The stock market correction has arrived: Massive global volatility, central bank wizardry, geo-political instability, and people finally realizing how overvalued the market has become.

- 0 Comments

The stock market is finally reflecting the true nature of the global economy. There is massive geo-political instability, central bank double-speak, and a growing trend of low wage labor. In the US, it is no surprise that subprime auto debt has grown at an outstanding pace simply because people are too broke to finance a car via traditional means. The S&P 500 has essentially given back any gains of 2014 within a couple of weeks. Volatility is now apparent as market participants realize that the free world cannot be controlled by plutocrat central bankers and their banking wizards. The market has turned into a deep capture casino where politicians serve as mouthpieces to placate the public and keep the wheels turning so people can remain calm when many real issues are obviously present. This isn’t merely a US issue. Worldwide countries are taking a piece out of the easy money playbook and the ramifications are being felt. There is no free banking lunch. The stock market correction is now here.

The stock market is hitting the correction button

First, much of the selling is being done by big funds triggered by technical trading. Over 80 percent of stock wealth is held in the hands of the top 10 percent. The public is simply a spectator to the stock market. So this correction is happening at higher levels. The public doesn’t need some Wall Street financier telling them that the middle class is shrinking. They are living this on a daily basis.

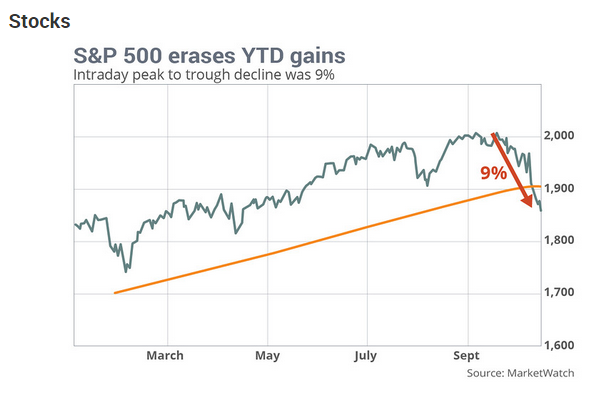

The S&P 500 is overvalued. We knew this. So it is no surprise that the S&P 500 has given up the gains of 2014 within a couple of weeks:

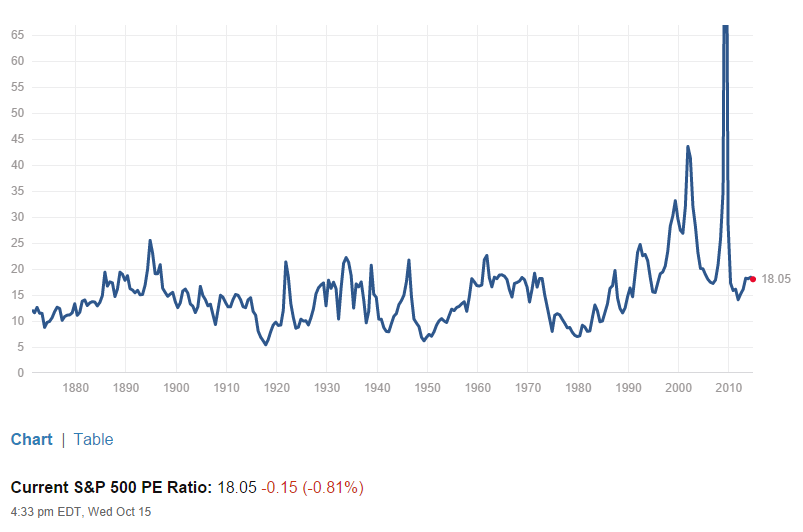

Even at current ratios the S&P 500 is overvalued by at least 16 percent relative to historical levels:

Is this correction real? Absolutely. The market is simply reflecting the geo-political risks that are hitting on multiple fronts. Many S&P 500 companies now do business abroad so it is not useful when some countries are reverting back to closed door policies or are facing dramatic social upheaval. Europe for example is now largely in recession, again.

The EU is the biggest trading bloc in the world so when you have this massive conglomeration of countries all reversing gains, you have to wonder what is going on. In reality, many of the countries never fully recovered from the Great Recession and are simply pricing in this risk into their stock values.

The US has been on a near manic upward trajectory since 2009 when central bank policy went with the “too big to fail†mantra and basically protected Wall Street. The end result is low wage jobs for the bulk of the country, inflated values in debt driven products, and a deep capture of government by Wall Street.

So the stock market is simply reflecting what is occurring in reality. The market has become too euphoric in a relatively short period of time simply on this blind faith that the Fed has some kind of god-like ability to push prices higher. This works to a certain degree until you create debt driven inflation in multiple assets.

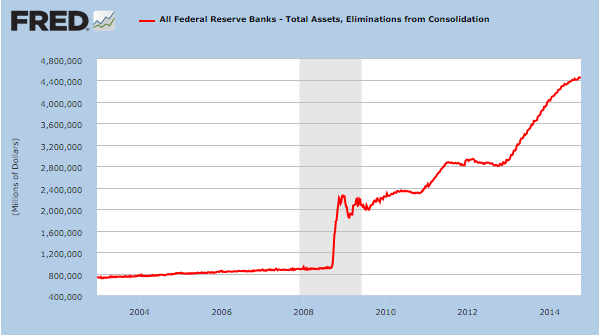

The Fed has shown no sign of pulling back in terms of their aggressive “save the banks†campaign:

The Fed’s balance sheet is well over $4.4 trillion. There is no signs of unwinding and it is no surprise we are following in the footsteps of Japan with their Quantitative Easing mis-adventures. They have created an army of part-time workers, a disenfranchised youth, and an aging population that now consumes more diapers than babies do. Does this sound familiar? In some ways, we are seeing this with a large number of people dropping out of the labor force and seeing the wages being earned by younger Americans.

The stock market correction was bound to happen. You can’t have a 200+ percent bull run since 2009 and not expect a correction, especially when a large portion of this was driven by hot money.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â