Tracking the Great Recession: Global Industrial Output and World Stock Markets Following the Great Depression.

- 4 Comment

How the investing world quickly forgets. If we go back into the distant future of March 2009, you would remember that on a panic filled day, the S&P 500 flirted with the 666 low. Since that day, the S&P 500 has rallied an astonishing 41 percent in only a 3-month period. Yet as astonishing as this is, the stock market is still down 40 percent from the peak reached in October of 2007. We are now 2 years into this economic downturn yet the sentiment for many investors has shifted from apocalyptic to outright giddy. Somehow 26,000,000 unemployed and underemployed Americans does not conjure up visions of a healthy economy.

If we are to carefully look at actual indicators of commerce and fix our gaze away from the banks, we realize that we are nowhere out of the woods just yet. Take a look at world industrial output:

*Source: Voxeu

Now this chart in itself should put a damper on any notion that we are fully in recovery. Let us forget about the underemployment measure now being at 16.4 percent and growing. If we think back to early 2008 part of the idea that this economic recession would not be so deep stemmed from the idea of decoupling. That is, the world would keep chugging along while the U.S. and other industrialized powers drifted into a recession silo. This of course has been utterly off base. This is a global recession:

Many have never witnessed a 40 percent rise in overall stock markets that occurred over a few weeks. We have now achieved that accolade. Yet this is not a sign of a healthy market. Massive volatility like this especially rapid jumps are signs of a market unsure of itself. The fact that global stock markets are actually deeper in the red than during the Great Depression tells us that we are still very much in a precarious state. The bet is that we will have a second half recovery. This is the second half.

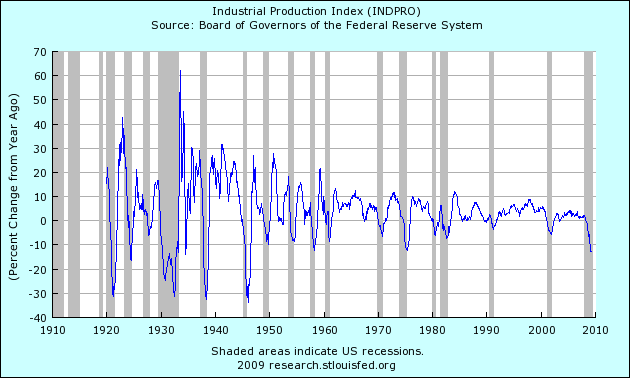

Recent data has pointed to things getting worse more slowly but that is not reason enough to celebrate. There are deep and structural problems in the system. Let us look at industrial production at home:

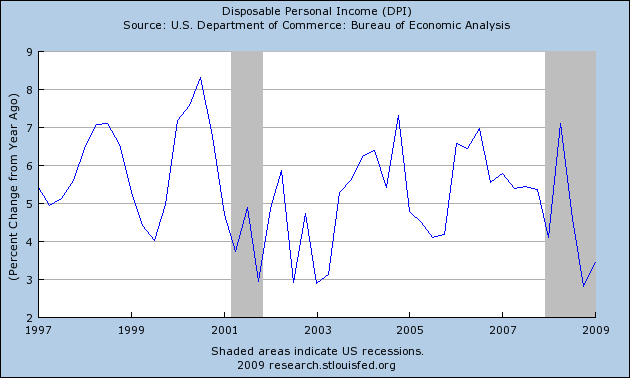

Industrial production is contracting on its fastest pace since the 1950s and the trend is still heading lower. Unemployment is increasing at a rapid pace as well. As we have discussed, even the slight gains in employment are occurring in large part by replacing $20 per hour jobs with $10 per hour jobs. On the surface the decrease in unemployment is good but is it really when we examine which jobs are replacing the old? If anything, the middle class is being squeezed further and further. Disposable income has collapsed since the recession hit:

This of course sends ripples through the global system. Many countries depend on the United States purchasing goods and with less disposable income, many Americans are pulling back and spending less. This is also occurring in more affluent countries dealing with their own aftermath of the recession. It is only logical to see contractions in global trade.

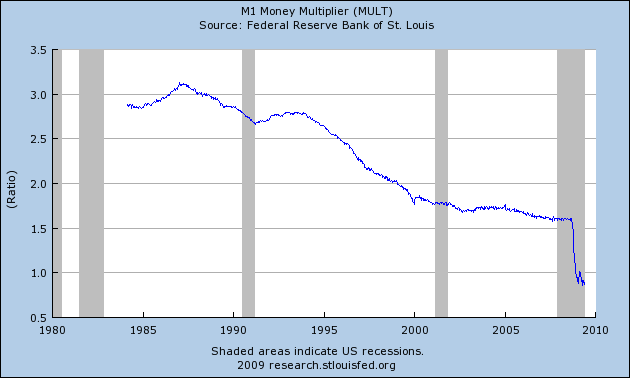

Some people are wondering why all the bailouts and quantitative easing have failed to stimulate the economy? First of all, the multiplier is below 1.0:

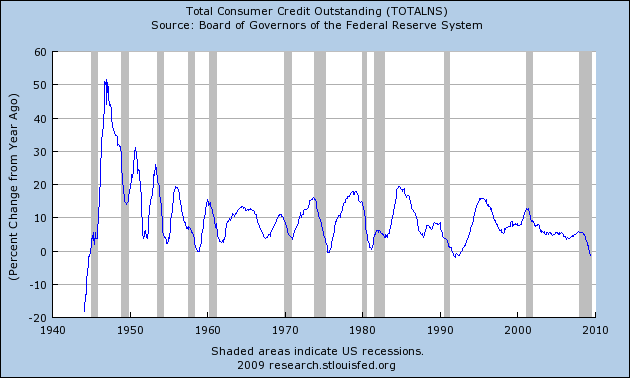

This is the first time it has gone below zero since the data series started in the early 1980s. What this means is that the government printing money has less and less of an impact in the real economy. How else would you explain that nearly $14 trillion in bailouts and commitments, one year of U.S. GDP mind you, can have so little real world impact on the real economy? First, much of the money has gone into the repair of the banking syndicate. That is, money was pumped into the banks and has remained their even though the purpose was for it to be lent to the public. If you have any doubt, I give you exhibit a:

The contraction in consumer credit is the first one in nearly 20 years. Something tells me we didn’t make $14 trillion in commitments and bailouts in the early 1990s. So as the real world tracks the Great Depression in many key aspects, the investing world keeps on believing in the green shoot argument. The second half is here and the clock is now ticking.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

Stock Coupons (including Questrade Coupons, Promotional Codes, Offers, Deals, Reviews) said:

Very good read. I have been in a bubble for the longest time in fear of investing much since i currently sport a 40% loss since September. I am starting to get the excitement again though.

June 9th, 2009 at 6:11 am -

CD Rates Guy said:

I’ll agree with you that the recent run-up in the markets is a play. A volatile market, whether up or down, is not a healthy indicator. The media has grown tired of reporting the same bad news day in and day out, so they’re looking to turn the story towards sunshine and hope.

Ironically, I feel like things were not as bad when they originally said the sky was falling. And now that they’re saying things are getting better, they might actually be getting worse. And oh yeah, this month’s unemployment report was a joke – do more research and see how they fudged these numbers.

June 9th, 2009 at 9:11 am -

silver said:

don’t go for the okey doke the market is being levitated by the plung protection team backed by a vitual printing press…….where the world will wind up after they’re through nobody knows but god these will be known as the good old days ….savor your freedom because it won’t last much longer.

June 9th, 2009 at 3:44 pm -

stock market said:

The stock market is too volatile which made it more unpredictable. The bailouts have not a single slight effect on the market. Stocks, bonds and ETF’s are low. Some investor even loss their investments. Analysts say that the market is showing promises but of what? those signs are not a guarantee that the market is getting better. Concerns like ” will the market gets worst before it finally recover?”. Anything is possible so we better be prepared and most of all if you are an investor in the stock market, do not be trapped in the panic-buying scheme or you will even loss more. But I am not an expert so better invest at your own risk.

August 26th, 2009 at 9:54 pm