US households already went off their fiscal cliff and breached their debt ceiling – US quickly approaching another debt ceiling limit aligning with the fiscal cliff.

- 4 Comment

Few people realize that the debt ceiling is aligning right on track with the fiscal cliff. Total public outstanding debt is now at $16.369 trillion and is only $63 billion away from breaching the limit. Not a coincidence that the fiscal cliff is also on the horizon. In essence, we are addicted to debt. However US households have been on a multi-year long process of deleveraging yet this is not being asked from banks or governmental institutions. Of course we knew this was coming. Anyone that was honestly objective realized that we were on an unsustainable path. Yet the name of the game is now about kicking the can furiously down the road so it falls beyond or line of vision. Then we act surprised when we arrive at the can and it has only gotten heavier with debt. So as we are T-minus a few days from the fiscal cliff, let us examine the debt ceiling.

Debt ceiling being breached  Â

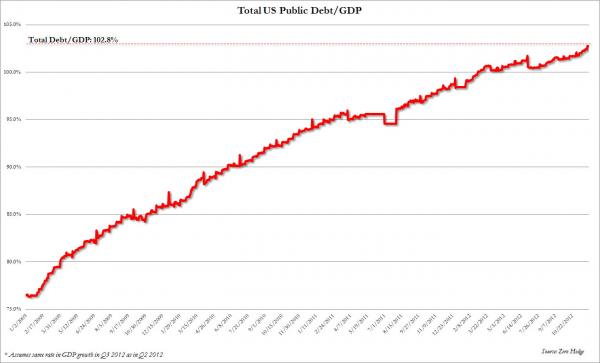

We are fast approaching the debt ceiling:

As stated, we are $63 billion away from hitting this. This week another $26 billion will be added courtesy of a few auctions so we will hit this before the New Year. Debt has been expanding at a furious pace:

The ECB is facing similar issues and they are essentially rolling over debt like a giant snowball. The reality is, the only way out of these mountains of debt is through a slow methodical inflation. The Fed is not even shy about admitting this. Why else would they be digitally printing money with no fear? They realize the debt destruction of American households is enough to offset the trillions of extensions and side programs that are being offered to the banking system. But after years of this, we are now seeing spillover effects via housing bubbles, student loan bubbles, food price hikes, healthcare costs soaring, and other items of that nature all in line with stagnant incomes.

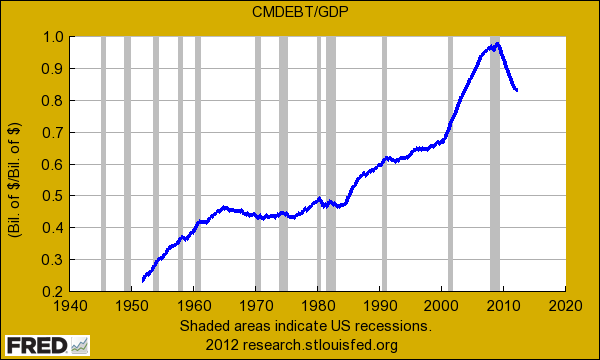

An interesting parallel is looking at US households. Instead of adjusting to lower incomes in the 1990s and 2000s, US households decided to go into massive debt. Yet that access to debt has now been breached. In essence, US households hit their own debt ceiling and fiscal cliff:

It is rather clear where the deleveraging started to happen. This is now a typical recession. This is shifting the landscape of how much debt households can really take on. Yet for government and banks, there doesn’t seem to be a limit although globally we are starting to see peak debt situations. Many countries are having issues even servicing their interest payments let alone thinking about paying back the debt they owe. These bailouts are simply methods of extending lines of credits to pay off already existing lines.

US households are clearly facing the grim reality that maybe they were not as wealthy as they once thought. After all, many do not even have enough for retirement and millions will completely rely on Social Security for years to come. This works well when you have a small older population with a large healthy working young population. Today we have a larger older population with a young less affluent population, with many not even working unfortunately.

So here we are hitting another debt ceiling limit right on time for the fiscal cliff. Combine this with 47 million Americans on food stamps and you need to ask yourself if this really sounds like an economic recovery.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

jimbo in limbo said:

To whom is all this trillions of debt owed? We’re talking about nations, a lot of them, including the U.S. What entity or entities “loaned” these huge sums?

December 4th, 2012 at 8:21 pm -

9t9s said:

Debt, and to whom is this ficticious monster debt owed?

Does anybody think anymore?

The so-called “national debt” is the interest payments the government “owes” the private central bank, the Federal Reserve.

It is the interest we owe for using paper credit cards called dollar bills.Since the Fed has illegally taken it upon themselves to issue our debt, I see no reason to pay it, nor to even take it seriously.

December 5th, 2012 at 6:36 am -

Hillary said:

Yes this is becoming more and more of an issue, lets just hope the Dems can get together with the Republicans to work through this and worry about their differences later.

December 6th, 2012 at 1:33 pm -

LiberatedCitizen said:

This will help you put it together

Interesting to note our government owes S.S. almost $2.7 Trillion

The TRUTH About Who Really Owns All Of America’s Debt

snip

Social Security Trust Fund

Total Holdings of US Treasuries: $2.67 trillionPercent of US Debt that they own: 19%

http://www.businessinsider.com/who-owns-us-debt-2011-7?op=1

US consumer debt at record high at USD2.7 trillion

http://www.presstv.ir/detail/2012/12/08/276951/us-consumer-debt-at-record-high/

Now why is this interesting read this and you will see

Social Security is not going broke

http://blogs.reuters.com/david-cay-johnston/2012/05/04/social-security-is-not-going-broke/

The Great American Retirement Scam: Why The Wealthiest CEO’s In America Want To Take Away Your Social Security

And the top 1% of the 1% like the bailed out warren buffoon use loopholes so if they do raise the taxes instead of closing the loopholes it will be what’s left of the middle class that suffers again.

John Boehner: Raise Taxes on the Rich

http://cnsnews.com/news/article/john-boehner-raise-taxes-rich

Obama On Tax Cuts: President Rejects Republican Plan To Close Loopholes

http://www.huffingtonpost.com/2012/11/14/obama-tax-cuts_n_2131256.html

Tax Payers With Income of Only $30,000 Face Annual Tax Hikes of $1,500

http://www.economicpolicyjournal.com/2012/12/tax-payers-with-income-of-only-30000.html

Middle Class–Not the Rich or the Poor–Pay Majority of Federal Taxes, Says CBO Data

How Buffett Saves Billions On His Tax Return

Warren Buffett Is A Punk

snip

Meanwhile, Buffett has given each of his kids a charitable foundation with billions each to manage. If a foundation has $3bb in it, then something like $90mm can go to salaries.

http://techcrunch.com/2012/05/12/warren-buffett-is-a-punk/

Implementing Warren Buffett’s Gift

The foundation must continue to satisfy the legal requirements qualifying Warren’s gift as charitable, exempt from gift or other taxes.

http://www.gatesfoundation.org/about/Pages/implementing-warren-buffetts-gift.aspx

Buffett’s Betrayal (Buffett firms got $95 billion of bailout cash)

http://blogs.reuters.com/rolfe-winkler/2009/08/04/buffetts-betrayal/

Third Way Document Proves Democratic Party Supports Institutionalized Looting by Banks

Obama and Boehner meeting privately for “Fiscal Cliff” resolutions. Let’s discuss… 2 men deciding U.S. future? Entitlements, what they are and are not. History: Banks entitled not people.

December 10th, 2012 at 9:04 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!