The shadow bailout of the commercial real estate industry – bailing out the Ritz, failed million dollar unit condo projects, and buying empty shopping malls. Why the Fed wants to destroy the US dollar and continue the failed bailouts of the banking sector.

- 3 Comment

It is amazing that so little information about commercial real estate has made it onto the mainstream media. Few in the public realize that commercial real estate (CRE) has actually fallen harder than residential real estate yet 99.9 percent of all media coverage has been strictly on residential real estate. The CRE market is enormous with over $3 trillion in CRE loans still outstanding and festering on the balance sheet of banks. At one point, CRE values reached over $6 trillion in the US with $3 trillion in loans. Today, CRE values are down to roughly $3.3 trillion yet the loan amount still hovers at $3 trillion. This is the disastrous end game of being underwater in real estate. While people fill the stores this holiday season consuming money they don’t have (after all nothing says thank you America like buying imported goods) property values are still in the dark levels of the trough. The banking sector is doing a complicated shadow bailout through quantitative easing, ignoring missed payments, rolling over CRE loans, and ultimately trying to sucker taxpayers into paying the entire bill. Ultimately this shadow bailout has been going on for years and no one seems to even care.

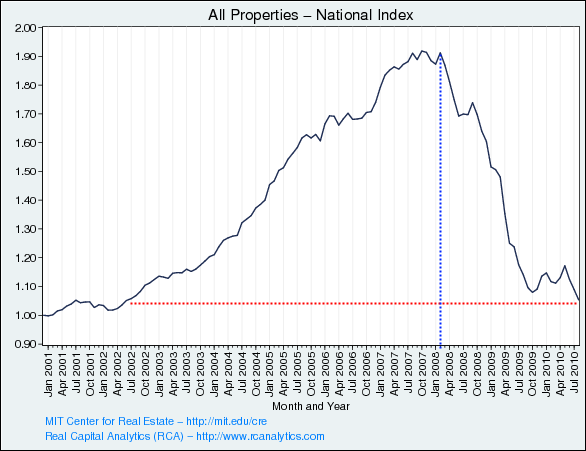

Contrary to what banks are publicly stating CRE values have collapsed:

Source:Â MIT

CRE values are down over 47 percent since their peak in 2008. The above index combines all CRE projects including industrial and commercial properties. Those strip malls that people are flying into during the holiday seasons are all backed by large amounts of debt. Banks are hoping that store owners have a strong enough holiday season to justify stronger rents into 2011. But how are you going to raise rents when retail stores can only charge a certain amount to a country that has seen stagnant wages for over a decade? Foot traffic is high because consumers simply have the habit of going out and consuming. But are they consuming in the same quantities as they did in 2005 or 2006? That is highly unlikely yet many of the CREW loans are valued at peak levels. As we have discussed, credit card companies have pulled back furiously in terms of credit lines offered to Americans. This was the life blood of the spending bonanza of the last decade.

You know what country had a giant amount of commercial real estate?

“(NY Times) In addition, Ireland’s European creditors reckon, if they can just hold on for a few years, perhaps there will be a recovery in asset values. But real estate prices rose dramatically in Ireland over the last decade – quadrupling by some measures. And fiscal contraction – either higher taxes or lower government spending or both, as negotiated with the I.M.F. and E.U. – is unlikely to help the residential real estate market (so far most of the damage has been in commercial real estate.)

It is true that Irish mortgages are “recourse†— that is, you can’t just turn in the keys and walk away from a property as you can in many parts of the United States. On the other hand, Irish residents can leave the country – moving to Britain or the United States is a well-established tradition for many families. And how can an Irish lender enforce debts when someone has emigrated?â€

The math behind the CRE deals was poorly construed and didn’t bet on cash flow scenarios but hoped on continued appreciation. There is no way that some of these strip malls in the US will ever justify current prices. Unlike residential real estate, there is no “emotional value†in buying a CRE property. It is purely financial. You either make money or you don’t. Banks right now are bleeding money in CRE deals but they keep pretending all is well and with the aid of the Federal Reserve they hope to destroy the US dollar enough so that in the end, the loans will inflate away. Is this the end game? Are we going to be happy to see a $10 loaf of bread and $5 gasoline just so banks can keep strip mall and failed condo project loans on their books?

And if you think it is only small time properties going under, try looking at this:

“(WSJ) The developers of the Ritz-Carlton Highlands hotel at Lake Tahoe apparently have leaned a little too far over their skis. Bank of America Corp., the lead lender in the hotel’s $157 million mortgage, has filed a default notice against the property.

Developer and owner East West Partners, based in Avon, Colo., is “talking daily†with its lenders to resolve the situation, East West senior partner Blake Riva said. At issue: $10 million of the loan has matured without being paid, and the lenders want East West to pitch in another $8 million of capital.

Otherwise, East West and Ritz-Carlton, a unit of Marriott International Inc., say the hotel is doing well. Like many mountain-resort businesses, the Ritz is temporarily closed and slated to reopen by mid-May, after the “mud season†passes and vacationers return to the area on the California-Nevada border.â€

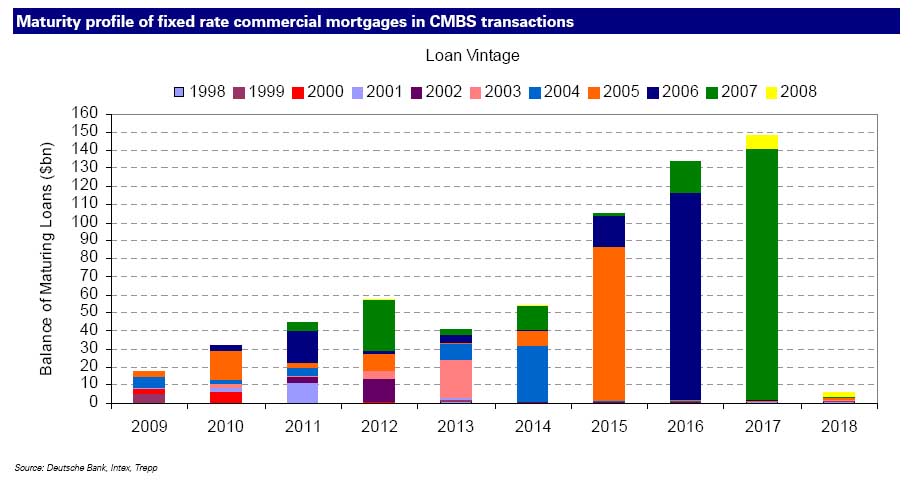

Yes, the Ritz is a “poor†property that we need to bailout. No wonder why the Fed has conspired with banks to create this enormous shadow bailout of the CRE market. If we look at the mortgage backed securities of CRE debt we can see that the problems are still building up in the pipeline:

Source:Â Zero Hedge

Ultimately the shadow bailout of the CRE industry is occurring because there is zero political will to bailout places like failed condo projects in Las Vegas where units sell for $1 million, or the Ritz Carlton, or buying up vacant shopping malls. The banking sector is still largely insolvent but as long as they can pretend that CRE values are inflated and the Fed gets busy destroying the dollar (i.e., QE1, QE2, QE?), they may ultimately succeed. Yet their idea of success is likely hurtful to working and middle class Americans. After all, it isn’t like the system has reformed in the last four years since the Great Recession hit so why should we expect anything different?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

cossack55 said:

Please bail them all out.

I am willing to sacrifice my property, liberty and life to ensure the bankers receive their proper and rightful bonuses.

Does this stance make me a “good American”?

November 27th, 2010 at 5:19 am -

kennyg said:

We are a dead country walking…..enjoy the present…..to our children these will be known as the good old day……WHY ARE WE SITTING AROUIND TAKING THIS CRAP.

November 29th, 2010 at 7:59 am -

Susan Miller said:

why? Why are we letting this happen. How do we stop this in it’s tracks? A revolution??? I doubt that now a days. Please somebody tell me why we are only realizing all of this now, when it is almost too late? Is this what they meant by “Dec 2012 will be the end of the world as we know it? How do we, as tax paying citizens get together and fight. Even if Ron Paul who has already talked about most of this , runs for presidency, will this “shadow” whatever, have him murdered before he can do anything about it? I am very worried about a Govt who was founded to help the people of our great country, the federal Govt was supposed to remain small and to just keep an eye on the smaller state Govts. Please read people, read and listen and don’t call it conspiracy theories like they want us to think it is. The last president who tried to make the public aware of this fiasco federal reserve printing money and what was really going on was shot in the head …. who really shot President John F. Kennedy? Dig in, learn, find people who are realizing whats happening to…know who you are voting for before you ever vote but please try to do everything you can before this whole “new world order takes hold. Do you remember who talked of New World Order in the 1940’s? Hitler, that’s who. Im 54 years old and don’t expect to be around but you people in your 30’s and down do something now before it really is too late.

December 1st, 2010 at 5:05 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!