The Weakest Bang for our Wilting Dollar – How we Overpaid for the Bailouts and were left with a Wilting Economy Propped up by Government Spending. Paying $446,000 Per Loan Modification and $43,000 for Homes that were already going to be Purchased.

- 0 Comments

So much horrible policy has occurred since the economy entered recession that the majority of Americans are shell shocked with each day of news. It used to be that a billion dollars in toxic assets was enough to garner some movement out of the market. Now, we talk about trillion dollar deficits as if they were normal. Take for example the ridiculous home buyer tax credit. Let us set aside for a second that massive home buying and speculation led us into this financial crisis in the first place. The home buyer tax credit was basically a gift to people for doing something they were already going to do. Keep in mind that even without the tax credit, people were going to buy homes. But this is what we are left with:

“(Las Vegas Sun) It’s awful policy,†says Andrew Jakabovics, associate director for housing and economics at the liberal Center for American Progress. “It’s incredibly expensive. It’s not well targeted.â€

…

“We paid $8,000 to at least 1.5 million people to do something they were going to do anyway,†Jakabovics says.

…

“A heck of a lot of people would have bought the house anyway,†says Ted Gayer, an economist at the Brookings Institution.

…

The tax break, due to expire at the end of November, is on track to cost $15 billion, twice what Congress had planned. In other words, it will cost $43,000 for every new homebuyer who would not have bought a house without the tax break.â€

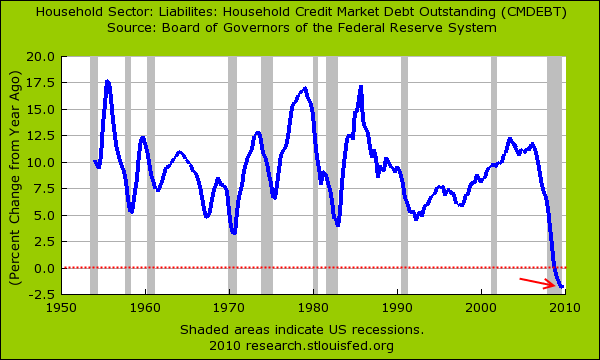

This is policy gone bad like milk left out on a hot sunny day. In many parts of the country $43,000 will buy someone a home or a condo.  Instead, we will blow through $15 billion to encourage people to buy something they were already going to buy. This is the kind of policy that we have had for decades. But the game is hitting a massive wall. For the first time in record keeping history household debt has contracted on a year over year basis:

Much of this comes from American households pulling back on spending but also, banks refusing to lend. In fact, the bailouts have done nothing that they were promised to do. First, the banking bailout was quoted as a necessity to keep liquidity in the system. To the contrary, liquidity is being pulled out of the system. Wall Street and their corporate public relations machines would like to convince you that banks are now having to be tighter with their lending given market conditions. It is amazing how in midsentence banks are able to shape-shift their position to always maximize their own profits but only after they have secured taxpayer money. If we really wanted to increase liquidity why don’t we just send each family $10,000 to get the economy going? Is this any less preposterous than paying $43,000 for someone to buy a home they were already going to buy?

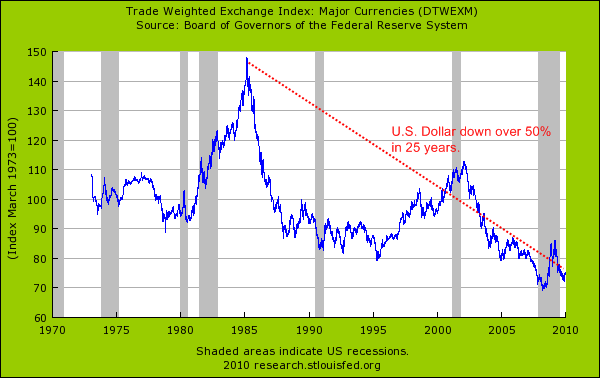

If you think that spending more and more and financing each purchase with debt is good for the long-term health of our economy, just look at the following:

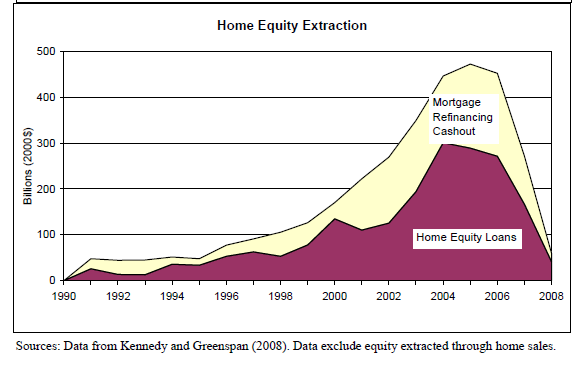

Over the last 25 years the U.S. dollar has been cut in half and U.S. households are feeling the effects of this. We would have felt this earlier in 2000 if it weren’t for the massive housing bubble that was ignited by the Federal Reserve and its spawn investment banks. All of a sudden, instead of spending money we had and protecting home equity houses became ATMs:

Source:Â Center for Retirement Research, Boston College

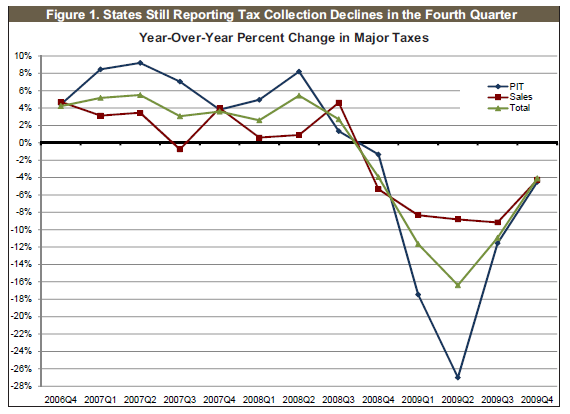

So even though incomes were stagnant for the decade, the average person on the street thought they were experiencing prosperity but all they were enjoying was a lease on a lifestyle that was no longer supported by underlying fundamentals. Most Americans are now dealing with this as they see credit card access shut down and access to home equity is gone since home prices have collapsed. Yet the only sector that seems to be back on its feet is the banking sector. Or to clarify, the too big to fail banking sector seems to be fine. Underemployment is still over 17 percent, credit is still pulling back, and states are still seeing faltering revenues:

Source:Â The Nelson A. Rockefeller Institute of Government

Tax collections are a good indicator of the economy since they are derived from working people. Looking at the stock market is like looking at someone who just hit blackjack 10 times in a row. At a certain point it needs to reflect reality. Yet the way we structured the bailouts was as absurd as the three page memo former Treasury Sectary Hank Paulson handed to Congress requesting $700 billion to clean up the toxic assets. That price tag now sounds cheap! And guess what? The toxic assets are still here which is only more proof that banks are two-faced liars that will siphon off every penny from the productive sector of the economy. As it turned out the $700 billion figure was simply pulled out of thin air by dividing ten percent of GDP ($1.4 trillion) in half according to the former interim Assistant Treasury Secretary Neel Kashkari:

“(WaPo) In Washington, he used his BlackBerry to determine the bailout sum presented to Congress. His arithmetic: “We have $11 trillion residential mortgages, $3 trillion commercial mortgages. Total $14 trillion. Five percent of that is $700 billion. A nice round number.”

Looking back, he says, he is more confident about the two-by-sixes.

“Seven hundred billion was a number out of the air,” Kashkari recalls, wheeling toward the hex nuts and the bolts. “It was a political calculus. I said, ‘We don’t know how much is enough. We need as much as we can get [from Congress]. What about a trillion?’ ‘No way,’ Hank shook his head. I said, ‘Okay, what about 700 billion?’ We didn’t know if it would work. We had to project confidence, hold up the world. We couldn’t admit how scared we were, or how uncertain.”

So what a shocker that GDP increased by over 5 percent when all was said and done.  It would have been a surprise if it hadn’t. Yet where did the money go? The vast majority into the stock market casino. Was there any massive targeted effort for job creation? Or what about reforming the financial industry that led us here? None of that was accomplished. So today, we have spent or committed $13 trillion on the financial sector with no strings attached. It is the biggest bank robbery in history and it is happening under our noses. In fact, people are pulling $700 billion out of thin air apparently just like Goldman Sachs needed every penny from AIG.

Most are familiar with the GDP equation:

GDP = private consumption + gross investment + government spending + (exports − imports)

Right now the biggest factor boosting GDP is government spending. Yet as we have seen with the home buyer tax credit, other programs have been a waste as well. Take the HAMP program as well backed by $75 billion. So far, only 168,000 permanent loan modifications have occurred. So run those numbers:

$75 billion / 168,000 = $446,428 per modification

Now of course, the program still has money left for additional modifications and other gifts to the banks like aiding in short sales. But do that math. With $75 billion we could have bought 750,000 homes for $100,000 each. Policy is so bad right now, we’d be better off just giving the money directly to the people to do whatever they wanted. Ironically this would stimulate the economy more than continuing down a road of expensive policy that is merely a method of transferring wealth to the banking elite.

The weaker dollar is a symptom of a bigger problem. The inefficient bailouts are a symptom of a bigger problem. Our government being controlled by Wall Street is merely the ultimate conclusion of four decades of egregious mismanagement and corporate welfare. If the government won’t do what is obviously right to reform the system then average Americans are left to wonder who is going to reign in Wall Street?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!