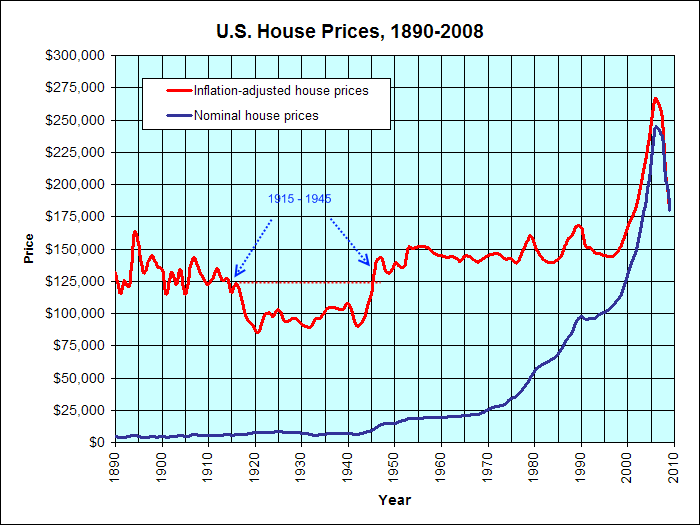

Will the U.S. face a generation of underperforming housing values? It happened from 1915 to 1945 and the current trend is not looking favorable. Current U.S. housing values over priced by 30 percent.

- 0 Comments

It is hard to imagine a time in U.S. history when housing was actually perceived as cheap for an entire generation. Yet this is the exact experience that occurred from 1915 to 1945. Home values were cheap in relative inflation adjusted terms. Even after 1945, homes were still affordable and this is where the seeds of viewing housing as a great investment took hold. But housing was a good investment for all the reasons it is not today. Housing was a store of value, not an ATM machine for funding your next boat. Yet the current credit bubble bursting is exposing the underlying problems with using a home as the primary function of wealth in this country. A home doesn’t offer anything more than shelter and certainly doesn’t create new and innovative employment sectors. Yet for an entire decade housing was seen as the elixir to solve every problem in our economy. Today, nationwide housing values are inflated by approximately 30 percent even after the current correction. This is hard to believe for many but all we need to do is look at data from 1968 and adjust it for inflation.

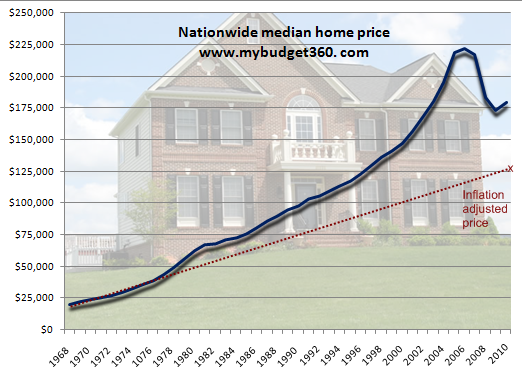

In 1968 the median nationwide home was selling for $20,100:

Source:Â NAR

The latest median home price is now up to $179,600. Using data from the BLS we find that the value of $20,100 from 1968 adjusting for inflation should be $126,094. In other words, nationwide home values would need to fall by close to 30 percent just to come back in line with inflation. And with inflation remaining flat, the only option on the table is for prices to correct:

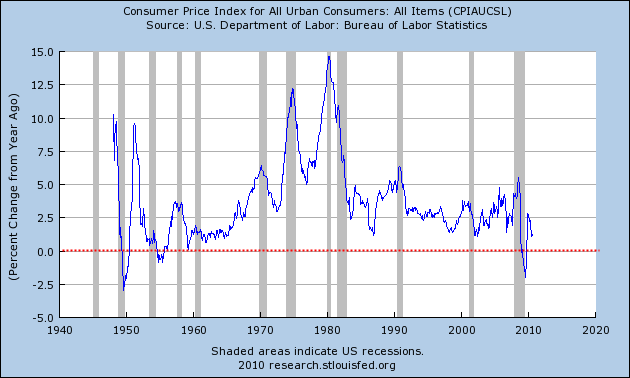

The CPI fell on a year-over-year basis for the first time in this recession since the 1950s. The Federal Reserve is desperately trying to inject inflation into the market so they can inflate the large amount of debt in the market away. Yet the only people being helped right now are the banks that hold trillions of dollars in overvalued real estate loans including toxic commercial real estate. The irony of all this intervention is that the market is demanding lower priced real estate. It was interesting to see that the bulk of sales over the last year came from the distressed real estate market. Why? Because these were lower priced properties. With over 17 percent of the American population unemployed or underemployed they can only afford to pay so much for a home. The median household income has remained stagnant for over a decade and is currently at $50,000. So a $179,600 home is stretching the budget.

We haven’t seen a time in recent memory where real estate was a good value adjusting for inflation. But there was a period in our history from 1915 to 1945 where real estate was a good deal:

For almost an entire generation real estate was cheap and didn’t even keep up with inflation. Keep in mind what also kept prices deflated was a weak employment sector and we have that today as well. It is fascinating to examine this because housing during these times was perceived merely as a place to live. Of course the big money as usual built their gilded mansions but that was only a tiny percent of the population. Yet the overall sentiment was that housing was simply a place to provide shelter and comfort. Much of that has recently shifted with the McMansion notion that even someone scraping by with middle class wages was somehow entitled to own a 2,500 square foot home even if it meant going into massive debt with the banking sector. As these people went bust, the taxpayer bailed out the banks and the banks kicked the people out of their home. Yet the prudent American is the one that is really getting hammered in this mess. This does a number on the collective psyche of the public.

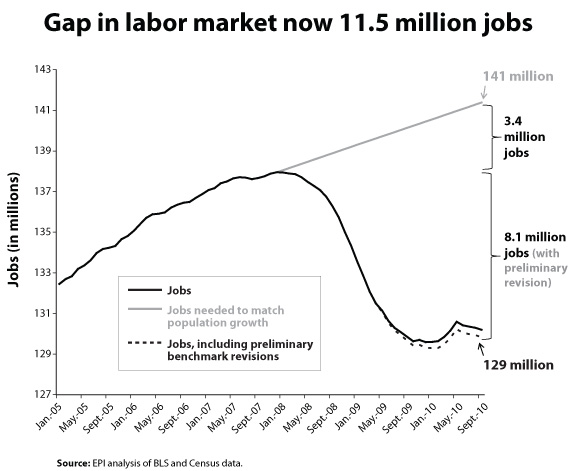

I know it is hard for many to even contemplate a market where real estate is bland for 10 years, forget about 30 years. But the 30 year timeframe is roughly one generation during the home buying years and household formation ages. What if today’s future potential buyer is now turned off from buying? Certainly many are never going to believe blindly the “real estate never goes down†mantra that permeated the market for decades. So it is very possible that we will now have a future generation of Americans that will buy moderately priced homes because they simply want a roof over their head. Many will gravitate to renting. Think of the children of many of the families being foreclosed on. Do you think they have a positive impression of banks and the home owning experience? Even if this isn’t what they want, the financial realities are very different now:

Source :Â Â EPI

A new report shows that we will now need 11.5 million jobs just to get back on track to the pre-recession levels. Do the math here. If we add 200,000 jobs a month we would need a consecutive streak of nearly five years just to reach this point. So it isn’t hard to envision real estate as a weak bet for at least the next five years. But again, the housing market went bust in 2006 so by that point in 2015 (assuming we even add 200,000 jobs a month) the negative taste of real estate would have touched an entirely new generation of Americans. It isn’t hard to see how real estate will turn out to have a very bad reputation for years to come.

Even the current foreclosure paperwork mess is shining a light on the entire fraud based housing system. Many Americans, the bulk who are responsible and prudent, are viewing this entire Wall Street banking mess and are shaking their heads with fury. How can banks first, make loans to individuals with no ability to pay and then have the biggest handout in American history from the taxpayer base that is actually financially careful? It certainly isn’t coming out from those in massive debt. Then, as most of the toxic mortgages are shifted to the taxpayer the banks then try to cut corners to kick people out of homes to churn money on the foreclosure process. Again, is the current government going to show their allegiance to the banking system over the American public? If you look at the shenanigans that went on during the 1920s leading up to the Great Depression you will realize that institutionalized embezzlement is par for the course until the system is completely restructures. We haven’t even touched the financial system in terms of reshaping it so expect this historic wealth transfer to continue.

Each year that goes on like this is another year where millions of Americans are turned off by the housing and banking industry. This does not bode well for real estate for an entire new generation of Americans.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!