The hidden gigantic risk of derivatives – Top 77 U.S. banks have their hand in $225 trillion in derivatives. The top 5 banks hold $7.8 trillion of all banking assets growing their asset base by $1.7 trillion from 2007.

- 1 Comment

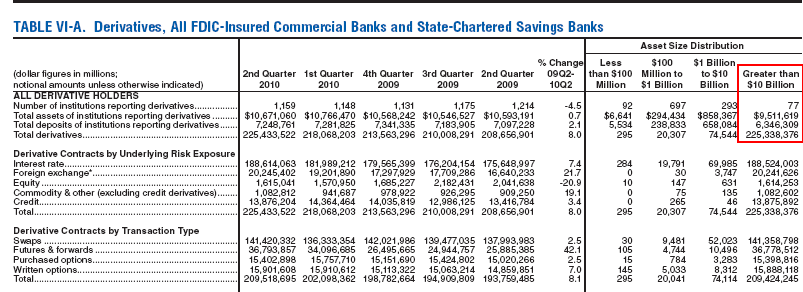

The concentration of banking risk in the United States is immense. The Federal Reserve and U.S. Treasury like to convey a pretense that we have a very diverse banking system with over 7,800 banking institutions. In the mind of most of the public, this seems like a very diverse industry. Imagine having 7,800 different kinds of hamburger businesses. One failure would not systematically breakdown the system. If Burger King went away our economy would still survive. Yet in the U.S. five banks hold $7.8 trillion of all banking assets. Total banking assets amount to $13 trillion so these five banks manage every 6 dollars out of 10 in our banking system. Even more amazing, 77 banks have their hands in $225 trillion in derivatives. That is correct, $225 trillion or 16 times the total amount of annual GDP for the United States.

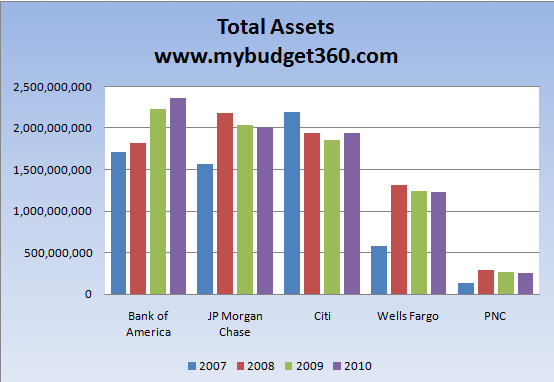

There is little doubt that in 2007 when the banking industry went into cardiac arrest, that too big to fail was a primary reason for the systemic risk. Yet since that tipping point, these too big to fail banks have gotten even bigger:

Source:Â 10-K

You can see the path rather clearly here. The current asset holdings of these banks are $7.8 trillion. At the end of 2007 these five banks had $6.1 trillion. So if too big to fail was a big issue how is it that in the last three years these banks have added $1.7 trillion to their balance sheets? Does this not mean that should another crisis hit (it will) that we will be subject to an even deeper and more profound crisis? If you remember the bailout of AIG, with a nice 100 cents on the dollar going to Goldman Sachs, the failure wasn’t brought on by subprime loans but by derivatives (bets) placed on the subprime loans. The casino was fully open and this is what really crushed the market.

Derivatives aren’t even mentioned in the mainstream press. Here is a good brief definition of what they are:

“(Huff Po) What’s A Derivative?

In basic terms a derivative is a bet tied to the movement of anything that can be valued. We could have a derivative bet which says the price of a mortgage-backed security (MBS), Hungarian currency or lemonade indexes will go up or down by a certain date.

Notice, however, that derivatives are not like stocks or bonds.

First, there’s no limit to the size of the derivative marketplace because none of the bettors actually have to own the underlying asset.

Second, there’s huge leverage because not much cash is needed to enter into a derivative agreement.

Third, if you bet on a derivative you typically make an off-setting bet to limit risk.

Fourth, your bet assumes that a specific counter-party can pay if you win.

$605 Trillion

According to the Bank for International Settlements (BIS), the notational value of derivatives at the end of June 2009 was $605 trillion.â€

The key points here involve the fact that investors don’t even have to own the underlying asset to gamble. That is how AIG got away insuring subprime MBS while allowing hedge funds and private investors to make wild bets that the market would implode (how did that add any value or jobs for that matter?). When it came time to pay, there was no way AIG was going to be able to honor their promises and that is where you, the taxpayer stepped in. It wasn’t necessarily the subprime mortgage that was an issue, after all you don’t pay, next the borrower loses the home, and the bank takes it over and takes the loss. A basic process when the system operates with a fiduciary responsibility instead of being a wild casino. It was the trillions of dollars at play in the opaque derivatives market that cause a lot of the counter-party mess. There are still $605 trillion in notational derivatives globally but $225 trillion are locked up in 77 of the biggest U.S. banks:

Source:Â FDIC

So do the math here. The FDIC has an insolvent Deposit Insurance Fund (DIF) backing up $13 trillion in actual physical assets and another $225 trillion in esoteric derivatives that we really have no idea about. They don’t trade openly on an exchange and have really no oversight. In other words, gear up for another financial explosion in the near future. Banks will argue leverage or notional value and that this isn’t such a big deal (yet we did bail them out because of this in many cases). Here is a good definition and example from Investopedia:

“What Does Notional Value Mean?

The total value of a leveraged position’s assets. This term is commonly used in the options, futures and currency markets because a very small amount of invested money can control a large position (and have a large consequence for the trader).

Investopedia explains Notional Value

For example, one S&P 500 Index futures contract obligates the buyer to 250 units of the S&P 500 Index. If the index is trading at $1,000, then the single futures contract is similar to investing $250,000 (250 x $1,000). Therefore, $250,000 is the notional value underlying the futures contract.”

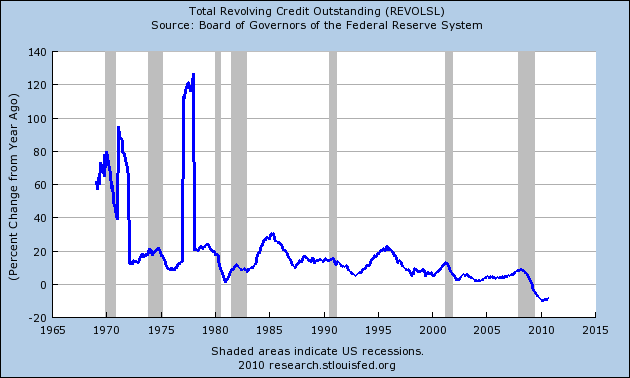

This is gambling and speculation and derivatives are tools of maximum leverage. Now you’ll hear people argue that each bet is offset by another with derivatives. True, but are we going to take the word of the financial sector again? Plus, the banking industry loves derivatives because of the leverage they allow. That is where the money is made. After all, 1 percent of $1 million isn’t much but 1 percent from $1 trillion and then you’re talking real money. Too bad you won’t see it and this is what the banking industry has become in the U.S. While banks make record profits again the middle class is seeing their credit shut off:

The amount of revolving credit to the public has now been contracting for well over a year. Nothing has changed in the banking industry so there is little reason to believe that we won’t see some major crisis hitting us again sometime soon. Only problem now is we have 17.1 percent unemployment and underemployment.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Bart said:

Great article. It was the derivatives market that caused the 2008 liquidity crisis -nobody knew who had was on the losing end of a lot of contracts and so the banks stopped lending to each other.

November 3rd, 2010 at 10:42 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!