Why do people feel poor even though the stock market is at a record high? The process of inflating asset bubbles and transferring wealth to targeted groups. S&P 500 up 145 percent from 2009 low.

- 1 Comment

The stock market provides a beautiful scent of success although most Americans will only catch a whiff of that aroma. The S&P 500 is now up 145 percent from the gloomy low reached in 2009. Even though this unrelenting trend upwards has added wealth to a few, the majority of Americans are still seeing the purchasing power of their dollars slowly erode. The one secure location for wealth in housing is now being usurped by Wall Street as investors begin to invest heavily in the rental real estate business. Speculation in the markets is once again booming. Japan had a mini-crash this week but the media cycle continues to pretend that printing your way into prosperity is somehow as easy as having central bankers pushing play on the iPod and expecting the hits to come one after another. The reason you likely do not feel the big gains of the recent run is because most of the gains have come from artificially low interest rates and companies slashing wages and squeezing profits out of current workers.

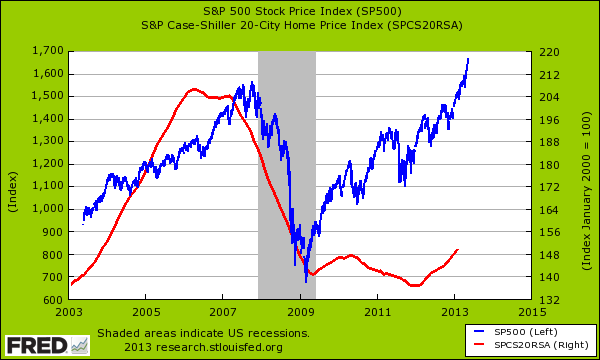

S&P 500 and Case Shiller

The vast majority of Americans have their wealth locked up in housing. While stocks are at record levels, the housing market still has a far way to go to reach the previous peak:

This is startling divergence especially when a large portion of the recent housing gains have come from the Federal Reserve going bananas into purchasing mortgage backed securities and easy money flooding the rental housing market. Is this sustainable? It is hard to tell especially when we are also reaching peak food stamp usage in the country.

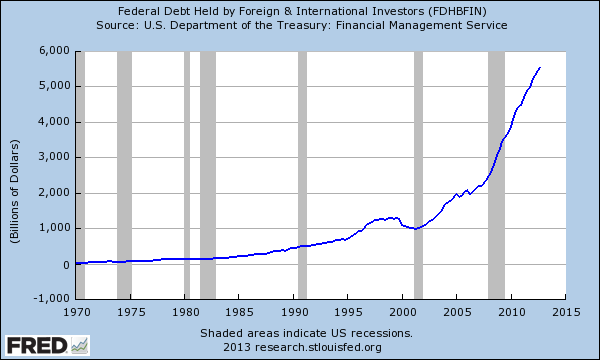

Our reliance on foreign debt has grown very large:

Nearly $6 trillion of our debt is now held by foreigners. When I look at a chart like this, I realize that our reliance on others is only going to grow more and more as we continue to spend at the current rate. We are now seeing much of this money flooding back onto our shores in the form of exclusive product purchases and also real estate investing in more select markets. For many people trying to live day by day, all these gains simply mean that life is getting more expensive while they see their standard of living erode.

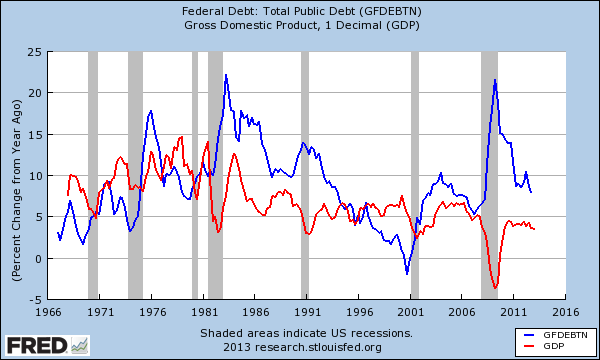

You can see this with the pace of GDP growth and also in the growth of total public debt:

The growth of public debt is far outpacing the growth of GDP. You can see that as the recession hit, debt spending expanded to back fill the loss in consumption from the private sector. But now as the market is back, debt based spending is still extremely high and a large part of this is coming from unprecedented actions from central banks.

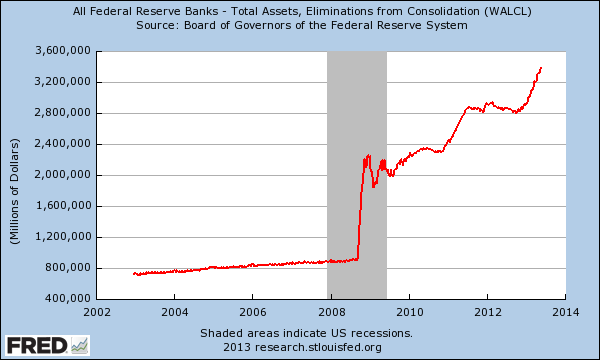

The example of the Nikkei in Japan crashing in one day is a good example of what happens when you enter into uncharted waters. Does this look remotely healthy in our case?

It is no coincidence that the stock market has been on rocket fuel since 2009 as well. Yet the middle class continues to erode in the United States. The reason many people feel poorer is because they actually are. The wealth of a very small segment of society continues to expand as they utilize all these new mechanisms of leveraging debt. Most Americans are unable to access these cheap funds from the Fed or having the knowledge to use high-frequency trading algorithms to make quick gains in the market.

It is still the case that half of this country has no savings or is living paycheck to paycheck. The Fed wants you to spend money you don’t have just to re-inflate the bubble. Best way to avoid recognizing major losses is simply to ignore them and inflate the market back up. It is easy to do when you control the digital printing press. The Nikkei’s 7 percent one day crash should tell you that not all easy money is golden.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

1 Comments on this post

Trackbacks

-

citizen60 said:

The general stock market has not reached new highs. In fact in inflation adjusted terms the S&P 500 would have to rise nearly 25% to regain its year 2000 peak. Plus as the nominal level rises a phantom capital gain causes a tax liability in addition to the real loss.

Guess which sector gets killed next? Everyone said the bond market right!

May 26th, 2013 at 2:46 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!