Young riding out recession by going into debt for college: Millennial unemployment jumps by two percent.

- 0 Comments

As the animal spirits of the economy rage wild, there are still difficult challenges ahead for younger Americans. While the stock market is up highlighting corporate euphoria, many companies are doing this with 4 million fewer workers. So the economic recovery is not evenly distributed and they rarely are. Yet younger Americans are still facing tough challenges ahead. One major trend has to do with many people going back to college. While education is positive, the costs are becoming incredibly high and many simply cannot afford it. This is why total student debt outstanding is now over $1 trillion. Why is this so important? Well for one, we are seeing data showing that recent graduates, those in the last decade, are not yielding solid gains from their ventures into college. With 4,000 colleges in the US, many are subpar and many are designed as vehicles to extract student loans. How is this economy treating younger Americans?

The trend for college

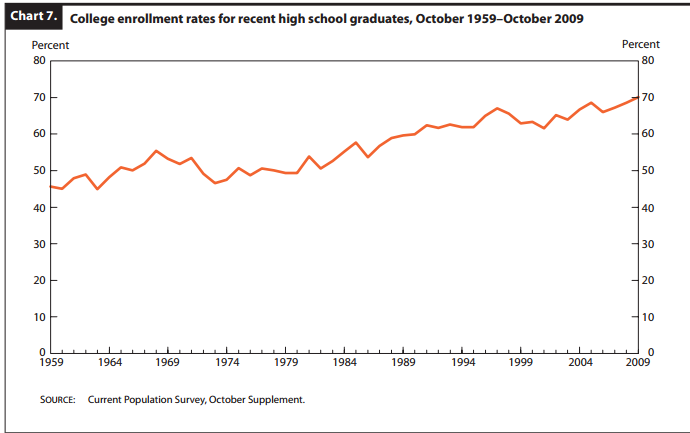

One piece of data that is very telling is the number of students enrolled in college:

What does the above chart tell us? For one, it shows that more high school graduates are going to college. Over 70 percent of high school graduates now enroll in college. Those finishing college is much lower of course, below 30 percent. However the above chart may not tell the entire story. We have to account for the rise of women attending colleges as well. This is also one of those important points to understand where in the past, one income was sufficient for a middle class lifestyle while now we are deep into a two-income trap.

Simply going to college is not a guarantee for a successful career. It never was. However now, there is a major mismatch between college costs and the actual value that is extracted in the market. People have a hard time questioning the mission of college but when the costs are so high, you have to ask questions. Plus, the only reason it is so expensive is the massive amount of loans funneled into the industry.

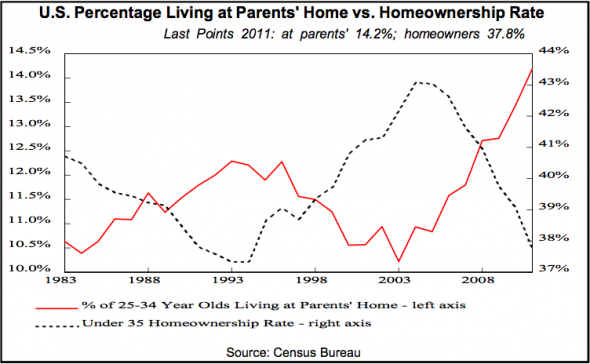

We also have a very high number of young Americans living at home:

Many have come back home after school concludes being labeled the boomerang generation. In an age of independence, you can rest assured that this trend to move back home has to do more with economics rather than cultural changes. I found it interesting that many of the new building projects in real estate now are focusing on mulit-unit properties in anticipation for these young Americans to move out of their parent’s place as they seek to strike out on their own.

What we find underneath the recent employment reports is that many are getting work in lower paying service sector jobs. Certainly not any employment that would justify tens of thousands of dollars in student loan debt. The unemployment rate for those 16 to 19 is well over 37 percent. This has been common for a very long time but highlights how common it is for people to flow right into the college education system. Yet how much thought is given behind this?

“(Policy Mic) Youth unemployment shows signs that worse things may be around the corner.

Generation Opportunity, a national, non-partisan organization advocating for millennials ages 18-29, shows the youth unemployment rate for 18-29 year olds specifically for January, 2013 was 13.1% (NSA). For December 2012 it was 11.5%, while the unemployment rate in November was 10.9%.â€

The declining labor participation rate actually puts an astounding 1.7 million young adults out of the employment figures. They are not counted in the unemployed figures because many have given up looking for work. It is still challenging for many young Americans and the student debt bubble is likely to align with the current youth crisis.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!