The persistent and sticky unemployment of the American worker – To get back to 5 percent unemployment we would need to add 285,000 jobs per month for 5 consecutive years.

- 3 Comment

The biggest problem facing many working and middle class families is the structural changes in our employment base. By this point in any “recovery†the private sector would be adding a tremendous amount of jobs. Yet there really is very little recovery for the typical American. The stock market is performing “well†for the moment but it is back to levels from a decade ago. Without a job however, there is little consolation that stock values are soaring on thin trading by a few large banks. Without a recovery in jobs there really is no economic recovery. Of course much of the media has a hard time even understanding how tough times are for most Americans. To put this into perspective, we would need to add 285,000 jobs per month for 5 consecutive years just to get to a healthy unemployment rate of 5 percent. The last time the private sector added that many jobs in one month was back in March of 2006 at the height of the housing bubble.

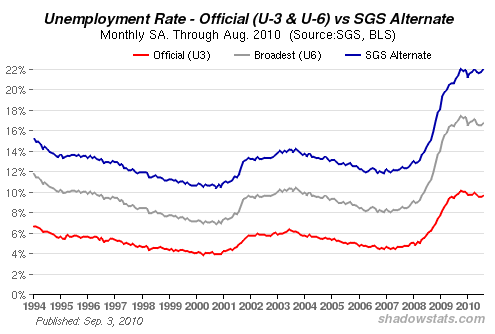

Let us look at the persistently high unemployment rate:

One of the more discouraging one-liners on the media is when people say, “well with a 9.7 percent unemployment rate that means that 90.3 percent are employed.â€Â First, this doesn’t account for those working part-time jobs wanting full-time employment. If we include this dataset the unemployment rate leaps up over 16 percent. Keep in mind that if someone is working 10 hours a week at Wal-Mart and lost their construction job this person doesn’t show up in the headline number. Next, 4 out of 10 Americans work in the low paying service sector. That is why even after accounting for these nuances in unemployment, we have many “fully employed†that are making barely enough to get by. The colloquial term that I have seen for this is the working poor.

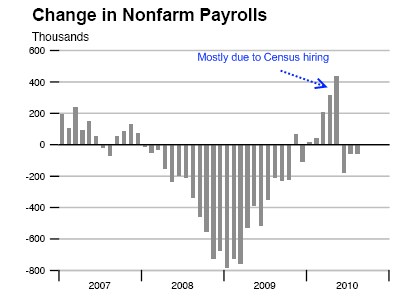

You might have seen this chart as good news:

The recent move up has virtually everything to do with government hiring (i.e., Census workers). Now that we have removed that, you can see that job growth is weak. In past recessions residential building usually was the match that ignited the recovery. But the problem this time is we have built way too much housing and have an enormous amount of vacant units. On top of that, you have close to 300,000 foreclosure filings per month still being filed adding a new pipeline for future inventory. The housing bubble was built over a decade and will have employment repercussions for years to come.

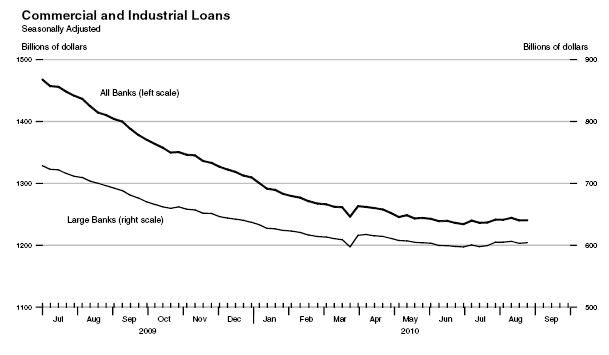

If we were really having a recovery, you would expect commercial loans to expand simply to meet new demand out in the market. Yet commercial real estate is in its own bubble and lending for this sector has moved only in one way:

Now don’t you think if this were a true recovery that more commercial loans would be hitting the market? Of course but the employment sector is in shambles. Consumer demand without a paycheck will take a hit. We know that the top 1 percent don’t spend as much as say the middle class in proportion to their income. Without solidifying our employment base, we should expect to see more strains on consumption which is a big part of our economy.

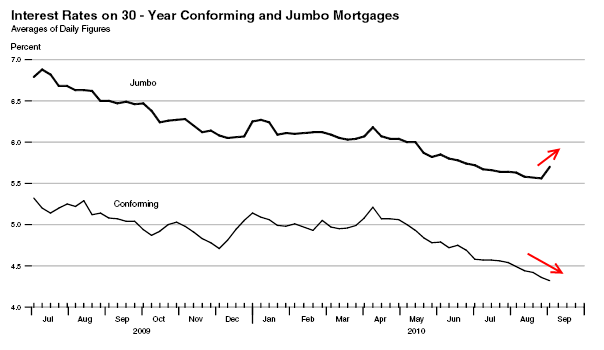

Mortgage rates are at all time lows yet housing has contracted severely:

These are historical lows for 30 year fixed mortgages. Yet housing isn’t really responding. Why? The housing bubble at the core, was always a problem about employment. That is why the only way home prices soared up was through a once in a lifetime debt bubble. The recipe was perfect since many loans were so easy to get that the stagnant wages were never a problem. They were just ignored. But even now with very loose lending standards people are having a tough time qualifying without tax credits because their incomes are either low or unstable.

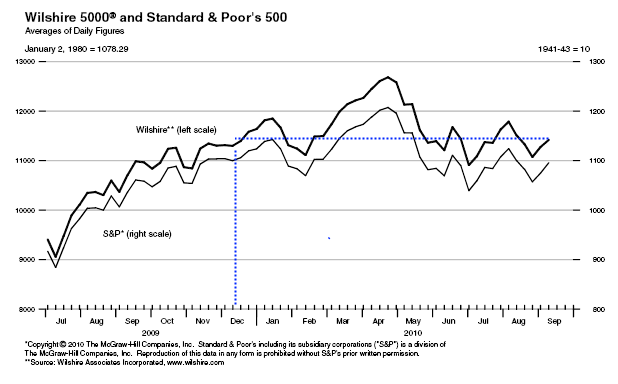

Even the recovery in the stock market is stalling out:

Stock values are back to levels seen in December of last year. If we expand the chart out, we are back to levels seen a decade ago. You would have done just as well by keeping your money in a CD or a savings account than putting it into the stock market. The stalling out should be obvious when you think that many of the companies listed on the exchange sell to consumers. If consumers are tightening their belts then demand will also falter. It is a troubling feedback loop.

Some jobs are not coming back. And older workers are facing similar issues to younger workers:

“(LA Times) Laid off in June 2008 from her $45,000-a-year post, Veasley-Fields at first wasn’t overly concerned. A college graduate, she had always enjoyed steady employment, including a long stint as a research manager at consulting firm McKinsey & Co. She crafted a crisp resume, networked through job clubs and navigated online employment sites like the seasoned researcher that she is.

But weeks stretched into months, with hundreds of unanswered job applications. California’s jobless rate in July stood at 12.3%, the third-highest in the nation, behind Nevada and Michigan. Veasley-Fields’ unemployment benefits have run out, her credit cards are maxed. She fears losing the tidy mid-Wilshire District bungalow where she and her 77-year-old husband are raising two granddaughters. Above all, she’s stunned that a middle-class life that took decades to build could unravel so quickly. She recently visited a food bank to secure enough staples to feed the girls.â€

In big metro areas we are accustomed to the coldness of not knowing our neighbors. We only find out how tough things are when we see the impersonal statistics. And the issues in the employment base have been going on for years now:

“LOUISVILLE, Ky. (AP) — A General Electric spokeswoman described the response as overwhelming as about 2,500 people picked up applications Wednesday for about 200 jobs in Louisville.

The company will continue taking applications through Thursday for the positions at Appliance Park.

The new hires will replace GE workers who are retiring.â€

The above article was from 2008. The recent data shows that for every one job opening six people are applying for it. I’ll be comfortable in calling this a recovery when we start adding 285,000 per month consistently. I just don’t see that but I hope I am wrong here.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Don said:

The real reason why jobs aren’t coming back is because these jobs are now being sent around the globe. This could have never happened 50 years ago. You aren’t only competing against others here, but you are also competing against people in Mumbai, China, VietNam, etc etc. Then throw in computerization and the inernet – less need for bank tellers, car salesmen, ad salesmen and you have a new business model that doesn’t run on labor.

donovan

editior

spiritnewsdaily.comSeptember 14th, 2010 at 5:23 pm -

phil said:

“The recent data shows that for every one job opening six people are applying for it”

I have two anecdotal examples of friends trying to hire for their companies and getting very few applicants. One was for a sales job which didn’t even specify compensation but with commission could have yielded six figures. A handful of people called and they were woefully unqualified. Where are the lines of people? Another was for a web designer that again yielded 1 or 2 resumes. Don’t we still have a glut of people with those skills from the first bubble bursting?

My fear is the extended unemployment benefits are causing people to either not look for jobs or not take job offerings seriously. Why should they when they have 2 years of benefits!

September 15th, 2010 at 10:14 am -

JeremiadJones said:

I calculate the cost of adding 3.5 million jobs per year, including administrative costs, at about $100 billion/year. Chicken feed, n’est-ce pas? Of course, it won’t happen. We’d have to give up a war or two to fund it.

September 18th, 2010 at 10:55 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!