The university of financialization – science and math graduates opt to go into the gambling fields of Wall Street banking instead of building productive jobs for society. Many non-tech majors choose lower paying fields while going into massive debt. Youth summer employment drops from 60 to 46 percent in last decade.

- 1 Comment

Going to college has always been a dream for many Americans. Parents have high hopes for their children going to a good school and coming out with a degree that has made them more well rounded as citizens. But this desire may not be coinciding with the marketing jargon that spews out from the industry. Since the US is now one giant financialization machine, banks have shifted their gambling addiction from real estate to higher education. In the last decade the fastest growing segment of higher education enrollment has come from the for-profit college industry. This is an industry that spends more money on slick marketing and deceptive advertising than it does on actual instruction. Across the board however college tuitions have increased even at quality institutions but many are finding their degree is not providing a solid return on investment.

Employment by degree

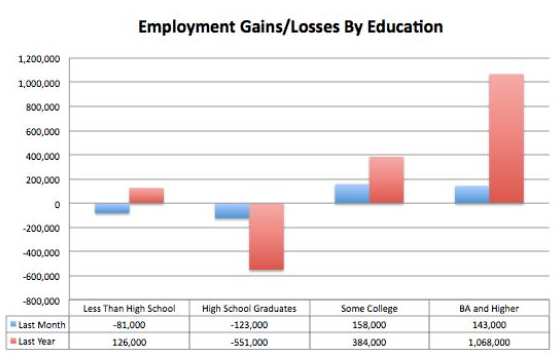

It is hard to argue with charts like the one below that show those with a college degree do better in obtaining a job than those who do not:

Source:Â The Atlantic

This chart although accurate does not highlight the entire picture in the sense that it only shows actual employment. So what if a for-profit college graduate beats out a high school graduate for a part-time Wal-Mart position. Does that really signify success? If we look at the actual earnings of college graduates over the last decade we have seen that in terms of wages, a college degree isn’t paying as much as it once did:

Source:Â BusinessWeek

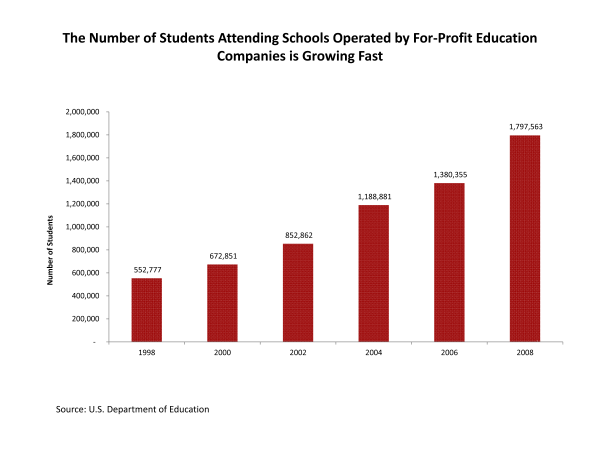

I attribute a big part of this to the dilution occurring in the system with millions of for-profit graduates coming out with massive amounts of student debt and very little potential of earning good careers. The growth in this segment of graduates is startling:

Source:Â Senator Harkin

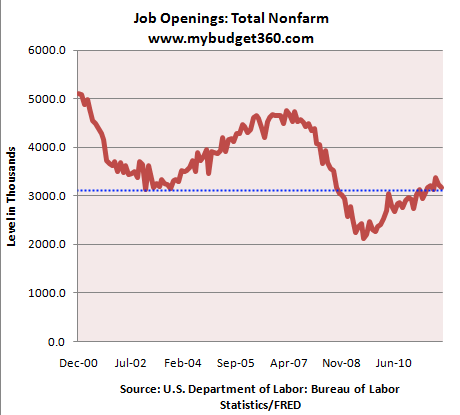

You have the above trend coupled with the reality that there are fewer job openings in the current marketplace:

The crushing blow to young workers

Many younger Americans are facing a daunting task ahead of them. They are finding a system where fewer good paying jobs are available and the challenging task of walking through an educational minefield where good schools compete with paper mills. We can see this trend with many fewer young Americans working:

Source:Â CNN Money

Part of this has to do with people going to college but that again falls into our argument. Where are students going and how much debt are they getting into? Some are even opting for payday loans to navigate the system. You also have the sordid reality that many young Americans are competing with former middle class Americans for those positions. Even at local stores I’ve noticed a larger number of older Americans working instead of a decade ago when most of the workforce was youthful staff.

Some of this lower earnings also comes from students switching into majors that pay less even at prestigious schools:

“(WSJ) Biyan Zhou wanted to major in engineering. Her mother and her academic adviser also wanted her to major in it, given the apparent career opportunities for engineers in a tough job market.

But during her sophomore year at Carnegie Mellon University, Ms. Zhou switched her major from electrical and computer engineering to a double major in psychology and policy management. Workers who majored in psychology have median earnings that are $38,000 below those of computer engineering majors, according to an analysis of U.S. Census data by Georgetown University.â€

This trend is nothing new but the large numbers in certain fields is. What is even more troubling is the number of would be scientists and engineers who give up real world jobs to pursue jobs in the casino of finance:

“Some science and math graduates also say they would rather channel their analytical skills into fields that pay higher and seem less tedious. Charles Mokuolu, 23, graduated from Georgia Tech in 2010 with a civil-engineering degree, and now heads the finance club at Duke University’s master of engineering management program. He recently secured a business-strategy job in the commercial leadership program of a large global manufacturing company.â€

Welcome to a new world where many receive an education with little chance of a solid career path and those that once went into building goods and services for America are now in the business of speculating and gambling with the lives of millions.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

1 Comments on this post

Trackbacks

-

Glenn M said:

I agree with your observation regarding loss of science and math grads in the ‘building’ industries, but this is not a new phenomenon. I graduated with a BS in chemical engineering from an Ivy League university in 1983. The poor prospects for a career in this field, while living in the US pushed me to medical school and a medical career. Although my decision has been (until very recently) a good one for me economically, I have always regretted my need to abandon an engineering career. Over the past 30 years of my career, however, I have noticed the trend towards shifting of technical work out of the US has only continued. A friend of mine tried to succeed in engineering, earning both a MS and a PhD before finally abandoning the struggle and also entering medicine for a more certain future.

The principal difference I see today vs. 30 years ago is that now medicine as a career has ceased to be a career with attractive future prospects in this country, leaving the ambitious student seeking a career in the US the financial casino as the only remaining profitable career path.February 1st, 2012 at 6:24 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!