Winging it through retirement: 30 percent of Americans have no retirement savings.

- 3 Comment

Planning for retirement does not happen overnight. You need to diligently plan and sock away savings like a squirrel stocking up for the season. Many Americans have no retirement savings and more troubling, many near retirement face a compressed timeline where they will need to save or face a massive decline in living standards in their later year. Retirement has become a sort of idealized vision of doing nothing. Many think that once retirement hits, all expenses will go away and that they will have unlimited funds to purchase Margaritas and spend time at a beach with crystal blue water in some part of the Mediterranean. Instead many will be working deep into older age and will be fighting off the cold because the heating bill is eating into their Social Security check. Many Americans are fully unprepared for retirement and despite the massive surge in the stock market since the Great Recession ended, many Americans are looking at retirement and are planning to wing it.

Winging retirement

There is a deep cognitive dissonance in our culture. We are obsessed with planning yet people fail to prepare. We have an obsession with eating right and staying healthy but are one of the fattest nations on the planet. This kind of split mentality helps to explain why in a country with so many retirement plans and options, most people are inadequately prepared for retirement.

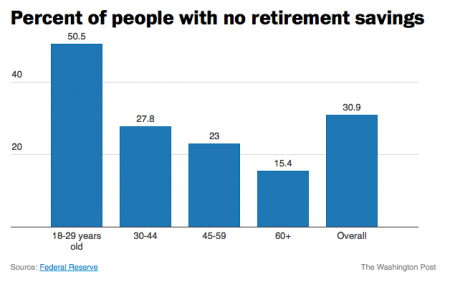

Take a look at how poorly prepared Americans are for retirement:

Source:Â Federal Reserve

Those 18 to 29 would have a big advantage in their future years if they only socked away a few bucks per month. Yet half of this group has nothing saved. Those 30 to 44 don’t do all that better. Ultimately, 30 percent of all Americans have no retirement savings. This is troubling.

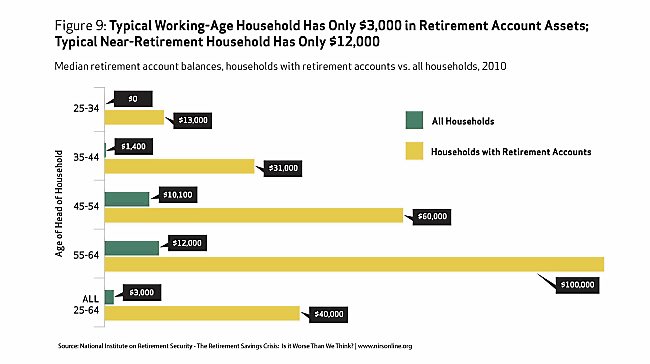

And then, when you look at how much is saved you realize that even those with some kind of retirement savings are virtually focusing on Social Security as their main source of income:

The typical near-retirement household only has $12,000. This is one minor medical emergency away from being fully bankrupt. Why are Americans so unprepared for retirement? First, most Americans are living paycheck to paycheck. For many, there is little left from the paycheck once the necessary expenses are paid. The typical American makes $26,000 per year and with inflation eroding purchasing power, those dollars are not going very far. The immediate needs of the day take precedent over the potential problems of the future.

The unfortunate aspect of all of this is that it would take only a few hundred dollars per month starting at an early age saved to have a decent sized nest egg. But people don’t see the value in that. It is an all or nothing kind of mentality. You see this every New Year when severely overweight people set unrealistic health goals when all they need to do is start with moderate walking and controlling food intake to make big differences. Don’t plan on 10 marathons when you need to start with a first step. The same goes with savings. But when people look at the end goal of needing $500,000 or $1 million for a nest egg they simply get overwhelmed. The financial sector is more than happy to step in and take your money if you are unwilling to do the research.

Many Americans also distrust the financial sector. So this simply compounds the problem. In reality most Americans are winging it when it comes to their retirement plans. The plan for most will be the default with Social Security which was never intended to be the primary source of incomes for millions of Americans. The new retirement is no retirement and working well into old age.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Ame said:

I would like to see what Figure 9 looked like after the stock market crash in 2008. I can bet the yellow bar was a WHOLE LOT closer to the green bar! So, I don’t think this graph is realistic considering how the stock market has been pumped up to unrealistic heights. Much of what makes up the “savings” in the yellow line will go *poof*. If you have your money in the stock market, it’s NOT savings for retirement. It’s gambling that money will be there when you need it.

Just ask those who lost 40% of their retirement portfolios in 2008. They are the gray-haired, stooped cashiers you see toiling at jobs once held by teens and early 20-somethings. They ran out of time to see compounding regain what they lost.

Plain ol’ vanilla savings account is real savings for retirement.

November 16th, 2014 at 8:38 am -

Rick Adams said:

Where would you like to see these young put their hard earned currency ? In the stock market. Good luck with that. How about CD’s. Now there’s a great return. The whole damn system is rigged. The bankers would like nothing more than for you to put your wealth into ” their ” system. Giving them the privilege to steal your currency. Look at what just happened at G-20. If you don’t know, then look it up. I tell my grandkids that right now ” Cash is trash “. Go buy some Silver.

November 17th, 2014 at 1:53 pm -

Jon said:

I like how CNBC’s Suze Orman constantly tells everyone to give all their money to wall street, and to work until 70 to retire. Great solution to the real problem, inflation / inequity.

November 17th, 2014 at 4:35 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â