The Art of Strategic Mortgage Defaults: The Coming Wave of Foreclosures in California. 588,000 People Nationwide Stop Paying Their Mortgage Even Though they had Funds to Pay.

- 10 Comment

Throughout the current housing crisis, most of the negative economic data has been clumped into one large group. That is, housing has been a nationwide problem and job losses have impacted virtually every state. Yet there is a coming crisis that has its targets on very specific states. In fact, many states will not even feel the repercussions of this new economic problem. The issue is that of strategic defaults. Most Americans have not heard of this term but they will know this intimately like they learned about subprime loans or interest only loans.

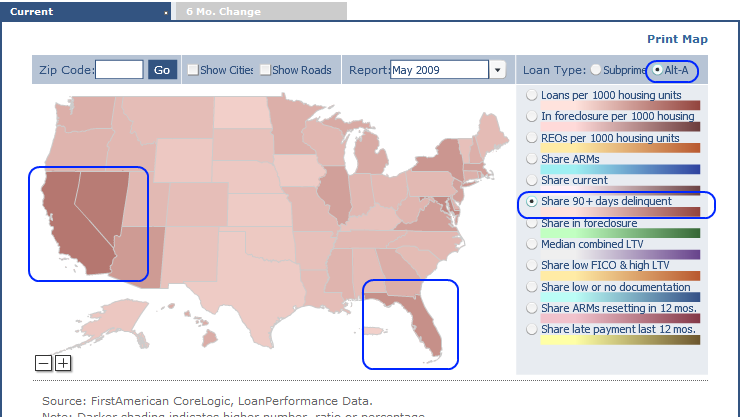

A strategic default occurs when a homeowner stops paying their mortgage even though they are still financially able to do so. A recent study shows why this problem will impact mega-housing bubble states like California more than other states. You will also find that many people that walkaway from these products have stellar credit scores. So why would someone strategically decide to leave their mortgage? The reasons are many but first let us look at the distribution of late Alt-A loans in the country:

Now why focus on Alt-A loans? Under this category of loans we will find most Interest Only and option ARM products. These are loans most at risk for a strategic default. In many cases for example option ARM loans were given to people with good credit but simply did not have the income to back up the purchase of a home. In these situations you would see a family with good credit and a household income of $100,000 taking on a $700,000 mortgage in California. With a teaser payment, the family could pull this off. But when the recast of the payment occurs the family will default especially given the crash in housing values in California.

Let us examine a few reasons why and how people strategically default. A recent study may surprise you. This study examined 24 million credit files and gives us a good view of the overall situation:

“The number of strategic defaults is far beyond most industry estimates — 588,000 nationwide during 2008, more than double the total in 2007. They represented 18% of all serious delinquencies that extended for more than 60 days in last year’s fourth quarter.”

This number is enormous and we can expect this number to rise. Why? Many of the interest only and option ARM products will start hitting recast dates in 2010 to 2012 that will severely impact borrower’s monthly payment. Many of these loans are far below the current loan modification program caps of being underwater at a ratio of 125 percent or higher. In some case, some of these loans have 150 to 200 percent LTV ratios. That is, someone might have a $600,000 mortgage on a home worth $300,000.

“Strategic defaulters often go straight from perfect payment histories to no mortgage payments at all. This is in stark contrast with most financially distressed borrowers, who try to keep paying on their mortgage even after they’ve fallen behind on other accounts.”

This is probably one of those shocking statistics. How can someone with a perfect credit history go from on time borrower to a strategic default? The answer is simple. For the average American their housing payment, either rent or mortgage, is the biggest line item on their budget. Increase that payment by 50, 60, or even 70 percent and you have a default waiting to happen. Housing makes up 34 percent of consumer expenditures:

In areas like California however, this category is much bigger. That is why this issue of strategic defaults is more concentrated to states like California and Florida that have the bulk of these Alt-A loans. 588,000 may sound high but it will only get higher in the next few years.

“Strategic defaults are heavily concentrated in negative-equity markets where home values zoomed during the boom and have cratered since 2006. In California last year, the number of strategic defaults was 68 times higher than it was in 2005. In Florida it was 46 times higher. In most other parts of the country, defaults were about nine times higher in 2008 than in 2005.”

It is rather clear how unequal this will impact the U.S. The strategic default seems to be an issue of housing bubble states. And you can put yourself in the shoes of someone who bought a home at the peak. Say you and your spouse bought a home in a bubble market for $500,000. Deep down, both of you felt that housing would never go down. This view was widespread. You saw for nearly 5 years homes appreciate by 10, 15, and 20 percent per year. At the very worst, you would be able to sell your home for $600,000 or $700,000 in a few years when your loan recast. Well your home is now worth $250,000. It may never regain that peak value. Your payment will jump from $1,500 to $3,000. You can rent a similar place for $1,300. What do you do? Many are simply electing to walkaway. In a state like California with 12.2 percent unemployment this decision might be made also by necessity. Sure, they can make the payment but how much of their budget is it eating up?

“Homeowners with large mortgage balances generally are more likely to pull the plug than those with lower balances. Similarly, people with credit ratings in the two highest categories measured by VantageScore — a joint scoring venture created by Experian and the two other national credit bureaus, Equifax and TransUnion — are far more likely to default strategically than people in lower score categories.”

Now this is simply more fuel to believe that those who strategically default will occur unequally in states like California and Florida. These states saw the biggest housing bubbles and also took on most of these exotic mortgages. If you don’t believe this? Just take a look at this article:

$30 billion home loan time bomb set for 2010

“(SF Chronicle) Thousands of Bay Area homes have a ticking time bomb embedded in their mortgage. The homes were purchased with loans known as option ARMs, short for adjustable rate mortgages.

Next year, many option ARM payments will begin to readjust, slamming borrowers with dramatically higher monthly mortgage bills. Analysts say that could unleash the next big wave of foreclosures – and home-loan data show that the risky loans were heavily used in the Bay Area.

From 2004 to 2008, “one in five people who took out a mortgage loan (for both purchases and refinancing) in the San Francisco metropolitan region (San Francisco, Alameda, Contra Costa, Marin and San Mateo counties) got an option ARM,” said Bob Visini, senior director of marketing in San Francisco at First American CoreLogic, a mortgage research firm. “That’s more than twice the national average.

“People think option ARMs (will be) a national crisis,” he said. “That’s not really true. It’s just in higher-cost areas like California where you see their prevalence.”

And here is an example of an area that depended on decent credit scores to dish out toxic mortgages like option ARMs. Now you might be asking why are so many loans gathered in certain areas? Well these areas had a collective bubble psychology where people had very little qualms taking out $500,000 or $600,000 mortgages:

“First American shows more than 54,000 option ARMs issued here with a value of about $30.9 billion. Fitch shows more than 47,000 option ARMs here with a value of about $28 billion. Both say their data underestimate the totals.

Why are so many option ARMs clustered here?

“In markets where home prices were going up rapidly, more and more borrowers needed a product like this to afford something,” said Alla Sirotic, senior director at Fitch Ratings. Option ARMs were designed for savvy real estate investors and people whose income fluctuates, such as those paid on commission. Instead, the loans became a tool for regular people to “stretch” to buy homes that were beyond their means.”

I tend to disagree that borrowers “needed” a special mortgage to afford housing. This is like saying people needed cows during tulip mania to buy tulips. These products were merely creations of the housing bubble. They only serve a purpose in a rapid rising housing market. They gave the biggest incentives to mortgage brokers and Wall Street. These loans are a mess. Take a look at an example that highlights all of the above:

“Joey Amacker of Newark, who works as an account manager for a catering company, refinanced his home with an option ARM for $624,000 so he could pull out money to build an addition. The friend who sold him the loan assured him that an option ARM was a safe and affordable product, he said.

Amacker said he initially made only the minimum monthly payment of $1,800, which covered part of his interest and none of the principal. The amount he owed grew to $660,000 by November 2008, according to loan documents…

Between the negative amortization and his missed payment and penalties, Amacker’s total debt has ballooned to $725,000, while the house is probably worth about $500,000, he said.

“I feel so ashamed of how I could have gotten myself in such a bad situation,” he said.

Like Amacker, most option ARM borrowers owe much more than their homes are worth, so they cannot refinance their way out of trouble.”

This is a perfect example of the environment for strategic defaults. The borrower took out a $624,000 mortgage that had a minimum payment of $1,800. The payment reflects a mortgage of $200,000 and not $624,000. However, with negative amortization the loan is now at $725,000 on a home that is probably worth $500,000. The payment will likely be higher than $4,000 once recast hits. Take a wild guess what will happen then?

Strategic defaults will be a major problem in 2010 but only for states in major bubbles. California and Florida need to gear up for this because it will be happening.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!10 Comments on this post

Trackbacks

-

john said:

very interesting article. how do you believe this will effect states like California and Florida?

September 22nd, 2009 at 11:56 pm -

Home Loans said:

Homeowners may not be aware of potential capital gains taxes according to what is called the mortgage over basis, which can count mortgage debt over cost basis as a gain, and might not be covered by an exemption.

October 29th, 2009 at 10:10 am -

Laura said:

How do you feel a strategic default will truly effect a homeowner’s ability to repurchase…..given the enormous amount of defaulters?

We are $200,000 upside down……..IndyMac (One West Bank) is a joke, and are just as shady as ever (as seen throughout web posts about their practices). Not sure what to do, how much of a hit on our taxes, credit, etc. On top of it all, our house has hit that mark when it’s time to recarpet, paint, etc. Many homeowners refinanced in 2005 to do remodeling projects, seeing the real estate gains. Those projects are now 5 years old and in need of possible updating again. So here we go…. a bunch of homes in need of updates, going into foreclosure, because owners would rather leave the house than flush another dime down the leaking toilets!January 27th, 2010 at 9:58 am -

charlie_magugi said:

hey if you are mad at bankers and the “fat cats”, this is the perfect way to shaft them back! The Govt cant do $hit to them, they need them. But we can. Walk away from your mortgage and rent. Let the banks and wall street sweat their quaterly reports and layoffs.

February 3rd, 2010 at 12:00 am -

Ted Akers said:

Very good article. It is unfortunate but is clearly an emerging trend as homeowners go further underwater. Option ARM recasts are starting to increase substantially, currently about $2B/mo., going to $4-5B/mo. in the next three months, and increasing steadily to around $12B by October 2012. It is not a pretty picture.

March 29th, 2010 at 9:48 am -

Alan Daniels said:

There is no excuse to walk away from a home if you can afford it! Short Sales and payment plans are great for those facing a distressed situation. I have been contacted by people who want to do a short sale or walk from there home just because they are angry at loss in equity. What ever happened to good old fashioned accountability? There is plenty of blame to throw around, but there is no excuse for default due to anger.

May 11th, 2010 at 7:31 am -

Steve said:

Great article and it has given us some incite as to where we stand in today’s market. What to do? I have a home that is worth 330k in the current Florida market, and a loan of 535k. It seems to me that its time to rethink this “Business” arrangement with the lender. Whit us paying the current PITI over the next 15 years I will still have negative equity even with a growth of 2@ (very optimistic) in our market. The kids are off to college soon and i think its time to wash my hands of this bad “Business” decision. Please tell me what you think and is there hope of not drowning before retirement.

May 12th, 2010 at 6:42 am -

Darrel said:

To Steve:

I think you should get on board. Join the flock. The sooner you do it, the better you will feel. Just save, rent for a while, and you will be able to purchase the same home for hundreds of thousands less.

May 21st, 2010 at 6:20 am -

Cara said:

We are seriously considering a strategic foreclosure and this is why… We purchased our home in FL in 2006 for $255,900. This price was what we could afford comfortably, less than 25% of our monthly income. We have two loans. We currenly still oew around $230,000 and our home is worth about $120,000. There are a lot of forclosures in our area and some of the home owners are renting to Section 8 tenants. My husaband and I are professionals and woul like to raise our 2 year old son to be one too. The other kids in our neighborhood swear and are not well behaved.

WE can easily afford another home in a different neighborhood where other professionals have relocated for $200,000-$300,000 in the same city in which we currently reside. We could by a house down the street from us for $100,000 (we almost have enough cash for that). Why shouldn’t we default? The mortgage company will not help us unless we do.

I think the best business decision for us is to “buy and bail”. Any ideas?July 26th, 2010 at 5:49 pm -

Sheryll said:

“There is no excuse to walk away from a home if you can afford it! Short Sales and payment plans are great for those facing a distressed situation. I have been contacted by people who want to do a short sale or walk from there home just because they are angry at loss in equity. What ever happened to good old fashioned accountability? There is plenty of blame to throw around, but there is no excuse for default due to anger.”

If you get into a 2-year contract with Verizon for $100 a month and 3 months in you find you can get the same deal with Spring for $50 a month, you break your contract. You take a $200 cancellation fee hit as a consequence of breaking your contract. In the long run, it makes good financial sense to do this. Why is a mortgage any different? You break a contract. You suffer a consequece. You are not breaking any laws. We are not walking away scot-free, there is a consequence. Our excellent credit ratings are going to SUCK big time… but why should we stay in a house for 20 years just to break even and prop up the banks, when we could make the best out of a bad situation, default, suffer with bad credit for 5-7 years and get on with our lives?

All this morality propaganda is just that – propaganda from the government and the banks. They don’t abide by “their” rules… why should the individual consumer?

January 12th, 2011 at 8:11 am