Hughes’ “Dream Deferred” poem, worth recalling these days:

What happens to a dream deferred?

Does it dry up

like a raisin in the sun?

Or fester like a sore—

And then run?

Does it stink like rotten meat?

Or crust and sugar over—

like a syrupy sweet?Maybe it just sags

like a heavy load.Or does it explode?

December 11th, 2014 at 2:45 am -

Dave said:

Over and over we see articles such as this listing out how bad the middle class has it vs the 1%ers. Yet there is little to offer as to how to reconcile this issue.

The only way to increase the strength of the middle class is to raise the top tax rates to 50% or more.

The 1%ers will ‘liquidate’ their gross value in order to lower their tax burden. One method is to pay the workers more, thereby raising their tax burden. In effect we all pay a little more.

This will help with our infrastructure deficts.

When I offer this suggestion, the response often is, very passionately, demanded of me is to name one country that successfully taxed its way to prosperity.

The answer?

The United States of America; 1945-1980December 11th, 2014 at 4:07 am -

jhpace1 said:

You can trace the problems with American housing straight to going off the gold standard in 1971. Homes had been mortgaged at 3 times a person’s annual salary for decades. It got down below 2 times annual salary in the early 1970s, and took off afterwards. Local, state, and Federal governments are too dependent upon property taxes (the only stationary target for taxation), and the banks make too much off of a mortgage, and Freddie and Fannie made too many governmental millionaires for the game to ever stop. It peaked in 2007 with people buying homes 8x their annual salary, and the Second Great Depression has realtors and banksters crying that housing just cannot drop again.

In a small, closed community housing would fall back to 2x, 3x levels, with renters making out like bandits for a year or two. But not when big institutional investors buy all the houses and rentals in town, keeping young new buyers from buying or renting at a discount. The bubble never gets popped then. Now we’re being told big money is leaving housing. Say hello to slum-lord type housing and dilapidated rentals as no maintenance happens for the next 20 years, because “it’s not worth it” to renter or owner.

So young people are faced with no jobs, horrendous debt levels, and housing that never fell since 2007 unless the entire neighborhood is worse off than Detroit or Chicago. Do you like being mugged once a week as the richest person on the block? Or everything not nailed down stolen from your front yard? Your children being harassed by the neighbor’s kids? Young people are saying “not yet” and staying with their parents. We’re going back to the Waltons age, multi-generational housing, which no government or realtor wants to hear.

December 11th, 2014 at 9:21 am -

pantsupdontloot said:

A deferred dream is not a dead dream. My dream was deferred because of Vietnam, my father’s because of WW2, but we both still lived our dreams. We just didn’t use the deferment as a crutch. Today’s generation was raised a lot higher on the hog than we were in the fifties and sixties, and a hellofalot higher than my dad’s generation in the 1930’s. So they had a great, over indulged, petted and pampered childhood, surely they can make a go of it as adults, can’t they? If they have to postpone marriage, kids, or even home ownership for awhile then that is not the end of their dream. If they have brains and are not stupid then they will use this time to accumulate wealth into their own pockets instead of smothering themselves in debt and really killing their dreams. They are in good shape if they will just take the cares they have been dealt and use them to their advantage. Dreamercide can only be invoked by the dreamer and no one else! Thanks and God blesss

December 11th, 2014 at 1:50 pm -

Snake Plisken said:

FTA: Design engineers we employ are earning 25 to 30 bucks an hour.

We just hired a Process Engineer with 3 years exp in our industry for 74K .

We’ll have an offer out to a Sr. Tooling engineer for 95K by early next week. This person has 25 years under his belt and a Journeyman’s card. If he accepts he’ll be earning close to what I do!

Best,

Snake Plisken

December 11th, 2014 at 8:57 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â