The Struggling Class – The emergence of consistent poverty. How the other half live financially. 40 million Americans on food assistance and large unbanked population. Family Dollar up over 80 percent through the recession.

- 7 Comment

It is disturbing to see many articles published in foreign newspapers and magazines highlighting the plight of the middle class in America. You would think that our own media would want to cover this issue which should be at the top of the list for everyone. Instead, our mainstream media systematically attempts to keep everyone financially in the dark and shell shocked into spending money (assuming they still have disposable income). They do this by pumping out inane show after inane show to keep people numb to the deeper problems of the day. The middle class is giving way to a new struggling class. This is a class that is defined by a constant struggle merely to chase the middle class carrot on the stick while the large banking sector becomes ever more powerful and the resource pie shrinks. The recovery never even appeared for millions of Americans.

It is troubling to see articles talking about the erosion of the middle class especially when they come from overseas:

“(Spiegel Online) Ventura is a small city on the Pacific coast, about an hour’s drive north of Los Angeles. Luxury homes with a view of the ocean dot the hillsides, and the beaches are popular with surfers. Ventura is storybook California. “It’s a well-off place,” says Captain William Finley. “But about 20 percent of the city is what we call at risk of homelessness.” Finley heads the local branch of the Salvation Army.

Last summer Ventura launched a pilot program, managed by Finley, that allows people to sleep in their cars within city limits. This is normally illegal, both in Ventura and in the rest of the country, where local officials and residents are worried about seeing run-down vans full of Mexican migrant workers parked on residential streets.

But sometime at the beginning of last year, people in Ventura realized that the cars parked in front of their driveways at night weren’t old wrecks, but well-tended station wagons and hatchbacks. And the people sleeping in them weren’t fruit pickers or the homeless, but their former neighbors.â€

Keep in mind this is for a relatively expensive Southern California county. I think many people in foreign nations are used to seeing areas like California through the eyes of reality television shows like “Laguna Beach†or “The Hills†but that only paints a caricature of a region. The fact of the matter is, many people are falling off the middle class treadmill right onto the poverty floor. There is very little safety net in the America of today at least if you are part of the middle class. If you are a big bank, you can fail in grandiose fashion and have billions of dollars funneled your way. This painful transition doesn’t happen seamlessly:

“Finley also noticed a change. Suddenly twice as many people were taking advantage of his social service organization’s free meals program, and some were even driving up in BMWs — apparently reluctant to give up the expensive cars that reminded them of better times.

Finley calls them “the new poor.” “That is a different category of people that I think we’re seeing,” he says. “They are people who never in their wildest imaginations thought they would be homeless.” They’re people who had enough money — a lot of money, in some cases — until recently.â€

Now I know most of you have little sympathy for someone holding onto a BMW while they are going for free meals at the Salvation Army. That is understood. But there are many more millions that never over extended and thought they were doing the right thing financially but were launched off the road from this painful recession. There is an emerging struggling class in this country and their numbers are looming large.

Food assistance

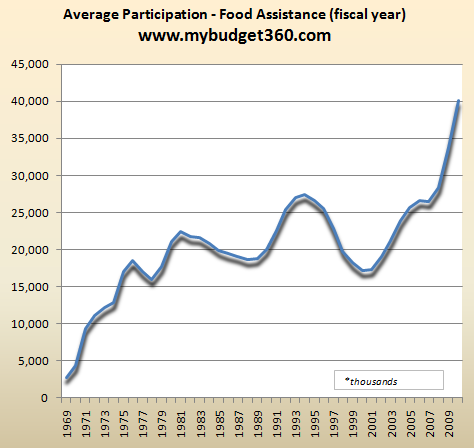

In every recession those seeking food assistance grows with the times. Yet this recession has pushed more people off the edge since the Great Depression:

Source:Â SNAP

Over 40 million Americans are now receiving food assistance. This is the highest rate ever recorded. We can’t compare this to the Great Depression because there was no safety net back then. Where did these new millions come from? Many came from the shrinking middle class. It is easy to see how financially things can unmask so quickly. You lose a job then you lose your home. A few months are bought before being evicted with the millions of foreclosures in the pipeline. But eventually, you are chasing a ticking clock. We have spent too much time focusing on the needs of Wall Street and banks and so little on the working and middle class. Don’t expect the media to show you charts like the one above.

The U.S. is spending $5 billion a month on food assistance. This money is spent quickly into the economy and that is why you see dollar stores doing well in this recession:

Just drive by any dollar store and you’ll see a wide range of people shopping there. There is a reason why Family Dollar is up over 80 percent since the recession started.

Unbanked

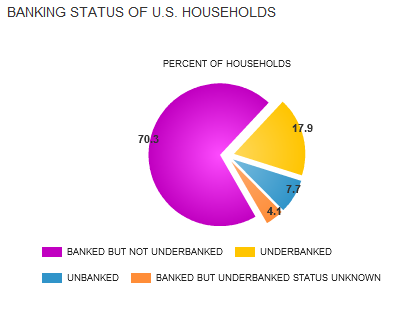

Source:Â FDIC

Nearly 30 percent of Americans are either unbanked, underbanked, or simply are off the financial grid. These people are simply struggling to keep their financial lives in order. The banking bailouts haven’t even come close to touching this group here. If you were to talk to that above person living in their car, their most pressing issue is getting a job. To them, this verbiage of quantitative easing and protecting big banks is merely a shell game to protect the rich. People have a strong sense of the financial injustice that is currently happening.

Retraining but for what?

In past recessions, many go back to school to retrain for new jobs. By the time most were done with their new training, the job market was usually rebounding or their new skills were in demand. That was an old world:

“(New York Times) For six weeks, Mr. Valle, 49, absorbed instruction in spreadsheets and word processing. He tinkered with his résumé. But the interviews his caseworker eventually arranged were for low-wage jobs, and they were mobbed by desperate applicants. More than a year later, Mr. Valle remains among the record 6.8 million Americans who have been officially jobless for six months or longer. He recently applied for welfare benefits.

“Training was fruitless,†he said. “I’m not seeing the benefits. Training for what? No one’s hiring.â€

Hundreds of thousands of Americans have enrolled in federally financed training programs in recent years, only to remain out of work. That has intensified skepticism about training as a cure for unemployment.â€

This job market is absolutely weak. Banks are turning out billions of dollars in profits thanks to taxpayer money. At the moment, this is a zero sum game. Banks have eaten 90 percent of the pie and have left 10 percent of it for the entire nation to fight over. This is why it feels like people are struggling for the scraps. While that is happening, the Federal Reserve has gone out of its way to secretly to purchase billions in bad commercial real estate deals from banks but they have tried to keep this under wraps.

The long-term unemployed chart is not pretty:

We really need to shift our entire focus on jobs and figuring out where we want to take our economy moving forward. Things are broken at the moment and it is largely the fault of the financial sector with government advocating for its bailouts. The new struggling class is merely a reflection of the broken system.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!7 Comments on this post

Trackbacks

-

Cobalt said:

Enough with the sugar coating we the people can handle the truth, unfortunately this does not seem to be the case. It is a power/money grab, we are the expendables and Jesus wept! This is a time of self examination and when it is all stripped away we find out what truly is important, God, family and the basics. We as a nation are so truly blessed and do not give it a second thought, our nation was highly blessed because we were founded on Christian principals, I believe the great I AM is giving us a big time out and if we as a nation do not repent and change our ways we will all slowly slip in to the abyss. So drop to your knees and pray, if you do not believe in god, he believes in you so quit being part of the problem and be part of the solution. Amen

August 28th, 2010 at 4:18 am -

bob said:

Thanks for this revealing expose’ on the reality facing millions in the USA and soon all over Europe as well.

August 28th, 2010 at 8:35 am -

Karel Koning said:

Hello;

I’m from the Netherlands (Europe) and I don’t understand why is it that the (American) media do not show -as you mention- charts like the one above about ‘Average-Participation-Food Assistence’…??

Isn’t it time to see the reality as it is…??

August 29th, 2010 at 5:08 am -

Greenman said:

It is a shame that things move so fast that except for the young and very fortunate there is a tall wall to climb to get to the top of the ladder of success.

It is available however like 30 years ago for the first time in decades it has become harder to achieve.

America has climbed wall of debt to look over the other side and learn that borrowed wealth has dragged society down to the point of waiting for liquidity to be affordable.

You see it is available but no longer affordable as i think of the days i paid 81/2 percent for a mortgage and was glad to get it. Today the rates are under 4% and even with only a few years gone by from when many were making double and triple of what they make today did anyone save a nickel for a rainy day? No they took bankruptcy as a choice.

I saved 5% of my income for decades very difficult when the money earned was so much less than today. I read people are saving what are you fooling me 11/2 or 2% that isn’t saving not when inflation is 3%.

Remember in 1974 what inflation was?

Well America better start and keep spending with earned money cash and not credit; otherwise we will be behind the 8 ball for a long time like near forever.

Better a slow recovery that has a foundation than one built on credit borrowed at 14 to 20 percent.

Sorry if you can’t buy that new cell phone every 2 years but who ever replaced their phones every 2 years in the past. I know everyone that made terrific money wants the gravy train back however those 50 to 80 dollar jobs won’t exist as we are have ourselves out of jobs by spoiled greed for decades. I don’t think they will post this because my fellow Americans don’t to read that they don’t want to sacrifice one bit.

They don’t even want to be responsible for their own

future. I feel for the folks I know in the mid-west that worked for a reasonable wage & now have found that the unaffordable luxury priced vehicles

they depended on making for a living can;t be afforded by normal Americans at their current costs.

Not when we keep factory pay wages unaffordable by the average American wage earner; that wants to buy the product. We have to loose weight America in many ways.

Bless America & guide us through this to sensible salvation.August 30th, 2010 at 3:48 am -

Greenman said:

We must teach our children values from hard work to not drinking and driving.

August 30th, 2010 at 3:50 am -

M. Scholl said:

Karel Koning:

The reason why the American media has not published charts and other realities regarding our financial meltdown is because a President and Congress they want to protect occupies positions of power.

Just wait until a Republican President and a conservative-leaning Congress are in power; you will see these charts and articles appear and increase.

September 25th, 2010 at 3:25 pm -

R. Peice said:

Really!!!!, it was the Republican President and Corporate Loving Congress(encouraging companies to ship jobs overseas, to appease their stockholders) that got us into this mess…..

February 4th, 2011 at 3:58 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!