What European Recovery? Unemployment at record high and debt only keeps reaching more unsustainable levels. Italy’s Debt to GDP crosses 125 percent.

- 0 Comments

I never understood why so many people bought into the notion that the European Union was recovering. If recovery means that a handful of well-connected bankers are bailed out with financial smoke and mirrors instead of facing reality while placing crushing austerity on the public, then yes, maybe a recovery is what was experienced. As of the writing of this article the EU is facing its highest unemployment rate on record. How is this even remotely positive or perceived as a recovery? In Greece, the politicians and some in the public are trying to go after people that accurately stated that yes, there is in fact too much debt. In Italy, a party led by a former comic did surprisingly well and it appears that there is no clear path ahead for the country. The amount of debt in the EU is comical so it is apropos that a comedian should do so well. There is nothing remotely resembling a recovery in the EU if we look outside of the banking sector which does a very poor job at reflecting the true state of the economy.

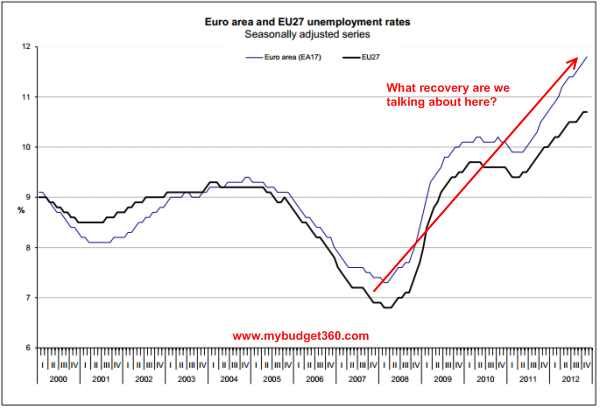

The EU at peak unemployment

Certainly workers across the EU do not feel that this is some sort of recovery:

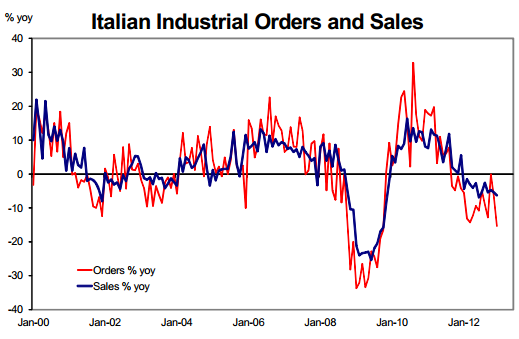

The markets were acting today as if this were some revelation especially with the elections in Italy. No, as the chart above highlights unemployment in the EU is at a peak level and never looked back since 2008. Why did the elections in Italy set off the market today? First, the real economy in Italy is truly contracting:

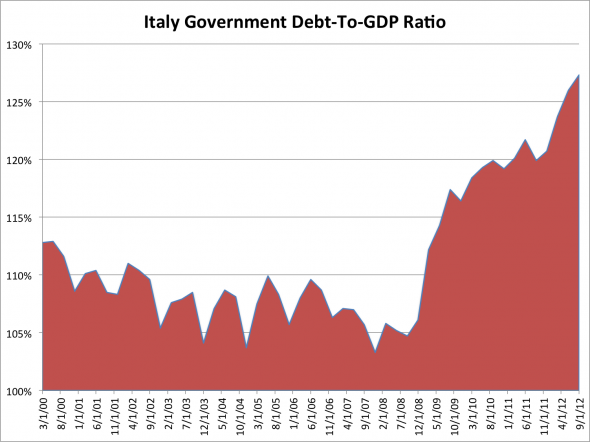

Italy is deep in recession. The country appears to have slipped back into recession. The unemployment rate is above 11 percent but for young Italians, it is well above 30 percent. There seems to be a western problem for young workers. But what is more problematic with Italy is the gigantic levels of debt relative to production. As we just mentioned, production is contracting and debt is growing. This is usually an unsustainable trend:

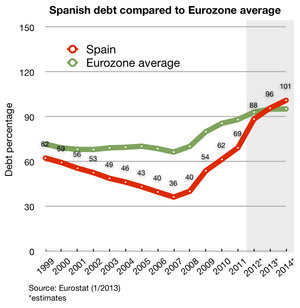

Since 2008 Debt-to-GDP in Italy went from roughly 100 percent to over 125 percent. We’ve discussed this in the past that countries seem to reach a tipping point when Debt-to-GDP hits 100 percent. The elections in Italy show a deep distrust of government and a growing resentment of what is transpiring. Yet Italy is not the only one in this predicament. Spain with a youth unemployment rate of 50 percent is seeing massive issues as well:

Spain’s debt has also crossed the 100 percent Rubicon. This is simply unsustainable and once the market realizes this it begins to punish these countries. The market for whatever reason, went into a debt addicted hibernation this last year or so. What you now see is some reemerging characters taking advantage of the situation:

“(USAToday) But one thing has become axiomatic about Berlusconi in his 20 years at the center of Italian politics: Never count him out.

This time around, in an age of wrenching austerity, he had a very simple campaign strategy: throw around the cash.

Berlusconi has promised to give back an unpopular property tax imposed by Monti — with money from his own deep pockets, if need be.â€Â        Â

You can understand why this strategy would work in a time of austerity. People view the banks as being able to have their cake and eat it too with central banking fiat partying while the public needs to take their hard and unsavory medicine. And that really is one of the hidden secrets of this current austerity movement; the only people dealing with austerity are those outside of the financial sector.

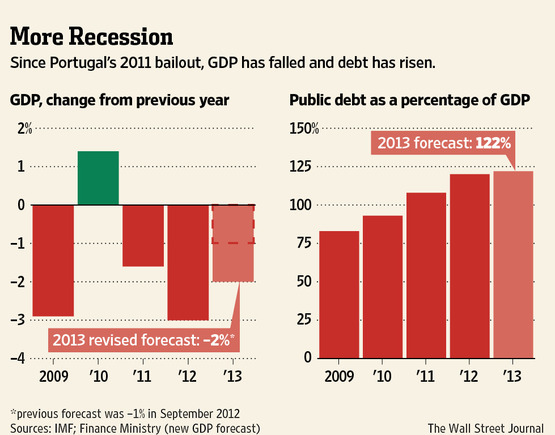

Portugal is another country that has crossed the 100 percent Debt-to-GDP ratio:

The reason this barrier is important is because you enter a position where you are essentially spending more than you produce. At a very simplistic level, you can see a household that makes $50,000 that goes into $100,000 of credit card debt is in deep problems. Governments face similar constraints. If they didn’t Zimbabwe would be the model when it came to money printing.

What European recovery are we really talking about here?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!