The Federal Reserve and U.S. Treasury Determined to Sink the U.S. Dollar in 2009. Why Gold and U.S. Dollar went up in 2008.

- 7 Comment

2008 will go down in history as the worst global market for countless investments since the Great Depression. It was significant even with the late rally which occurred after the November bottom. What this signifies is that market volatility a sign of a very unhealthy marketplace will continue in 2009. Yet the more important point to consider is that the Federal Reserve headed by Ben Bernanke and the U.S. Treasury which will be under new leadership soon, have been showing no signs that they are interested in preserving the value of the U.S. Dollar (USD).

This isn’t simply a conjecture but is based on facts. When Ben Bernanke was quoted as throwing dollars from helicopters what he meant is he had no regard for maintaining the actual value of the USD. What he was discussing is battling the menace that is deflation. Bernanke is an expert regarding the Great Depression. I’m not sure that when he took the Federal Reserve chairman position did he realize he was actually going to have to face a situation which would put his theory into practice.

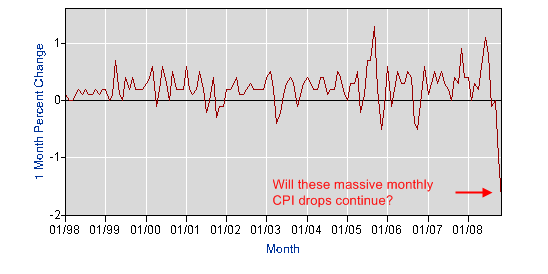

What we are facing is deflation and we have not seen prices drop this fast since the Great Depression:

That is why we are already dealing with the prospect that this recession will have deep impacts like nothing we have seen since World War II. The fact that consumer prices have been falling over the past 4 months is significant. This is not a one month event. We have seen incredible drops over this time:

August 2008:Â Â Â Â Â Â Â Â Â Â Â Â Â -0.1

September 2008:Â Â Â Â Â Â Â Â 0.0

October 2008:Â Â Â Â Â Â Â Â Â Â Â Â -1.0

November 2008:Â Â Â Â Â Â Â Â -1.7

The major question is will this continue. Most of the recent historical drops have to do with the bubble in oil bursting and automotive sales simply falling off a cliff:

*Source:Â Suddendebt.blogspot.com

The above chart in automotive sales is extremely telling. Sales have fallen off a cliff. What has occurred is we have spent our future today. That is, we have enough cars floating in the marketplace to satisfy years of demand. That is something that is being missed with the auto bailouts. One part is yes, American automakers have missed the boat in creating cars people want to buy. Yet the bigger problem is people simply have no money to buy any additional cars unless more unhealthy credit is extended. This is something that the U.S. Treasury and Federal Reserve would love to see happen.

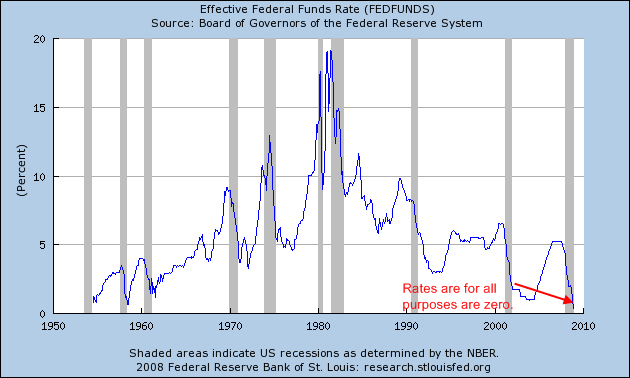

Every action they have taken comes at the cost of individual financial success. They are purposely making it useless to save money. At least, that is the psychological warfare they are trying to do. How so? First, you drive interest rates so low that it is almost pointless to save:

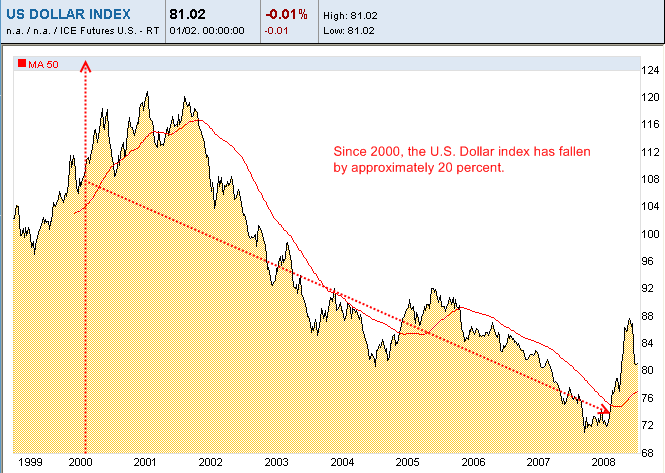

The Federal Reserve has kept interest rates at historical lows for this entire decade. Alan Greenspan was the first to take rates to historical lows and was only beaten by his predecessor in Ben Bernanke. This is problematic. One primary reasons the housing bubble took off for so many years was the fact that credit was flooded into the system. This of course came at the expense of the U.S. Dollar:

Since 2000 the USD has fallen by nearly 20 percent. That is significant in terms of a country’s currency. As you will also notice in the chart above, we had a bounce from recent lows that has increased the value of the USD by roughly 10 percent. Why the sudden jump? The fact that the USD was up in 2008 is by no means any help by the Federal Reserve or U.S. Treasury. The reason the USD rallied last year was the destruction of the decoupling myth. What it turned out was other countries around the world had equally bad or even worse balance sheets than the US. So a flock to safety occurred. In dire times the USD still holds that throne.

Even with negative rates on treasuries, people still felt the need to store their money in the USD. During this time Ben Bernanke manipulated the effective funds rate to go from 3.94 percent in January of 2008 to our recent zero percent. We have never seen it this low since the Great Depression.

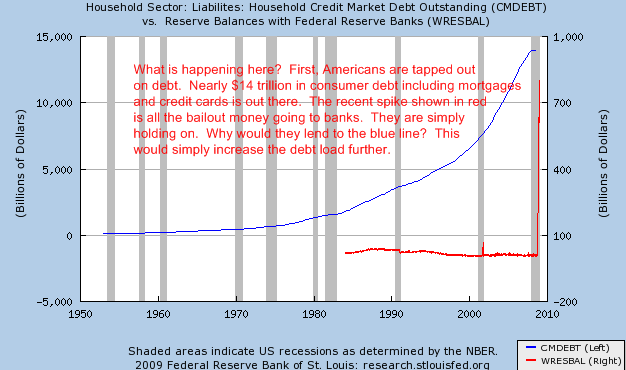

Keep in mind that it would be very simple for our government agencies to increase the value of the USD. All they would need to do is to raise rates to attract more capital in the system. Capital, not devaluing the currency. But that is the least of their worries. What they want is for people to spend more and more. That is why credit and debt is flooding the system:

This is an important chart. First, the U.S. consumer is tapped out. They are carrying roughly $14 trillion in debt with auto loans, student loans, mortgage debt, and credit card debt. The spike highlighted in red above is banks keeping additional funds in excess reserves. This is money that they can lend without putting their reserve limits at risk. Yet they are not. Why? Look at the blue line. If you were a bank, would you lend to a consumer market with nearly $14 trillion in debt? Of course not. Yet the Federal Reserve somehow thinks this is the solution to our problems. Give banks which were at the center of creating this mess access to more funds at the expense of taxpayers.

The Fed is already pushing the limits on its own books putting nearly $3 trillion of questionable assets on its books. This housing bubble has its roots in 1979 and only took off starting a decade ago.

From every early indication we are getting, the Fed is determined to keep this gig going. What this means, is hard assets like gold will probably have another positive year. By the way, gold was another winner in 2008 even after tanking. The reason for gold is more basic. Where else will people store their money. In zero percent treasuries? Globally? Under the mattress? It seems like gold will be one of the few last spots. The Fed and U.S. Treasury seem to indicate further policies that will slam the dollar. Yet here is another problem. Other global central banks are doing the same thing which almost negates our own actions. The race to zero interest rate policy has started.

The U.S. Treasury and Fed which have a responsibility in protecting a stable dollar are set to destroy it.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!7 Comments on this post

Trackbacks

-

Shalom Patrick Hamou said:

Quantitative Easing Won’t Work

In a Liquidity Trap although Saving (S) is abnormally high investment (I) is next to 0.

Hence, the Keynesian paradigm I = S is not verified.

The purpose of Quantitative Easing being to lower the yield on long-term savings it doesn’t create $1 of investment.

It does diminish the yield on long-term US Treasury debt but lowers marginally, if at all, the asked yield on savings.

This and other issues are explored in my tract:

A Specific Application of Employment, Interest and Money

Plea for a New World Economic OrderAbstract:

This tract makes a critical analysis of credit based, free market economy, Capitalism, and proves that its dysfunctions are the result of the existence of credit.

It shows that income / wealth disparity, cause and consequence of credit and of the level of long-term interest-rates, is the first order hidden variable, possibly the only one, of economic development.

It solves most of the puzzles of macro economy: among which Business Cycles, Stagflation, Greenspan Conundrum, Deflation and Keynes’ Liquidity Trap…

It shows that no fiscal or monetary policy, including the barbaric Quantitative Easing will get us out of depression.

A Credit Free, Free Market Economy will correct all of those dysfunctions.

The alternative would be, on the long run, to wait for the physical destruction (through war or rust) of most of our productive assets. It will be at a cost none of us can afford to pay.

A Specific Application of Employment, Interest and Money

http://www.17-76.net/interest.htmlJanuary 2nd, 2009 at 11:41 am -

Mark Herpel said:

It is sinking but could take years to bottom out, or it could be next year. Simply put the best way to protect your saving may be digital gold currency. This is allocated gold stored for you in secure bullion vaults. You own the actual gold not some paper promise and the account value moves daily with your holdings. Unlike gold coins kept in the home, digital gold can be bought or sold 24/7 it’s always liquid.

MarkJanuary 2nd, 2009 at 3:08 pm -

Justin said:

We are not seeing “true” deflation. We are seeing asset deflation (imaginary paper values diminish) along with a vast increase in the money supply (the bailouts are causing the printing press bearings to smoke). The value of stocks and houses on paper is imaginary. There values can not be truly realized until those assets are sold. Look at the imaginary paper value of all the stocks in a market. Their current priced value can not be realized because in order to redeem that value they must be sold. As stocks are sold, their values drop. Think about it. With asset deflation consumers feel poor and are weary of purchasing wants. This does not help, and can lead to, a recession. Fearing hard times, consumer’s begin saving their cash, demand and prices drop. Again, this does not a recession. The slowing of the velocity of money appears to be deflation but it is not… the money supply is not shrinking, however cashflow is slowing… it has similar effects. In order to combat and discourage the holding of U.S. dollars Helicopter Ben is running the presses into the ground. Printing money increases the supply of money (the definition of inflation). As soon as enough people realize what’s happening (their cash is becoming worth less [worthless]), they will start spending it as fast as they can. This could very well be the beginning of the end of the U.S. dollar as we enter hyper inflation.

Inflation IS NOT the increase in prices of goods and services and deflation IS NOT the decrease in prices of goods and services! The CHANGES IN PRICES ARE SYMPTOMS OF EITHER CONDITION BUT NOT THE CONDITION ITSELF! Inflation is an increase in the money supply (inflating money supply, NOT inflating prices) and deflation is a decrease in the money supply (deflating money supply, NOT deflating prices)… A headache is not an illness, it is a symptom of an illness or malady. Additional investigation is required to determine the cause of a headache.

AS much as I hate taxes, I think the only way that the Government will be able to kill off hyper inflation, should it set in, is to tax the extra money out of existence. The government will need to destroy money collected through extremely high taxes by paying off debts and the FED. Unfortunately, once money is in the hands of politicians they like to spend it instead.

January 3rd, 2009 at 6:55 am -

Lobsang Tengyie said:

The Fed & Treasury are going to shot-term bury the value of the dollar. There is no doubt of that. Why? Because the US is faced with it’s worst economic crisis since the great depression and rather than face soup lines and mass unemployment, the Obama Administration will choose to print money and TEMPORARILY kill the value of the dollar at the cost of double-digit inflation down the road in the not-so-distant future. The cost may be the toppling of the dollar as the world’s reserve currency. The EU would love the Euro to ascend to that throne. As that prospect becomes more likely in 2009 one of the final props will be kicked out in the valuing of the dollar. Freefall is the certain result with the dollar devaluating 30-40% within 24-36 months. If the US Dollar manages to hang on as the majority (more than any other) reserve currency, with the 2 trillion dollar increase in the US money supply, the value of the dollar may ONLY devalue 20-30%, in the SHORT TERM. In the long term, the US economy will recover as it learns to compete with the rest of the world on a more level playing field.

January 6th, 2009 at 12:10 pm -

Steve C said:

The money supply isn’t expanding, it’s collapsing.

Few will agree with that, because M0, M1, M2 are all moving upwards. But none of these include newer debt instruments.

Debt is traded and transferred like other forms of money. Over 60 TRILLION dollars of credit default swaps (CDS) alone existed at their peak. The value of this form of money is plummetting, and this represents a rapid collapse of the effective money supply that is an order of magnitude greater in the downward direction than the upwards movement of M2 and other measures.

The Federal Reserve is expanding the more traditional measures of money supply to compensate for the collapse of the total real money supply. The seemingly-reckless expansion of M2 is a result of attempting to compensate for the far-larger collapse of the real money supply.

Thus, the “asset deflation” is really no different from price deflation and reflects the contraction of the money supply. Welcome to 1929, relived.

What the Federal Reserve is doing (quantitative easing) is absolutely correct, but probably still too small to achieve the needed effect.

The fiscal stimulus of big federal budget deficits is also perfectly appropriate, but probably too small to achieve the needed effect.

Steve

March 2nd, 2009 at 5:22 pm -

Hugh McKenna said:

I have been trying to research with specificity and key words in google what the value of the dollar is. Can someone please tell me what the dollar is actually worth today; or tell me where to go to get the figure myself. I would deeply appreciate it. Realistically, I think it’s about a nickel if you don’t believe what the FED says. You can write me at my e-mail written1hm@gmail.com. Thanks Hugh

March 8th, 2009 at 10:29 am -

Ron Everson said:

In 1913 when the Fed Act was was put in place of the current system, the Constitution Article 1 section 9 stated that only Congress can coin money and regulate the value there of! With the Fed handiling the currency, first they have to back their currency with something, the Fed does not! THe fed pays the US treasury between $19.00 to $21.00 per sheet of 32 bills, denomination a non factor in the price! The Fed then bonds this cash with the US Treasury at face value, plus interest! Now the Fed makes anywhere from $11.00 to $3,179.00 plus interest! The Fed also brought their enforcement group the IRS and this is why they can charge a interest because they use our taxes to back the debt! This is the simplest of explantions!

The Fed is a private company that has been issuing credit to the US as money when real money is the Gold deposits at Fort Knox! A Fedreal Reserve Note is an instrument of debt!

May 23rd, 2009 at 1:45 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!