You Cannot Afford a $350,000 Home with a $75,000 Household Income!

- 43 Comment

You would think that before people make the largest financial decision in their lives, they would do a monthly budget first. Yet during this past decade budgets were hardly brought to the forefront and were pushed to the back of any financial decisions. The new definition of housing affordability should include the idea of maintaining a sustainable long-term budget. Of course many can afford a two year teaser rate but what happens when the payment jumps up? How secure is your employment? Do you have enough to save for retirement after you pay for your home each month? These are all factors that need to be considered to purchase a home.I’ve gotten a few e-mails about buying a home in California. Of course many people that have been sitting on the fence are now thinking seriously about purchasing a home in the state.

Let us take a look at some numbers first:

California Median Home Price

April 2007:Â Â Â Â Â $597,640

July 2008:Â Â Â Â Â Â Â $350,760

Decline:Â Â Â Â Â Â Â Â Â $246,880

Price decline from peak:Â Â Â Â Â Â Â Â 41.3%

*Source:Â California Association of Realtors

A 41.3% year over year decline is stunning for a state that is so large. A year ago 341,130 homes were sold in the entire state. That works out to a monthly average of 28,427 homes sold per month. Last month 39,507 homes sold in the state. Keep in mind that this is a jump but data for the summer is always high. You can expect this number to decrease. In addition, most of the sales were foreclosure properties which are pushing prices even lower. We are going to hypothetically see if you can afford that $350,706 median priced home.

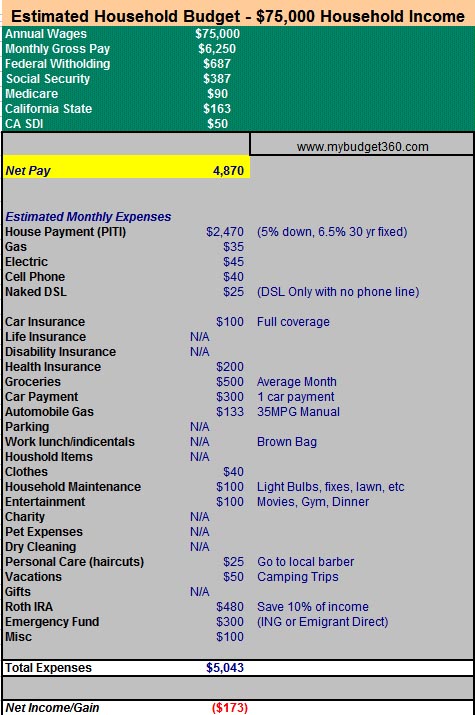

The budget below is for a married couple with a $75,000 household income:

The first thing we need to figure out is the monthly net income. The monthly gross income is $6,250 but after taxes it will be $4,870. A rule of thumb that is very generous by most bankers and lenders is your home payment should not be more than one-third of your gross take home pay. So let us first find out our threshold:

$6,250 / 3 = $2,083 per month

Above, the family will be purchasing the median priced California home with a 5 percent down payment ($17,535). As you can see in the budget, the monthly home payment will workout to $2,470 which is higher than our threshold figure. We’ll go ahead and assume that this couple goes ahead with this move.

You need to realize that it costs money to upkeep your home. That is lawn care, roof, plumbing, and other things come up throughout the year. I am simply setting aside $100 a month for this but this can jump radically if you need major service like a roof replacement. In the budget we also have only one car payment at $300 per month and we’ll also assume that this car is highly fuel efficient. Maybe a Honda Civic or Toyota Corolla.

So to a certain extent, this family is living modestly and not extravagantly. We are also setting aside 10% into a Roth IRA for retirement and putting away $300 a month into an emergency fund.

For a married couple $500 a month in groceries is doable. I know some will argue that this is too low/high but this can be done. We are also assuming this couple isn’t eating out during the work week and brown bagging their lunch.

So can this couple afford the home? The answer is no at least if we follow our initial definition. Yes, a lender may give you a loan especially it they use a home to income ratio (HTI) and don’t look at a debt to income ratio which will include the car and any other credit cards they may have.

At this level, your monthly home payment is consuming 50% of your monthly net take home pay. I would argue that you should use your net monthly pay to calculate what you can safely afford. That is for this couple, they can afford a home with a monthly payment no larger than:

$4,870 / 3 = $1,623 per month

This works out to a home priced around $250,000.

This may seem like a boring figure but keep in mind the median household income for California is $55,734. In inflation adjusted terms, Californians are actually poorer than in 2000 when the median income was $56,638. In fact there are very few counties that have a median household income that comes close to $75,000. Orange County which is viewed as a more affluent Southern California county has a median household income of approximately $70,000. The current median home price in Orange County is $461,000.

The trend in California is unmistakable. Prices are still coming down and if you really dig deep in to a budget like the above, which I imagine is on the conservative side you can understand why so few families can afford homes in the state even after a stunning 41.3% drop.

Hopefully this article allows you to plug in your own numbers to determine whether you can afford a home. Â If you cannot, there really isn’t a rush to do so. Â Prices are still trending lower.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!43 Comments on this post

Trackbacks

-

Ann said:

I don’t question your logic, but I do question your median incomes. I live in the SF Bay Area, and I personally know of a great many people who make money under the table in one way or another. The classic examples are nannies, housecleaners, etc. Not highly paid jobs, no, but given that skilled, reputable grown-up babysitters in my area are known to make $20 per hour tax-free, and independent housecleaners charge at least $120 per couple-hour job (again tax-free), these jobs can add substantially to household income and can easily be paired with other jobs and quite possibly with government perks based upon low reported income.

All of which makes buying a home more affordable than you might imagine for people who could not necessarily afford a house on paper. Particularly for people who are married or include siblings and older children in informal economy family businesses and even in homeownership–a tightly knit family can become a pretty good income center.

So…how to get good data, then?

September 1st, 2008 at 10:48 pm -

Francis said:

California housing has been one big Ponzi scheme, where everyone depended on making money, by selling their house to the next sucker. These always fail, and the market will HAVE to return to affordable, and sustainable prices, or 3x average household salary. IN Cali, that works out to an average of 165,000 – a far cry from 550,000.

September 2nd, 2008 at 6:26 am -

NISMOTT said:

I make slightly more than 75K and I was recently approved for 270K wit 6% down. I have almost no debt and credit score of 750. I live in San Diego so finding a “nice” home for 270K is not going to be easy. I am planning on waiting at least another 4 months to see if prices come down a little more.

September 2nd, 2008 at 7:42 am -

Richard said:

A few flaws:

1) You assume nobody can do better than putting 5% down.

2) You don’t factor in reduced taxes via the mortgage deduction.

3) You assume a constant rate of contribution to the emergency fund. You are essentially assuming a $300/mo emergency above and beyond planned expenses. Is that a bit high?

4) Your model assumes all homebuyers are working-class. What about retirees or the investor-class?

Otherwise a nice article.

September 2nd, 2008 at 8:20 am -

helper said:

need to add property taxes…

September 2nd, 2008 at 2:38 pm -

dan k said:

Nice blog – I intend to visit frequently. I make 100,000 and I would not spend that much on a house payment (and I’m single too). Camping as a vacation for the next 10, 15, 20 years? Peanut butter sandwiches every day? Furniture lasts forever? I’m a homeowner, but its a pretty modest home, and when I bought my monthly payment was comparable to rent. People spent on houses just like they spent on stocks – thought there was easy money.

September 3rd, 2008 at 8:15 am -

Jason said:

With the interest deduction from your income taxes, the above budget would actually work

October 28th, 2008 at 1:09 pm -

Blinz said:

Also 10% into Roth post-tax dollars doesnt make sense. Pre-Tax contributions up till what 14k these days. That is almost the entire loss right there.

October 28th, 2008 at 3:00 pm -

chris said:

Whoever wrote this is exactly correct. Sure you can split hairs about the side jobs and tax deductions but who out there is really saving in money? Who only spends $500 on food in LA?

There is no reason (except phony money) why the price of homes should not be close to the median incomes of the area. The age of people going bananas buying,selling, cashing out over and over again, always getting by with another refinance are over. The idea of a home as a nestegg or ATM are over. Anyone getting in LA right now will probably find themselves in another year underwater. WAIT!

October 28th, 2008 at 4:24 pm -

se7en said:

Ding ding ding – Jason wins. Interest on the loan is tax deductable.

October 28th, 2008 at 6:34 pm -

Emily said:

You’re forgetting things like maintenance on a house, property taxes, insurance, etc. Lots of miscalleneous expenses when you own a house.

October 28th, 2008 at 7:05 pm -

Amy said:

We’ve had this debate at length on a mailing list at work… basically, it comes down to where you want to put your discretionary spending. I don’t value having a nice car or eating out and cook most things from scratch, so the car payment goes away and the insurance is cheaper (I just found a 42mpg beater for ~$2700, including initial tune-up), and the food is <$150/mo/person.

Still, your example is probably true, that you shouldn’t use your $75k annual income to buy a $350k house. But if you’re making, say, $200k, what’s wrong with spending over half your income on house? You have plenty left over to cover other normal expenses. A nice house loses you less money than a nice car.

Besides which, as many have pointed out, that’s only when you start out. Through inflation and career advancement, your pay should go up, so you won’t be so crunched. Maybe you take camping vacations the first 3 years, but after that, you’re getting ahead, and prices will come back up eventually.

October 28th, 2008 at 7:09 pm -

Jan said:

It seems like one thing omitted here is how much money has already been paid in to houses. If you are going to argue that only when a median income can afford median house – will the housing prices stabilize – then you need to account for what fraction of the median house has already been paid off. I have to think that some appreciable fraction of homes are fully paid off – and many more have large portions paid off – and in that situation even a well below median income can afford to live in a median cost house. Not buy it – but if one inherited the house, got it in a divorce settlement, or bought it 20 years ago when it was a small fraction of the price – then one can “afford” it even on a small salary. But both the house value and the salary count toward the median statistics – thereby skewing the income needed for a median house upward. Someone out there probably knows how much of existing value has already been paid off – but I suspect that it will significantly reduce the salary needed for the average house (using the argument above).

October 28th, 2008 at 7:53 pm -

Mick said:

The property taxes will be around $750 a month too.

October 28th, 2008 at 9:39 pm -

Dave said:

All I can say is the reason that no one can afford houses is because everyone is buying with little or nothing down. Put $50-$100k down (it’s called saving) and then you can own a house without putting yourself under massive stress. Also I’m from Canada but frankly your budget is unrealistic. Monthly gas should be $200/month and electricity and gas should be higher as well. Also there’s nothing in the budget for misc. purchases (ie. birthday presents, sports, broken shovel, etc…). Let’s not forget something like Christmas – how is someone with the above saving for Christmas? you can look at the emergency fund for $300/month and say there it is, but that’s for a roof repair, broken fridge, new a/c unit, etc…

October 29th, 2008 at 3:47 am -

name said:

Ya its true alot of people do make extra money “under the table” that is very common for people in places that are expensive to live in: San Diego, Los Angeles, Bay Area, Miami, etc.

I do disagree with your premises of a 30 year mortgage i as a loan officer think they are the worst loan you can get. I think the best option for someone staying put somewhere is a 15 year loan.

30 year loans are for idiots.October 29th, 2008 at 5:55 am -

Kevin said:

The commenters above are right. I see that you used PITI instead of just principal in interest, so that *does* cover property taxes and homeowners insurance, but you completely neglected the tax benefits of deducting mortgage interest paid.

For the loan you specified, year one would see $21,600 in interest paid on the loan. For a Head of Household earning $75K gross, federal taxes come to $13,813. If that taxable income is reduced by $21,600 (by deducting paid mortgage interest) that tax burden falls to $8,413, a savings of $5,400 per year, or $450 a month.

After factoring the tax benefits of home ownership, rather than running a household deficit of $173 per month, they have a $277 a month surplus. Further, while their home ownership costs will stay static over the next 30 years, the average income for a given household usually goes up a few percent a year, easing the burden further over time.

October 29th, 2008 at 8:11 am -

alistair said:

You say you chose a highly efficient car. and whilst i’ll agree that on your side of the pond it’s pretty much a necessity are you sure that the miles travelled is realistic? $133 At say $3.50 per gallon (i cant beleive people moan about this being expensive) is 1330 miles per month, 44 per day (or about 63 per working day). isn’t that a little high?

plus you seem to have missed out beer…. i guess that probably has it’s own seperate butget.

October 29th, 2008 at 8:25 am -

george said:

The mortgage interest deduction is a red herring. It goes away over time. The whole point of the article was long term affordability. Once you start to pay down principal you’re getting very little benefit form the interest deduction unless you make huge charity contributions, otherwise you could get the standard deduction while renting for the same benefit.

October 30th, 2008 at 8:41 am -

ThirdNormal said:

There are a couple of flaws with the logic here.

First off: “median household income” is not the same as “median homebuyer income”. The median household income is pulled down by college students who have little or no income & rent, and by seniors who have a small retirement income but own their homes free and clear. Neither of these households are in the market to buy a home. The majority of home buyers are people at the peak of their earning potential (say in their 30’s and 40’s) who earn significantly over the median household income.

Second: any accounting of the benefits of home ownership should take into account the fact that the home will appreciate in value over time. Granted the 20% per year appreciation rates of a few years ago are clearly unsustainable, but moderate appreciation at around the rate of inflation is reasonable to expect over the long term. The $350,000 home in the example appreciating at a modest 3%/year will add about $875/month to the owner’s net worth. This is a very significant amount that is totally ignored in this analysis.

December 24th, 2008 at 10:17 am -

Marcia R. said:

Nice article! I make about $75K, including an yearly bonus, and was approved for $300K, which I thought was excessive considering that when I check the mortgage calculators I do not see how I could afford a home in the bracket. Even though we are tempted to buy more since we are talking about a “home”, it is best to be conservative and to do the homework prior to getting into more than what we can afford.

February 9th, 2009 at 1:01 pm -

Gman said:

A History of Home Values (graph 1890 to 2006)

http://www.investingintelligently.com/wp-content/uploads/2006/08/a_history_of_home_values.png

The Yale economist Robert J. Shiller created an index of American housing prices going back to 1890. It is based on sales prices of standard existing houses, not new construction, to track the value of housing as an investment over time. It presents housing values in consistent terms over 116 years, factoring out the effects of inflation.

The 1890 benchmark is 100 on the chart. If a standard house sold in 1890 for $100,000 (inflation-adjusted to today’s dollars), an equivalent standard house would have sold for $66,000 in 1920 (66 on the index scale) and $199,000 in 2006 (199 on the index scale, or 99 percent higher than 1890).

May 16th, 2009 at 8:26 am -

nomad said:

Let’s all be clear about one thing, truth be told, no house is ever worth more than a few hundred dollars. The economy is based on hyped up numbers. Banks are making huge profit off charging you extra to purchase a home, car, etc. A house is only made of wood and stone, cheap wood I might add. We as a society should place things at their true value not what we think someone might pay for it.

People who pay anything over a few hundred dollars for a car or home are fools. It’s these fools that keep the banks in business.

November 22nd, 2011 at 2:09 pm -

Danny said:

I make 40k annually with a 730 credit score and about 10% down, how much loan can I qualify for?

February 16th, 2012 at 12:46 pm -

Big V said:

I can’t believe some of the delusional comments on this article. People, houses are STILL overpriced in San Diego (2012), but they are way lower than they were in 2008. I mean seriously, “under the table babysitters” do not justify any $500,000 median house price. duh.

March 26th, 2012 at 3:53 pm -

Marty said:

Well I just paid off my house. 37 years old and paid for an $85000 house in 15 years. Let me tell you that the banks said I could afford a 120000 house. I have a good job in az and the house is az. It is not easy didn’t go out to eat. Didnt take many vacations, fixed and repaired things myself. Didnt try to keep up with jones’s. Did buy brand new things including taking stuff out of the trash. It can be done. Having a house is like having a drivers license it’s a privilege not a right. Screw up and both are taking away.

May 21st, 2012 at 7:19 pm -

S' said:

smart finance company, letting dumb buyers borrow more than they should. the finance company gets the payments and the property back in a few years. moral of the story: if it seems too good to be true, it is.

November 10th, 2012 at 3:24 am -

ranndino said:

Nomad, YOU are the fool! You have absolutely no idea what you’re taling about. There’s this thing called market price. I dare you to go out and buy a house for a few hundred dollars. You won’t find one even in the crappiest neighborhood of Detroit. Maybe a straw hut in Nicaragua.

April 25th, 2013 at 7:31 am -

michael corey said:

Most banks would not loan on these figures anyway usually the highest would be 25/38 income to debt ratio.

May 11th, 2013 at 6:33 am -

zeck said:

How come nobody ever mentions UNFORESEEN cost or situations that will come up over the next 30 years of your life(the life of a home loan).You know that always something happens in your life that you didn’t expect and all of a sudden you have another bill or cost.For example,you just get a speeding ticket,which currently cost $431.And your auto insurance goes up because now you have a speeding ticket on your driving record.Or you get into an accident,and you can’t work.Or you get sick,and you can’t work.Or you get laid off and can’t find another job.The job market is not stable and most likely will never be again in Los Angeles or OC.I could go on with a huge list of UNFORESEEN cost or situations that will ultimately make you end up not being able to sustain/afford your overpriced home.

The more you pay for a home the more stress,anxiety,pain and problems you will have and most likely you will lose the home due to UNFORESEEN cost and situations.

Buying a home in LA or OC is over for the average person.And many of the people who do get into a home in these areas will not last long.Most likely,2,5,10 years later they will eventually not be able to afford the home and ultimately will lose their home.Answer-try to move to a state where you can buy a house for $100,000-180,000.Assuming your household income is at least $75,000-$100,000.And buy a house that was built within the last 10 years.You’ll have much less move in cost on maintenance.

May 30th, 2013 at 7:02 pm -

Nightvid Cold said:

Surely you can afford it if you can pay cash for the house?

May 4th, 2014 at 8:16 am -

SocialCritic said:

The piece correctly indicates that the house in the example is in reality unaffordable to a couple making $75K per year. However, the elephant in the living room that most of the financial media is missing is that in those same over-inflated housing markets, people who are trying to save by renting often commit equally egregious financial mistakes even to cover median rents. If you live and work where the jobs are, it’s increasingly a lose-lose scenario.

Take this astounding fact:

“Renters in Southern California have to pay nearly 48 percent of their income on a median rental property

…

“University of Southern California’s Lusk Center for Real Estate estimated that rents will increase more than 8 percent in Los Angeles County by the middle of 2016 to more than $1,850 a month.” (* source below)

In view of the RENT BUBBLE nobody’s talking about in the major population centers from New York and California to Washington and Florida, home ownership doesn’t look all that irresponsible in comparison to the risk of renting. If you are going to violate the 30% rule of thumb, many people would rather do it on a house as opposed to spend their life moving every year or two to increasingly bad (or outlying) areas to accommodate rental inflation.

The article appears to be using Southern California home pricing as a baseline. As of 2015, those prices are again hitting the ~$500K mark for a 65-year-old ~1300 sq. ft. fixer in LA/OC. In SoCal where the subprime lending crisis originated, we now have the home bubble solidly re-inflated, a rather convenient “bailout” of all those homeowners who would otherwise (still) find themselves underwater. This might not be such a problem but at the same time we have a RENT BUBBLE comprised of all those people who lost their homes and are still competing for rental housing (housing that isn’t necessarily cheaper than a mortgage).

The housing recovery has been hampered by the very fact that there is this presumption that in good job markets where average earnings are higher, people can afford it. There is talk of loosening mortgage lending standards to make housing more available to such buyers. At face value this seems ludicrous. But when you consider that being a mere renter sets you up for the same budget headaches — and that in some markets it is actually cheaper to own vs. rent — it begins to make sense why the de-facto solution is to allow people who shouldn’t qualify to nonetheless obtain a home loan (again!).

In spite of all the ravages of the Great Recession we Americans, and particularly our elected representatives, are asleep at the wheel when it comes to fingering the broader practice of routine (“normal”) price gouging?

As a teenager, I grasped the economic irony when, in visiting a small mountain community, I noticed that the cost of gas there was SIGNIFICANTLY lower than it was in the greater metro area close to the ports and refineries (where I lived). This was my first wake-up call that price manipulation in housing, food, gas, energy and other staples is routine. Sure people make more — and they feel that for their education level or tax bracket they ought to be able to at least match the living standard their parents had (often on a single income at that!). But they can’t be further from the truth.

If we had a non-manipulated, non-monopolistic economy, living within miles of a major port or refinery WOULD mean cheaper prices of products shipped the short distance from that port to our store shelves. Likewise, living miles from the nation’s largest refineries ought to translate to cheaper prices at the pump.

But they don’t!

For all the perception that small communities in the parts of the Midwest and South are lacking in opportunities for jobs, there are areas where a waitress can buy a home. Her counterpart in a big city close to where the country’s major goods and services are actually produced or sold (“the jobs”), on the other hand, would be taking in roommates just to RENT.

Are we beginning to appreciate that something is fundamentally wrong?

We can talk budgeting until the cows come home. But until Americans realize that there are calculated attempts to offset their better job prospects with higher living costs, or to charge them more for food, gas and even insurance just because they live in a “wealthy” geographic area, we have to ask questions. If we can spend that much more transporting food and gas into small towns, yet the prices at Walmart there are lower and so too is the cost of owning and renting a home, are those small towns really so wayward or those big cities really so prosperous?

Budgeting should always be a priority for every household. But when it feels like you’re doing everything right yet are still forced to make “mistakes” even though Uncle Sam says you are solidly middle class per your tax bracket, please know that it’s not just “you”. The economy is rigged to offset any and all regional job/income gains by inflating costs of living relative to median incomes. Therefore it is possible to be “poor” in a job-rich community with a professional salary, yet be a responsible saver in a small town with comparatively fewer prospects (or to even make do on a single income).

One of the reasons Americans don’t manage their finances properly is because too many of us are in a damned-if-we-do, damned-if-don’t scenario. When people can’t control for economic forces beyond their direct control they often give up.

If we want to combat “economic fatalism”, America’s financial experts need to change their approach to conveying the message of financial responsibility. We need the media to do a better job, for one, of facilitating Economic Transparency. Let’s take, for example, the tax code. How many of us appreciate that the federal poverty line is determined only by how much it costs a family to EAT for a year, and little more? We all know that the cost of eating, if it doesn’t include a baseline estimate for shelter, sets the bar for poverty artificially low. How many more Americans would be “poor” and profoundly so if the definition of poverty took into account other fixed expenses?

According to the website Shadow Stats, the feds have tinkered with how other statistics, most notably inflation, have been tabulated. Efforts to alter how inflation was calculated, among other indicators of the true Financial State of America, began with “free trade” (globalization). People may be surprised to learn that economic experts worry most about “deflation”. Inflation is considered low even though the cost of basic staples occupies a greater percentage of our budgets than it once did. It turns out, official inflation statistics do not include things we can’t escape paying — like food and energy. What we call the “middle class”, adjusted for inflation and cost of living in today’s dollars, would be “poor” in the 1950s and much of the ’70s.

The U.S. government is in the business of lying to us. Meanwhile, the financial media is complicit in not calling out irrelevant data if not overtly fraudulent statistical methods.

Many Americans personal budgets aren’t working because in spite of seemingly “high” professional salaries the cost of living is constantly edging up, and yet not finding itself expressed in the usual facts and figures put out by Federal agencies. We are living with the fallout of globalization, and this only a relatively brief 35 years in. What was a single-breadwinner household pre-globalization has morphed into a dual income household norm today. Make no mistake! If nothing changes what is today’s single-family lifestyle will become tomorrow’s multigenerational living (income) necessity.

When will mainstream financial experts and media pundits on the right and left speak out? Do they think that it is useless to critique broader trends in the economy because all we can “control” is our own personal spending habits?

Do the Dave Ramseys and Suzie Ormans of the world not understand that as Americans become more and more disenfranchised it will become paradoxically that much harder to compel us to save or budget responsibly? Acknowledging the gouging that is going on — that we Americans pay a premium for energy, food, higher education, health care and other “private sector” expenses as compared to the rest of the developed world — would have the impact of mobilizing people. At every turn we pay the “American lifestyle premium”. Who are we kidding? By paying higher prices than the rest of the developed world — to include even far-flung locations — we are effectively submitting to taxation at the hands of corporations — without representation!

April 17th, 2015 at 3:13 pm -

Joanna said:

How about an updated article on this same subject? The numbers have changed here in Los Angeles, i.e. home prices and interest rates. Also electricity and water rates are climbing as are monthly sanitation charges and Internet access.

Thank you.

June 11th, 2015 at 12:47 pm -

VW Lover said:

I make roughly $50,000 a year and my wife doesn’t work. We own a home that has been appraised at between $360,000-380,000. How? Because we got extremely lucky and bought this home new in 1997 for $150,000 then the housing market in a very desirable suburb of Portland OR went crazy and the housing prices more than doubled. We also had a down payment of $50,000 that was obtained in the sale of our previous home. Just got lucky at the right time.

June 16th, 2015 at 8:56 pm -

charity said:

SocialCritic -Great Post!

Absolutely on the dot. People just dont get it. cant see it for what it is.

We left the rental market about 3 years ago now, but never contimplated homeownership as we were not even interested in it until after the recession had already begun. then it was impossible.

We have friends that have bought tooo much house twice since 2007 and lost it/will be loosig it again.

The first time they bought in Sept 2007 and in June of 2010 lost their job . within a month of being unemployed-they just didnt want to spend 1800 $ of their unemployment on the house payment and stopped paying. And then they got out of it by the skin though a shortsale in August of 2010.

Moved to another state got another job rented for 1 year. got another job.rented for a year. moved to yet another job and then bought another house December of 2013 Made first payment in Jan 2014 and now have lost their job again.

All job loss has been downsizing in their field(lineman).

They bought this last house after having moved because the same employer who owned another division that sold out before said they could move and work for another company they had.

Yesterday they got notice that the company is shutting down. they have a HP that is 1200mo and added a new truck payment in Feb/March of 650$, add in insurance call it an even 2000 mo need from unemployment for both installments and they live in oregon. horrible state for keeping your money.

Sept 2009 We saved our money bought a 13YO 1 ton truck.paid cash. 8K

June 2012 We saved our money and bought a small 5th wheel 35YO to use to live in while we save our money for a full size 5th wheel. This was to remove being a renter so we could keep the money we would have paid to rent. 1.8K

April 2015 we saved our money bought a 10YO full size RV 4 X Slides, D/W , W/D, central heating and air, 2 rooms, 100% self contained. 16Kwe own all three of these and have no mortgage/truck payment. Everything is well cared for and serviced. We take home 3300 mo, have a bit of discresionary income, have good credit for the first time in our lives (where as we had NO CREDIT before not even a ss# on the reports.)

Just last week we were discussing adding in a truck payment and I told my house buying friend that although we qualified to finanace a new dodge truck, doesnt mean we should. i told her anything can happen in 7 years and that whole time we dont actually own the truck. I just think at 700$ mo there is something very inflated about that whole thing and Id rather buy used and PIF and own it. she said she just doesnt think about what could happen if they loose thier jobs they will figure that out then.

OK I said what are the odds that by the time you are 65 you will still be at the same job making the same money, which is how long you will need to make payments until the house is yours because you are 36 now. No answer.

our next step is to buy a camp, preloaded with 1-2 bedroom cabin septic already in ,well already in, perimiter in, electric in. they run 20-50K in the outback. that we can own as well. And aside from Annual taxes on property and registration we are clear and we own our home and transportation.

It takes alot longer to save to pay in full. and alot more diligence and patience, but you get there-thats the point. the mortgage market is a trap and it is a gamble. renting is a gamble. alternative houseing is where the options are. thats where it is more likely that success can be gained for the long term not just today.

The question at the end of all of this folks should ask is “will my job support the payment to the end of the 30 year note? 15year note?7 year note? ect… ” its like “are you feeling lucky” like that. cheers.

June 20th, 2015 at 9:19 am -

JB said:

My sister and husband #3 “bought” a house in Phoenix valued between $7 and $8 hundred thou (4,000+ sq ft, 5 br, 3.5 baths) for just the two of them, then the housing bubble burst. Wanted to travel, so put it on the market where comparable homes were now listed at ca. $285,000 — if you could find a buyer… My sister had retired for a bit over a month, but then needed to go back to work to keep making the payments (husband was not working). She finally retired for good at age 70, concluded that they needed to invest thousands in granite counter tops, but still couldn’t find a buyer. So, recently, they just walked away from it. Yup, just walked away.

Moral of the story: Live within your means (are ego-driven individuals really trying to impress other people, or are they still trying to impress themselves…?)July 9th, 2015 at 7:07 am -

Anne said:

Hair – 120

Vacations, trips, shows, travel – 200

Clothes – 300

Quality food – 800

Gas – 80

Utilities – 100

Phone – 80

Internet – 120Net pay – 71,000

Gross – I estimate 48,000 (NY)So my monthly pay will be 4,000.

Mmm. Yeah, unless I find a real good deal, buying a home off my income alone, and I did not include savings, retirement and insurance, I’ll be renting. There are some good deals though in the area so I might get lucky.

L

July 16th, 2015 at 6:38 pm -

Anne said:

No debt except dog gone student loans. Still, need a really, really good deal to lock myself into a mortgage. Also, this is based on my income alone and not a combination of mine and my spouse’s.

July 16th, 2015 at 6:47 pm -

DJ said:

Great post SocialCritic, and here we are again. Where I live in So. Cal. we are once again right near $500K median home price. My question is how are all these homes being sold? The average household income has barely moved. In order to purchase a home, one would need an average household income of at least $125K. The majority is a far cry from this figure. Seems like it is nearly time to sell, perhaps 6 months before another bust in this manipulated, rigged bankers game.

August 10th, 2015 at 9:58 pm -

Uncle Frank said:

Retired 2003 in California, sold my 30 year old mobile home in Silicon Valley for $35K, which had a monthly space rent of $650. Then moved to Reno and rented for $817 per month. Californians started bidding up homes in Reno so I decided they were too over priced for me. I moved to West Texas, purchased a four year old home for $127K. Paid it off in 2009. I love the scenery and climate in California but I’m happy living on an annual budget of $32K, while saving an extra $15K for traveling, with a total retirement income of $47K. One must live within their means otherwise massive debt is their future. By the way, for the median price of home in Southern California one could have a heck of a nice little ranchette here in West Texas.

September 17th, 2015 at 3:26 pm -

FiercePhoenix said:

Wow, I had to click the link just to make sure this is real. I make just under that and thought my realtor and loan agent were nuts when they thought I should buy a house for $200,000. Are the people proposing $350,000 TRYING to bankrupt people

February 27th, 2016 at 12:34 pm -

Nancy Williams said:

I could do this if cellphones only cost $40 per month or heath insurance really cost $200 for 2 adults. $35 for electric???? Come on triple thise numbers and then maybe they will be close to real

August 3rd, 2016 at 10:26 am -

Joe Pocketchange said:

I would say the bigger issue is that 350k doesn’t get you much anymore, and that most families would kill to be pulling 75k a year.

The vast majority of adults these days make less than 30k a year, so why don’t we address the REAL problem here which is how our society is voting itself into coffin-like “tiny homes,” under the guise that it somehow sets them free from living with elbow room.

Why don’t we question why these cardboard craptastic homes cost so damn much, and why society as a whole makes so damn little? Isn’t that the problem?

August 16th, 2016 at 10:59 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!