The Average Net Worth by Age: The massive financial chicanery brought on by housing equity figures and the new real estate bubble.

- 11 Comment

The best indicator of wealth is your net worth. Take you assets and subtract out your liabilities. It should come as no surprise to most Americans that half of this country is living paycheck to paycheck. One third of Americans have zero dollars for their net worth or in many cases for young Americans, have a negative net worth thanks to mountains of student loan debt. The latest data from the Census and Federal Reserve show skewed views on net worth figures. First, the recent housing bubble led by investor money buying single family homes isn’t really helping most Americans. In fact, the home ownership rate has fallen for about a decade now. Investors are thrilled as they leverage cheap funds to boost their own net worth but the main driver of net worth building, housing, is now being held by fewer Americans. The bull market with stocks has also pushed wealth figures up but it should be noted that only half of Americans actually own any stocks outright. Let us look at net worth figures by age ranges.

Net worth scorecard

For the typical American most of their net worth is locked in their property (if they own). This is why you might have someone having a paid off house worth $200,000 still struggling to put food on the table as a retiree. Most retirees rely on Social Security as their primary source of income. But what about owning your home free and clear? You still have taxes, insurance, and maintenance costs. The home is not throwing off any income. You simply don’t pay rent (one line item of expenses). But you still need enough cash flow to pay for all items associated with the home plus food, health care, and other costs of daily living.

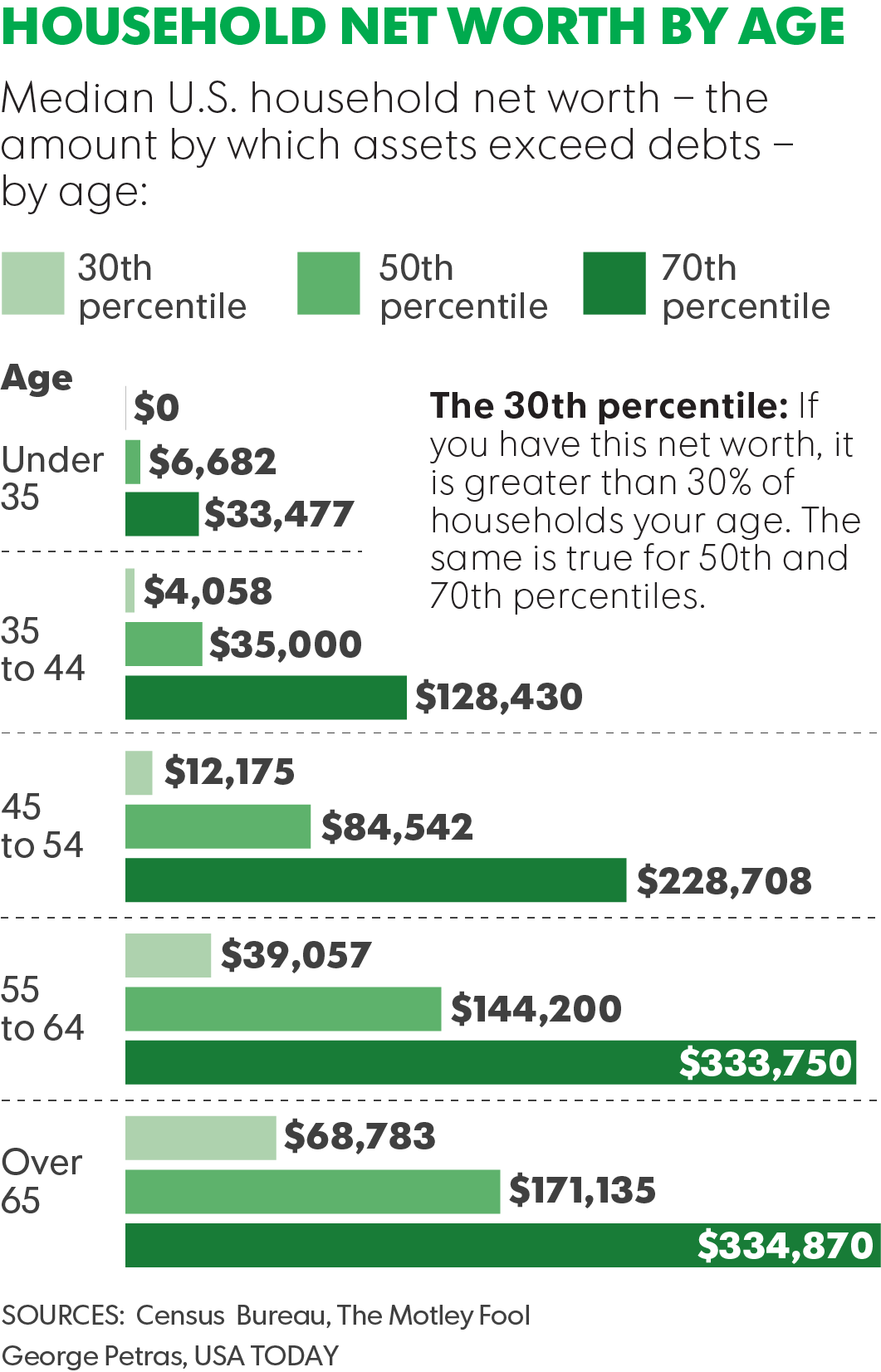

Take a look at net worth figures by age:

This is shocking when you think of the wealthiest nation in the world. For those 35 or younger the typical net worth amount is $6,682 (enough for two months of expenses in any large metro area). For those between 35 and 44 the mid-range is $35,000 (enough for a new car). Between 45 to 54 it jumps to $84,000 (enough for four years of college tuition for one kid). From 55 to 64 it jumps to $144,000 but this is largely due to housing (the same goes for the over 65 age range with the typical net worth figure jumping to $171,000)

The housing illusion of wealth in net worth figures is enormous. The housing industry uses this as the default answer as to why everyone should buy a home. But you can’t afford a $250,000 home on the typical $50,000 household income! I rarely see financial analysts making this connection. They usually talk about net worth figures as if this was easily accessible liquid funds. They are not sitting in your bank account ready for access. If it is locked up in housing equity, you will need to sell the place before unlocking the funds. This means finding another place to buy or rent.

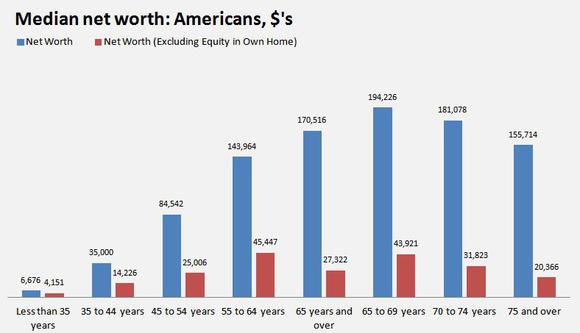

Here is some clearer data showing net worth figures with and without housing equity:

This is critical here and also shows why the Fed is trying to boost the housing market at all costs. Of course the unintended (or intended) consequence is that now more homes are owned by big investors boosting their bottom line and only accelerating the destruction of the middle class. Homes are more expensive to buy yet this is really the typical way most Americans build wealth. If you look at the chart above, you realize that without housing most Americans have very little liquid wealth. Even the 55 to 64 year old crowd only has $45,000 to their name once home equity is removed.

For those 35 and younger, the Millennial crowd is largely unable to buy without the help of rich parents as studies are finding. What the results show is that most Americans are one medical emergency away from being flat broke. And this is data as of now with a frothy stock market and a resurgent investor driven housing bubble. Just imagine what will be the case when the inevitable correction hits.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!11 Comments on this post

Trackbacks

-

Tom said:

I don’t feel upper-middleclass. If I became a labor-nonparticipant, I would exaust my retirement accounts and hit zero in just a few years. Even now I can’t afford dental care or a dependable car. As for college, my kids will be on their own.

However, I have learned not to worry about such things. My place in the vast universe is very small. I try not to overestimate my importance.

September 21st, 2015 at 2:07 pm -

Patrick said:

I’m in the 70% percentile for my age with a net worth of 70K. Funny it seems that I am in the upper portion for my age group, but I cannot afford health insurance, I don’t have dental and only a small life insurance. Fortunately I covered college costs early for my kids so that is paid for. But this makes me wonder, how on earth others in my age group are even surviving?

August 25th, 2016 at 11:04 am -

Patrick said:

I am 34 right now

August 25th, 2016 at 11:05 am -

Stefan said:

Looking at this I feel bummed out about the US. I have a net worth of over $600k ($200k without home equity) at age 32 but I certainly don’t feel rich. I drive a beat up 13 year old truck with no ac. My wife and I don’t feel financially secure enough to have children at this point. I’m not sure how other people in this country survive.

September 29th, 2016 at 2:40 pm -

John said:

Age 29, about 200k liquid Assets (debt free)

I feel poor living on the East coast.

-Cant afford health care

-Can hardly afford mortgage

-Very hard to maintain income needed to keep what I already acquired in life.

-Dont feel financially secure enough to start a family of my own(have siblings and parents that need help financially atm).At a point where I think I just want to give up and re-evaluate whats important in my life, If I stopped working tomorrow I would probably run out of money in less than 2 years because my family and siblings depend on me to some degree, because the costs of the household have become too large for parents to keep up alone.

There are just no high paying jobs, unless you are self-employed, and the stress of running your own business could kill most people.

I just wish there was somewhere I could stuff 50,000$ and earn 10% interest to relieve the pressure just a bit.

I really want to just sell everything and buy a farm, but this is where I have roots…

It really feels like the only way to give myself a safe future is to abandon all my roots, turn my back on any family that might need my help in the future and get out of the city.The money has just caught us off guard, it lost too much purchasing power too quickly and we didnt have time to react.

I consider myself fairly financially educated ( I dont squander money) dont drink dont do drugs.

But the cost of electricity, cell phones, general utilities + food have exploded over the past 5 years and the mortgage is out of control.

Taxes and Insurance costs have gotten to the point that its not even worth keeping the business going because ill still go broke in 5 years even if everything goes according to plan.

A good plan is a 5 year plan in my book.

When no matter what you do your 5 year plan ends with you starving to death, you know its tough.

Im not opting for the best plan that will give me long term stability… im opting for the plan that ends with me being poor the farthest out.Im actually hoping Trump wins so that something changes…. I dont know if he can fix anything and I am not counting on it, but he is the only ” variable ” in this equation that isnt fixed the so called you are going to go broke unless “X factor”

When Donald Trump is the ” X factor ” that determines if you survive or not…….. you know things are broken.-A concerned American who is very scared even though the rest of the country considers me successful lol

If I am successful, there must be millions of people starving to death on the streets of America that no one is reporting about…If I had one wish in this world, it would be for the mortgage to disappear so that I could feel like all these years of working have atleast amounted to something, if we lose the house, it would be complete devastation, I would never invest in America or hiring people again…. id move to a rural area and just give up on the so called ” American Dream “.

Real Estate taxes and Insurance have created a situation where you pay your mortgage and instead of it going down every month it goes up………… very discouraging, its like you are being punished for doing the right thing…….working, hiring, paying your own way…. no breaks, just punishment by banks and government and insurance companies.October 6th, 2016 at 11:11 pm -

Jack said:

I am 59 as is my wife. She retired last year. I never calculated my net worth until I read this. I am shocked. Our net worth is $1.2 million. Only $220k is real estate (our home). We have both worked hard all our adult lives and saved and invested as best we could. We both had management position for the last 20 years of our careers. I never ever considered us wealthy, just comfortable. I guess we are quite fortunate and blessed after looking at these statistics. We have zero debt. We kept refinancing our mortgage at a lower term in order to pay it off early. We pounded money into our 401k accounts consistently, even during the rough years when kids were in college. Told them they could do private schools if they got scholarships otherwise they had to go to a more affordable State college. Consequently we took on no debt for their education. They have the rest of their lives to work and pay it off, I always told them that Mom and Dad were going to retire and not carry their debt. Might sound mean but we paid our own way through school. I don’t ever imagine our kids aged 34, 32 and 28 will ever achieve the financial success we did. It’s a much different world than we we got out of college in 1979.

October 17th, 2016 at 8:27 am -

anonymous said:

I have done better than most. One path that I took to build wealth was the following. Hope it helps you guys out.

1. By a beat up condo next to a military base or college.

2. Live in it until it is paid off.

3. Buy a normal house.

4. Use the money from the condo rent to pay bills including mortgage.

5. Max your 401k to get the match.

6. Start roth ira with the rest.

7. If you still have money start buying index funds.

8. Keep doing this and you will be in good shape.November 12th, 2016 at 9:37 am -

A. Rinzel said:

I am a retired professional engineer who worked in property protection engineering for 37 years, now 73 years old. My wife and I did the same kind of work, she spending her last 7 years working for the same company that I did as an engineering assistant. We lived conservatively for decades, both having pensions and 401k accounts throughout our working years. We now live in a modern, comfortable home in the Midwest worth about $615,000, having moved recently, upsizing in the process to accommodate caring for a couple of handicapped individuals instead of spending time traveling and golfing. We have a net worth of about $3,200,000 and have no money worries. Our health is good. We were successful in building our futures financially because we always spent considerably less than we made, rarely replaced our cars, investing the rest in stocks and mutual funds instead of in cash or mostly bonds. We still have about 60 percent of our portfolio in equities, not intending to change that as there is no need to do so.

December 14th, 2016 at 8:31 am -

boris fekete said:

YEAH USA SUCKS, cult of spending for spending’s sake leads to these ridiculous results of net worth statistics, that make americans poor compared to even to “poorer” of eu countries… and imagine how it will look like when the bubble of us equities bursts…401k hahaha

January 9th, 2017 at 5:58 am -

Robert. said:

I’m going to be OK (age 60 currently), but it’s shocking to see how many others will not. It’s tragic. My opinion is that it only takes a very small handful of extraordinarily wealthy people to screw up the balance of net worth for everyone else. I wish I could think of a solution or offer some advice, but I can’t. I don’t know enough. What I do predict is that we’ll go back to having more family members living together under one roof, multi-generational.

January 23rd, 2017 at 5:00 pm -

Heather said:

Thank you for this! I always wondered how I was doing, and now, at 56 I know I will be okay. I’ve never lived beyond my means; bought a modest house – my only house – and now it’s paid for. Once you get old you don’t really WANT a huge house and the maintenance/insurance do you? I tallied up my net worth and minus the house it’s just under $400,000. I don’t have any debts. I don’t buy things I can’t pay for. I don’t plan to use the 401k until I’m in my 70’s so it has time to go down and up a few more times, and I’ll move to more secure funds when I get closer to needing it. I hope when I quit my job, I can help people learn to be financially responsible. I learned in the school of bad choices and hard knocks but I graduated from that school when I was 25 and never looked back! I didn’t pay for my kids college, I paid for my own. I think if more kids had to pay they wouldn’t squander their time. Just my opinion.

February 3rd, 2017 at 10:57 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â